Answered step by step

Verified Expert Solution

Question

1 Approved Answer

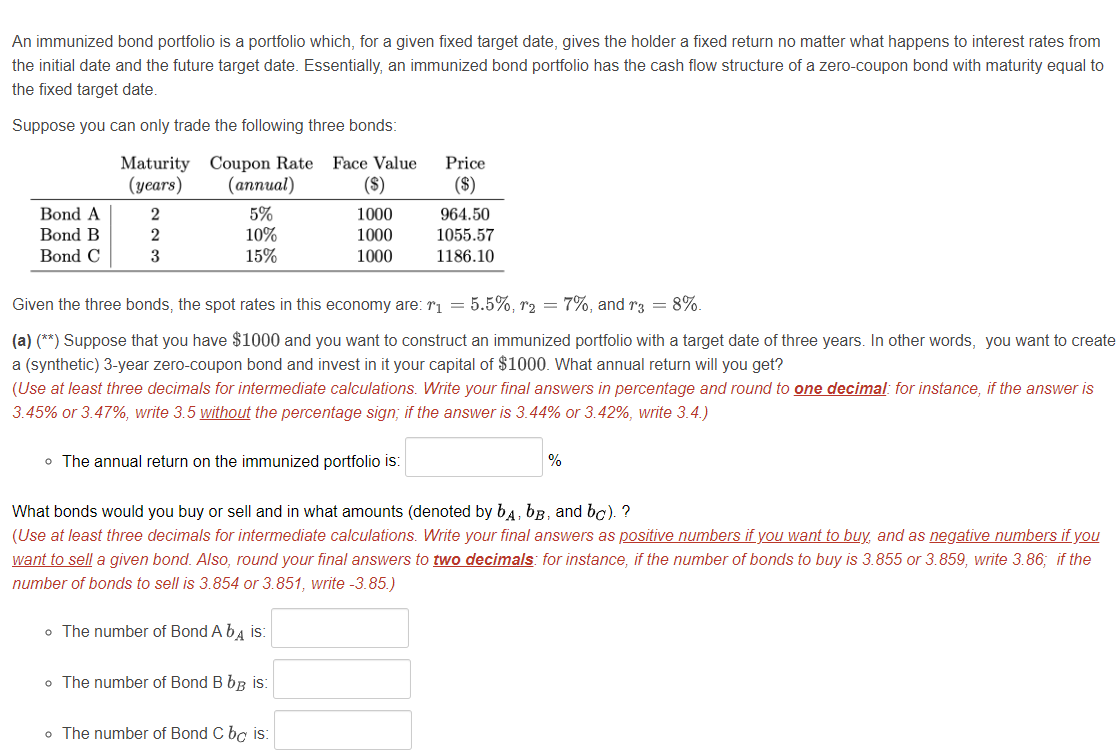

An immunized bond portfolio is a portfolio which, for a given fixed target date, gives the holder a fixed return no matter what happens to

An immunized bond portfolio is a portfolio which, for a given fixed target date, gives the holder a fixed return no matter what happens to interest rates from

the initial date and the future target date. Essentially, an immunized bond portfolio has the cash flow structure of a zerocoupon bond with maturity equal to

the fixed target date.

Suppose you can only trade the following three bonds:

Given the three bonds, the spot rates in this economy are: and

a Suppose that you have $ and you want to construct an immunized portfolio with a target date of three years. In other words, you want to create

a syntheticyear zerocoupon bond and invest in it your capital of $ What annual return will you get?

Use at least three decimals for intermediate calculations. Write your final answers in percentage and round to one decimal: for instance, if the answer is

or write without the percentage sign; if the answer is or write

The annual return on the immunized portfolio is:

What bonds would you buy or sell and in what amounts denoted by and

Use at least three decimals for intermediate calculations. Write your final answers as positive numbers if you want to buy, and as negative numbers if you

want to sell a given bond. Also, round your final answers to two decimals: for instance, if the number of bonds to buy is or write ; if the

number of bonds to sell is or write

The number of Bond is:

The number of Bond is:

The number of Bond is:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started