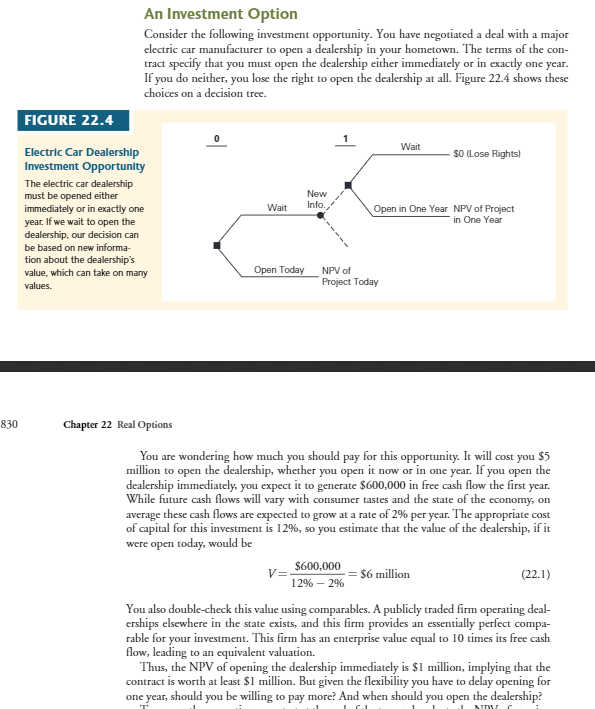

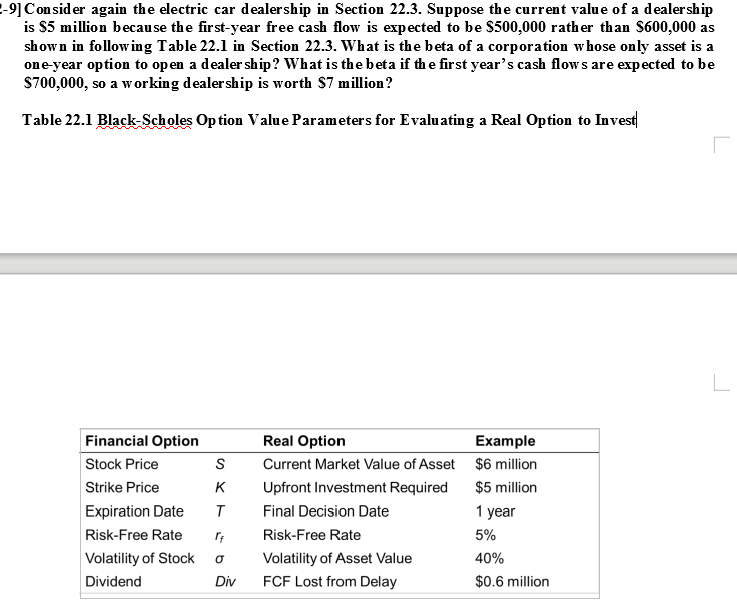

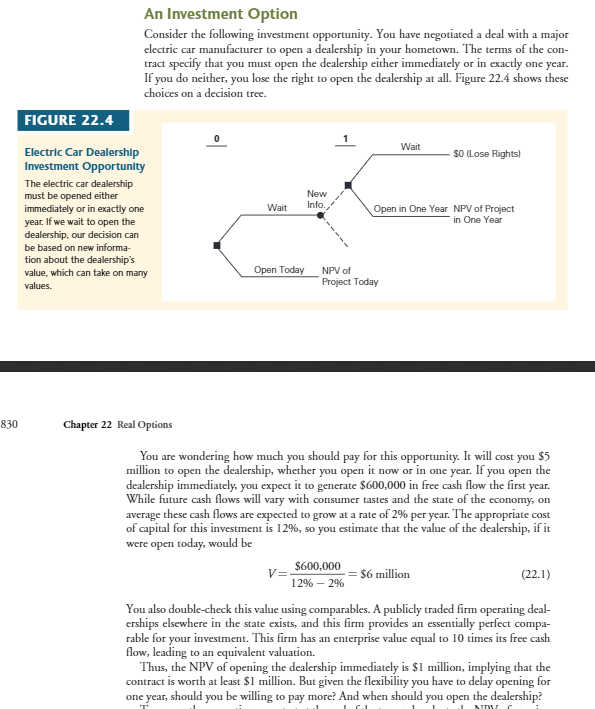

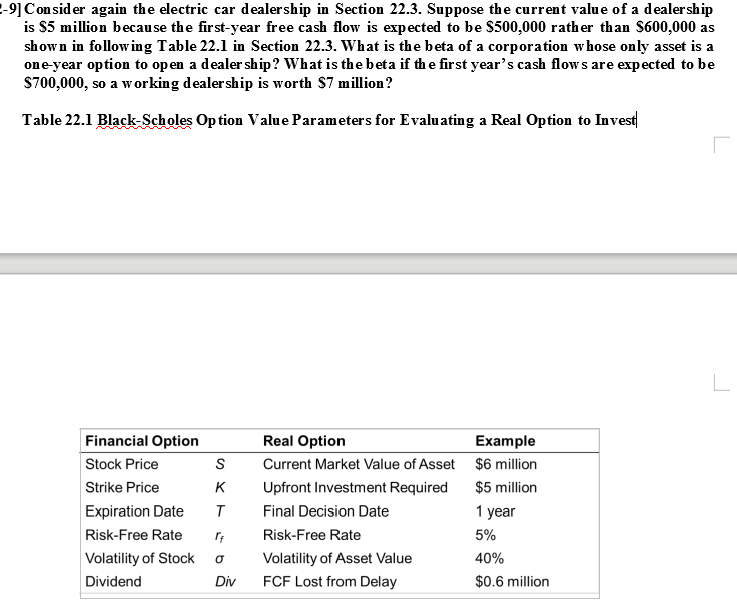

An Investment Option Consider the following investment opportunity. You have negotiated a deal with a major electric car manufacturer to open a dealership in your hometown. The terms of the con tract specify that you must open the dealership either i If you do neither, you lose the right to open the dealership at all. Figure 22.4 shows these choices on a decision tree. immediately or in exactly one year FIGURE 22.4 Wait Electric Car Dealershlp Investment Opportunity The electric car dealership must be opened either immediately or in exactly one $0 (Lose Rights New Wait Info. Open in One Year NPV of Project in One Year If we wait to open the dealership, our decision can be based on new informa- tion about the dealership's value, which can take on many values. Open TodayNPV of Project Today 830 Chapter 22 Real Options You are wondering how much you should pay for this opportunity. It will cost you $5 million to open the dealership, whether you open it now or in one year. If you open the dealership immediately, you expect it to generate $600,000 in free cash flow the first year. While future cash flows will vary with consumer tastes and the state of the average these cash flows are expected to grow at a rate of 296 per year. The appropriate cost of capital for this investment is 12%, so you estimate that the value of the dealership, if it were