CASE: OutReach Networks: First Venture Round

3. What is the value of the firm under the venture capital method?

As per instructions in the discussion for this case, enter data for two valuations and resulting percentage stake for Everest Partners. One that tries to get as close as possible to the equity stake demanded by the investors, and another one where the inputs are closer to the situation of OutReach.

| | Everest Partners | Perezs point of view |

| Ratio Selected | | |

| Ratio Value* | | |

| Terminal Value | | |

| Target Rate | | |

| Post-money valuation | | |

| Equity Stake | | |

* After any adjustments made.

4. What is the value of the firm under the discounted cash flow method? Assume that after 2017 cash flows grow at a rate of 5% forever.

| | |

| Discount Rate | |

| Present Value of Forecasted Period | |

| Terminal Value | |

| Present Value of Terminal Value | |

| Total NPV | |

| Expected NPV | |

| Equity Stake | |

5. Is Everest Partners justified in asking for a 30% equity stake?

6. What should Pete Perez do?

I NEED THE EXCEL CALCULATION

I NEED THE EXCEL CALCULATION

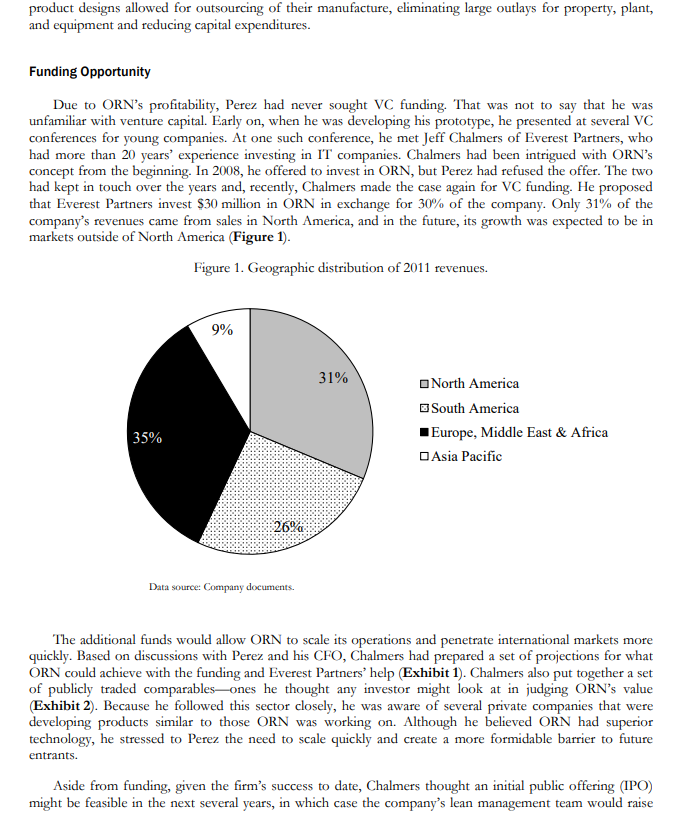

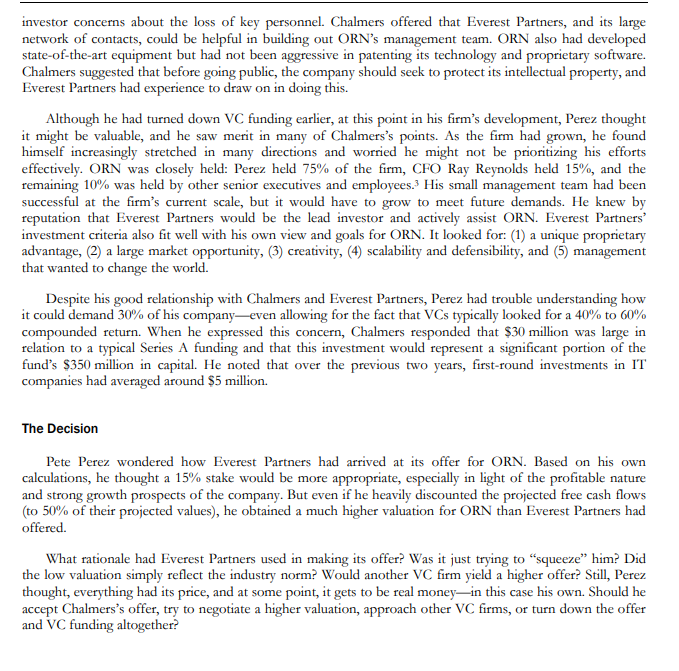

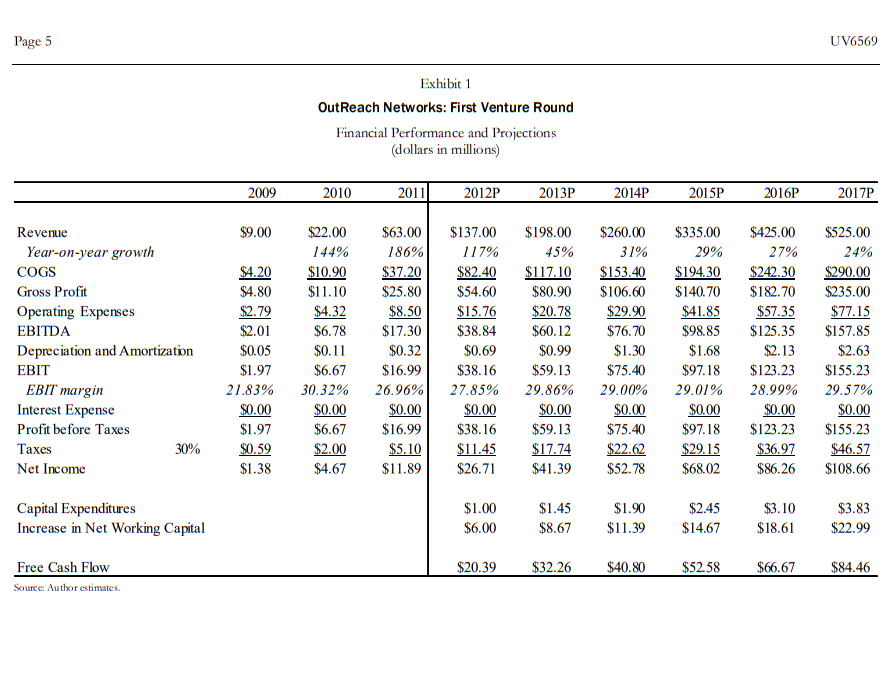

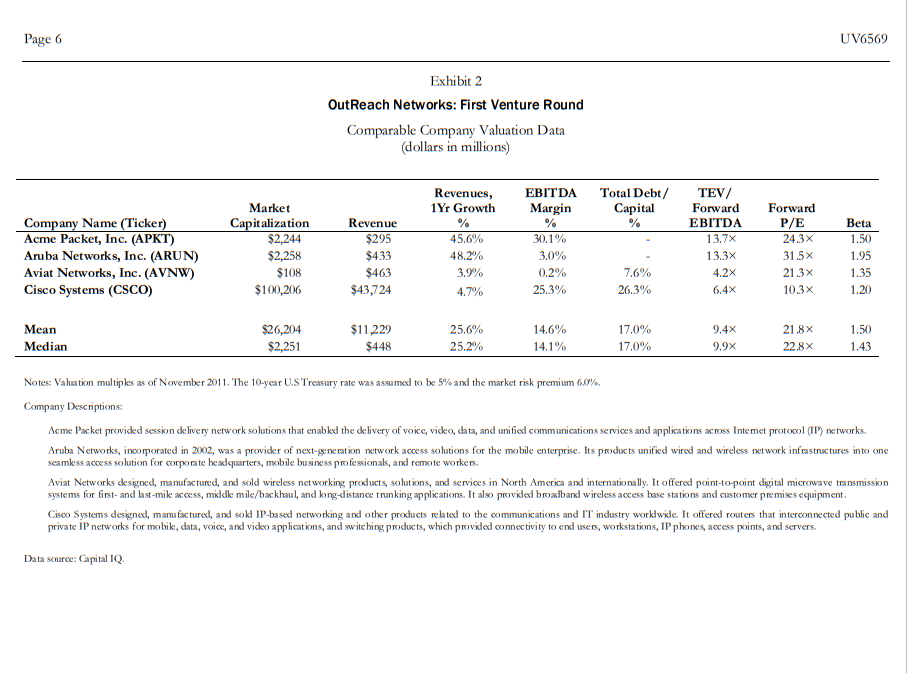

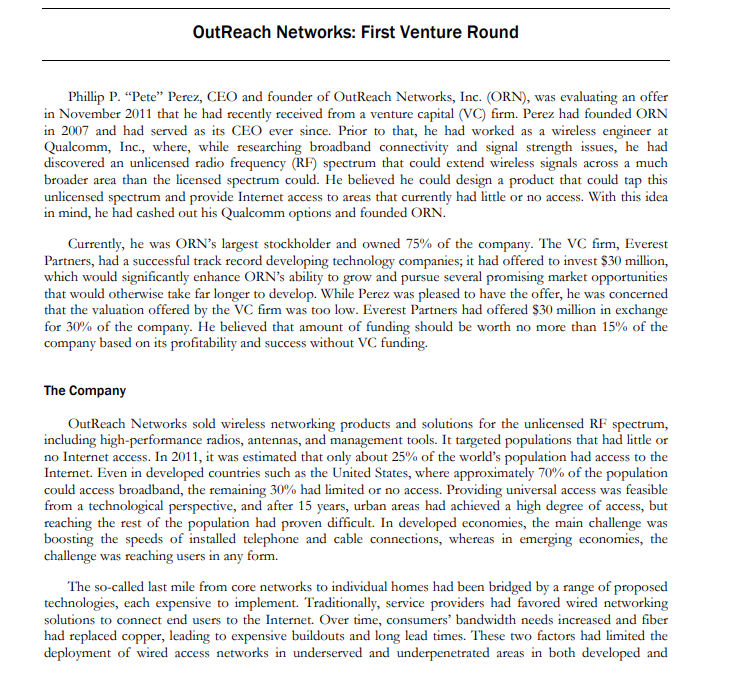

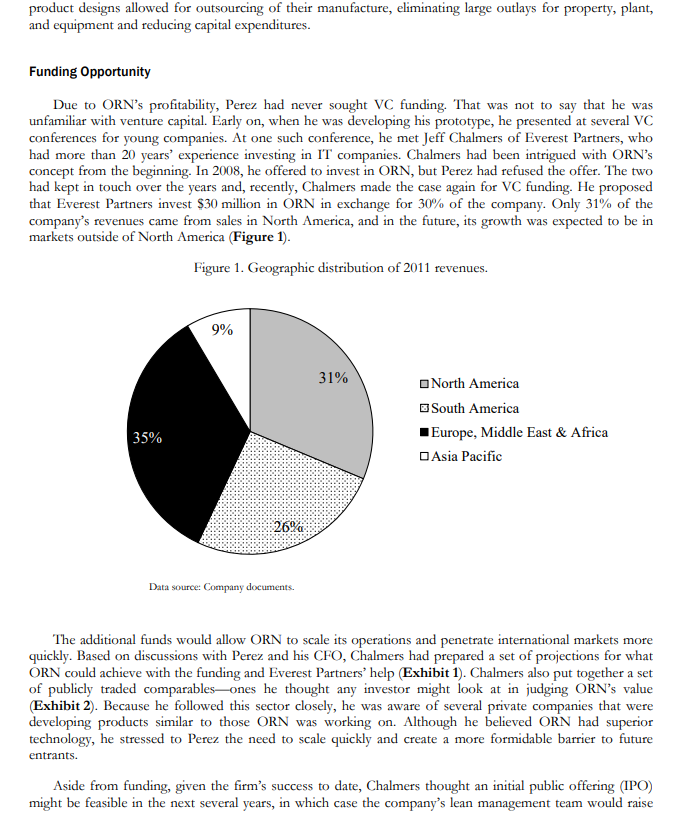

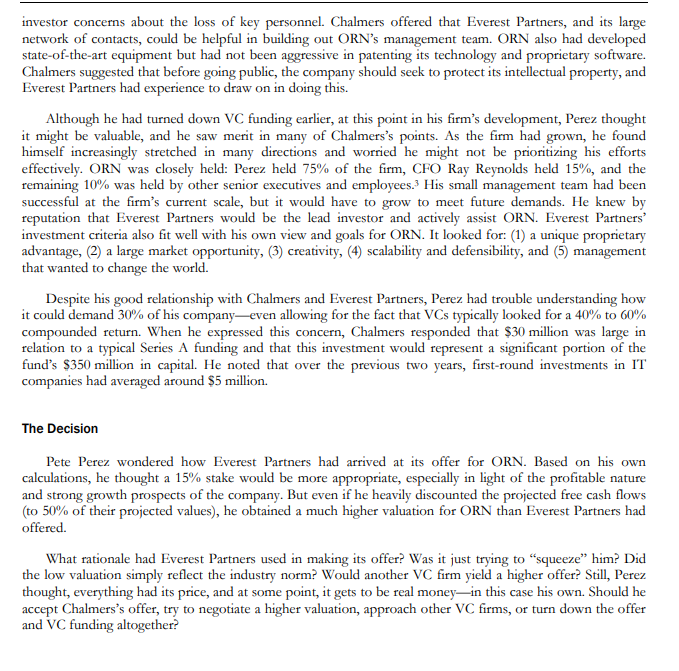

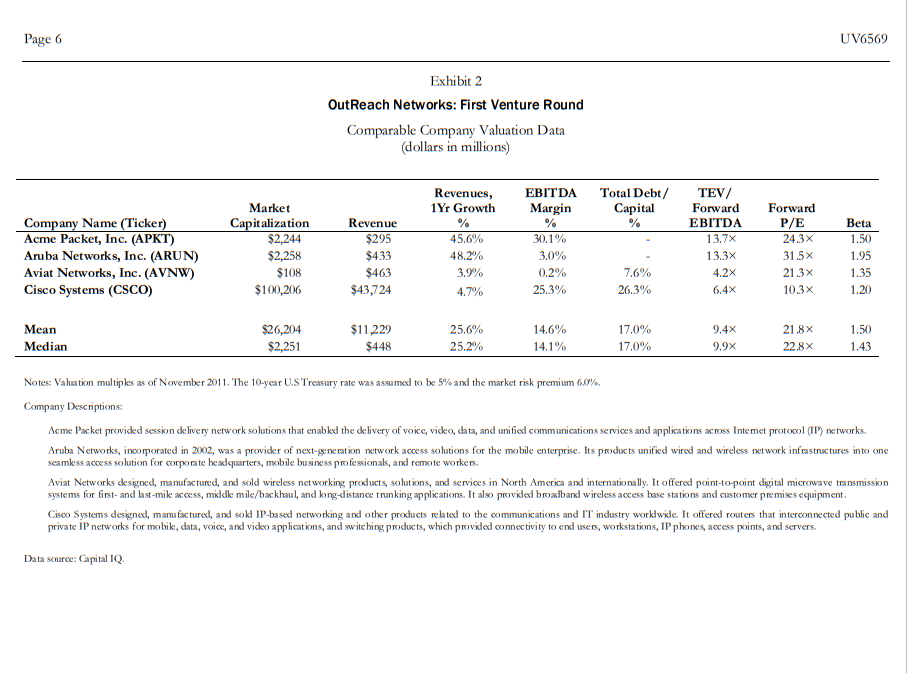

OutReach Networks: First Venture Round Phillip P. "Pete Perez, CEO and founder of OutReach Networks, Inc. (ORN), was evaluating an offer in November 2011 that he had recently received from a venture capital (VC) firm. Perez had founded ORN in 2007 and had served as its CEO ever since. Prior to that, he had worked as a wireless engineer at Qualcomm, Inc., where, while researching broadband connectivity and signal strength issues, he had discovered an unlicensed radio frequency (RF) spectrum that could extend wireless signals across a much broader area than the licensed spectrum could. He believed he could design a product that could tap this unlicensed spectrum and provide Internet access to areas that currently had little or no access. With this idea in mind, he had cashed out his Qualcomm options and founded ORN. Currently, he was ORN's largest stockholder and owned 75% of the company. The VC firm, Everest Partners, had a successful track record developing technology companies; it had offered to invest $30 million, which would significantly enhance ORN's ability to grow and pursue several promising market opportunities that would otherwise take far longer to develop. While Perez was pleased to have the offer, he was concerned that the valuation offered by the VC firm was too low. Everest Partners had offered $30 million in exchange for 30% of the company. He believed that amount of funding should be worth no more than 15% of the company based on its profitability and success without VC funding. The Company OutReach Networks sold wireless networking products and solutions for the unlicensed RF spectrum, including high-performance radios, antennas, and management tools. It targeted populations that had little or no Internet access. In 2011, it was estimated that only about 25% of the world's population had access to the Internet. Even in developed countries such as the United States, where approximately 70% of the population could access broadband, the remaining 30% had limited or no access. Providing universal access was feasible from a technological perspective, and after 15 years, urban areas had achieved a high degree of access, but reaching the rest of