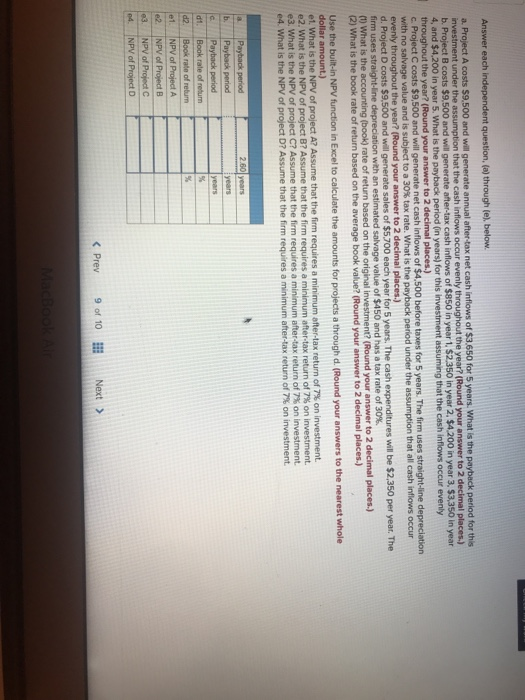

Answer each independent question, (a) through (e), below. a. Project A costs $9.500 and will generate annual after-tax net cash inflows of $3,650 for 5 years. What is the payback period for this investment under the assumption that the cash inflows occur evenly throughout the year? (Round your answer to 2 decimal places.) b. Project B costs $9.500 and will generate after-tax cash inflows of $850 in year 1, $2.350 in year 2. $4,200 in year 3. $3,350 in year 4, and $4,200 in year 5. What is the payback period in years) for this investment assuming that the cash inflows occur evenly throughout the year? (Round your answer to 2 decimal places.) c. Project C costs $9,500 and will generate net cash inflows of $4.500 before taxes for 5 years. The firm uses straight-line depreciation with no salvage value and is subject to a 30% tax rate. What is the payback period under the assumption that all cash inflows occur evenly throughout the year? (Round your answer to 2 decimal places.) d. Project D costs $9,500 and will generate sales of $5.700 each year for 5 years. The cash expenditures will be $2,350 per year. The firm uses straight-line depreciation with an estimated salvage value of $450 and has a tax rate of 30% (1) What is the accounting (book) rate of return based on the original investment? (Round your answer to 2 decimal places.) (2) What is the book rate of return based on the average book value? (Round your answer to 2 decimal places.) Use the built-in NPV function in Excel to calculate the amounts for projects a through d. (Round your answers to the nearest whole dollar amount.) el. What is the NPV of project A? Assume that the firm requires a minimum after-tax return of 7% on investment. e2. What is the NPV of project B? Assume that the firm requires a minimum after-tax return of 7% on investment. e3. What is the NPV of project C? Assume that the firm requires a minimum after-tax return of 7% on investment. e4. What is the NPV of project D? Assume that the firm requires a minimum after-tax return of 7% on investment. a 2.60 years dt. Payback period Payback period Payback period Book rate of return Book rate of rebum NPV of Project A NPV of Project B NPV of Project C NPV of Project D e1. e2. 3. 4.