Answered step by step

Verified Expert Solution

Question

1 Approved Answer

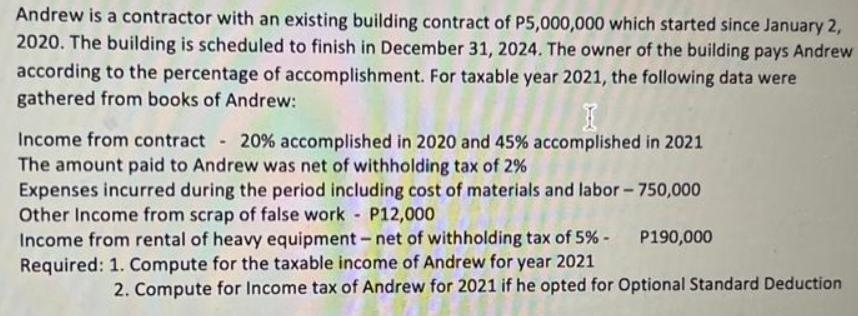

Andrew is a contractor with an existing building contract of P5,000,000 which started since January 2, 2020. The building is scheduled to finish in

Andrew is a contractor with an existing building contract of P5,000,000 which started since January 2, 2020. The building is scheduled to finish in December 31, 2024. The owner of the building pays Andrew according to the percentage of accomplishment. For taxable year 2021, the following data were gathered from books of Andrew: Income from contract - 20% accomplished in 2020 and 45% accomplished in 2021 The amount paid to Andrew was net of withholding tax of 2% Expenses incurred during the period including cost of materials and labor - 750,000 Other Income from scrap of false work P12,000 Income from rental of heavy equipment - net of withholding tax of 5% - P190,000 Required: 1. Compute for the taxable income of Andrew for year 2021 - 2. Compute for Income tax of Andrew for 2021 if he opted for Optional Standard Deduction

Step by Step Solution

★★★★★

3.38 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

To compute the taxable income of Andrew for the year 2021 we need to consider the income expenses and other relevant details 1 Compute Taxable Income ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started