the population had proven difficult. In developed economies, the main challenge was boosting the speeds of installed telephone and cable connections, whereas in emerging economies, the challenge was reaching users in any form. The so-called last mile from core networks to individual homes had been bridged by a range of proposed technologies, each expensive to implement. Traditionally, service providers had favored wired networking solutions to connect end users to the Internet. Over time, consumers' bandwidth needs increased and fiber had replaced copper, leading to expensive buildouts and long lead times. These two factors had limited the deployment of wired access networks in underserved and underpenetrated areas in both developed and emerging markets. As a result, wireless solutions were gaining traction as a cost-effective way to address last- mile connectivity in these markets. Using commodity hardware coupled with proprietary software, ORN solutions greatly reduced the up- front capital expenditures required to build out a last-mile network, enabling Internet service to be provided to a wide range of currently underserved or poorly served markets. Traditionally, Wi-Fi carriers had been large, deep-pocketed companies (e.g., AT&T, Comcast), but ORN's products had sparked the growth of entrepreneurial wireless Internet service providers (WISPs). Typically, a WISP started because broadband connectivity was needed where it currently did not exist or the existing service was poor or expensive. Decreases in equipment costs had lowered barriers to entry, allowing these entrepreneurial-minded ISPs to enter. WISPs needed elevated sites for their equipment as well as access to commercial-grade Internet. With that, and about $5,000 of ORN gear, individuals with basic networking skills could build a network that covered 100 subscribers. WISP customers could realize 15 Mbps to 20 Mbps download speeds, compared to DSL, which topped out at 3 Mbps to 4 Mbps. It was estimated that with as few as 20 customers spending $50 per month on service, the hardware cost, including the customer premise equipment (CPE), could be covered in the first five months of operations. The idea for ORN grew out of Perez's experience at Qualcomm, where he researched issues of broadband connectivity and the strength of wireless signals. He learned through this process that the U.S. Federal Communications Commission (FCC) permitted Wi-Fi signals ranging from 13 dBm to over 20 dBm, which greatly increased the effective range of an 802.11 signal. The 802.11 signal utilized spectrum formally known as the industrial, scientific, and medical bands and fell in the unlicensed RF spectrum.2 It had two main advantagesit was free and available in ample supply. Because WISPs did not have to rent access infrastructure or obtain and resell service from incumbent operators, they avoided having to negotiate costly access from these providers and were able to achieve a highly competitive cost structure. These advantages resulted in a growing community of WISPs, which fueled the use of ORN equipment. In 2007, when Perez realized no one was using this spectrum commercially, he cashed out $50,000 in Qualcomm options and designed a radio card that extended the range of Wi-Fi equipment. Over the course of 2008, he experimented with several prototypes designed to overcome significant performance challenges to signal quality (e.g., dynamic spectrum noise, device interference, and outdoor obstacles). Revenues had grown exponentially from $9 million in 2009, the company's first full year of operations, to $63 million in 2011 (Exhibit 1). Unusual