ANSWER ALL PARTS IN ALL QUESTIONS

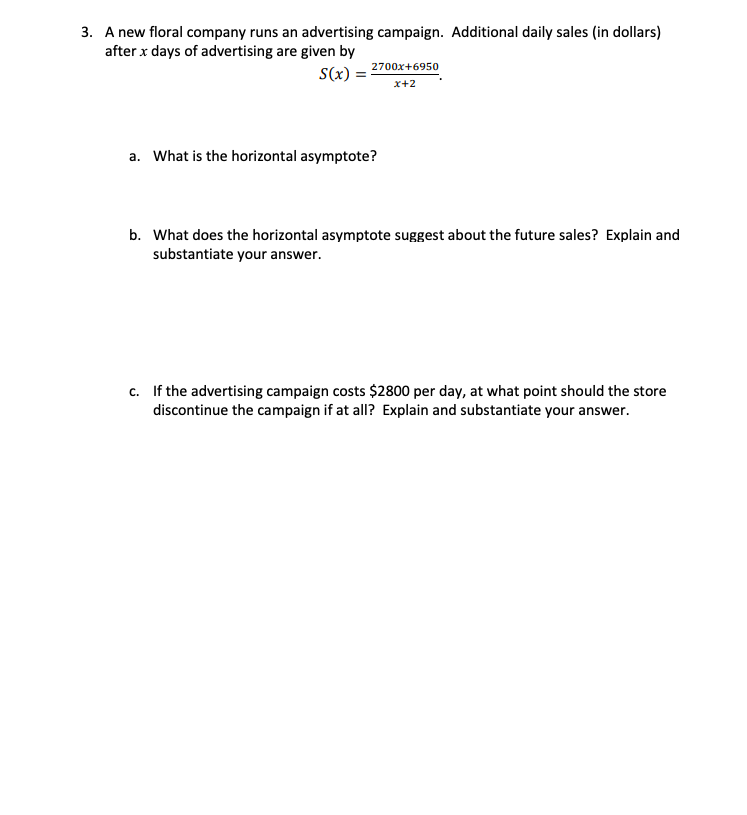

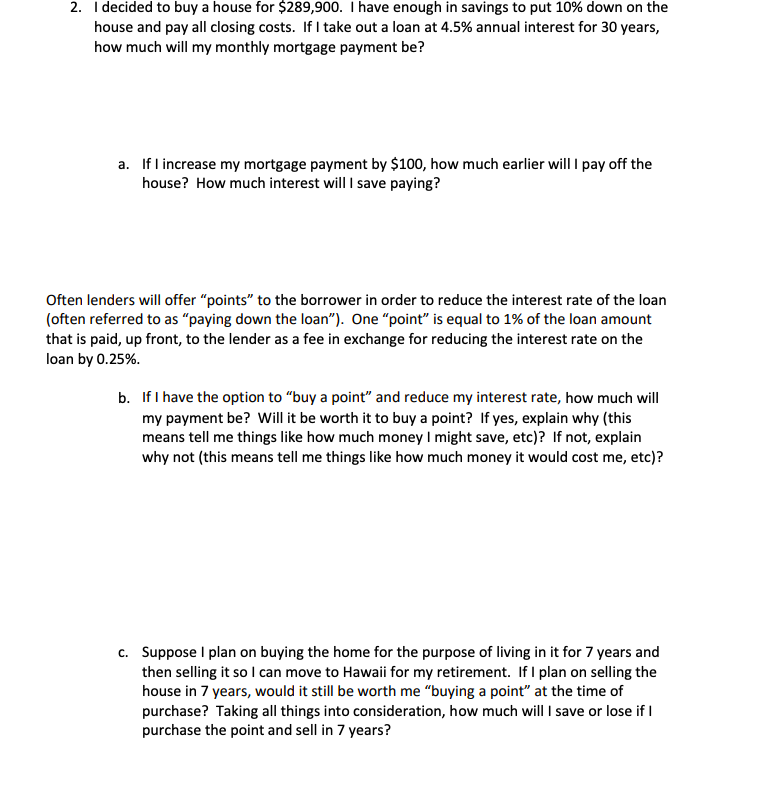

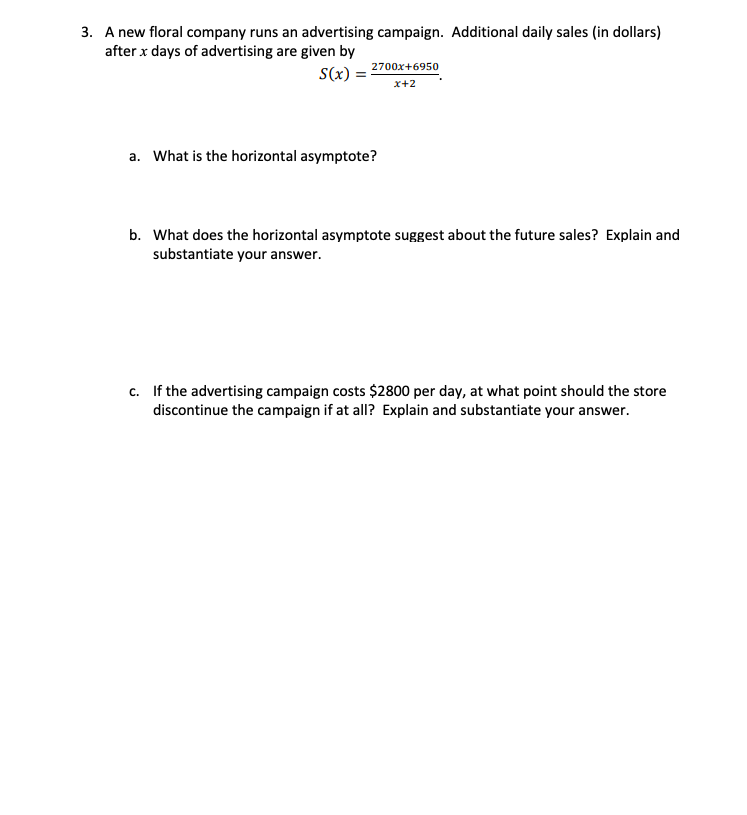

1. A company will need $50,000 in five years for a new addition. To meet the goal, the company will deposit money into an account paying 8% annual interest, compounded quarterly. How much should the company deposit each quarter in order to be able to pay for the addition? Looking at a couple of scenarios to compare to the initial investment (above): a. Exactly 20 months after the company begins their investment (above), they receive a payment from a settled lawsuit of $2500 that they immediately deposit into the account. If they continue, uninterrupted, with their quarterly deposits, will the company be able to afford to add a skylight to the addition if the change order (the amount added to the original cost of $50,000) is $3500? If yes, how much, if any would be left over? If no, how much more money will they need? b. Suppose that instead of depositing the money quarterly for five years, they decide to finance the addition (the original $50,000) for five years at 4% interest, compounded quarterly. How much would their quarterly payments be? How much difference will the company spend (money they put out) on the addition if they choose this finance option instead of the original savings plan? Assume that they use the $2500 from the settlement on something else and it doesn't come in to play in this plan. 2. I decided to buy a house for $289,900. I have enough in savings to put 10% down on the house and pay all closing costs. If I take out a loan at 4.5% annual interest for 30 years, how much will my monthly mortgage payment be? a. If I increase my mortgage payment by $100, how much earlier will I pay off the house? How much interest will I save paying? Often lenders will offer "points" to the borrower in order to reduce the interest rate of the loan (often referred to as paying down the loan). One point is equal to 1% of the loan amount that is paid, up front, to the lender as a fee in exchange for reducing the interest rate on the loan by 0.25%. b. If I have the option to "buy a point and reduce my interest rate, how much will my payment be? Will it be worth it to buy a point? If yes, explain why (this means tell me things like how much money I might save, etc)? If not, explain why not (this means tell me things like how much money it would cost me, etc)? C. Suppose I plan on buying the home for the purpose of living in it for 7 years and then selling it so I can move to Hawaii for my retirement. If I plan on selling the house in 7 years, would it still be worth me "buying a point" at the time of purchase? Taking all things into consideration, how much will I save or lose if I purchase the point and sell in 7 years? 3. A new floral company runs an advertising campaign. Additional daily sales (in dollars) after x days of advertising are given by S(x) = 2700x+6950 X+2 a. What is the horizontal asymptote? b. What does the horizontal asymptote suggest about the future sales? Explain and substantiate your answer. C. If the advertising campaign costs $2800 per day, at what point should the store discontinue the campaign if at all? Explain and substantiate your answer. 