Answered step by step

Verified Expert Solution

Question

1 Approved Answer

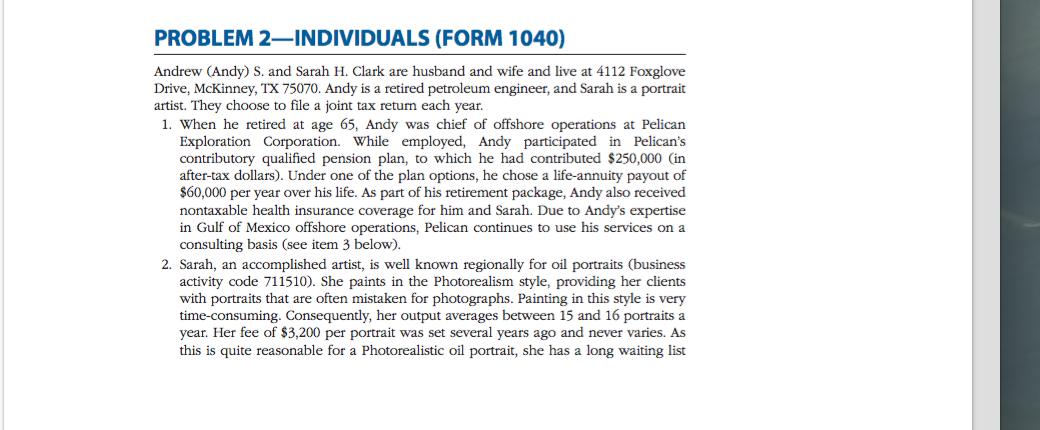

PROBLEM 2-INDIVIDUALS (FORM 1040) Andrew (Andy) S. and Sarah H. Clark are husband and wife and live at 4112 Foxglove Drive, McKinney, TX 75070.