for a start-up, ORN had been profitable from the beginning for several reasons. First, the company employed an indirect sales model selling through various channels that responded to demand from a growing community of WISP users. This eliminated the cost of direct-sales efforts, such as building a sales force, and limited its marketing costs. As a testament to its lean operations, the company had fewer than 100 total employees in 2011. As a result, operating margins in the vicinity of 30% had been achieved starting in 2010 and were projected to remain at that level in future years. The downside of this was that ORN had limited visibility into future sales, making it more difficult to predict future operating results and limited means to spur sales should the need arise. The second reason for early profitability was that ORN's simple product designs allowed for outsourcing of their manufacture, eliminating large outlays for property, plant, and equipment and reducing capital expenditures. Funding Opportunity Due to ORN's profitability, Perez had never sought VC funding. That was not to say that he was unfamiliar with venture capital. Early on, when he was developing his prototype, he presented at several VC conferences for young companies. At one such conference, he met Jeff Chalmers of Everest Partners, who had more than 20 years' experience investing in IT companies. Chalmers had been intrigued with ORN's concept from the beginning. In 2008, he offered to invest in ORN, but Perez had refused the offer. The two had kept in touch over the years and, recently, Chalmers made the case again for VC funding. He proposed that Everest Partners invest $30 million in ORN in exchange for 30% of the company. Only 31% of the company's revenues came from sales in North America, and in the future, its growth was expected to be in markets outside of North America (Figure 1). Figure 1. Geographic distribution of 2011 revenues. 9% 31% North America South America Europe, Middle East & Africa Asia Pacific 35% 26% Data source: Company documents. The additional funds would allow ORN to scale its operations and penetrate international markets more quickly. Based on discussions with Perez and his CFO, Chalmers had prepared a set of projections for what ORN could achieve with the funding and Everest Partners' help Exhibit 1). Chalmers also put together a set of publicly traded comparablesones he thought any investor might look at in judging ORN's value (Exhibit 2). Because he followed this sector closely, he was aware of several private companies that were developing products similar to those ORN was working on. Although he believed ORN had superior technology, he stressed to Perez the need to scale quickly and create a more formidable barrier to future entrants. Aside from funding, given the firm's success to date, Chalmers thought an initial public offering (IPO) might be feasible in the next several years, in which case the company's lean management team would raise investor concerns about the loss of key personnel. Chalmers offered that Everest Partners, and its large network of contacts, could be helpful in building out ORN's management team. ORN also had developed state-of-the-art equipment but had not been aggressive in patenting its technology and proprietary software. Chalmers suggested that before going public, the company should seek to protect its intellectual property, and Everest Partners had experience to draw on in doing this. Although he had turned down VC funding earlier, at this point in his firm's development, Perez thought it might be valuable, and he saw merit in many of Chalmers's