Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Andrew's Slabs bought a delivery truck on 1/7/2016. It cost $33,000 (including GST), and it was decided to depreciate it at 30%. At the

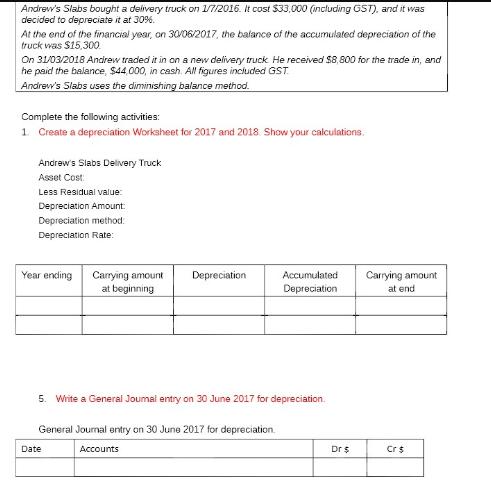

Andrew's Slabs bought a delivery truck on 1/7/2016. It cost $33,000 (including GST), and it was decided to depreciate it at 30%. At the end of the financial year, on 30/06/2017, the balance of the accumulated depreciation of the truck was $15,300 On 31/03/2018 Andrew traded it in on a new delivery truck. He received $8,800 for the trade in, and he paid the balance, $44,000, in cash. All figures included GST. Andrew's Slabs uses the diminishing balance method. Complete the following activities: 1. Create a depreciation Worksheet for 2017 and 2018 Show your calculations. Andrew's Slabs Delivery Truck Asset Cost: Less Residual value: Depreciation Amount: Depreciation method: Depreciation Rate: Year ending Carrying amount at beginning. Depreciation Date Accumulated Depreciation 5. Write a General Joumal entry on 30 June 2017 for depreciation. General Journal entry on 30 June 2017 for depreciation. Accounts Dr $ Carrying amount at end Cr $

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION 1 Asset Cost 30000 Excluding GST 10 3000 Residual Val...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started