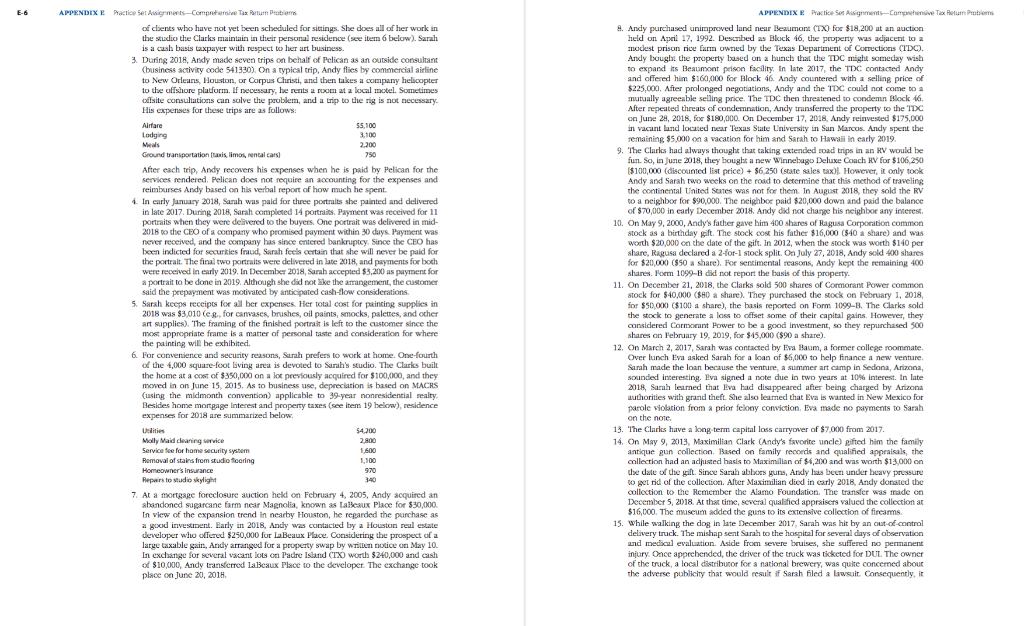

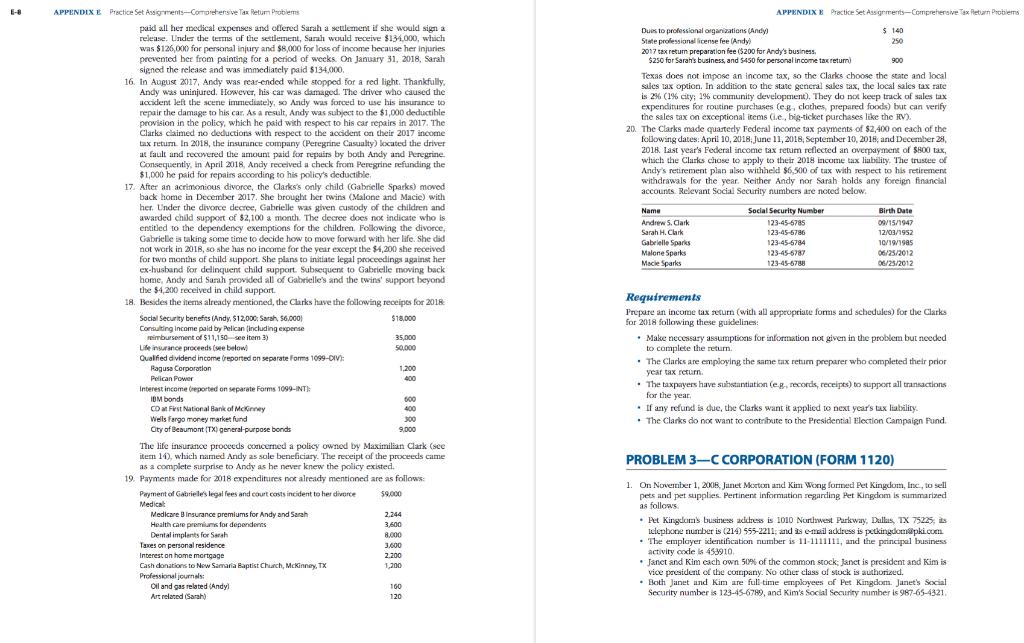

PROBLEM 2-INDIVIDUALS (FORM 1040) Andrew (Andy) S. and Sarah H. Clark are husband and wife and live at 4112 Foxglove Drive, McKinney, TX 75070. Andy is a retired petroleum engineer, and Sarah is a portrait artist. They choose to file a joint tax return each year. 1. When he retired at age 65, Andy was chief of offshore operations at Pelican Exploration Corporation. While employed, Andy participated in Pelican's contributory qualified pension plan, to which he had contributed $250,000 (in after-tax dollars). Under one of the plan options, he chose a life-annuity payout of $60,000 per year over his life. As part f his retirement package, Andy also received nontaxable health insurance coverage for him and Sarah. Due to Andy's expertise in Gulf of Mexico offshore operations, Pelican continues to use his services on a consulting basis (see item 3 below). 2. Sarah, an accomplished artist, is well known regionally for oil portraits (business activity code 711510). She paints in the Photorealism style, providing her clients with portraits that are often mistaken for photographs. Painting in this style is very time-consuming. Consequently, her output averages between 15 and 16 portraits a year. Her fee of $3,200 per portrait was set several years ago and never varies. As this is quite reasonable for a Photorealistic oil portrait, she has a long waiting list E-6 APPENDIX E Practice Set Assignments-Comprehensive Tax Return Problems of clients who have not yet been scheduled for sittings. She does all of her work in the studio the Clarks maintain in their personal residence (see item 6 below). Sarah is a cash basis taxpayer with respect to her art business. 3. During 2018, Andy made seven trips on behalf of Pelican as an outside consultant (business activity code 541330). On a typical trip, Andy flies by commercial airline to New Orleans, Houston, or Corpus Christi, and then takes a company helicopter to the offshore platform. If necessary, he rents a room at a local motel. Sometimes offsite consultations can solve the problem, and a trip to the rig is not necessary. His expenses for these trips are as follows: Airfare Lodging Meals Ground transportation (taxis, limos, rental cars) After each trip, Andy recovers his expenses when he is paid by Pelican for the services rendered. Pelican does not require an accounting for the expenses and reimburses Andy based on his verbal report of how much he spent. $5,100 3,100 2.200 750 4. In early January 2018, Sarah was paid for three portraits she painted and delivered in late 2017. During 2018, Sarah completed 14 portraits. Payment was received for 11 portraits when they were delivered to the buyers. One portrait was delivered in mid- 2018 to the CEO of a company who promised payment within 30 days. Payment was never received, and the company has since entered bankruptcy. Since the CEO has been indicted for securities fraud, Sarah feels certain that she will never be paid for the portrait. The final two portraits were delivered in late 2018, and payments for both were received in early 2019. In December 2018, Sarah accepted $3,200 as payment for a portrait to be done in 2019. Although she did not like the arrangement, the customer said the prepayment was motivated by anticipated cash-flow considerations. 5. Sarah keeps receipts for all her expenses. Her total cost for painting supplies in 2018 was $3,010 (eg, for canvases, brushes, oil paints, smocks, palettes, and other art supplies). The framing of the finished portrait is left to the customer since the most appropriate frame is a matter of personal taste and consideration for where the painting will be exhibited. 