points. As the firm had grown, he found himself increasingly stretched in many directions and worried he might not be prioritizing his efforts effectively. ORN was closely held: Perez held 75% of the firm, CFO Ray Reynolds held 15%, and the remaining 10% was held by other senior executives and employees. His small management team had been successful at the firm's current scale, but it would have to grow to meet future demands. He knew by reputation that Everest Partners would be the lead investor and actively assist ORN. Everest Partners investment criteria also fit well with his own view and goals for ORN. It looked for: (1) a unique proprietary advantage, (2) a large market opportunity, (3) creativity, (4) scalability and defensibility, and (5) management that wanted to change the world. Despite his good relationship with Chalmers and Everest Partners, Perez had trouble understanding how it could demand 30% of his companyeven allowing for the fact that VCs typically looked for a 40% to 60% compounded return. When he expressed this concern, Chalmers responded that $30 million was large in relation to a typical Series A funding and that this investment would represent a significant portion of the fund's $350 million in capital. He noted that over the previous two years, first-round investments in IT companies had averaged around $5 million. The Decision Pete Perez wondered how Everest Partners had arrived at its offer for ORN. Based on his own calculations, he thought a 15% stake would be more appropriate, especially in light of the profitable nature and strong growth prospects of the company. But even if he heavily discounted the projected free cash flows (to 50% of their projected values), he obtained a much higher valuation for ORN than Everest Partners had offered What rationale had Everest Partners used in making its offer? Was it just trying to "squeeze him? Did the low valuation simply reflect the industry norm? Would another VC firm yield a higher offer? Still, Perez thought, everything had its price, and at some point, it gets to be real moneyin this case his own. Should he accept Chalmers's offer, try to negotiate a higher valuation, approach other VC firms, or turn down the offer and VC funding altogether? Page 6 UV6569 Exhibit 2 OutReach Networks: First Venture Round Comparable Company Valuation Data (dollars in millions) Total Debt/ Capital % Company Name (Ticker) Acme Packet, Inc. (APKT) Aruba Networks, Inc. (ARUN) Aviat Networks, Inc. (AVNW) Cisco Systems (CSCO) Market Capitalization $2,244 $2,258 $108 $100,206 Revenue $295 $433 $463 $43,724 Revenues, 1Yr Growth % 45.6% 48.2% 3.9% 4.7% EBITDA Margin % 30.1% 3.0% 0.2% 25.3% TEV/ Forward EBITDA 13.7% 13.3x 4.2x 6.4x Forward P/E 24.3 31.5 x 21.3x 10.3 x Beta 1.50 1.95 1.35 1.20 7.6% 26.3% Mean Median $26,204 $2,251 $11,229 $448 25.6% 25.2% 14.6% 14.1% 17.0% 17.0% 9.4x 9.9x 21.8 x 22.8% 1.50 1.43 Notes: Valuation multiples as of November 2011. The 10-year U.S Treasury rate was assumed to be 5% and the market risk premium 60%. Company Descriptions: Acme Packet provided session delivery network solutions that enabled the delivery of voice, vicko, data, and unified communications services and applications across Inte met protocol (IP) networks. Aruba Networks, incorporated in 2002, was a provider of next-generation network access solutions for the mobile enterprise. Its products unified wired and wireless network infrastructures into one seamless access solution for corporate headquarters, mobile business professionals, and remote workers. Aviat Networks ok signed, manufactured, and sold wireless networking products, solutions, and