Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer as many you think you can answer, its multiple choice fill in the blank. Karen's home has a replacement value of $300,000, therefore (using

answer as many you think you can answer, its multiple choice fill in the blank.

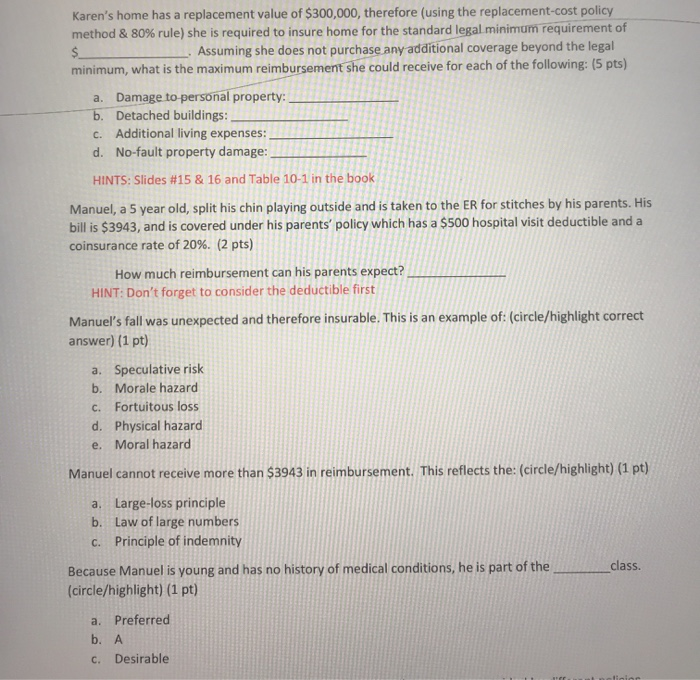

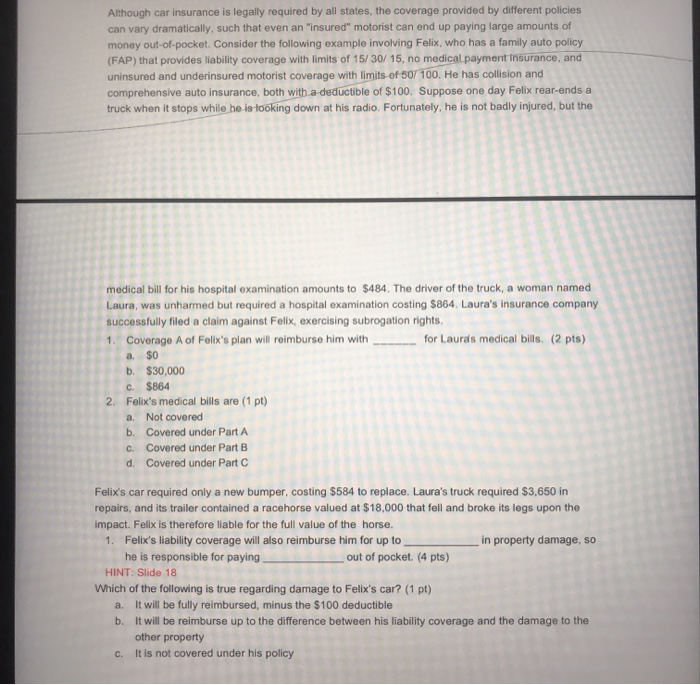

Karen's home has a replacement value of $300,000, therefore (using the replacement-cost policy method & 80% rule) she is required to insure home for the standard legal minimum requirement of $ Assuming she does not purchase any additional coverage beyond the legal minimum, what is the maximum reimbursement she could receive for each of the following: (5 pts) a. Damage to personal property: b. Detached buildings: C. Additional living expenses: d. No-fault property damage: HINTS: Slides #15 & 16 and Table 10-1 in the book Manuel, a 5 year old, split his chin playing outside and is taken to the ER for stitches by his parents. His bill is $3943, and is covered under his parents' policy which has a $500 hospital visit deductible and a coinsurance rate of 20%. (2 pts) How much reimbursement can his parents expect? HINT: Don't forget to consider the deductible first Manuel's fall was unexpected and therefore insurable. This is an example of: (circle/highlight correct answer) (1 pt) a. Speculative risk b. Morale hazard C. Fortuitous loss d. Physical hazard e. Moral hazard Manuel cannot receive more than $3943 in reimbursement. This reflects the: (circle/highlight) (1 pt) a. Large-loss principle b. Law of large numbers C. Principle of indemnity Because Manuel is young and has no history of medical conditions, he is part of the class. (circle/highlight) (1 pt) a. Preferred b. A c. Desirable Although car insurance is legally required by all states, the coverage provided by different policies can vary dramatically, such that even an "insured" motorist can end up paying large amounts of money out-of-pocket. Consider the following example involving Felix, who has a family auto policy (FAP) that provides liability coverage with limits of 15/30/15, no medical payment insurance, and uninsured and underinsured motorist coverage with limits of 507 100. He has collision and comprehensive auto insurance, both with a deductible of $100. Suppose one day Felix rear-ends a truck when it stops while he is tooking down at his radio. Fortunately, he is not badly injured, but the a. medical bill for his hospital examination amounts to $484. The driver of the truck, a woman named Laura, was unharmed but required a hospital examination costing $864. Laura's insurance company successfully filed a claim against Felix, exercising subrogation rights 1. Coverage A of Felix's plan will reimburse him with for Laura's medical bills. (2 pts) $0 b. $30,000 $864 2. Felix's medical bills are (1 pt) Not covered b. Covered under Part A C. Covered under Part B d. Covered under Part c. a Felix's car required only a new bumper, costing $584 to replace. Laura's truck required $3,650 in repairs, and its trailer contained a racehorse valued at $18,000 that fell and broke its legs upon the impact. Felix is therefore liable for the full value of the horse. 