6. For convenience and security reasons, Sarah prefers to work at home. One-fourth of the 4,000 square-foot living area is devoted to Sarah's studio. The Clarks built the home at a cost of $350,000 on a lot previously acquired for $100,000, and they moved in on June 15, 2015. As to business use, depreciation is based on MACRS (using the midmonth convention) applicable to 39-year nonresidential realty. Besides home mortgage Interest and property taxes (see item 19 below), residence expenses for 2018 are summarized below. Uslities Molly Maid cleaning service Service fee for home security system Removal of stains from studio flooring Homeowners Insurance Repairs to studio skylight 54,200 2,800 1,600 1,100 970 340 7. At a mortgage foreclosure auction held on February 4, 2005, Andy acquired and abandoned sugarcane farm near Magnolia, known as LaBeaux Place for $30,000. In view of the expansion trend in nearby Houston, he regarded the purchase as a good investment. Early in 2018, Andy was contacted by a Houston real estate developer who offered $250,000 for LaBeaux Place. Considering the prospect of a large taxable gain, Andy arranged for a property swap by written notice on May 10. In exchange for several vacant lots on Padre Island (TX) worth $240,000 and cash of $10,000, Andy transferred LaBeaux Place to the developer. The exchange took place on June 20, 2018. APPENDIX E Practice Set Assignments-Comprehensive Tax Return Problems 8. Andy purchased unimproved land near Beaumont (TX) for $18,200 at an auction held on April 17, 1992. Described as Block 46, the property was adjacent to a modest prison rice farm owned by the Texas Department of Corrections (TDC). Andy bought the property based on a bunch that the TDC might someday wish to expand its Beaumont prison facility. In late 2017, the TDC contacted Andy and offered him $160,000 for Block 46. Andy countered with a selling price of $225,000. After prolonged negotiations, Andy and the TDC could not come to a mutually agreeable selling price. The TDC then threatened to condemn Block 46. After repeated threats of condemnation, Andy transferred the property to the TDC on June 28, 2018, for $180,000. On December 17, 2018, Andy reinvested $175,000 in vacant land located near Texas State University in San Marcos. Andy spent the remaining $5,000 on a vacation for him and Sarah to Hawaii in early 2019. 9. The Clarks had always thought that taking extended road trips in an RV would be fun. So, in June 2018, they bought a new Winnebago Deluxe Coach RV for $106,250 ($100,000 (discounted list price) + $6,250 (state sales tax). However, it only took Andy and Sarah two weeks on the road to determine that this method of traveling the continental United States was not for them. In August 2018, they sold the RV to a neighbor for $90,000. The neighbor paid $20,000 down and paid the balance. of $70,000 in early December 2018. Andy did not change his neighbor any interest. 10. On May 9, 2000, Andy's father gave him 400 shares of Ragusa Corporation common stock as a birthday gift. The stock cost his father $16,000 ($40 a share) and was worth $20,000 on the date of the gift. In 2012, when the stock was worth $140 per share, Ragusa declared a 2-for-1 stock split. On July 27, 2018, Andy sold 400 shares for $20,000 ($50 a share). For sentimental reasons, Andy kept the remaining 400 shares. Form 1099-B did not report the basis of this property. 11. On December 21, 2018, the Clarks sold 500 shares of Cormorant Power common stock for $40,000 ($80 a share). They purchased the stock on February 1, 2018, for $50,000 ($100 a share), the basis reported on Form 1099-8. The Clarks sold the stock to generate a loss to offset some of their capital gains. However, they considered Cormorant Power to be a good investment, so they repurchased 500 shares on February 19, 2019, for $45,000 ($90 a share). 12. On March 2, 2017, Sarah was contacted by Eva Baum, a former college roommate. Over lunch Eva asked Sarah for a loan of $6,000 to help finance a new venture. Sarah made the loan because the venture, a summer art camp in Sedona, Arizona, sounded interesting. Eva signed a note due in two years at 10% interest. In late 2018, Sarah learned that Eva had disappeared after being charged by Arizona authorities with grand theft. She also learned that Eva is wanted in New Mexico for parole violation from a prior felony conviction. Eva made no payments to Sarah on the note. 13. The Clarks have a long-term capital loss carryover of $7,000 from 2017. 