services in North America and internationally. It offered point-to-point digital microwave transmission systems for first- and last-mik access, miidk mile/backhaul, and long-distance trunking applications. It also provided broadband wireless access base stations and customer premises equipment Cisco Systems designed, manufactured, and sok IP-based networking and other products related to the communications and IT industry worklwide. It offered routers that interconnected public and private IP networks for mobile, chata, voice, and vicko applications, and switching products, which provided connectivity to end users, workstations, IP phones, access points, and servers. Data source: Capital IQ OutReach Networks: First Venture Round Phillip P. "Pete Perez, CEO and founder of OutReach Networks, Inc. (ORN), was evaluating an offer in November 2011 that he had recently received from a venture capital (VC) firm. Perez had founded ORN in 2007 and had served as its CEO ever since. Prior to that, he had worked as a wireless engineer at Qualcomm, Inc., where, while researching broadband connectivity and signal strength issues, he had discovered an unlicensed radio frequency (RF) spectrum that could extend wireless signals across a much broader area than the licensed spectrum could. He believed he could design a product that could tap this unlicensed spectrum and provide Internet access to areas that currently had little or no access. With this idea in mind, he had cashed out his Qualcomm options and founded ORN. Currently, he was ORN's largest stockholder and owned 75% of the company. The VC firm, Everest Partners, had a successful track record developing technology companies; it had offered to invest $30 million, which would significantly enhance ORN's ability to grow and pursue several promising market opportunities that would otherwise take far longer to develop. While Perez was pleased to have the offer, he was concerned that the valuation offered by the VC firm was too low. Everest Partners had offered $30 million in exchange for 30% of the company. He believed that amount of funding should be worth no more than 15% of the company based on its profitability and success without VC funding. The Company OutReach Networks sold wireless networking products and solutions for the unlicensed RF spectrum, including high-performance radios, antennas, and management tools. It targeted populations that had little or no Internet access. In 2011, it was estimated that only about 25% of the world's population had access to the Internet. Even in developed countries such as the United States, where approximately 70% of the population could access broadband, the remaining 30% had limited or no access. Providing universal access was feasible from a technological perspective, and after 15 years, urban areas had achieved a high degree of access, but reaching the rest of the population had proven difficult. In developed economies, the main challenge was boosting the speeds of installed telephone and cable connections, whereas in emerging economies, the challenge was reaching users in any form. The so-called last mile from core networks to individual homes had been bridged by a range of proposed technologies, each expensive to implement. Traditionally, service providers had favored wired networking solutions to connect end users to the Internet. Over time, consumers' bandwidth needs increased and fiber had replaced copper, leading to expensive buildouts and long lead times. These two factors had limited the deployment of wired access networks in underserved and underpenetrated areas in both developed and emerging