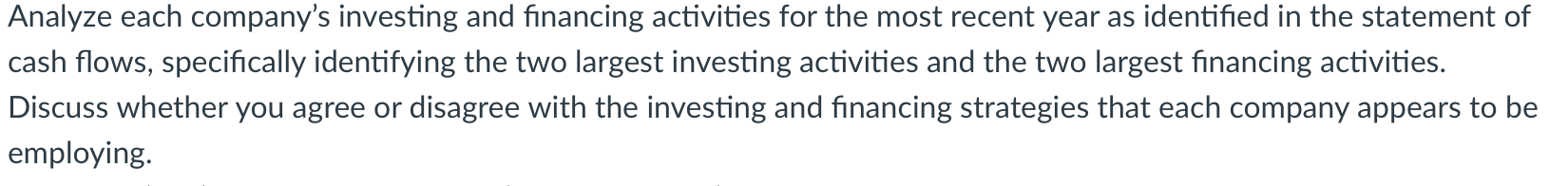

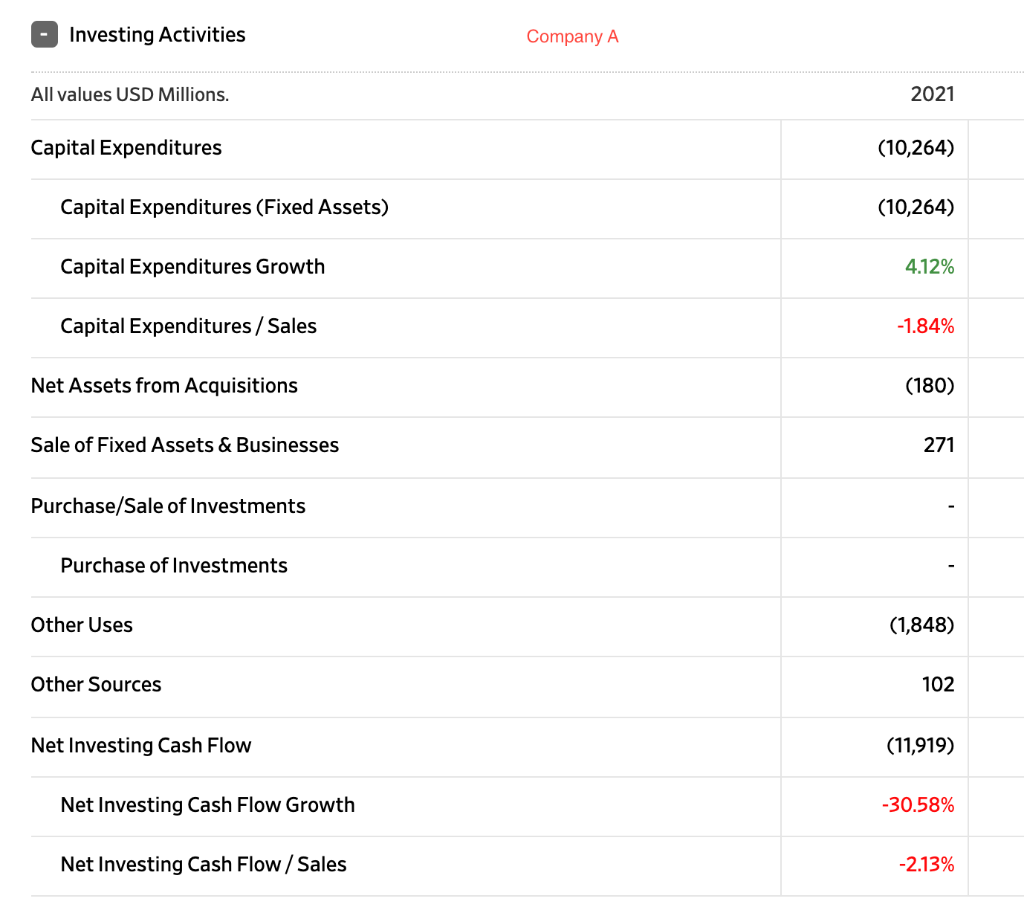

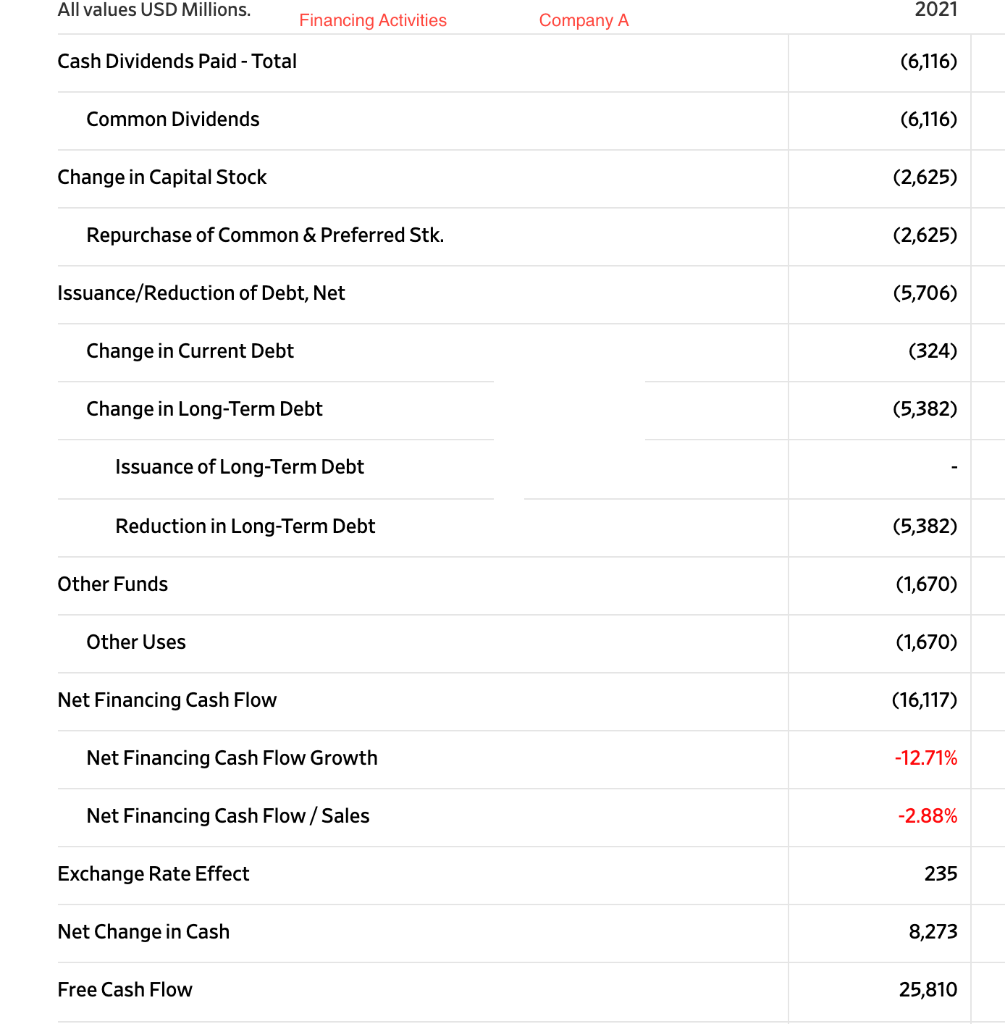

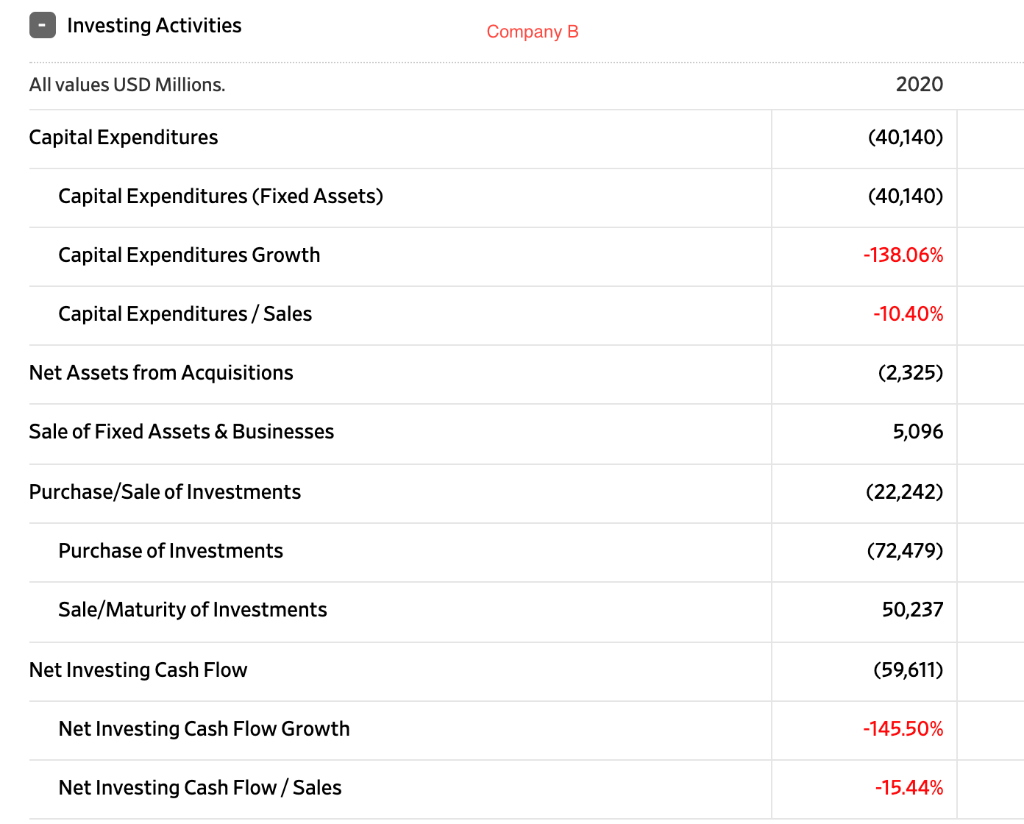

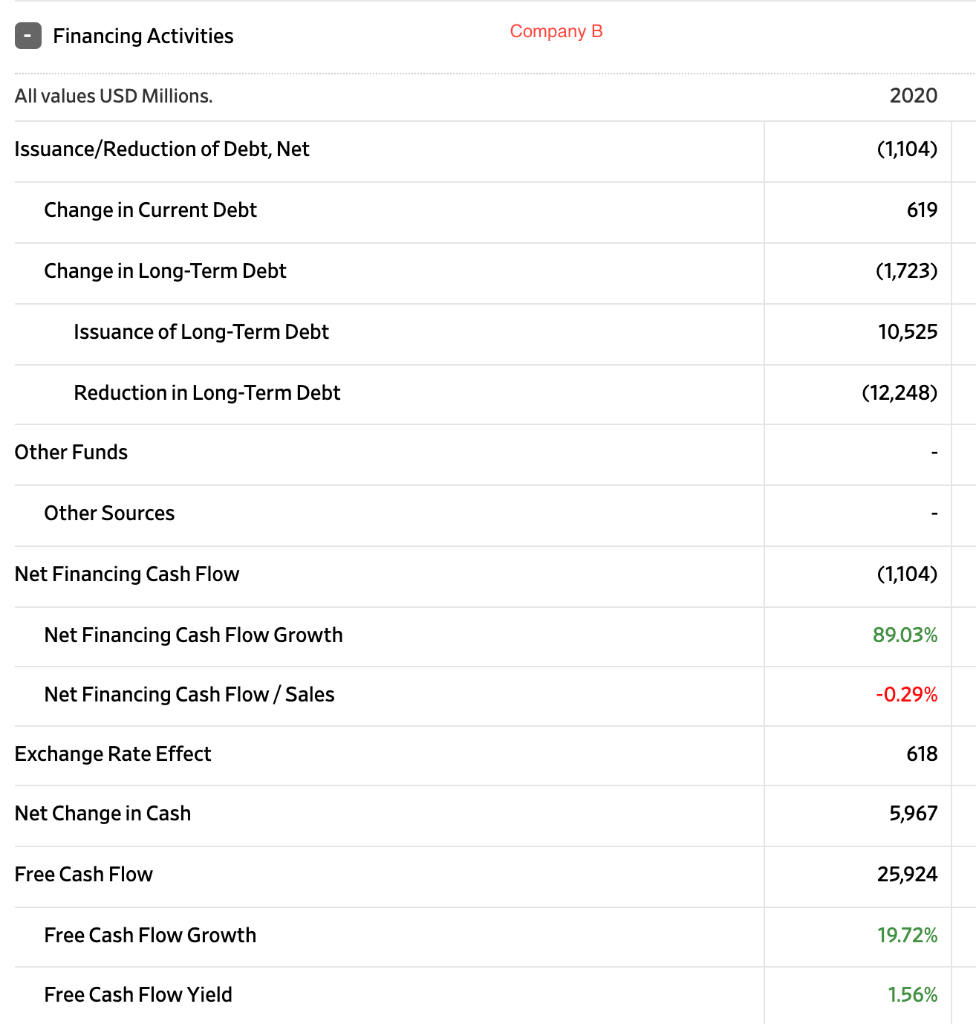

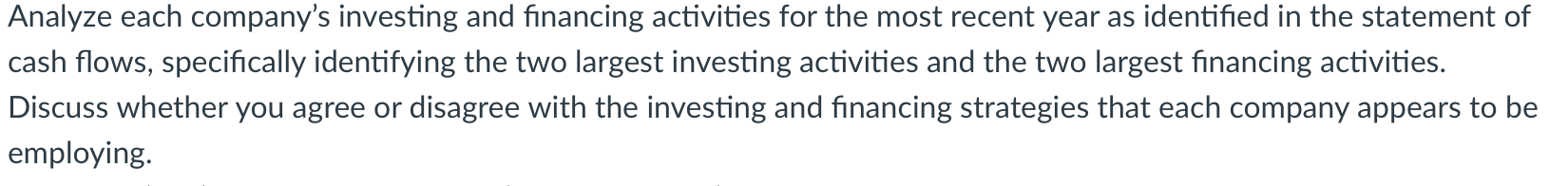

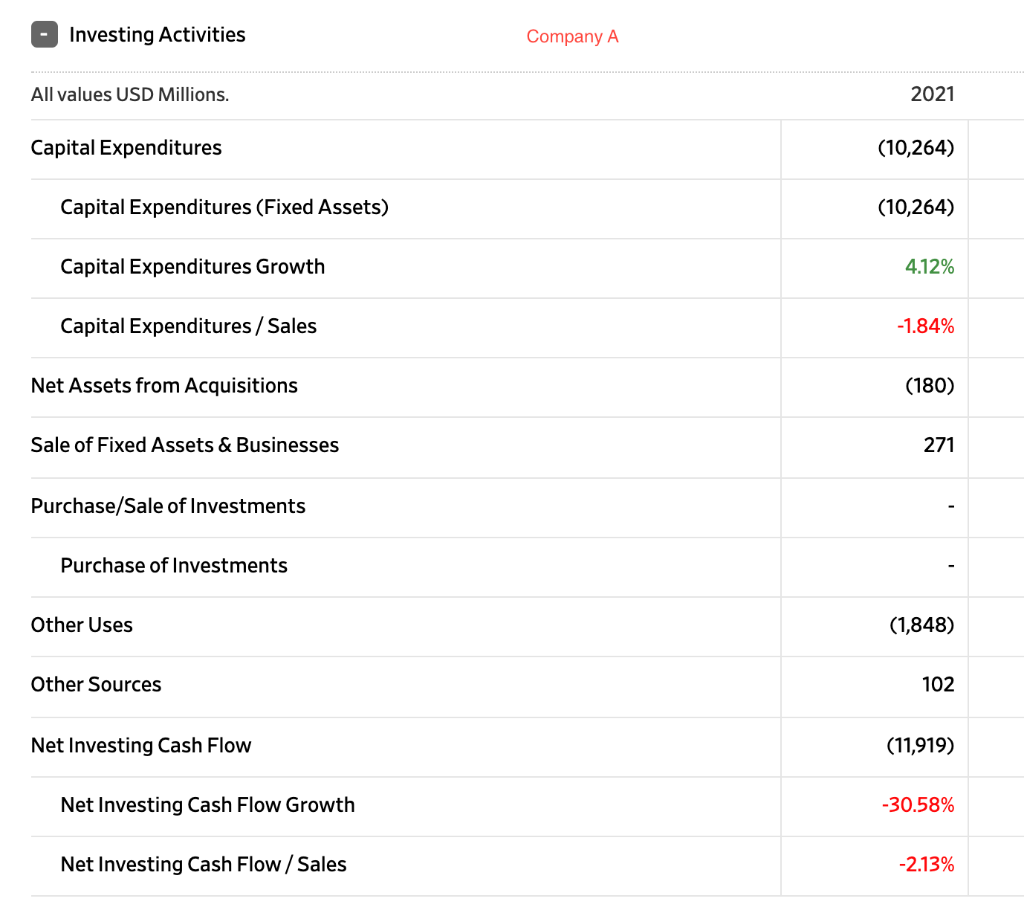

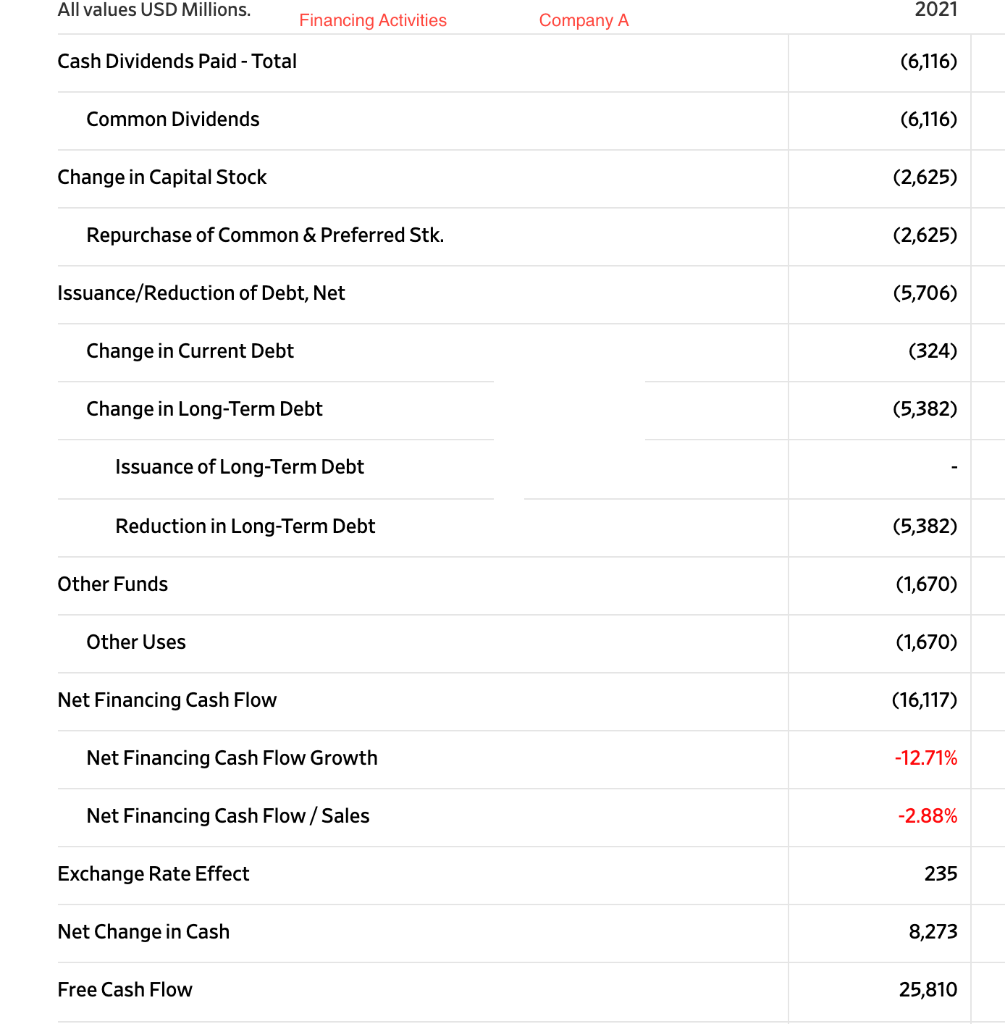

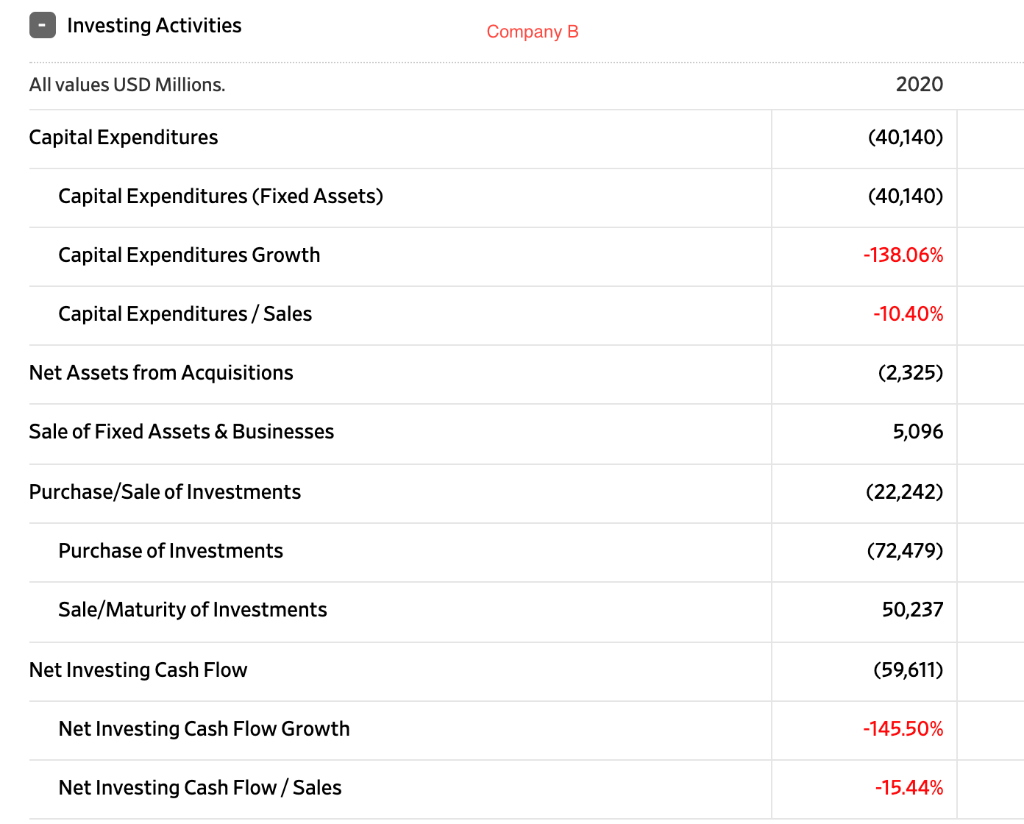

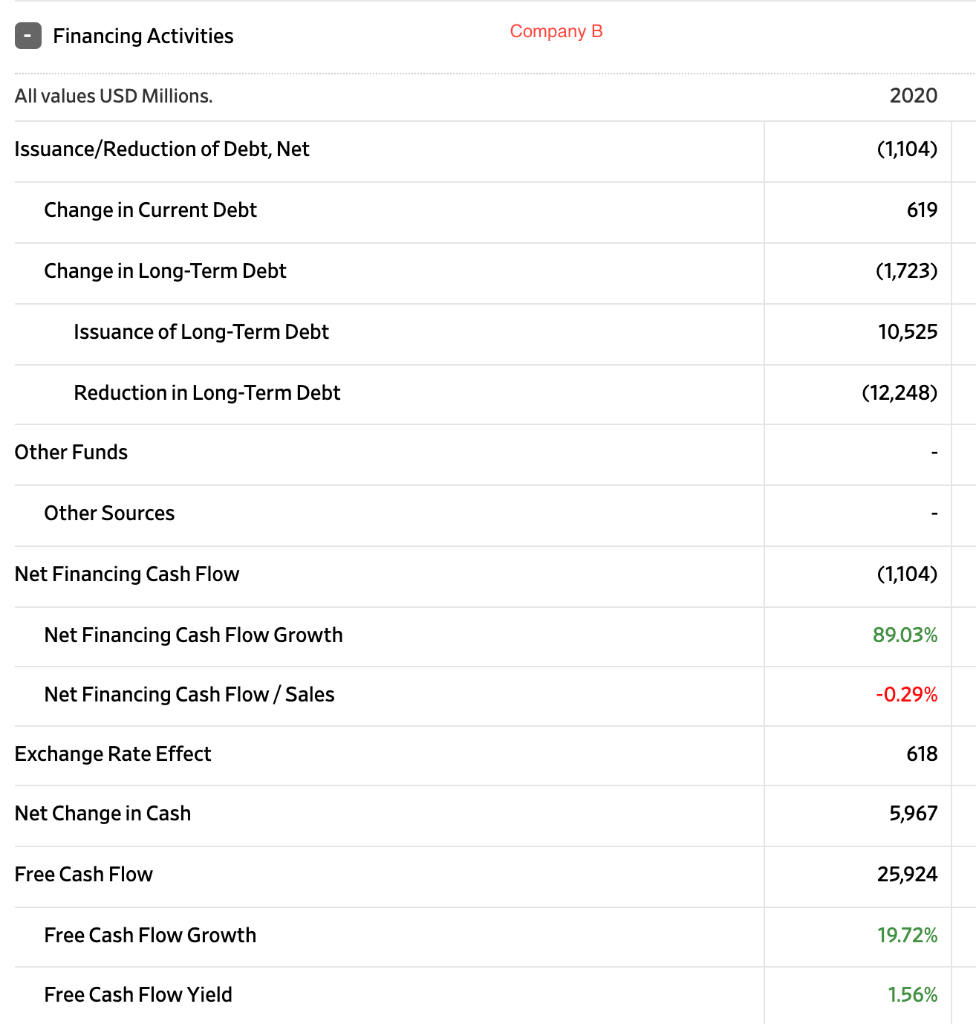