14. On May 9, 2013, Maximilian Clark (Andy's favorite uncle) gifted him the family antique gun collection. Based on family records and qualified appraisals, the collection had an adjusted hasis to Maximilian of $4,200 and was worth $13,000 on the date of the gift. Since Sarah abbors guns, Andy has been under heavy pressure to get rid of the collection. After Maximilian died in early 2018, Andy donated the collection to the Remember the Alamo Foundation. The transfer was made on December 5, 2018. At that time, several qualified appraisers valued the collection at $16,000. The museum added the guns to its extensive collection of firearms. 15. While walking the dog in late December 2017, Sarah was hit by an out-of-control delivery truck. The mishap sent Sarah to the hospital for several days of observation and medical evaluation. Aside from severe bruises, she suffered no permanent injury. Once apprehended, the driver of the truck was ticketed for DUL. The owner of the truck, a local distributor for a national brewery, was quite concerned about the adverse publicity that would result if Sarah filed a lawsuit. Consequently, it 6-8 APPENDIX E Practice Set Assignments-Comprehensive Tax Return Problems paid all her medical expenses and offered Sarah a settlement if she would sign a release. Under the terms of the settlement, Sarah would receive $134,000, which was $126,000 for personal injury and $8,000 for loss of income because her injuries prevented her from painting for a period of weeks. On January 31, 2018, Sarah signed the release and was immediately paid $134,000. 16. In August 2017, Andy was rear-ended while stopped for a red light. Thankfully, Andy was uninjured. However, his car was damaged. The driver who caused the accident left the scene immediately, so Andy was forced to use his insurance to repair the damage to his car. As a result, Andy was subject to the $1,000 deductible provision in the policy, which he paid with respect to his car repairs in 2017. The Clarks claimed no deductions with respect to the accident on their 2017 income tax return. In 2018, the insurance company (Peregrine Casualty) located the driver at fault and recovered the amount paid for repairs by both Andy and Peregrine. Consequently, in April 2018, Andy received a check from Peregrine refunding the $1,000 he paid for repairs according to his policy's deductible. 17. After an acrimonious divorce, the Clarks's only child (Gabrielle Sparks) moved back home in December 2017. She brought her twins (Malone and Macie) with her. Under the divorce decree, Gabrielle was given custody of the children and awarded child support of $2,100 a month. The decree does not indicate who is entitled to the dependency exemptions for the children. Following the divorce, Gabrielle is taking some time to decide how to move forward with her life. She did not work in 2018, so she has no income for the year except the $4,200 she received for two months of child support. She plans to initiate legal proceedings against her ex-husband for delinquent child support. Subsequent to Gabrielle moving back. home, Andy and Sarah provided all of Gabrielle's and the twins' support beyond the $4,200 received in child support. 18. Besides the items already mentioned, the Clarks have the following receipts for 2018 $18,000 Social Security benefits (Andy, $12,000: Sarah, $6,000) Consulting income paid by Pelican (including expense reimbursement of $11,150 see item 3) Life insurance proceeds (see below) Qualified dividend income (reported on separate Forms 1099-DIV): Ragusa Corporation Pelican Power Interest income reported on separate Forms 1099-INT) IBM bonds CD at First National Bank of McKinney Wells Fargo money market fund City of Beaumont (TX) general-purpose bonds Payment of Gabriele's legal fees and court costs incident to her divorce Medical Medicare B Insurance premiums for Andy and Sarah Health care premiums for dependents Dental implants for Sarah The life insurance proceeds concerned a policy owned by Maximilian Clark (see item 14), which named Andy as sole beneficiary. The receipt of the proceeds came as a complete surprise to Andy as he never knew the policy existed. 