markets. As a result, wireless solutions were gaining traction as a cost-effective way to address last- mile connectivity in these markets. Using commodity hardware coupled with proprietary software, ORN solutions greatly reduced the up- front capital expenditures required to build out a last-mile network, enabling Internet service to be provided to a wide range of currently underserved or poorly served markets. Traditionally, Wi-Fi carriers had been large, deep-pocketed companies (e.g., AT&T, Comcast), but ORN's products had sparked the growth of entrepreneurial wireless Internet service providers (WISPs). Typically, a WISP started because broadband connectivity was needed where it currently did not exist or the existing service was poor or expensive. Decreases in equipment costs had lowered barriers to entry, allowing these entrepreneurial-minded ISPs to enter. WISPs needed elevated sites for their equipment as well as access to commercial-grade Internet. With that, and about $5,000 of ORN gear, individuals with basic networking skills could build a network that covered 100 subscribers. WISP customers could realize 15 Mbps to 20 Mbps download speeds, compared to DSL, which topped out at 3 Mbps to 4 Mbps. It was estimated that with as few as 20 customers spending $50 per month on service, the hardware cost, including the customer premise equipment (CPE), could be covered in the first five months of operations. The idea for ORN grew out of Perez's experience at Qualcomm, where he researched issues of broadband connectivity and the strength of wireless signals. He learned through this process that the U.S. Federal Communications Commission (FCC) permitted Wi-Fi signals ranging from 13 dBm to over 20 dBm, which greatly increased the effective range of an 802.11 signal. The 802.11 signal utilized spectrum formally known as the industrial, scientific, and medical bands and fell in the unlicensed RF spectrum.2 It had two main advantagesit was free and available in ample supply. Because WISPs did not have to rent access infrastructure or obtain and resell service from incumbent operators, they avoided having to negotiate costly access from these providers and were able to achieve a highly competitive cost structure. These advantages resulted in a growing community of WISPs, which fueled the use of ORN equipment. In 2007, when Perez realized no one was using this spectrum commercially, he cashed out $50,000 in Qualcomm options and designed a radio card that extended the range of Wi-Fi equipment. Over the course of 2008, he experimented with several prototypes designed to overcome significant performance challenges to signal quality (e.g., dynamic spectrum noise, device interference, and outdoor obstacles). Revenues had grown exponentially from $9 million in 2009, the company's first full year of operations, to $63 million in 2011 (Exhibit 1). Unusual for a start-up, ORN had been profitable from the beginning for several reasons. First, the company employed an indirect sales model selling through various channels that responded to demand from a growing community of WISP users. This eliminated the cost of direct-sales efforts, such as building a sales force, and limited its marketing costs. As a testament to its lean operations, the company had fewer than 100 total employees in 2011. As a result, operating margins in the vicinity of 30% had been achieved starting in 2010 and were projected to remain at that level in future years. The downside of this was that ORN had limited visibility into future sales, making it more difficult to predict future operating results and limited means to spur sales