Answered step by step

Verified Expert Solution

Question

1 Approved Answer

An asset costs $682,000. The CCA rate for this asset is 32%. The asset's useful life is two years after which it will be worth

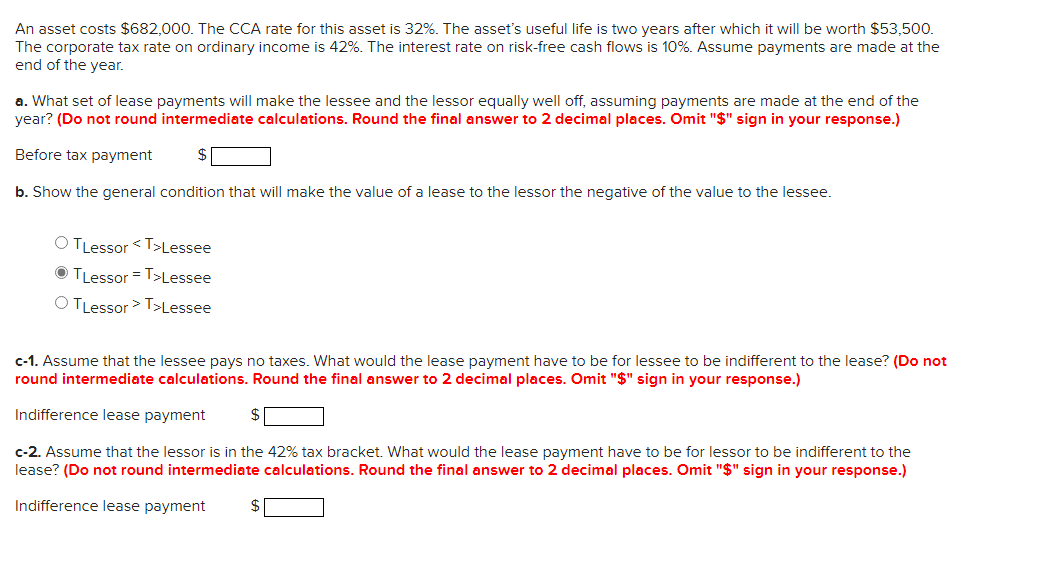

An asset costs $682,000. The CCA rate for this asset is 32%. The asset's useful life is two years after which it will be worth $53,500. The corporate tax rate on ordinary income is 42%. The interest rate on risk-free cash flows is 10%. Assume payments are made at the end of the year. a. What set of lease payments will make the lessee and the lessor equally well off, assuming payments are made at the end of the year? (Do not round intermediate calculations. Round the final answer to 2 decimal places. Omit "\$" sign in your response.) Before tax payment $ b. Show the general condition that will make the value of a lease to the lessor the negative of the value to the lessee. TLessor

An asset costs $682,000. The CCA rate for this asset is 32%. The asset's useful life is two years after which it will be worth $53,500. The corporate tax rate on ordinary income is 42%. The interest rate on risk-free cash flows is 10%. Assume payments are made at the end of the year. a. What set of lease payments will make the lessee and the lessor equally well off, assuming payments are made at the end of the year? (Do not round intermediate calculations. Round the final answer to 2 decimal places. Omit "\$" sign in your response.) Before tax payment $ b. Show the general condition that will make the value of a lease to the lessor the negative of the value to the lessee. TLessorStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started