19. Payments made for 2018 expenditures not already mentioned are as follows: $9,000 Taxes on personal residence Interest on home mortgage Cash donations to New Samaria Baptist Church, McKinney, TX Professional journals: 35.000 50,000 Oil and gas related (Andy) Art related (Sarah) 1,200 400 600 400 300 9,000 2,244 3,600 8,000 3.600 2.200 1,200 160 120 Dues to professional organizations (Andy) State professional license fee (Andy) 2017 tax return preparation fee ($200 for Andy's business, $250 for Sarah's business, and $450 for personal income tax return) APPENDIX E Practice Set Assignments-Comprehensive Tax Return Problems. $ 140 250 Texas does not impose an income tax, so the Clarks choose the state and local sales tax option. In addition to the state general sales tax, the local sales tax rate is 2% (1% city; 1% community development). They do not keep track of sales tax expenditures for routine purchases (eg, clothes, prepared foods) but can verify the sales tax on exceptional items (.e., big-ticket purchases like the RV). Name Andrew S. Clark Sarah H. Clark 20. The Clarks made quarterly Federal income tax payments of $2,400 on each of the following dates: April 10, 2018, June 11, 2018, September 10, 2018, and December 28, 2018. Last year's Federal income tax return reflected an overpayment of $800 tax, which the Clarks chose to apply to their 2018 income tax liability. The trustee of Andy's retirement plan also withheld $6,500 of tax with respect to his retirement withdrawals for the year. Neither Andy nor Sarah holds any foreign financial accounts. Relevant Social Security numbers are noted below. Gabrielle Sparks Malone Sparks Macle Sparks 900 Social Security Number 123-45-6785 123-45-6786 123-45-6784 123-45-6787 123-45-6788 Birth Date 09/15/1947 12/03/1952 10/19/1985 06/25/2012 06/25/2012 Requirements Prepare an income tax return (with all appropriate forms and schedules) for the Clarks for 2018 following these guidelines: Make necessary assumptions for information not given in the problem but needed to complete the return. The Clarks are employing the same tax return preparer who completed their prior year tax return. . The taxpayers have substantiation (eg, records, receipts) to support all transactions for the year. . If any refund is due, the Clarks want it applied to next year's tax liability. The Clarks do not want to contribute to the Presidential Election Campaign Fund. PROBLEM 3-C CORPORATION (FORM 1120) 1. On November 1, 2008, Janet Morton and Kim Wong formed Pet Kingdom, Inc., to sell pets and pet supplies. Pertinent information regarding Pet Kingdom is summarized as follows. Pet Kingdom's business address is 1010 Northwest Parkway, Dallas, TX 75225, its telephone number is (214) 555-2211; and is e-mail address is petkingdom@pki.com The employer identification number is 11-1111111, and the principal business activity code is 453910. Janet and Kim each own 50% of the common stock; Janet is president and Kim is vice president of the company. No other class of stock is authorized. Both Janet and Kim are full time employees of Pet Kingdom. Janet's Social Security number is 123-45-6789, and Kim's Social Security number is 987-65-4321.

Step by Step Solution

★★★★★

3.38 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

problem 2 Andrew Andy S and Sarah H Clark are husband and wife and live at 4112 Foxglove Drive McKinney TX 75070 Andy is a retired petroleum engineer and Sarah is a portrait artist They choose to file ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started