Answered step by step

Verified Expert Solution

Question

1 Approved Answer

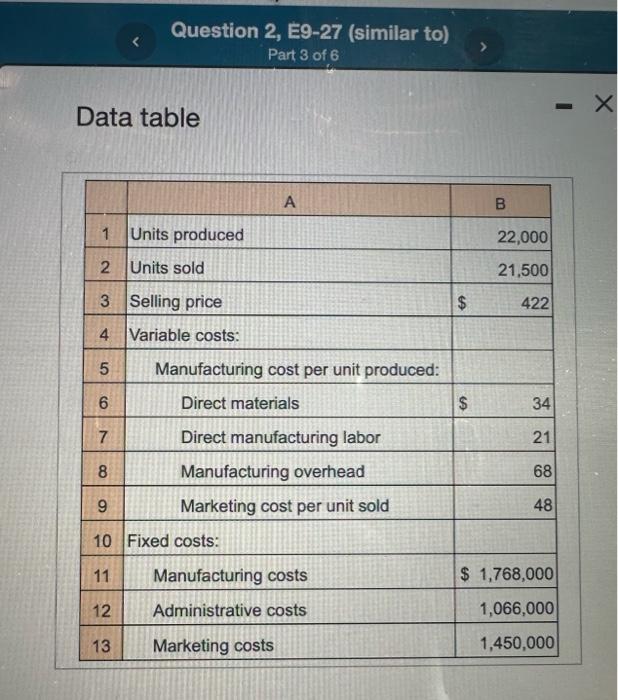

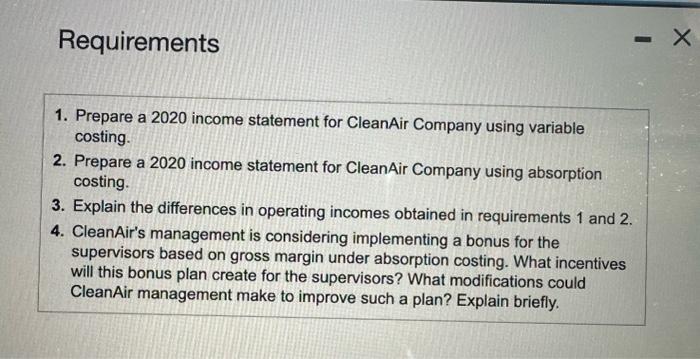

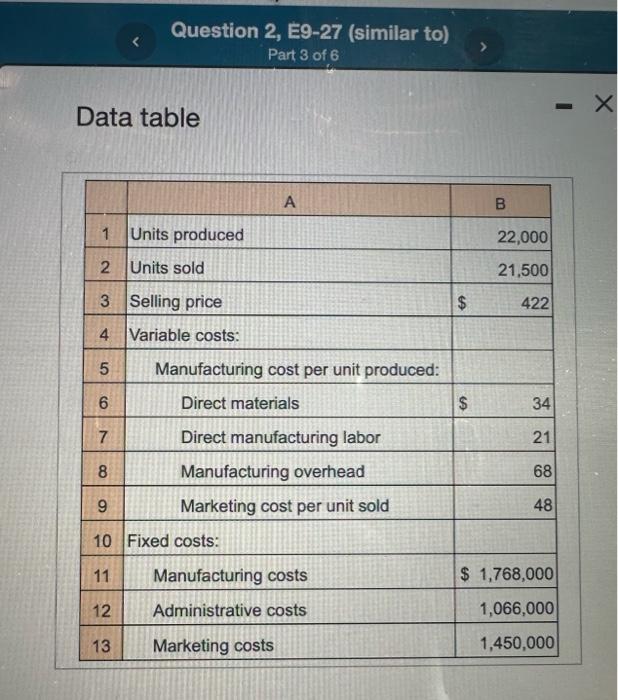

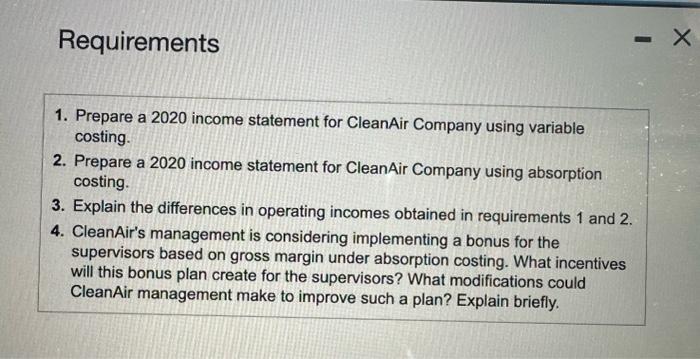

answer all requirements. redo everything. Data table Requirements 1. Prepare a 2020 income statement for CleanAir Company using variable costing. 2. Prepare a 2020 income

answer all requirements. redo everything.

