Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Anderson Inc: Economics of Royalty Assignment Anderson Inc, is a startup company that designs, manufactures, and distributes environment friendly iPhone covers. Pat, the CEO of

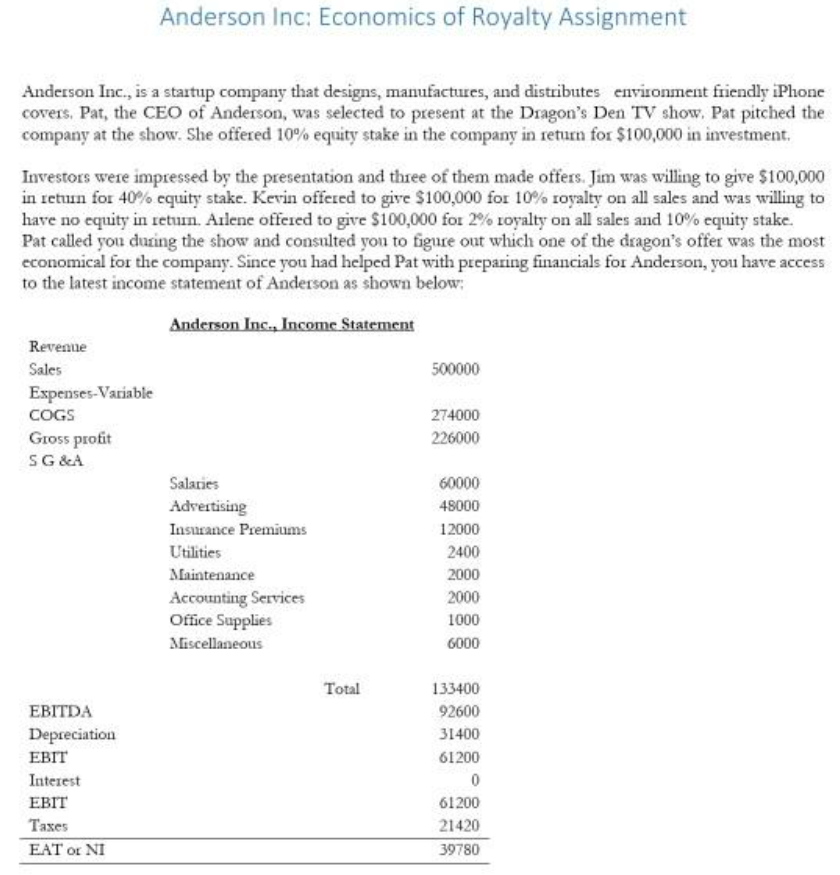

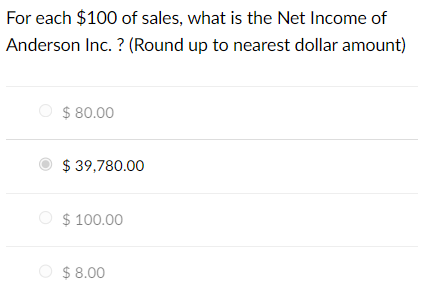

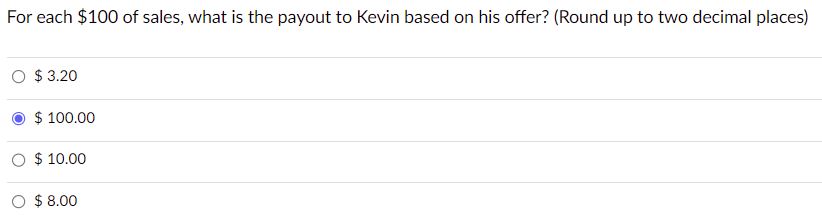

Anderson Inc: Economics of Royalty Assignment Anderson Inc, is a startup company that designs, manufactures, and distributes environment friendly iPhone covers. Pat, the CEO of Anderson, was selected to present at the Dragon's Den TV show, Pat pitched the company at the show. She offered 10% equity stake in the company in return for $100,000 in investment. Investors were impressed by the presentation and three of them made offers. Jim was willing to give $100,000 in return for 40% equity stake. Kevin offered to give $100,000 for 10% royalty on all sales and was willing to have no equity in return. Arlene offered to give $100,000 for 2% royalty on all sales and 10% equity stake. Pat called you during the show and consulted you to figure out which one of the dragon's offer was the most economical for the company. Since you had helped Pat with preparing financials for Anderson, you have access to the latest income statement of Anderson as shown below; For each $100 of sales, what is the Net Income of Anderson Inc. ? (Round up to nearest dollar amount) $80.00 $39,780.00 $100.00 $8.00 For each $100 of sales, what is the payout to Kevin based on his offer? (Round up to two decimal places) $3.20 $100.00 $10.00 $8.00

Anderson Inc: Economics of Royalty Assignment Anderson Inc, is a startup company that designs, manufactures, and distributes environment friendly iPhone covers. Pat, the CEO of Anderson, was selected to present at the Dragon's Den TV show, Pat pitched the company at the show. She offered 10% equity stake in the company in return for $100,000 in investment. Investors were impressed by the presentation and three of them made offers. Jim was willing to give $100,000 in return for 40% equity stake. Kevin offered to give $100,000 for 10% royalty on all sales and was willing to have no equity in return. Arlene offered to give $100,000 for 2% royalty on all sales and 10% equity stake. Pat called you during the show and consulted you to figure out which one of the dragon's offer was the most economical for the company. Since you had helped Pat with preparing financials for Anderson, you have access to the latest income statement of Anderson as shown below; For each $100 of sales, what is the Net Income of Anderson Inc. ? (Round up to nearest dollar amount) $80.00 $39,780.00 $100.00 $8.00 For each $100 of sales, what is the payout to Kevin based on his offer? (Round up to two decimal places) $3.20 $100.00 $10.00 $8.00 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started