Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer Choices: 1. a) 581.73 b) 623.29 c) 831.05 d) 1,163.47 2. a) 39.47% b) 50.75% c) 56.39% d) 66.54% 3. a) 18.78% b) 21.60%

Answer Choices:

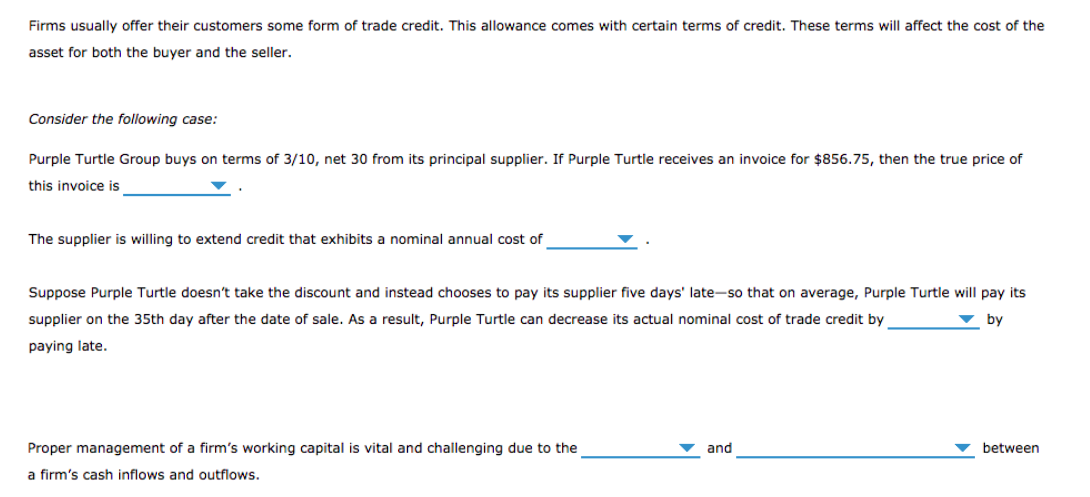

1. a) 581.73 b) 623.29 c) 831.05 d) 1,163.47

2. a) 39.47% b) 50.75% c) 56.39% d) 66.54%

3. a) 18.78% b) 21.60% c) 33.80% d) 36.68%

4 & 5: Proper management of a firms working capital is vital and challenging due to the (uncertainty or certainty) and (synchronized timing or lack of synchronized timing) between a firms cash inflows and outflows

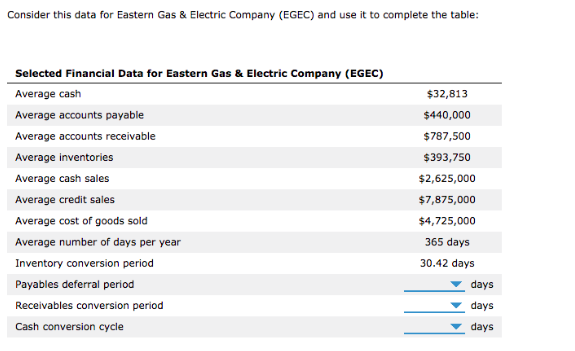

6. Payable deferral period: a) 33.52 b) 33.99 c) 122.36

7. Receivables conversion period: a) 219.00 b) 36.50 c) 36.00

8. Cash conversion cycle: a) 66.92 b) 32.93 c) 100.91

Thank you!

Firms usually offer their customers some form of trade credit. This allowance comes with certain terms of credit. These terms will affect the cost of the asset for both the buyer and the seller. Consider the following case Purple Turtle Group buys on terms of 3/10, net 30 from its principal supplier. If Purple Turtle receives an invoice for $856.75, then the true price of this invoice is The supplier is willing to extend credit that exhibits a nominal annual cost of Suppose Purple Turtle doesn't take the discount and instead chooses to pay its supplier five days' late-so that on average, Purple Turtle will pay its supplier on the 35th day after the date of sale. As a result, Purple Turtle can decrease its actual nominal cost of trade credit by by paying late. Proper management of a firm's working capital is vital and challenging due to the between and a firm's cash inflows and outflows Consider this data for Eastern Gas & Electric Company (EGEC) and use it to complete the table: $32,813 Selected Financial Data for Eastern Gas & Electric Company (EGEC) Average cash Average accounts payable Average accounts receivable $440,000 Average inventories $787,500 $393,750 $2,625,000 Average cash sales Average credit sales $7,875,000 Average cost of goods sold Average number of days per year Inventory conversion period Payables deferral period Receivables conversion period Cash conversion cycle $4,725,000 365 days 30.42 days days days days Firms usually offer their customers some form of trade credit. This allowance comes with certain terms of credit. These terms will affect the cost of the asset for both the buyer and the seller. Consider the following case Purple Turtle Group buys on terms of 3/10, net 30 from its principal supplier. If Purple Turtle receives an invoice for $856.75, then the true price of this invoice is The supplier is willing to extend credit that exhibits a nominal annual cost of Suppose Purple Turtle doesn't take the discount and instead chooses to pay its supplier five days' late-so that on average, Purple Turtle will pay its supplier on the 35th day after the date of sale. As a result, Purple Turtle can decrease its actual nominal cost of trade credit by by paying late. Proper management of a firm's working capital is vital and challenging due to the between and a firm's cash inflows and outflows Consider this data for Eastern Gas & Electric Company (EGEC) and use it to complete the table: $32,813 Selected Financial Data for Eastern Gas & Electric Company (EGEC) Average cash Average accounts payable Average accounts receivable $440,000 Average inventories $787,500 $393,750 $2,625,000 Average cash sales Average credit sales $7,875,000 Average cost of goods sold Average number of days per year Inventory conversion period Payables deferral period Receivables conversion period Cash conversion cycle $4,725,000 365 days 30.42 days days days daysStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started