Answered step by step

Verified Expert Solution

Question

1 Approved Answer

And operating income: it cut out of the screenshot. Thanks! Walsh Transportation Company's general manager reports quarterly to the company president on the firm's operating

And operating income: it cut out of the screenshot. Thanks!

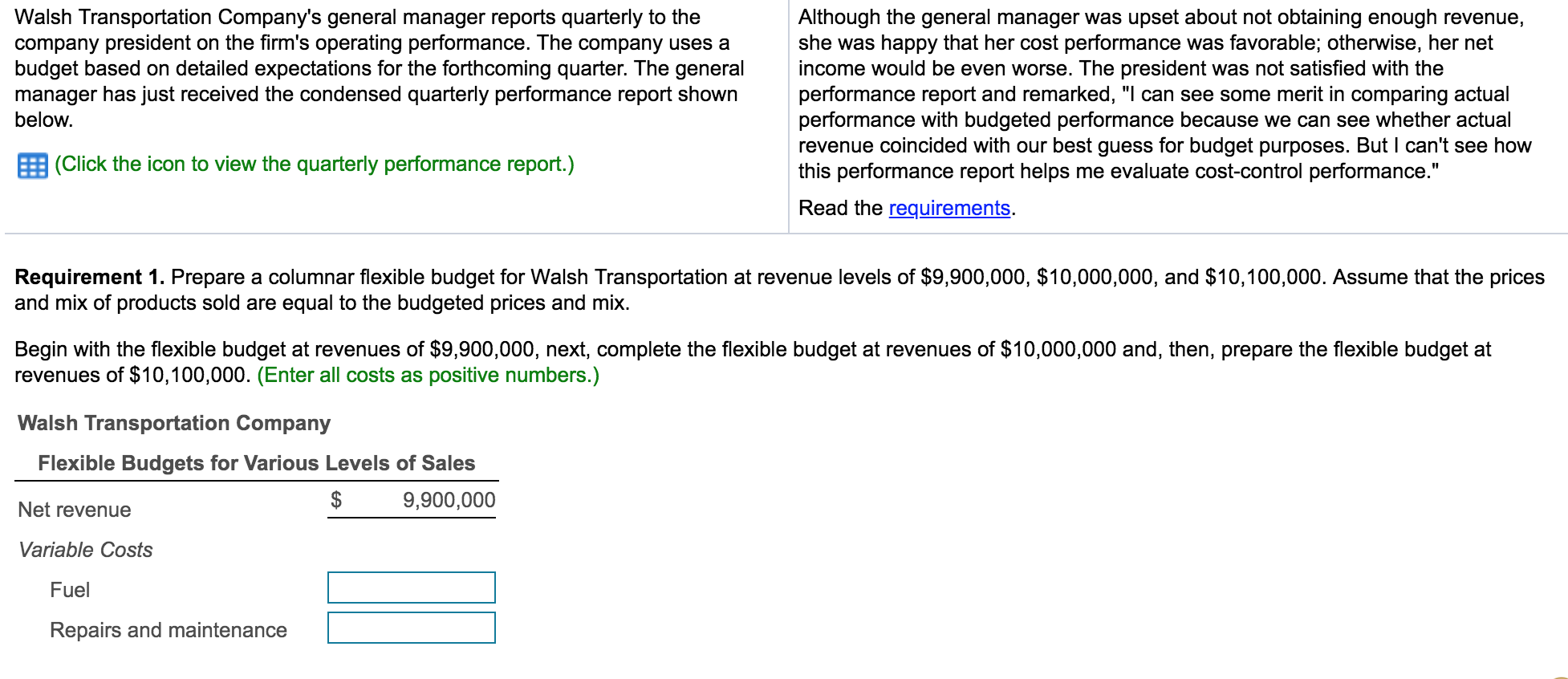

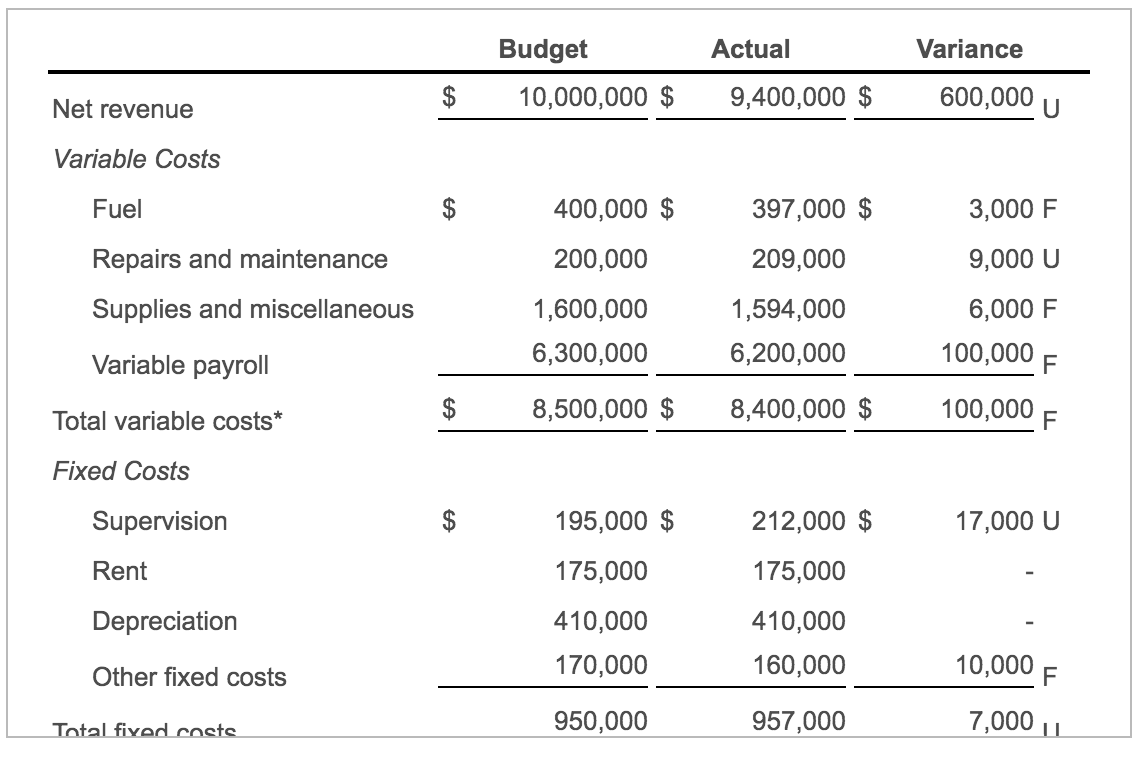

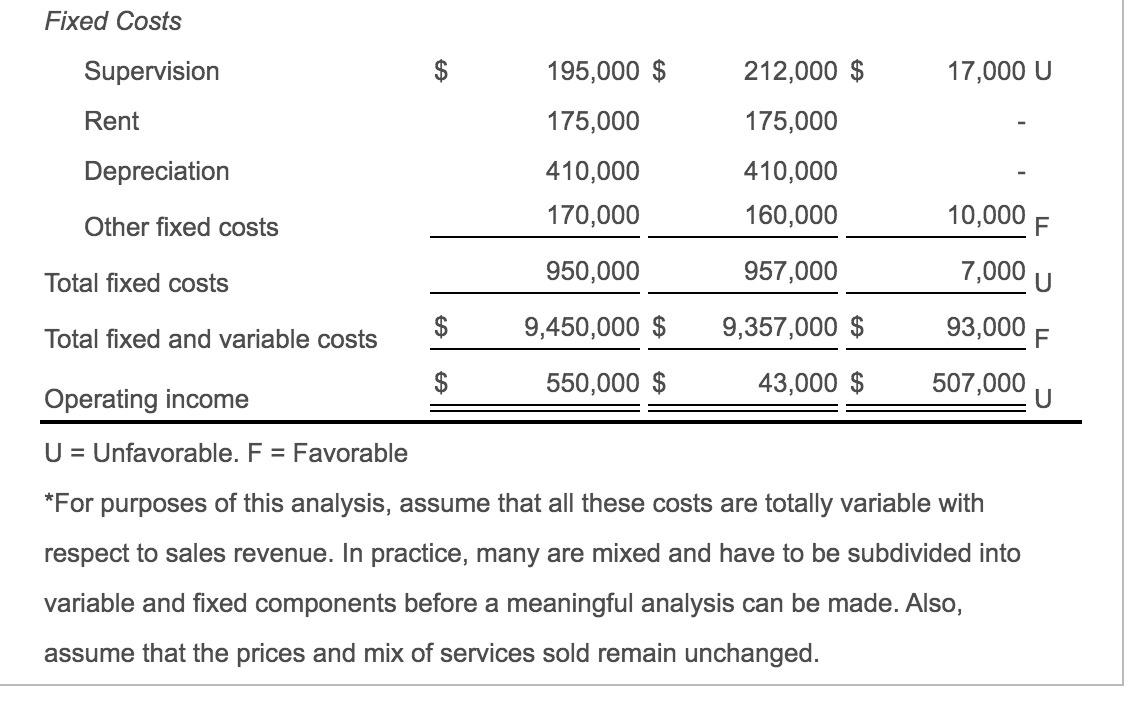

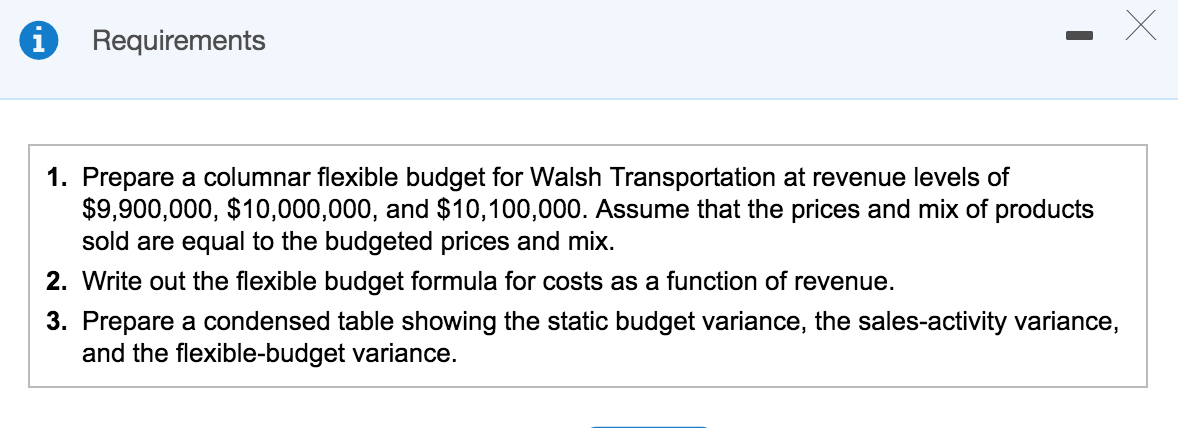

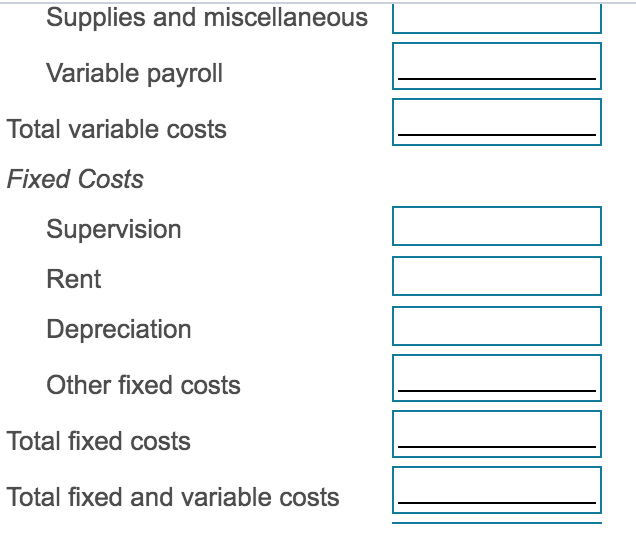

Walsh Transportation Company's general manager reports quarterly to the company president on the firm's operating performance. The company uses a budget based on detailed expectations for the forthcoming quarter. The general just received the condensed quarterly performance report shown below. Although the general manager was upset about not obtaining enough revenue, she was happy that her cost performance was favorable; otherwise, her net income would be even worse. The president was not satisfied with the performance report and remarked, "I can see some merit in comparing actual performance with budgeted performance because we can see whether actual revenue coincided with our best guess for budget purposes. But I can't see how this performance