should the need arise. The second reason for early profitability was that ORN's simple product designs allowed for outsourcing of their manufacture, eliminating large outlays for property, plant, and equipment and reducing capital expenditures. Funding Opportunity Due to ORN's profitability, Perez had never sought VC funding. That was not to say that he was unfamiliar with venture capital. Early on, when he was developing his prototype, he presented at several VC conferences for young companies. At one such conference, he met Jeff Chalmers of Everest Partners, who had more than 20 years' experience investing in IT companies. Chalmers had been intrigued with ORN's concept from the beginning. In 2008, he offered to invest in ORN, but Perez had refused the offer. The two had kept in touch over the years and, recently, Chalmers made the case again for VC funding. He proposed that Everest Partners invest $30 million in ORN in exchange for 30% of the company. Only 31% of the company's revenues came from sales in North America, and in the future, its growth was expected to be in markets outside of North America (Figure 1). Figure 1. Geographic distribution of 2011 revenues. 9% 31% North America South America Europe, Middle East & Africa Asia Pacific 35% 26% Data source: Company documents. The additional funds would allow ORN to scale its operations and penetrate international markets more quickly. Based on discussions with Perez and his CFO, Chalmers had prepared a set of projections for what ORN could achieve with the funding and Everest Partners' help Exhibit 1). Chalmers also put together a set of publicly traded comparablesones he thought any investor might look at in judging ORN's value (Exhibit 2). Because he followed this sector closely, he was aware of several private companies that were developing products similar to those ORN was working on. Although he believed ORN had superior technology, he stressed to Perez the need to scale quickly and create a more formidable barrier to future entrants. Aside from funding, given the firm's success to date, Chalmers thought an initial public offering (IPO) might be feasible in the next several years, in which case the company's lean management team would raise investor concerns about the loss of key personnel. Chalmers offered that Everest Partners, and its large network of contacts, could be helpful in building out ORN's management team. ORN also had developed state-of-the-art equipment but had not been aggressive in patenting its technology and proprietary software. Chalmers suggested that before going public, the company should seek to protect its intellectual property, and Everest Partners had experience to draw on in doing this. Although he had turned down VC funding earlier, at this point in his firm's development, Perez thought it might be valuable, and he saw merit in many of Chalmers's points. As the firm had grown, he found himself increasingly stretched in many directions and worried he might not be prioritizing his efforts effectively. ORN was closely held: Perez held 75% of the firm, CFO Ray Reynolds held 15%, and the remaining 10% was held by other senior executives and employees. His small management team had been successful at the firm's current scale, but it would have to grow to meet future demands. He knew by reputation that Everest Partners would be the lead investor and actively assist ORN. Everest Partners investment criteria also fit well with his own view and goals for ORN. It looked for: (1) a unique proprietary advantage, (2) a large market opportunity, (3) creativity, (4) scalability and defensibility, and (5) management