Question

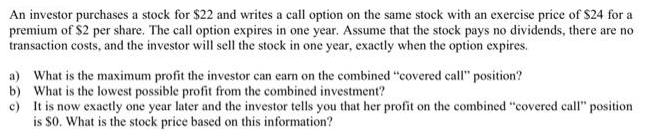

An investor purchases a stock for $22 and writes a call option on the same stock with an exercise price of $24 for a

An investor purchases a stock for $22 and writes a call option on the same stock with an exercise price of $24 for a premium of $2 per share. The call option expires in one year. Assume that the stock pays no dividends, there are no transaction costs, and the investor will sell the stock in one year, exactly when the option expires. a) What is the maximum profit the investor can earn on the combined "covered call" position? What is the lowest possible profit from the combined investment? b) c) It is now exactly one year later and the investor tells you that her profit on the combined "covered call" position is 80. What is the stock price based on this information?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a The maximum profit the investor can earn on the combined covered call position is achieved if the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Financial Management

Authors: Eugene F. Brigham, Joel F. Houston

12th edition

978-0324597714, 324597711, 324597703, 978-8131518571, 8131518574, 978-0324597707

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App