Answer all questions.,,,

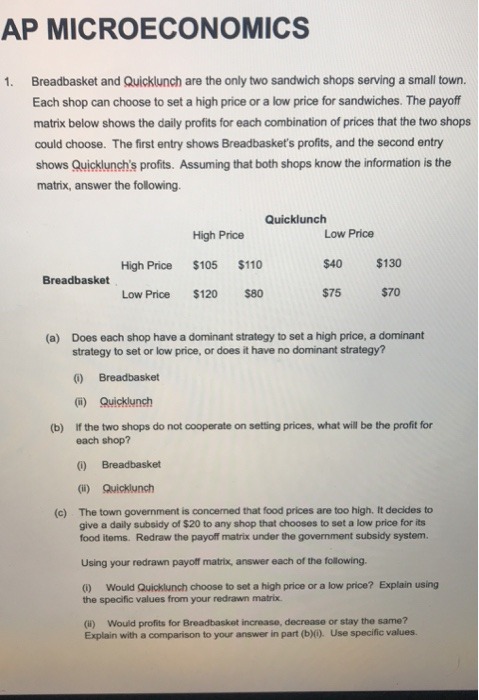

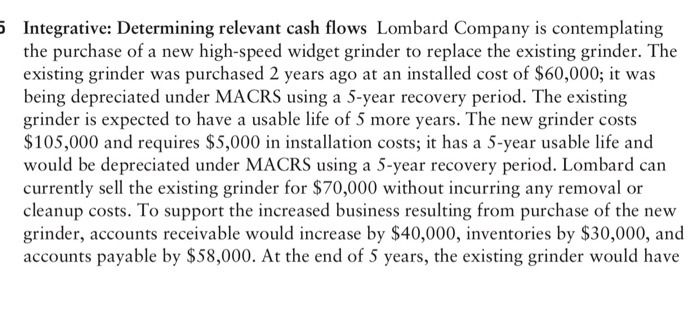

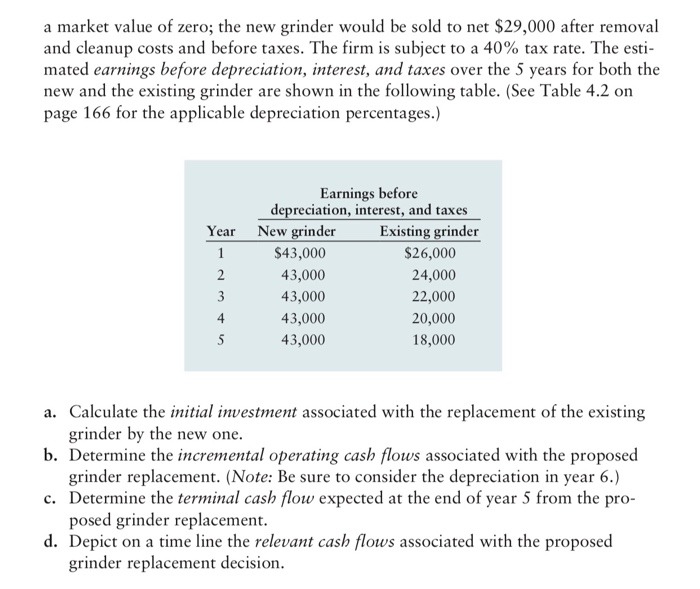

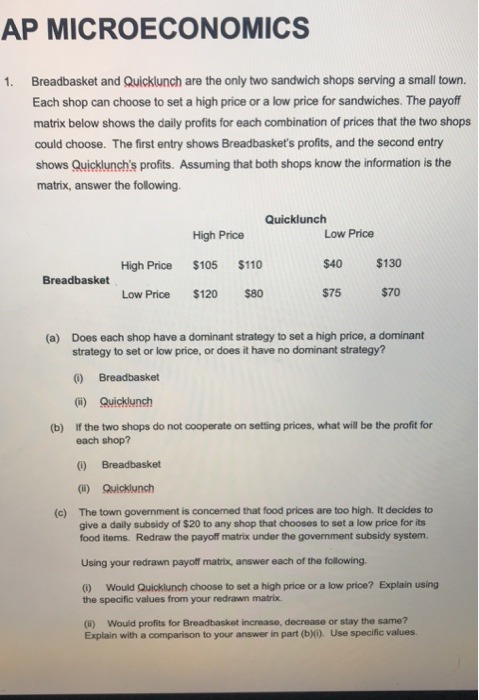

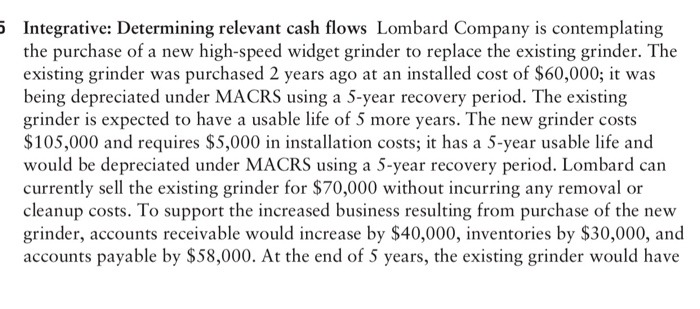

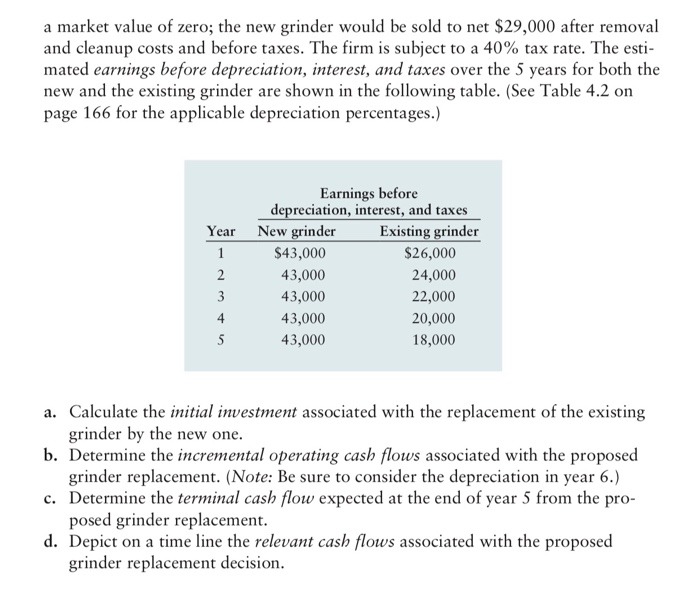

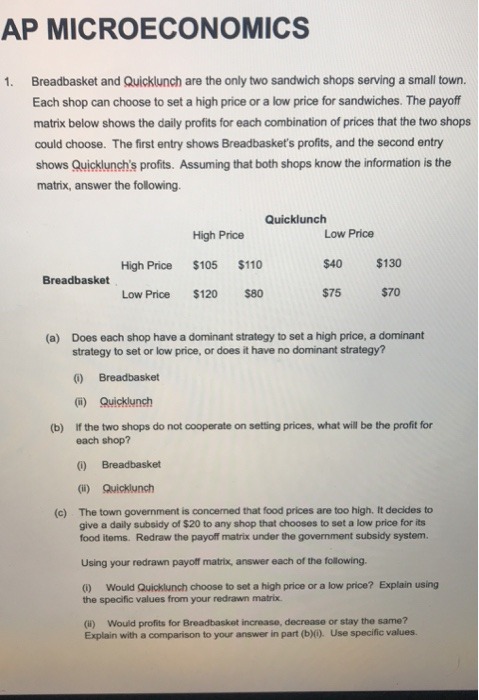

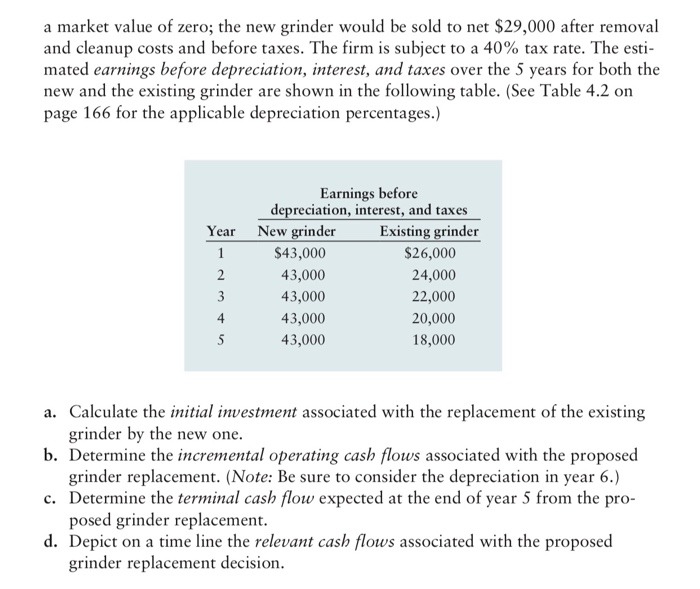

AP MICROECONOMICS 1 . Breadbasket and Quicklunch are the only two sandwich shops serving a small town. Each shop can choose to set a high price or a low price for sandwiches. The payoff matrix below shows the daily profits for each combination of prices that the two shops could choose. The first entry shows Breadbasket's profits, and the second entry shows Quicklunch's profits. Assuming that both shops know the information is the matrix, answer the following Quicklunch High Price Low Price High Price $105 $110 $40 $130 Breadbasket Low Price $120 $80 $75 $70 (a) Does each shop have a dominant strategy to set a high price, a dominant strategy to set or low price, or does it have no dominant strategy? Breadbasket () Quicklunch (b) If the two shops do not cooperate on setting prices, what will be the profit for each shop? (1) Breadbasket (ii) Quicklunch (c) The town