that wanted to change the world. Despite his good relationship with Chalmers and Everest Partners, Perez had trouble understanding how it could demand 30% of his companyeven allowing for the fact that VCs typically looked for a 40% to 60% compounded return. When he expressed this concern, Chalmers responded that $30 million was large in relation to a typical Series A funding and that this investment would represent a significant portion of the fund's $350 million in capital. He noted that over the previous two years, first-round investments in IT companies had averaged around $5 million. The Decision Pete Perez wondered how Everest Partners had arrived at its offer for ORN. Based on his own calculations, he thought a 15% stake would be more appropriate, especially in light of the profitable nature and strong growth prospects of the company. But even if he heavily discounted the projected free cash flows (to 50% of their projected values), he obtained a much higher valuation for ORN than Everest Partners had offered What rationale had Everest Partners used in making its offer? Was it just trying to "squeeze him? Did the low valuation simply reflect the industry norm? Would another VC firm yield a higher offer? Still, Perez thought, everything had its price, and at some point, it gets to be real moneyin this case his own. Should he accept Chalmers's offer, try to negotiate a higher valuation, approach other VC firms, or turn down the offer and VC funding altogether? Page 6 UV6569 Exhibit 2 OutReach Networks: First Venture Round Comparable Company Valuation Data (dollars in millions) Total Debt/ Capital % Company Name (Ticker) Acme Packet, Inc. (APKT) Aruba Networks, Inc. (ARUN) Aviat Networks, Inc. (AVNW) Cisco Systems (CSCO) Market Capitalization $2,244 $2,258 $108 $100,206 Revenue $295 $433 $463 $43,724 Revenues, 1Yr Growth % 45.6% 48.2% 3.9% 4.7% EBITDA Margin % 30.1% 3.0% 0.2% 25.3% TEV/ Forward EBITDA 13.7% 13.3x 4.2x 6.4x Forward P/E 24.3 31.5 x 21.3x 10.3 x Beta 1.50 1.95 1.35 1.20 7.6% 26.3% Mean Median $26,204 $2,251 $11,229 $448 25.6% 25.2% 14.6% 14.1% 17.0% 17.0% 9.4x 9.9x 21.8 x 22.8% 1.50 1.43 Notes: Valuation multiples as of November 2011. The 10-year U.S Treasury rate was assumed to be 5% and the market risk premium 60%. Company Descriptions: Acme Packet provided session delivery network solutions that enabled the delivery of voice, vicko, data, and unified communications services and applications across Inte met protocol (IP) networks. Aruba Networks, incorporated in 2002, was a provider of next-generation network access solutions for the mobile enterprise. Its products unified wired and wireless network infrastructures into one seamless access solution for corporate headquarters, mobile business professionals, and remote workers. Aviat Networks ok signed, manufactured, and sold wireless networking products, solutions, and services in North America and internationally. It offered point-to-point digital microwave transmission systems for first- and last-mik access, miidk mile/backhaul, and long-distance trunking applications. It also provided broadband wireless access base stations and customer premises equipment Cisco Systems designed, manufactured, and sok IP-based networking and other products related to the communications and IT industry worklwide. It offered routers that interconnected public and private IP networks for mobile, chata, voice, and vicko applications, and switching products, which provided connectivity to end users, workstations, IP phones, access points, and servers. Data source: Capital

I NEED THE EXCEL CALCULATION

I NEED THE EXCEL CALCULATION