Answered step by step

Verified Expert Solution

Question

1 Approved Answer

During 2020, the following changes in its depreciation policies were adopted by Company A: Equipment A was purchased for P8,000,000. Straight-line has been recorded

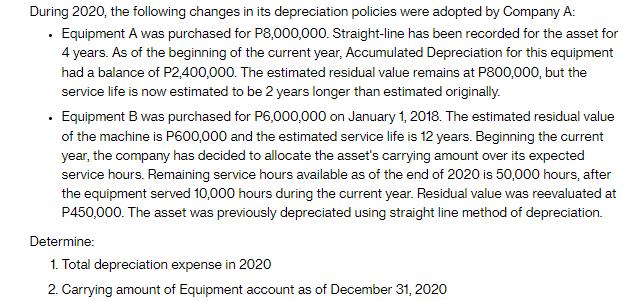

During 2020, the following changes in its depreciation policies were adopted by Company A: Equipment A was purchased for P8,000,000. Straight-line has been recorded for the asset for 4 years. As of the beginning of the current year, Accumulated Depreciation for this equipment had a balance of P2,400,000. The estimated residual value remains at P800,000, but the service life is now estimated to be 2 years longer than estimated originally. Equipment B was purchased for P6,000,000 on January 1, 2018. The estimated residual value of the machine is P600,000 and the estimated service life is 12 years. Beginning the current year, the company has decided to allocate the asset's carrying amount over its expected service hours. Remaining service hours available as of the end of 2020 is 50,000 hours, after the equipment served 10,000 hours during the current year. Residual value was reevaluated at P450,000. The asset was previously depreciated using straight line method of depreciation. Determine: 1. Total depreciation expense in 2020 2. Carrying amount of Equipment account as of December 31, 2020

Step by Step Solution

★★★★★

3.37 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the total depreciation expense in 2020 and the carrying amount of the Equipment account as of December 31 2020 we need to consider the ch...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started