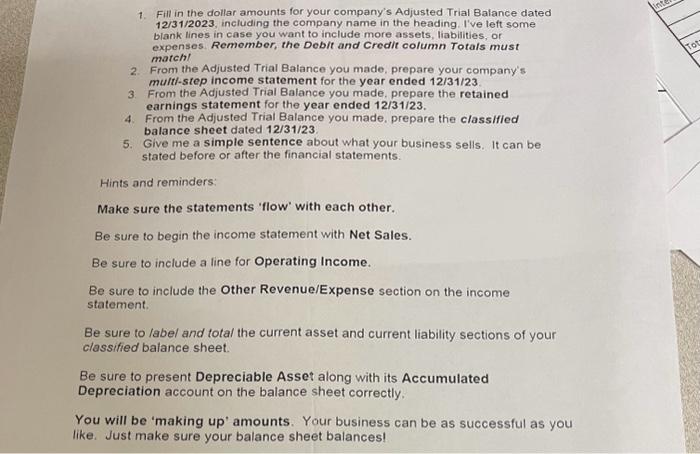

1. Fill in the dollar amounts for your company's Adjusted Trial Balance dated 12/31/2023, including the company name in the heading. I've left some blank lines in case you want to include more assets, liabilities, or expenses. Remember, the Debit and Credit column Totals must match! 2. From the Adjusted Trial Balance you made, prepare your company's mult/-step income statement for the year ended 12/31/23. 3. From the Adjusted Trial Balance you made, prepare the retained earnings statement for the year ended 12/31/23. 4. From the Adjusted Trial Balance you made, prepare the class/fied balance sheet dated 12/31/23. 5. Give me a simple sentence about what your business sells. It can be stated before or after the financial statements. Hints and reminders: Make sure the statements 'flow' with each other. Be sure to begin the income statement with Net Sales. Be sure to include a line for Operating Income. Be sure to include the Other Revenue/Expense section on the income statement. Be sure to label and total the current asset and current liability sections of your classified balance sheet. Be sure to present Depreciable Asset along with its Accumulated Depreciation account on the balance sheet correctly. You will be 'making up' amounts. Your business can be as successful as you like. Just make sure your balance sheet balances! 1. Fill in the dollar amounts for your company's Adjusted Trial Balance dated 12/31/2023, including the company name in the heading. I've left some blank lines in case you want to include more assets, liabilities, or expenses. Remember, the Debit and Credit column Totals must match! 2. From the Adjusted Trial Balance you made, prepare your company's mult/-step income statement for the year ended 12/31/23. 3. From the Adjusted Trial Balance you made, prepare the retained earnings statement for the year ended 12/31/23. 4. From the Adjusted Trial Balance you made, prepare the class/fied balance sheet dated 12/31/23. 5. Give me a simple sentence about what your business sells. It can be stated before or after the financial statements. Hints and reminders: Make sure the statements 'flow' with each other. Be sure to begin the income statement with Net Sales. Be sure to include a line for Operating Income. Be sure to include the Other Revenue/Expense section on the income statement. Be sure to label and total the current asset and current liability sections of your classified balance sheet. Be sure to present Depreciable Asset along with its Accumulated Depreciation account on the balance sheet correctly. You will be 'making up' amounts. Your business can be as successful as you like. Just make sure your balance sheet balances