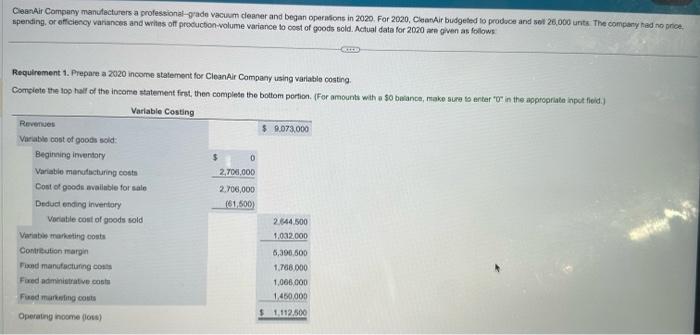

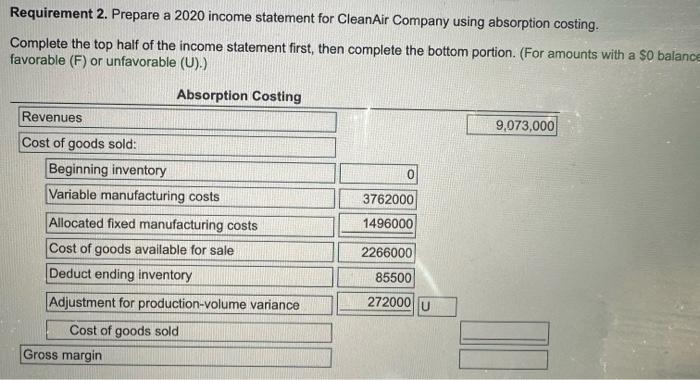

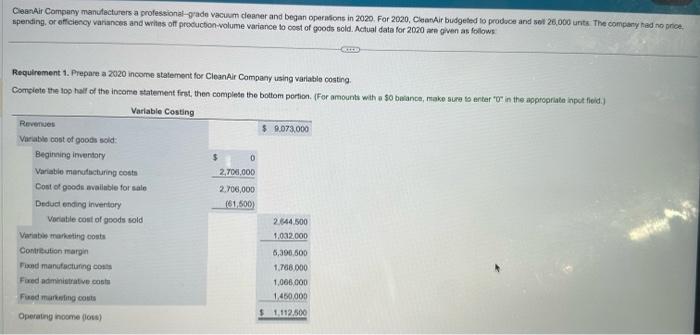

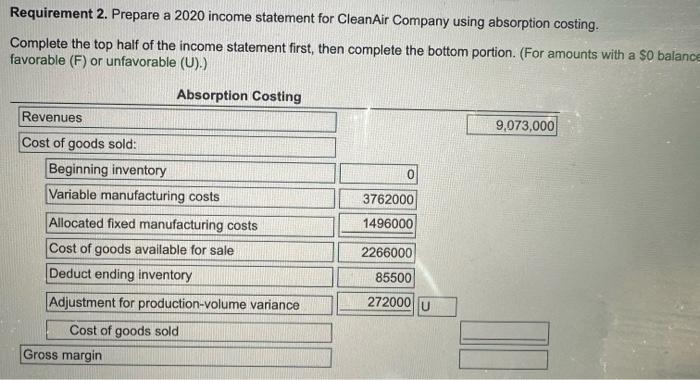

Data table Requirements 1. Prepare a 2020 income statement for CleanAir Company using variable costing. 2. Prepare a 2020 income statement for CleanAir Company using absorption costing. 3. Explain the differences in operating incomes obtained in requirements 1 and 2 . 4. CleanAir's management is considering implementing a bonus for the supervisors based on gross margin under absorption costing. What incentives will this bonus plan create for the supervisors? What modifications could CleanAir management make to improve such a plan? Explain briefly. CleanAir Company manulacturers a professionat-grade vacuum deaner and began opernofs in 2020. For 2020, CleatAir budgeted to prodoce and sor 26,000 unts The compsty had no price spending, or efficienoy varancos and writes off producbon-wolume variance to ocst of goots sold. Actual data for 2090 are oiven as fodlows. Requirement 1. Prepare a 2020 income statement for CleanAir Company using variable costing. Requirement 2. Prepare a 2020 income statement for CleanAir Company using absorption costing. Complete the top half of the income statement first, then complete the bottom portion. (For amounts with a $0 balanc favorable (F) or unfavorable (U).)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started