government is concerned that food prices are too high, It decides to give a daily subsidy of $20 to any shop that chooses to set a low price for its food items. Redraw the payoff matrix under the government subsidy system. Using your redrawn payoff matrix, answer each of the following. (1) Would Quicklunch choose to set a high price or a low price? Explain using the specific values from your redrawn matrix. (il) Would profits for Breadbasket increase, decrease or stay the same? Explain with a comparison to your answer in part (b)(i). Use specific values.Integrative: Determining relevant cash flows Lombard Company is contemplating the purchase of a new high-speed widget grinder to replace the existing grinder. The existing grinder was purchased 2 years ago at an installed cost of $60,000; it was being depreciated under MACRS using a 5-year recovery period. The existing grinder is expected to have a usable life of 5 more years. The new grinder costs $105,000 and requires $5,000 in installation costs; it has a 5-year usable life and would be depreciated under MACRS using a 5-year recovery period. Lombard can currently sell the existing grinder for $?0,000 without incurring any removal or cleanup costs. To support the increased business resulting from purchase of the new grinder, accounts receivable would increase by $40,000, inventories by $30,000, and accounts payable by $53,000. At the end of 5 years, the existing grinder would have a market value of zero; the new grinder would be sold to net $29,000 after removal and cleanup costs and before taxes. The firm is subject to a 40% tax rate. The esti- mated earnings before depreciation, interest, and taxes over the 5 years for both the new and the existing grinder are shown in the following table. (See Table 4.2 on page 166 for the applicable depreciation percentages.) Earnings before depreciation, interest, and taxes Year New grinder Existing grinder $43,000 $26,000 43,000 24,000 43,000 22,000 43,000 20,000 5 43,000 18,000 a. Calculate the initial investment associated with the replacement of the existing grinder by the new one. b. Determine the incremental operating cash flows associated with the proposed grinder replacement. (Note: Be sure to consider the depreciation in year 6.) c. Determine the terminal cash flow expected at the end of year 5 from the pro- posed grinder replacement. d. Depict on a time line the relevant cash flows associated with the proposed grinder replacement decision