open today would be economy, on S600,000- s6 million 1296-296 You also double-check this value using comparables. A publicly traded firm operating deal erships elsewhere in the state exists, and this firm provides an essentially perfect compa- rable for your investment. This firm has an enterprise value equal to 10 times its free cash flow, leading to an equivalent valuation. Thus, the NPV of opening the dealership immediately is $1 million, implying that the contract is worth at least $1 million. But given the flexibility you have to delay opening for one year, should you be willing to pay more? And when should you open the dealership? -9 Consider again the electric car dealership in Section 22.3. Suppose the current value of a dealership is S5 million because the first-year free cash flow is expected to be S500,000 rather than S600,000 as shown in following Table 22.1 in Section 22.3. What is the beta of a corporation w hose only asset is a one-year option to open a dealer ship? What is the beta if th e first year's cash flows are expected to be S700,000, so a working dealership is worth S7 million? Table 22.1 Black-Scholes Option Value Parameters for Evaluating a Real Option to Invest Financial Option Stock Price Strike Price Expiration Date T Risk-Free Rate r Volatility of Stock Dividend Real Option Current Market Value of Asset Upfront Investment Required Final Decision Date Risk-Free Rate Volatility of Asset Value FCF Lost from Delay Example $6 million $5 million 1 year 5% 40% $0.6 million S K Div