Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Anderson Corporation had $400,000 in the bank at the end of the prior year, and its working capital accounts except cash and notes payable remained

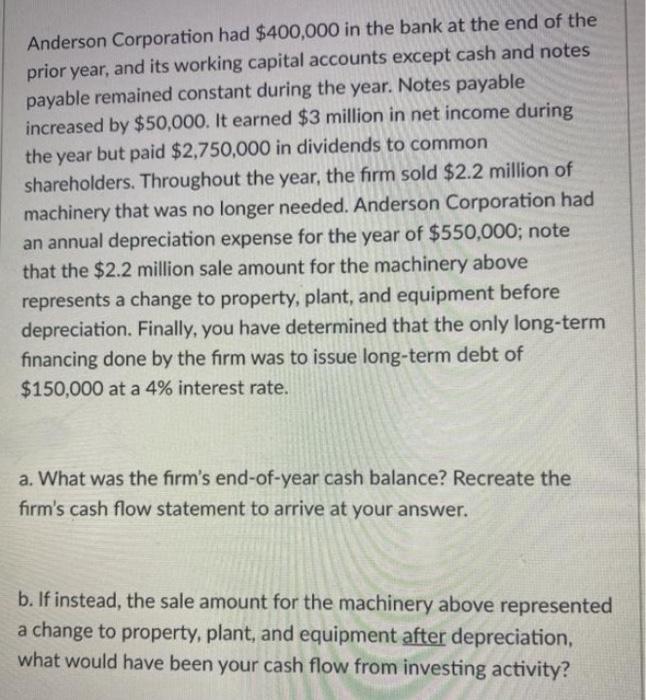

Anderson Corporation had $400,000 in the bank at the end of the prior year, and its working capital accounts except cash and notes payable remained constant during the year. Notes payable increased by $50,000. It earned $3 million in net income during the year but paid $2,750,000 in dividends to common shareholders. Throughout the year, the firm sold $2.2 million of machinery that was no longer needed. Anderson Corporation had an annual depreciation expense for the year of $550,000; note that the $2.2 million sale amount for the machinery above represents a change to property, plant, and equipment before depreciation. Finally, you have determined that the only long-term financing done by the firm was to issue long-term debt of $150,000 at a 4% interest rate. a. What was the firm's end-of-year cash balance? Recreate the firm's cash flow statement to arrive at your answer. b. If instead, the sale amount for the machinery above represented a change to property, plant, and equipment after depreciation, what would have been your cash flow from investing activity?

Anderson Corporation had $400,000 in the bank at the end of the prior year, and its working capital accounts except cash and notes payable remained constant during the year. Notes payable increased by $50,000. It earned $3 million in net income during the year but paid $2,750,000 in dividends to common shareholders. Throughout the year, the firm sold $2.2 million of machinery that was no longer needed. Anderson Corporation had an annual depreciation expense for the year of $550,000; note that the $2.2 million sale amount for the machinery above represents a change to property, plant, and equipment before depreciation. Finally, you have determined that the only long-term financing done by the firm was to issue long-term debt of $150,000 at a 4% interest rate. a. What was the firm's end-of-year cash balance? Recreate the firm's cash flow statement to arrive at your answer. b. If instead, the sale amount for the machinery above represented a change to property, plant, and equipment after depreciation, what would have been your cash flow from investing activity Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started