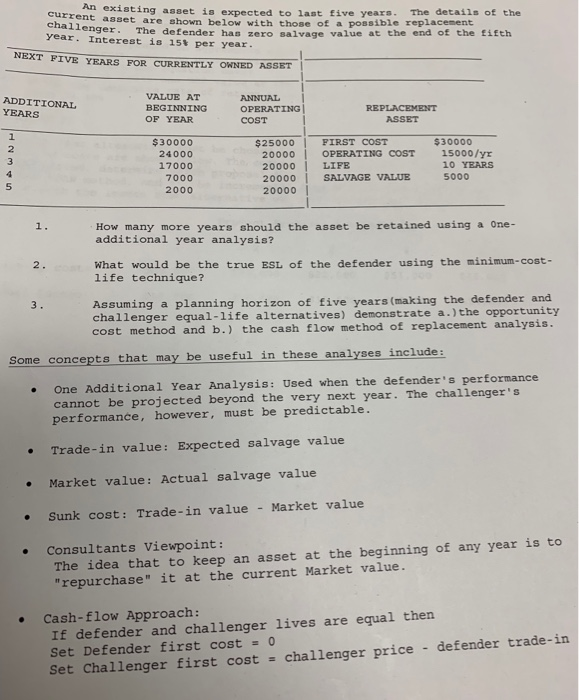

Question: An existing asset is expected to last five years. The details of the Cdzrent asset are shown below with those of a possible replacement challenger.

An existing asset is expected to last five years. The details of the Cdzrent asset are shown below with those of a possible replacement challenger. The defender has zero salvage value at the end of the fifth year. Interest is 15t per year. NEXT FIVE YEARS FOR CURRENTLY ONNED ASSET VALUE AT ANNUAL ADDITIONAL REPLACEMENT BEGINNING OPERATING YEARS OF YEAR ASSET COST 1 $30000 15000/yr $30000 FIRST COST $25000 2 24000 OPERATING COST 20000 3 10 YEARS 17000 7000 2000 LIFE 20000 SALVAGE VALUE 5000 20000 5 20000 How many more years should the asset be retained using a One- additional year analysis? 1. What would be the true ESL of the defender using the minimum-cost- life technique? 2. Assuming challenger equal-life alternatives) demonstrate a.) the opportunity cost method and b.) the cash flow method of replacement analysis. planning horizon of five years (making the defender and 3. a Some concepts that may be useful in these analyses include: One Additional Year Analysis: Used when the defender's performance cannot be projected beyond the very next year. The challenger's performance, however, must be predictable. Trade-in value: Expected salvage value Market value: Actual salvage value Market value Sunk cost: Trade-in value Consultants Viewpoint: The idea that to keep a "repurchase" it at the current Market value. an asset at the beginning of any year is to Cash-flow Approach: If defender and challenger lives are equal then Set Defender first cos Set Challenger first cost = = 0 challenger price defender trade-in NM un An existing asset is expected to last five years. The details of the Cdzrent asset are shown below with those of a possible replacement challenger. The defender has zero salvage value at the end of the fifth year. Interest is 15t per year. NEXT FIVE YEARS FOR CURRENTLY ONNED ASSET VALUE AT ANNUAL ADDITIONAL REPLACEMENT BEGINNING OPERATING YEARS OF YEAR ASSET COST 1 $30000 15000/yr $30000 FIRST COST $25000 2 24000 OPERATING COST 20000 3 10 YEARS 17000 7000 2000 LIFE 20000 SALVAGE VALUE 5000 20000 5 20000 How many more years should the asset be retained using a One- additional year analysis? 1. What would be the true ESL of the defender using the minimum-cost- life technique? 2. Assuming challenger equal-life alternatives) demonstrate a.) the opportunity cost method and b.) the cash flow method of replacement analysis. planning horizon of five years (making the defender and 3. a Some concepts that may be useful in these analyses include: One Additional Year Analysis: Used when the defender's performance cannot be projected beyond the very next year. The challenger's performance, however, must be predictable. Trade-in value: Expected salvage value Market value: Actual salvage value Market value Sunk cost: Trade-in value Consultants Viewpoint: The idea that to keep a "repurchase" it at the current Market value. an asset at the beginning of any year is to Cash-flow Approach: If defender and challenger lives are equal then Set Defender first cos Set Challenger first cost = = 0 challenger price defender trade-in NM un

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts