Answer all questions throughly please!! Any help greatly appreciated

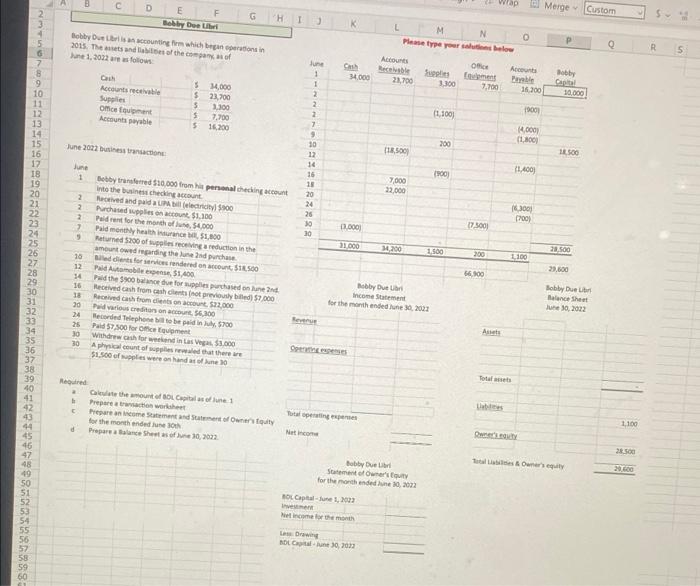

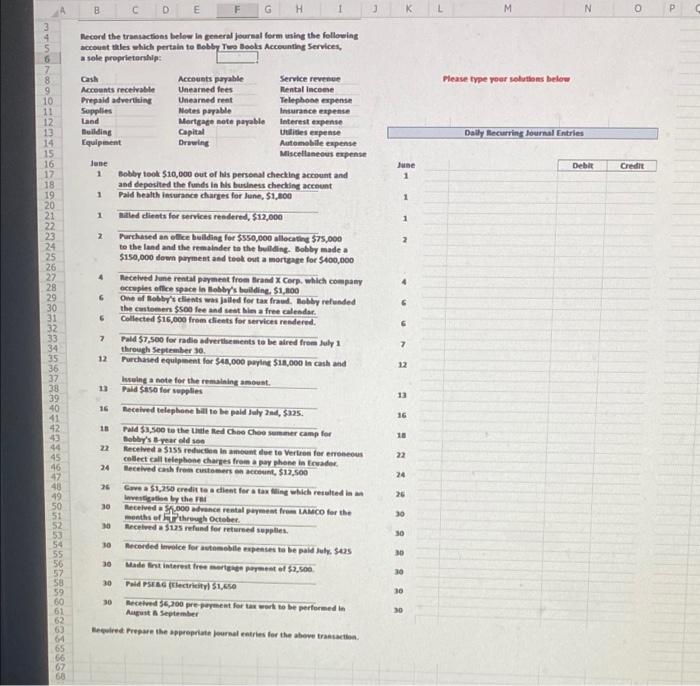

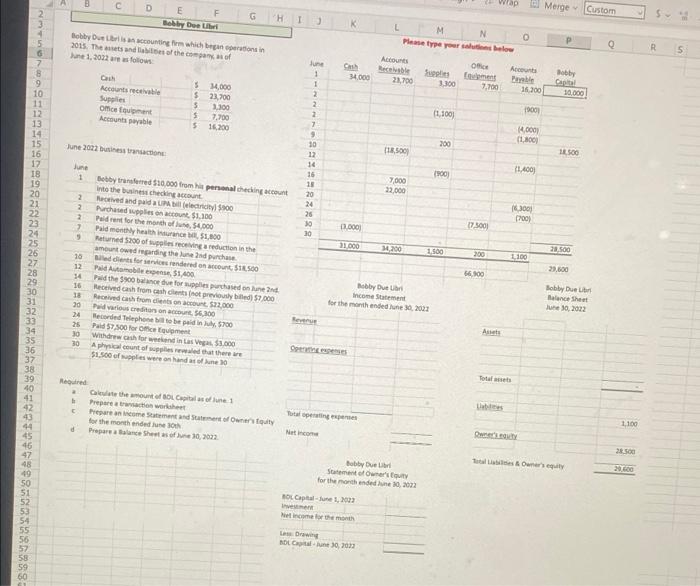

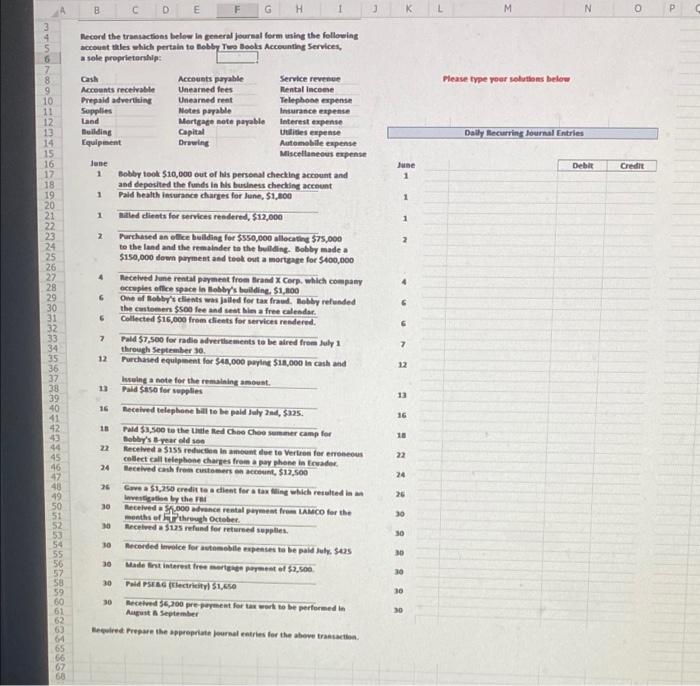

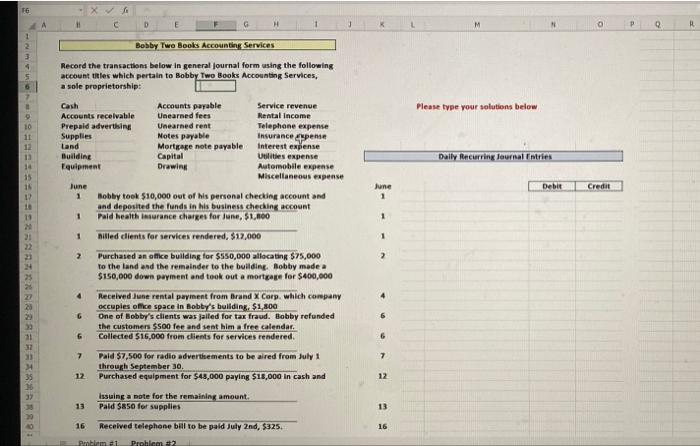

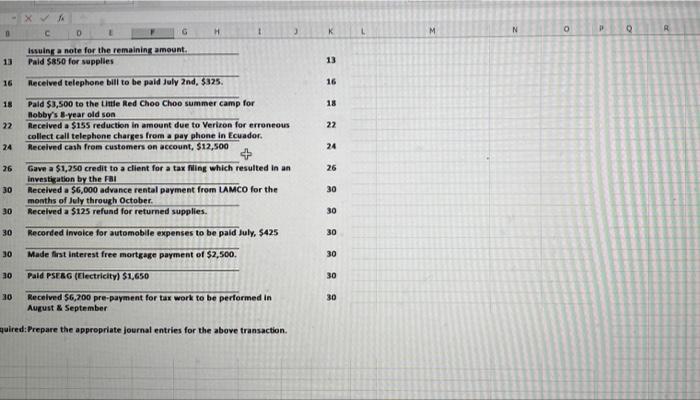

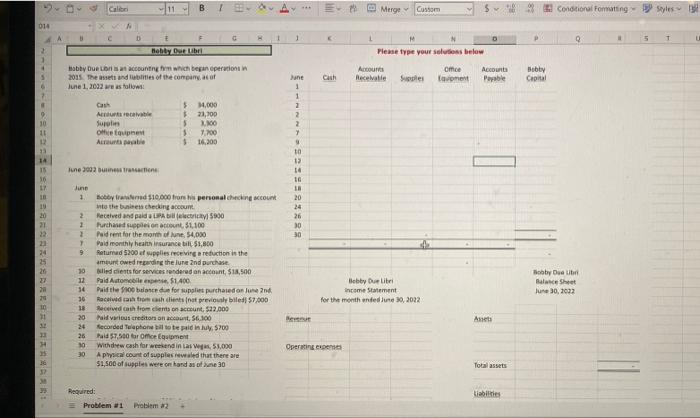

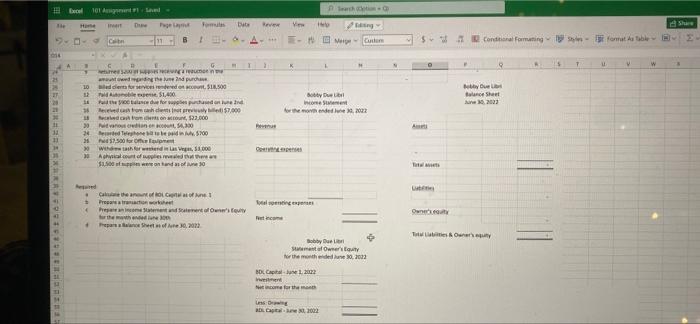

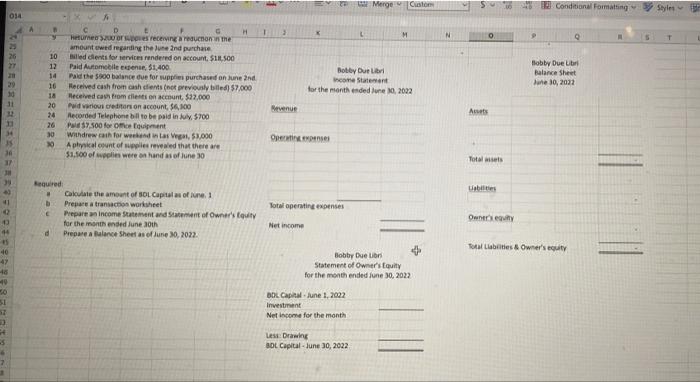

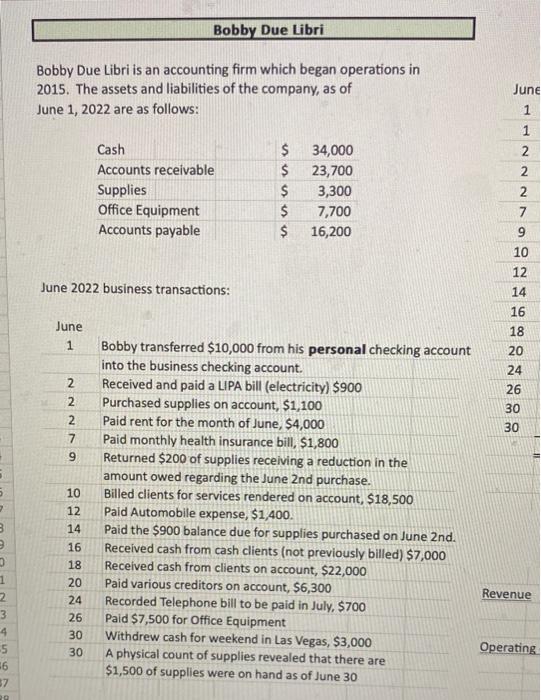

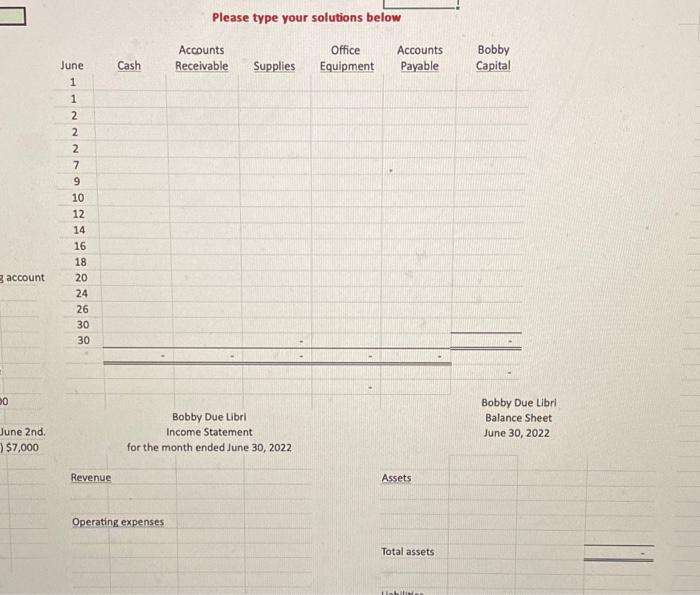

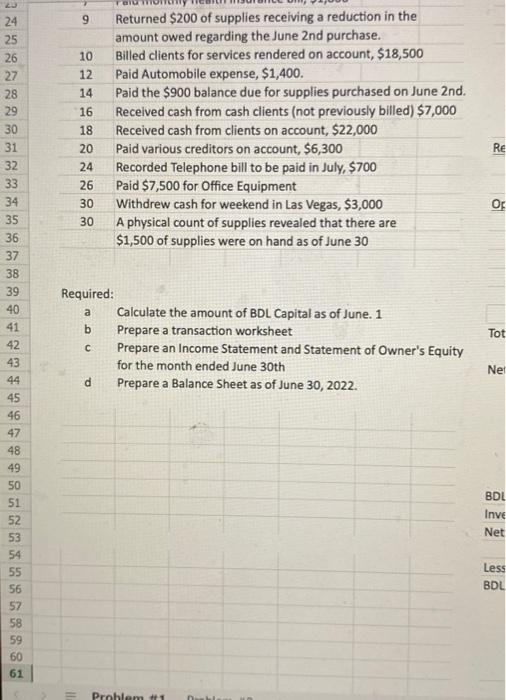

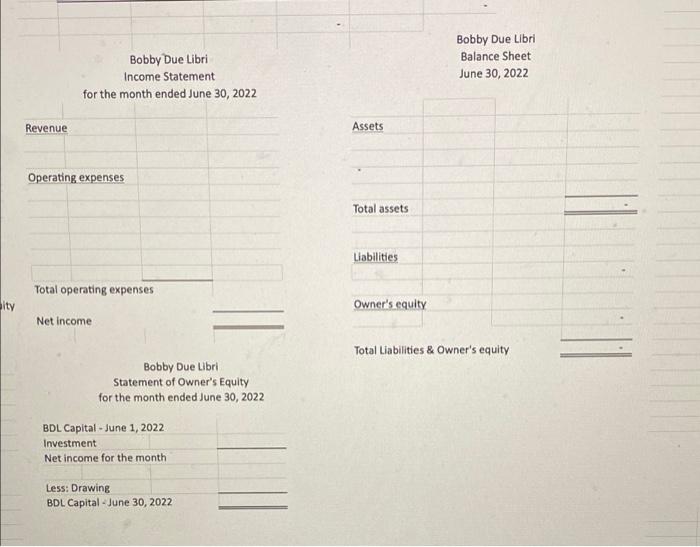

855433 (8 11 12 13 14 15 16 17 18 19 20 21 22 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 56 9 10 D E F G Bobby Doe Libri Bobby Due Libri is an accounting firm which began operations in 2015 The assets and liabilities of the company, as of June 1, 2022 are as follows S 34,000 Cash Accounts receivable Supplies 23,700 1,300 Office Equipment 7,700 Accounts payable S 16,200 June 2022 business transactions June 1 Bobby transferred $20,000 from his personal checking account into the business checking account. 2 Received and paid a LIPA bill (electricity) $900 2 Purchased supplies on account, $1,100 Paid rent for the month of June, $4,000 Paid monthly health insurance bill, $1,800 Returned $200 of supplies receiving a reduction in the amount owed regarding the June 2nd purchase Biled dients for services rendered on account, $18,500 Paid Automobile expense, $1,400 Paid the $900 balance due for supplies purchased on June 2nd 16 Received cash from cash clients (not previously billed) $7,000 Received cash from clients on account, $22,000 Paid various creditors on account, $6,300 Recorded Telephone bill to be paid in July, $700 Paid $7,500 for Office Equipment Withdrew cash for weekend in Las Vegas, $3,000 A physical count of supples revealed that there are $1,500 of supplies were on hand as of June 30 Calculate the amount of BOL Capital as of June 1 Prepare a transaction worksheet Prepare an income Statement and Statement of Owner's Equity for the month ended June 30th Prepare a Balance Sheet as of June 30, 2022 2 7 " 223222ZARA 10 12 14 18 20 24 26 30 30 Required a h C d $ S $ H 13 June 1 1 2 2 2 7 9 10 ANNN=RA222 12 14 16 18 20 24 26 30 30 K Cash 34,000 Accounts Receivable 21,700 (18,500 7,000 22,000 34,200 Bobby Due Libri Income Statement for the month ended June 30, 2022 (1,000) 31,000 L M N Please type your solutions below Office foment Supplies 3,300 7,700 (1,100) 200 (900) Revenue Operating expenses Total operating expenses Net Income BOL Capital-June 1, 2022 Investment Net Income for the month Lass Drawing BOL Capital-June 30, 2022 Bobby Due Libri Statement of Owner's Equity for the month ended June 30, 2022 1,100 (7,500) 200 66,300 0 Accounts Peable 16,300 (900) (4,000) (1,800) (1,400) (6,300) (700) 1,100 Merge Custom Q Bobby Capital 10.000 18,500 28,500 29,600 Bobby Due Libri Balance Sheet June 30, 2022 Assets Total assets Owner's equty Total Liabilities & Owner's equity 1,100 28,500 29,600 R S 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 32 34 35 36 37 38 39 40 41 42 43 44 45 46 48 50 60 61 63 64 65 BCDE G 1 3 Record the transactions below in general journal form using the following account tiles which pertain to Bobby Two Books Accounting Services, a sole proprietorship: Cash Accounts receivable Accounts payable Unearned fees Unearned rent Service revenue Rental income Prepaid advertising Telephone expense Supplies Notes payable Insurance expense Land Mortgage note payable Interest expense Building Capital Uslities expense Automobile expense Equipment Drawing Miscellaneous expense June 1 Bobby took $10,000 out of his personal checking account and and deposited the funds in his business checking account Paid health insurance charges for June, $1,800 1 Billed clients for services rendered, $12,000 2 Purchased an office building for $550,000 allocating $75,000 to the land and the remainder to the building. Bobby made a $150,000 down payment and took out a mortgage for $400,000 Received June rental payment from Brand X Corp, which company occupies office space in Bobby's building, $1,800 6 One of Bobby's clients was jailed for tax fraud. Bobby refunded the customers $500 fee and sent him a free calendar. 6 Collected $16,000 from clients for services rendered. 7 Pald $7,500 for radio advertisements to be aired from July 1 through September 30. 12 Purchased equipment for $48,000 paying $18,000 in cash and Issuing a note for the remaining amount. Paid $850 for supplies 13 16 Received telephone bill to be paid July 2nd, $325. 18 Pald $3,500 to the Little Red Choo Choo summer camp for Bobby's 8-year old son 22 Received a $155 reduction in amount due to Vertron for erroneous collect call telephone charges from a pay phone in Ecuador Received cash from customers on account, $12,500 24 26 Gave a $1,250 credit to a client for a tax fling which resulted in an investigation by the FBI 30 Received a 5.000 advance rental payment from LAMCO for the months of through October. 30 Received a $125 refund for returned supplies. 30 Recorded invoice for automobile expenses to be paid July, $425 30 Made first interest free mortgage payment of $2,500 30 Paid PSE&G (Electricity) $1,650 30 Received 56,200 pre-payment for tax work to be performed in August & September Required Prepare the appropriate journal entries for the above transaction. K June 1 1 1 7 12 13 16 18 22 24 26 30 30 30 30 30 30 M Please type your solutions below N Daily Recurring Journal Entries Debit Credit P 16 1 2 10 11 12 13 14 15 16 17 18 19 RRRAAARROI X f #1 D H Bobby Two Books Accounting Services Record the transactions below in general journal form using the following account titles which pertain to Bobby Two Books Accounting Services, a sole proprietorship: Cash Accounts receivable Prepaid advertising Accounts payable Unearned fees Unearned rent Notes payable Mortgage note payable. Service revenue Rental income Telephone expense Supplies Insurance expense Land Building Capital Interest expense Utilities expense Automobile expense Equipment Drawing Miscellaneous expense June 1 Bobby took $10,000 out of his personal checking account and and deposited the funds in his business checking account Paid health insurance charges for June, $1,800 1 1 Billed clients for services rendered, $12,000 2 Purchased an office building for $550,000 allocating $75,000 to the land and the remainder to the building. Bobby made a $150,000 down payment and took out a mortgage for $400,000 4 Received June rental payment from Brand X Corp. which company occupies office space in Bobby's building, $1,800 G One of Bobby's clients was jailed for tax fraud. Bobby refunded the customers $500 fee and sent him a free calendar. 6 Collected $16,000 from clients for services rendered. 7 Paid $7,500 for radio advertisements to be aired from July 1 through September 30. 12 Purchased equipment for $45,000 paying $18,000 in cash and issuing a note for the remaining amount. 13 Paid $850 for supplies 16 Received telephone bill to be paid July 2nd, $325. FE Problem #1 Problem #2 June 1 1 12 13 16 M Please type your solutions below Daily Recurring Journal Entries Debit Credit R - X fa 0 C issuing a note for the remaining amount. 13 Paid $850 for supplies 16 Received telephone bill to be paid July 2nd, $325. 18 Paid $3,500 to the Little Red Choo Choo summer camp for Bobby's 8-year old son 22 Received a $155 reduction in amount due to Verizon for erroneous collect call telephone charges from a pay phone in Ecuador. Received cash from customers on account, $12,500 24 + 26 Gave a $1,250 credit to a client for a tax filing which resulted in an investigation by the FBI 30 Received a $6,000 advance rental payment from LAMCO for the months of July through October. 30 Received a $125 refund for returned supplies. 30 Recorded invoice for automobile expenses to be paid July, $425 30 Made first interest free mortgage payment of $2,500. 30 Paid PSE&G (Electricity) $1,650 30 Received $6,200 pre-payment for tax work to be performed in August & September quired:Prepare the appropriate journal entries for the above transaction. K 13 16 18 22 24 26 30 30 30 30 30 30 L M N O P Q 014 2 S 6 . 33 15 36 18 19 20 27 10 31 32 AARNARRI 34 35 B N Bobby Due Libri Bobby Due Libris an accounting frm which began operations in 2015 The assets and liabilities of the company as of June 1, 2022 are as follows: $ 34,000 $23,300 Cash Accounts receivable Supplie Office Equipment Accounts payable S 1,300 $ 7,700 $16,200 June 2022 business transactions June 1 Bobby trained $10,000 from his personal checking account into the business checking account. 2 Received and paid a LIPA (lectricity) 5900 Purchased suppiles on account, $1,100 Paid rent for the month of June, $4,000 Paid monthly health insurance till $1,800 Returned 5200 ef supplies receiving a reduction is the amount owed regarding the June 2nd purchase. lied clients for services rendered an account, $18,500 Paid Automobile expense, $1,400 Paid the $900 balance due for supplies purchased on June 2nd Raceived cash from cash clients (not previously billed) $7,000 18 Received cash from clients on account, $22,000 20 Paid various creditors on account, $6.300 Recorded Telephone bill to be paid in July, 5700 26 Paid $7,500 for Office Equipment 30 30 Withdrew cash for weekend in Las Vegas, $1,000 A physical count of supples revealed that there are $1,500 of supplies were on hand as of June 30 Required: Problem #1 Problem #2 2 2 7 9 2====2=222 30 12 Calibri June 1 1 2 2 2 7 9 10 12 32=== ERR 14 10 18 20 24 26 30 30 Cash Merge Custom M Please type your solutions below Supple office tavoment Revenue Operating expenses Accounts Receivable Bobby Due Libri income Statement for the month ended June 30, 2022 D Accounts Payable Ast Total assets Liabilities Bobby Capital Conditional Formatting Styles 9 5 T Bobby Dad Libri Balance Sheet June 30, 2022 He 1014 Decel 101 Asign #1 Sond De Iet Cab E F Need game in aut wedding the June 2nd purcha cents for services rendered on account, $18.500 Tald Automobile ex $1,400 the 500 lance due for supplies purchased on nend Recevedcap from cash clients that prevusly $7,000 ecca from des on account, $22.000 voceana, 4,300 Telenetben 5700 $7,500 for Off Equipment with tash for weekend in Las Veges, $1.000 A physical count of supplies revealed that there are $3,500 of ups were on and of 30 red Calue the amount of ROL Capital as of June. 1 Prepare a transaction worke Prome Statement and Statement of O'qit for the month ended 30 Preparace Sheet as of June 30, 2022 Hie " Y 10 12 14 36 18 30 24 26 X 30 S Page Lay Formulas Date Rever View - Revenue Total penting expe p M Bobby Dub Income Statement for the month ended Jun 30, 2022 Search on sing Custom BD Capital-June 1, 2022 Investment Nincome for the math Less Drawing BDL Capitale 30, 2002 Bobby Dub Statement of Owner's Equity for the month ended he 30, 2022 $conditional Formanings format As Table by De L Balance Sheet 30,2022 Total Liabities & Owner's ey Share 46 49 50 014 CARRARE 51 D 24 26 43 44 40 47 27 A G H T Heturned 300 or suppies receiving a reduction in the amount owed regarding the June 2nd purchase Billed clients for services rendered on account, $18.500 Paid Automobile expense, $1,400 14 16 18 Paid the $900 balance due for supplies purchased on June 2nd Received cash from cash clients (not previously billed) $7,000 Received cash from clients on account, $22,000 Paid various creditors on account, $6,300 Recorded Telephone bill to be paid in July, $700 Pald $7,500 for Office Equipment 20 24 26 30 30 Withdrew cash for weekend in Las Vegas, $3,000 A physical count of supplies revealed that there are $1,500 of supplies were on hand as of June 30 Required: Calculate the amount of SOL Capital as of June. 1. b Prepare a transaction worksheet C Prepare an Income Statement and Statement of Owner's Equity for the month ended June 30th Prepare a Balance Sheet as of June 30, 2022. B 10 12 2 Merge Custom M X L Bobby Due Libri Income Statement for the month ended June 30, 2022 Revenue Operating expenses Total operating expenses Net income BOL Capital June 1, 2022 Investment Net income for the month Less Drawing BOL Capital-June 30, 2022 Bobby Due Libri Statement of Owner's Equity for the month ended June 30, 2022 0. to Conditional Formatting 9 Q Bobby Due Libri Balance Sheet June 30, 2022 Assets Total assets Uabilities Owner's equity Total Liabilities & Owner's equity 5 Styles 3 D 1 2 3 4 -5 6 37 20 Bobby Due Libri Bobby Due Libri is an accounting firm which began operations in 2015. The assets and liabilities of the company, as of June 1, 2022 are as follows: Cash $ 34,000 Accounts receivable $ 23,700 Supplies $ 3,300 Office Equipment $ 7,700 Accounts payable $ 16,200 June 2022 business transactions: June 1 Bobby transferred $10,000 from his personal checking account into the business checking account. 2 Received and paid a LIPA bill (electricity) $900 Purchased supplies on account, $1,100 2 Paid rent for the month of June, $4,000 Paid monthly health insurance bill, $1,800 Returned $200 of supplies receiving a reduction in the amount owed regarding the June 2nd purchase. Billed clients for services rendered on account, $18,500 Paid Automobile expense, $1,400. 14 Paid the $900 balance due for supplies purchased on June 2nd. 16 Received cash from cash clients (not previously billed) $7,000 18 Received cash from clients on account, $22,000 20 Paid various creditors on account, $6,300 Recorded Telephone bill to be paid in July, $700 26 Paid $7,500 for Office Equipment 30 Withdrew cash for weekend in Las Vegas, $3,000 30 A physical count of supplies revealed that there are $1,500 of supplies were on hand as of June 30 2 7 9 10 12 222283 24 June ~~~~~ 1 1 2 2 2 7 9 10 12 14 16 18 20 24 26 30 30 Revenue Operating g account 00 June 2nd. $7,000 June 1 1 2 2 2 7 9 10 12 14 16 18 20 24 26 30 30 Cash Please type your solutions below Office Equipment Revenue Operating expenses Accounts Receivable Supplies Bobby Due Libri Income Statement for the month ended June 30, 2022 Accounts Payable Assets Total assets Habilities Bobby Capital Bobby Due Libri Balance Sheet June 30, 2022 wwwwwwwNNE 4 25 26 27 28 29 30 31 2 33 34 35 35 37 38 39 40 4234567 48 49 50 51 N345557 58 59 60 61 24 32 36 52 9 Returned $200 of supplies receiving a reduction in the amount owed regarding the June 2nd purchase. 10 Billed clients for services rendered on account, $18,500 Paid Automobile expense, $1,400. 12 14 16 Paid the $900 balance due for supplies purchased on June 2nd. Received cash from cash clients (not previously billed) $7,000 Received cash from clients on account, $22,000 Paid various creditors on account, $6,300 18 20 24 Recorded Telephone bill to be paid in July, $700 Paid $7,500 for Office Equipment 26 30 Withdrew cash for weekend in Las Vegas, $3,000 A physical count of supplies revealed that there are $1,500 of supplies were on hand as of June 30 30 Required: a Calculate the amount of BDL Capital as of June. 1 Prepare a transaction worksheet C Prepare an Income Statement and Statement of Owner's Equity for the month ended June 30th Prepare a Balance Sheet as of June 30, 2022. b d ***20 Problem #1 Re Of Tot Net BDL Inve Net Less BDL ity Bobby Due Libri Income Statement. for the month ended June 30, 2022 Revenue Operating expenses Total operating expenses Net income BDL Capital - June 1, 2022 Investment Net income for the month Less: Drawing BDL Capital - June 30, 2022 Bobby Due Libri Statement of Owner's Equity for the month ended June 30, 2022 Bobby Due Libri Balance Sheet June 30, 2022 Assets Total assets Liabilities Owner's equity Total Liabilities & Owner's equity 855433 (8 11 12 13 14 15 16 17 18 19 20 21 22 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 56 9 10 D E F G Bobby Doe Libri Bobby Due Libri is an accounting firm which began operations in 2015 The assets and liabilities of the company, as of June 1, 2022 are as follows S 34,000 Cash Accounts receivable Supplies 23,700 1,300 Office Equipment 7,700 Accounts payable S 16,200 June 2022 business transactions June 1 Bobby transferred $20,000 from his personal checking account into the business checking account. 2 Received and paid a LIPA bill (electricity) $900 2 Purchased supplies on account, $1,100 Paid rent for the month of June, $4,000 Paid monthly health insurance bill, $1,800 Returned $200 of supplies receiving a reduction in the amount owed regarding the June 2nd purchase Biled dients for services rendered on account, $18,500 Paid Automobile expense, $1,400 Paid the $900 balance due for supplies purchased on June 2nd 16 Received cash from cash clients (not previously billed) $7,000 Received cash from clients on account, $22,000 Paid various creditors on account, $6,300 Recorded Telephone bill to be paid in July, $700 Paid $7,500 for Office Equipment Withdrew cash for weekend in Las Vegas, $3,000 A physical count of supples revealed that there are $1,500 of supplies were on hand as of June 30 Calculate the amount of BOL Capital as of June 1 Prepare a transaction worksheet Prepare an income Statement and Statement of Owner's Equity for the month ended June 30th Prepare a Balance Sheet as of June 30, 2022 2 7 " 223222ZARA 10 12 14 18 20 24 26 30 30 Required a h C d $ S $ H 13 June 1 1 2 2 2 7 9 10 ANNN=RA222 12 14 16 18 20 24 26 30 30 K Cash 34,000 Accounts Receivable 21,700 (18,500 7,000 22,000 34,200 Bobby Due Libri Income Statement for the month ended June 30, 2022 (1,000) 31,000 L M N Please type your solutions below Office foment Supplies 3,300 7,700 (1,100) 200 (900) Revenue Operating expenses Total operating expenses Net Income BOL Capital-June 1, 2022 Investment Net Income for the month Lass Drawing BOL Capital-June 30, 2022 Bobby Due Libri Statement of Owner's Equity for the month ended June 30, 2022 1,100 (7,500) 200 66,300 0 Accounts Peable 16,300 (900) (4,000) (1,800) (1,400) (6,300) (700) 1,100 Merge Custom Q Bobby Capital 10.000 18,500 28,500 29,600 Bobby Due Libri Balance Sheet June 30, 2022 Assets Total assets Owner's equty Total Liabilities & Owner's equity 1,100 28,500 29,600 R S 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 32 34 35 36 37 38 39 40 41 42 43 44 45 46 48 50 60 61 63 64 65 BCDE G 1 3 Record the transactions below in general journal form using the following account tiles which pertain to Bobby Two Books Accounting Services, a sole proprietorship: Cash Accounts receivable Accounts payable Unearned fees Unearned rent Service revenue Rental income Prepaid advertising Telephone expense Supplies Notes payable Insurance expense Land Mortgage note payable Interest expense Building Capital Uslities expense Automobile expense Equipment Drawing Miscellaneous expense June 1 Bobby took $10,000 out of his personal checking account and and deposited the funds in his business checking account Paid health insurance charges for June, $1,800 1 Billed clients for services rendered, $12,000 2 Purchased an office building for $550,000 allocating $75,000 to the land and the remainder to the building. Bobby made a $150,000 down payment and took out a mortgage for $400,000 Received June rental payment from Brand X Corp, which company occupies office space in Bobby's building, $1,800 6 One of Bobby's clients was jailed for tax fraud. Bobby refunded the customers $500 fee and sent him a free calendar. 6 Collected $16,000 from clients for services rendered. 7 Pald $7,500 for radio advertisements to be aired from July 1 through September 30. 12 Purchased equipment for $48,000 paying $18,000 in cash and Issuing a note for the remaining amount. Paid $850 for supplies 13 16 Received telephone bill to be paid July 2nd, $325. 18 Pald $3,500 to the Little Red Choo Choo summer camp for Bobby's 8-year old son 22 Received a $155 reduction in amount due to Vertron for erroneous collect call telephone charges from a pay phone in Ecuador Received cash from customers on account, $12,500 24 26 Gave a $1,250 credit to a client for a tax fling which resulted in an investigation by the FBI 30 Received a 5.000 advance rental payment from LAMCO for the months of through October. 30 Received a $125 refund for returned supplies. 30 Recorded invoice for automobile expenses to be paid July, $425 30 Made first interest free mortgage payment of $2,500 30 Paid PSE&G (Electricity) $1,650 30 Received 56,200 pre-payment for tax work to be performed in August & September Required Prepare the appropriate journal entries for the above transaction. K June 1 1 1 7 12 13 16 18 22 24 26 30 30 30 30 30 30 M Please type your solutions below N Daily Recurring Journal Entries Debit Credit P 16 1 2 10 11 12 13 14 15 16 17 18 19 RRRAAARROI X f #1 D H Bobby Two Books Accounting Services Record the transactions below in general journal form using the following account titles which pertain to Bobby Two Books Accounting Services, a sole proprietorship: Cash Accounts receivable Prepaid advertising Accounts payable Unearned fees Unearned rent Notes payable Mortgage note payable. Service revenue Rental income Telephone expense Supplies Insurance expense Land Building Capital Interest expense Utilities expense Automobile expense Equipment Drawing Miscellaneous expense June 1 Bobby took $10,000 out of his personal checking account and and deposited the funds in his business checking account Paid health insurance charges for June, $1,800 1 1 Billed clients for services rendered, $12,000 2 Purchased an office building for $550,000 allocating $75,000 to the land and the remainder to the building. Bobby made a $150,000 down payment and took out a mortgage for $400,000 4 Received June rental payment from Brand X Corp. which company occupies office space in Bobby's building, $1,800 G One of Bobby's clients was jailed for tax fraud. Bobby refunded the customers $500 fee and sent him a free calendar. 6 Collected $16,000 from clients for services rendered. 7 Paid $7,500 for radio advertisements to be aired from July 1 through September 30. 12 Purchased equipment for $45,000 paying $18,000 in cash and issuing a note for the remaining amount. 13 Paid $850 for supplies 16 Received telephone bill to be paid July 2nd, $325. FE Problem #1 Problem #2 June 1 1 12 13 16 M Please type your solutions below Daily Recurring Journal Entries Debit Credit R - X fa 0 C issuing a note for the remaining amount. 13 Paid $850 for supplies 16 Received telephone bill to be paid July 2nd, $325. 18 Paid $3,500 to the Little Red Choo Choo summer camp for Bobby's 8-year old son 22 Received a $155 reduction in amount due to Verizon for erroneous collect call telephone charges from a pay phone in Ecuador. Received cash from customers on account, $12,500 24 + 26 Gave a $1,250 credit to a client for a tax filing which resulted in an investigation by the FBI 30 Received a $6,000 advance rental payment from LAMCO for the months of July through October. 30 Received a $125 refund for returned supplies. 30 Recorded invoice for automobile expenses to be paid July, $425 30 Made first interest free mortgage payment of $2,500. 30 Paid PSE&G (Electricity) $1,650 30 Received $6,200 pre-payment for tax work to be performed in August & September quired:Prepare the appropriate journal entries for the above transaction. K 13 16 18 22 24 26 30 30 30 30 30 30 L M N O P Q 014 2 S 6 . 33 15 36 18 19 20 27 10 31 32 AARNARRI 34 35 B N Bobby Due Libri Bobby Due Libris an accounting frm which began operations in 2015 The assets and liabilities of the company as of June 1, 2022 are as follows: $ 34,000 $23,300 Cash Accounts receivable Supplie Office Equipment Accounts payable S 1,300 $ 7,700 $16,200 June 2022 business transactions June 1 Bobby trained $10,000 from his personal checking account into the business checking account. 2 Received and paid a LIPA (lectricity) 5900 Purchased suppiles on account, $1,100 Paid rent for the month of June, $4,000 Paid monthly health insurance till $1,800 Returned 5200 ef supplies receiving a reduction is the amount owed regarding the June 2nd purchase. lied clients for services rendered an account, $18,500 Paid Automobile expense, $1,400 Paid the $900 balance due for supplies purchased on June 2nd Raceived cash from cash clients (not previously billed) $7,000 18 Received cash from clients on account, $22,000 20 Paid various creditors on account, $6.300 Recorded Telephone bill to be paid in July, 5700 26 Paid $7,500 for Office Equipment 30 30 Withdrew cash for weekend in Las Vegas, $1,000 A physical count of supples revealed that there are $1,500 of supplies were on hand as of June 30 Required: Problem #1 Problem #2 2 2 7 9 2====2=222 30 12 Calibri June 1 1 2 2 2 7 9 10 12 32=== ERR 14 10 18 20 24 26 30 30 Cash Merge Custom M Please type your solutions below Supple office tavoment Revenue Operating expenses Accounts Receivable Bobby Due Libri income Statement for the month ended June 30, 2022 D Accounts Payable Ast Total assets Liabilities Bobby Capital Conditional Formatting Styles 9 5 T Bobby Dad Libri Balance Sheet June 30, 2022 He 1014 Decel 101 Asign #1 Sond De Iet Cab E F Need game in aut wedding the June 2nd purcha cents for services rendered on account, $18.500 Tald Automobile ex $1,400 the 500 lance due for supplies purchased on nend Recevedcap from cash clients that prevusly $7,000 ecca from des on account, $22.000 voceana, 4,300 Telenetben 5700 $7,500 for Off Equipment with tash for weekend in Las Veges, $1.000 A physical count of supplies revealed that there are $3,500 of ups were on and of 30 red Calue the amount of ROL Capital as of June. 1 Prepare a transaction worke Prome Statement and Statement of O'qit for the month ended 30 Preparace Sheet as of June 30, 2022 Hie " Y 10 12 14 36 18 30 24 26 X 30 S Page Lay Formulas Date Rever View - Revenue Total penting expe p M Bobby Dub Income Statement for the month ended Jun 30, 2022 Search on sing Custom BD Capital-June 1, 2022 Investment Nincome for the math Less Drawing BDL Capitale 30, 2002 Bobby Dub Statement of Owner's Equity for the month ended he 30, 2022 $conditional Formanings format As Table by De L Balance Sheet 30,2022 Total Liabities & Owner's ey Share 46 49 50 014 CARRARE 51 D 24 26 43 44 40 47 27 A G H T Heturned 300 or suppies receiving a reduction in the amount owed regarding the June 2nd purchase Billed clients for services rendered on account, $18.500 Paid Automobile expense, $1,400 14 16 18 Paid the $900 balance due for supplies purchased on June 2nd Received cash from cash clients (not previously billed) $7,000 Received cash from clients on account, $22,000 Paid various creditors on account, $6,300 Recorded Telephone bill to be paid in July, $700 Pald $7,500 for Office Equipment 20 24 26 30 30 Withdrew cash for weekend in Las Vegas, $3,000 A physical count of supplies revealed that there are $1,500 of supplies were on hand as of June 30 Required: Calculate the amount of SOL Capital as of June. 1. b Prepare a transaction worksheet C Prepare an Income Statement and Statement of Owner's Equity for the month ended June 30th Prepare a Balance Sheet as of June 30, 2022. B 10 12 2 Merge Custom M X L Bobby Due Libri Income Statement for the month ended June 30, 2022 Revenue Operating expenses Total operating expenses Net income BOL Capital June 1, 2022 Investment Net income for the month Less Drawing BOL Capital-June 30, 2022 Bobby Due Libri Statement of Owner's Equity for the month ended June 30, 2022 0. to Conditional Formatting 9 Q Bobby Due Libri Balance Sheet June 30, 2022 Assets Total assets Uabilities Owner's equity Total Liabilities & Owner's equity 5 Styles 3 D 1 2 3 4 -5 6 37 20 Bobby Due Libri Bobby Due Libri is an accounting firm which began operations in 2015. The assets and liabilities of the company, as of June 1, 2022 are as follows: Cash $ 34,000 Accounts receivable $ 23,700 Supplies $ 3,300 Office Equipment $ 7,700 Accounts payable $ 16,200 June 2022 business transactions: June 1 Bobby transferred $10,000 from his personal checking account into the business checking account. 2 Received and paid a LIPA bill (electricity) $900 Purchased supplies on account, $1,100 2 Paid rent for the month of June, $4,000 Paid monthly health insurance bill, $1,800 Returned $200 of supplies receiving a reduction in the amount owed regarding the June 2nd purchase. Billed clients for services rendered on account, $18,500 Paid Automobile expense, $1,400. 14 Paid the $900 balance due for supplies purchased on June 2nd. 16 Received cash from cash clients (not previously billed) $7,000 18 Received cash from clients on account, $22,000 20 Paid various creditors on account, $6,300 Recorded Telephone bill to be paid in July, $700 26 Paid $7,500 for Office Equipment 30 Withdrew cash for weekend in Las Vegas, $3,000 30 A physical count of supplies revealed that there are $1,500 of supplies were on hand as of June 30 2 7 9 10 12 222283 24 June ~~~~~ 1 1 2 2 2 7 9 10 12 14 16 18 20 24 26 30 30 Revenue Operating g account 00 June 2nd. $7,000 June 1 1 2 2 2 7 9 10 12 14 16 18 20 24 26 30 30 Cash Please type your solutions below Office Equipment Revenue Operating expenses Accounts Receivable Supplies Bobby Due Libri Income Statement for the month ended June 30, 2022 Accounts Payable Assets Total assets Habilities Bobby Capital Bobby Due Libri Balance Sheet June 30, 2022 wwwwwwwNNE 4 25 26 27 28 29 30 31 2 33 34 35 35 37 38 39 40 4234567 48 49 50 51 N345557 58 59 60 61 24 32 36 52 9 Returned $200 of supplies receiving a reduction in the amount owed regarding the June 2nd purchase. 10 Billed clients for services rendered on account, $18,500 Paid Automobile expense, $1,400. 12 14 16 Paid the $900 balance due for supplies purchased on June 2nd. Received cash from cash clients (not previously billed) $7,000 Received cash from clients on account, $22,000 Paid various creditors on account, $6,300 18 20 24 Recorded Telephone bill to be paid in July, $700 Paid $7,500 for Office Equipment 26 30 Withdrew cash for weekend in Las Vegas, $3,000 A physical count of supplies revealed that there are $1,500 of supplies were on hand as of June 30 30 Required: a Calculate the amount of BDL Capital as of June. 1 Prepare a transaction worksheet C Prepare an Income Statement and Statement of Owner's Equity for the month ended June 30th Prepare a Balance Sheet as of June 30, 2022. b d ***20 Problem #1 Re Of Tot Net BDL Inve Net Less BDL ity Bobby Due Libri Income Statement. for the month ended June 30, 2022 Revenue Operating expenses Total operating expenses Net income BDL Capital - June 1, 2022 Investment Net income for the month Less: Drawing BDL Capital - June 30, 2022 Bobby Due Libri Statement of Owner's Equity for the month ended June 30, 2022 Bobby Due Libri Balance Sheet June 30, 2022 Assets Total assets Liabilities Owner's equity Total Liabilities & Owner's equity