Analyze each company's investing and financing activities for the most recent year as identified in the statement of cash flows, specifically identifying the two largest investing activities and the two largest financing activities. Discuss whether you agree or disagree with the investing and financing strategies that each company appears to be employing. - Investing Activities Company A All values USD Millions. 2021 Capital Expenditures (10,264) Capital Expenditures (Fixed Assets) (10,264) Capital Expenditures Growth 4.12% Capital Expenditures / Sales -1.84% Net Assets from Acquisitions (180) Sale of Fixed Assets & Businesses 271 Purchase/Sale of Investments Purchase of Investments Other Uses (1,848) Other Sources 102 Net Investing Cash Flow (11,919) Net Investing Cash Flow Growth -30.58% Net Investing Cash Flow / Sales -2.13% All values USD Millions. 2021 Financing Activities Company A Cash Dividends Paid - Total (6,116) Common Dividends (6,116) Change in Capital Stock (2,625) Repurchase of Common & Preferred Stk. (2,625) Issuance/Reduction of Debt, Net (5,706) Change in Current Debt (324) Change in Long-Term Debt (5,382) Issuance of Long-Term Debt Reduction in Long-Term Debt (5,382) Other Funds (1,670) Other Uses (1,670) Net Financing Cash Flow (16,117) Net Financing Cash Flow Growth -12.71% Net Financing Cash Flow / Sales -2.88% Exchange Rate Effect 235 Net Change in Cash 8,273 Free Cash Flow 25,810 - Investing Activities Company B All values USD Millions. 2020 Capital Expenditures (40,140) Capital Expenditures (Fixed Assets) (40,140) Capital Expenditures Growth -138.06% Capital Expenditures / Sales -10.40% Net Assets from Acquisitions (2,325) Sale of Fixed Assets & Businesses 5,096 Purchase/Sale of Investments (22,242) Purchase of Investments (72,479) Sale/Maturity of Investments 50,237 Net Investing Cash Flow (59,611) Net Investing Cash Flow Growth -145.50% Net Investing Cash Flow / Sales -15.44% Financing Activities Company B All values USD Millions. 2020 Issuance/Reduction of Debt, Net (1,104) Change in Current Debt 619 Change in Long-Term Debt (1,723) Issuance of Long-Term Debt 10,525 Reduction in Long-Term Debt (12,248) Other Funds Other Sources Net Financing Cash Flow (1,104) Net Financing Cash Flow Growth 89.03% Net Financing Cash Flow / Sales -0.29% Exchange Rate Effect 618 Net Change in Cash 5,967 Free Cash Flow 25,924 Free Cash Flow Growth 19.72% Free Cash Flow Yield 1.56%