1. A company will need $50,000 in five years for a new addition. To meet the goal, the company will deposit money into an account paying 8% annual interest, compounded quarterly. How much should the company deposit each quarter in order to be able to pay for the addition? Looking at a couple of scenarios to compare to the initial investment (above): a. Exactly 20 months after the company begins their investment (above), they receive a payment from a settled lawsuit of $2500 that they immediately deposit into the account. If they continue, uninterrupted, with their quarterly deposits, will the company be able to afford to add a skylight to the addition if the change order (the amount added to the original cost of $50,000) is $3500? If yes, how much, if any would be left over? If no, how much more money will they need? b. Suppose that instead of depositing the money quarterly for five years, they decide to finance the addition (the original $50,000) for five years at 4% interest, compounded quarterly. How much would their quarterly payments be? How much difference will the company spend (money they put out) on the addition if they choose this finance option instead of the original savings plan? Assume that they use the $2500 from the settlement on something else and it doesn't come in to play in this plan. 2. I decided to buy a house for $289,900. I have enough in savings to put 10% down on the house and pay all closing costs. If I take out a loan at 4.5% annual interest for 30 years, how much will my monthly mortgage payment be? a. If I increase my mortgage payment by $100, how much earlier will I pay off the house? How much interest will I save paying? Often lenders will offer "points" to the borrower in order to reduce the interest rate of the loan (often referred to as paying down the loan). One point is equal to 1% of the loan amount that is paid, up front, to the lender as a fee in exchange for reducing the interest rate on the loan by 0.25%. b. If I have the option to "buy a point and reduce my interest rate, how much will my payment be? Will it be worth it to buy a point? If yes, explain why (this means tell me things like how much money I might save, etc)? If not, explain why not (this means tell me things like how much money it would cost me, etc)? C. Suppose I plan on buying the home for the purpose of living in it for 7 years and then selling it so I can move to Hawaii for my retirement. If I plan on selling the house in 7 years, would it still be worth me "buying a point" at the time of purchase? Taking all things into consideration, how much will I save or lose if I purchase the point and sell in 7 years? 3. A new floral company runs an advertising campaign. Additional daily sales (in dollars) after x days of advertising are given by S(x) = 2700x+6950 X+2 a. What is the horizontal asymptote? b. What does the horizontal asymptote suggest about the future sales? Explain and substantiate your answer. C. If the advertising campaign costs $2800 per day, at what point should the store discontinue the campaign if at all? Explain and substantiate your