1. Felix's liability coverage will also reimburse him for up to in property damage, so he is responsible for paying. out of pocket. (4 pts) HINT: Slide 18 Which of the following is true regarding damage to Felix's car? (1 pt) It will be fully reimbursed, minus the $100 deductible b. It will be reimburse up to the difference between his liability coverage and the damage to the other property It is not covered under his policy a. C. Karen's home has a replacement value of $300,000, therefore (using the replacement-cost policy method & 80% rule) she is required to insure home for the standard legal minimum requirement of $ Assuming she does not purchase any additional coverage beyond the legal minimum, what is the maximum reimbursement she could receive for each of the following: (5 pts) a. Damage to personal property: b. Detached buildings: C. Additional living expenses: d. No-fault property damage: HINTS: Slides #15 & 16 and Table 10-1 in the book Manuel, a 5 year old, split his chin playing outside and is taken to the ER for stitches by his parents. His bill is $3943, and is covered under his parents' policy which has a $500 hospital visit deductible and a coinsurance rate of 20%. (2 pts) How much reimbursement can his parents expect? HINT: Don't forget to consider the deductible first Manuel's fall was unexpected and therefore insurable. This is an example of: (circle/highlight correct answer) (1 pt) a. Speculative risk b. Morale hazard C. Fortuitous loss d. Physical hazard e. Moral hazard Manuel cannot receive more than $3943 in reimbursement. This reflects the: (circle/highlight) (1 pt) a. Large-loss principle b. Law of large numbers C. Principle of indemnity Because Manuel is young and has no history of medical conditions, he is part of the class. (circle/highlight) (1 pt) a. Preferred b. A c. Desirable Although car insurance is legally required by all states, the coverage provided by different policies can vary dramatically, such that even an "insured" motorist can end up paying large amounts of money out-of-pocket. Consider the following example involving Felix, who has a family auto policy (FAP) that provides liability coverage with limits of 15/30/15, no medical payment insurance, and uninsured and underinsured motorist coverage with limits of 507 100. He has collision and comprehensive auto insurance, both with a deductible of $100. Suppose one day Felix rear-ends a truck when it stops while he is tooking down at his radio. Fortunately, he is not badly injured, but the a. medical bill for his hospital examination amounts to $484. The driver of the truck, a woman named Laura, was unharmed but required a hospital examination costing $864. Laura's insurance company successfully filed a claim against Felix, exercising subrogation rights 1. Coverage A of Felix's plan will reimburse him with for Laura's medical bills. (2 pts) $0 b. $30,000 $864 2. Felix's medical bills are (1 pt) Not covered b. Covered under Part A C. Covered under Part B d. Covered under Part c. a Felix's car required only a new bumper, costing $584 to replace. Laura's truck required $3,650 in repairs, and its trailer contained a racehorse valued at $18,000 that fell and broke its legs upon the impact. Felix is therefore liable for the full value of the horse. 1. Felix's liability coverage will also reimburse him for up to in property damage, so he is responsible for paying. out of pocket. (4 pts) HINT: Slide 18 Which of the following is true regarding damage to Felix's car? (1 pt) It will be fully reimbursed, minus the $100 deductible b. It will be reimburse up to the difference between his liability coverage and the damage to the other property It is not covered under his policy a. C Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started