report helps me evaluate cost-control performance." Read the requirements. E (Click the icon to view the quarterly performance report.) Requirement 1. Prepare a columnar flexible budget for Walsh Transportation at revenue levels of $9,900,000, $10,000,000, and $10,100,000. Assume that the prices and mix of products sold are equal to the budgeted prices and mix. Begin with the flexible budget at revenues of $9,900,000, next, complete the flexible budget at revenues of $10,000,000 and, then, prepare the flexible budget at revenues of $10,100,000. (Enter all costs as positive numbers.) Walsh Transportation Company Flexible Budgets for Various Levels of Sales $ 9,900,000 Net revenue Variable Costs Fuel Repairs and maintenance Budget Actual Variance Net revenue $ 10,000,000 $ 9,400,000 $ 600,000 u Variable Costs Fuel 3,000 F 9,000 U Repairs and maintenance Supplies and miscellaneous 400,000 $ 200,000 1,600,000 6,300,000 8,500,000 $ 397,000 $ 209,000 1,594,000 6,200,000 Variable payroll 6,000 F 100,000 F 100,000 F Total variable costs* $ 8,400,000 $ Fixed Costs Supervision 212,000 $ 17,000 U Rent 175,000 195,000 $ 175,000 410,000 170,000 Depreciation 410,000 160,000 Other fixed costs 10,000 F Total fixed costs 950,000 957,000 7,000 L Fixed Costs Supervision 17,000 U Rent 195,000 $ 175,000 410,000 170,000 950,000 9,450,000 $ 212,000 $ 175,000 410,000 160,000 Depreciation Other fixed costs 10,0 T 7,000 U Total fixed costs Total fixed and variable costs 957,000 9,357,000 $ 43,000 $ 93,000 F 507,000 Operating income $ 550,000 $ U = Unfavorable. F = Favorable *For purposes of this analysis, assume that all these costs are totally variable with respect to sales revenue. In practice, many are mixed and have to be subdivided into variable and fixed components before a meaningful analysis can be made. Also, assume that the prices and mix of services sold remain unchanged. A Requirements 1. Prepare a columnar flexible budget for Walsh Transportation at revenue levels of $9,900,000, $10,000,000, and $10,100,000. Assume that the prices and mix of products sold are equal to the budgeted prices and mix. 2. Write out the flexible budget formula for costs as a function of revenue. 3. Prepare a condensed table showing the static budget variance, the sales-activity variance, and the flexible-budget variance. Supplies and miscellaneous Variable payroll Total variable costs Fixed Costs Supervision Rent Depreciation Other fixed costs Total fixed costs Total fixed and variable costsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started