Answered step by step

Verified Expert Solution

Question

1 Approved Answer

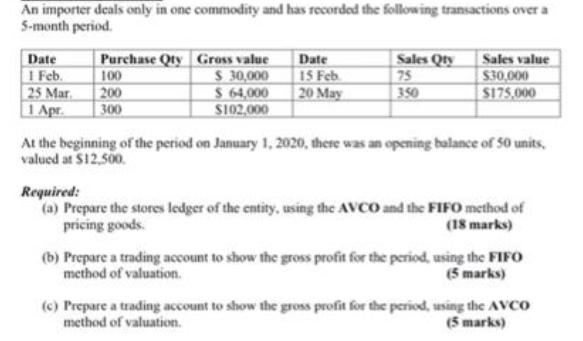

An importer deals only in one commodity and has recorded the following transactions over a 5-month period. Date 1 Feb. 25 Mar 1 Apr.

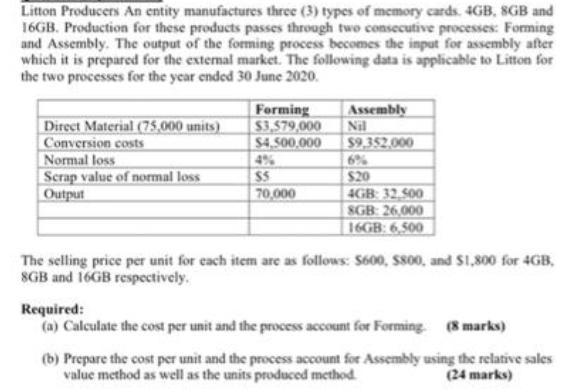

An importer deals only in one commodity and has recorded the following transactions over a 5-month period. Date 1 Feb. 25 Mar 1 Apr. Purchase Qty Gross value $ 30,000 $ 64,000 $102,000 100 200 300 Date 15 Feb 20 May Sales Qty 75 350 Sales value $30,000 $175,000 At the beginning of the period on January 1, 2020, there was an opening balance of 50 units, valued at $12,500. Required: (a) Prepare the stores ledger of the entity, using the AVCO and the FIFO method of pricing goods. (18 marks) (b) Prepare a trading account to show the gross profit for the period, using the FIFO method of valuation. (5 marks) (c) Prepare a trading account to show the gross profit for the period, using the AVCO method of valuation. (5 marks) Litton Producers An entity manufactures three (3) types of memory cards. 4GB, 8GB and 16GB. Production for these products passes through two consecutive processes: Forming and Assembly. The output of the forming process becomes the input for assembly after which it is prepared for the external market. The following data is applicable to Litton for the two processes for the year ended 30 June 2020. Direct Material (75,000 units) Conversion costs Normal loss Scrap value of normal loss Output Forming $3,579,000 $4,500,000 $5 70,000 Assembly Nil $9.352.000 6% $20 4GB: 32,500 SGB: 26,000 16GB: 6,500 The selling price per unit for each item are as follows: 5600, $800, and $1,800 for 4GB, 8GB and 16GB respectively. Required: (a) Calculate the cost per unit and the process account for Forming (8 marks) (b) Prepare the cost per unit and the process account for Assembly using the relative sales value method as well as the units produced method. (24 marks)

Step by Step Solution

★★★★★

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Answer a Store ledger of the entity Method 1 First in first out method FIFO Date Bought Issued Stock ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started