Answered step by step

Verified Expert Solution

Question

1 Approved Answer

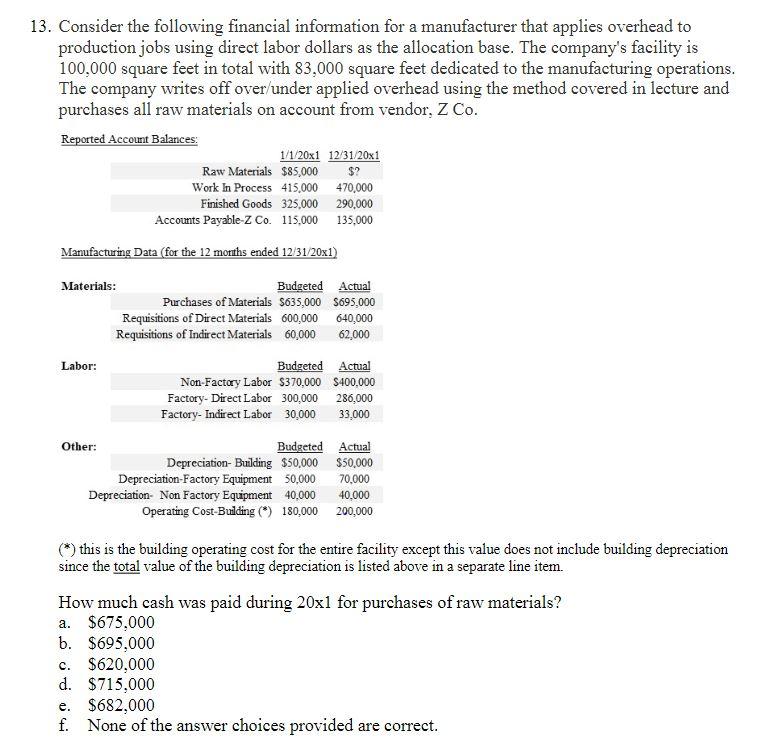

Answer is A, looking for an explanation please! 13. Consider the following financial information for a manufacturer that applies overhead to production jobs using direct

Answer is A, looking for an explanation please!

13. Consider the following financial information for a manufacturer that applies overhead to production jobs using direct labor dollars as the allocation base. The company's facility is 100,000 square feet in total with 83,000 square feet dedicated to the manufacturing operations. The company writes off over/under applied overhead using the method covered in lecture and purchases all raw materials on account from vendor, Z Co. Reported Account Balances: 1/1/20x1 12/31/20x1 Raw Materials $85,000 $? Work In Process 415,000 470,000 Finished Goods 325,000 290,000 Accounts Payable z Co. 115,000 135,000 Manufacturing Data (for the 12 months ended 12/31/20x1) Materials: Budgeted Actual Purchases of Materials S635,000 5695,000 Requisitions of Direct Materials 600,000 640,000 Requisitions of Indirect Materials 60,000 62,000 Labor: Budgeted Actual Non-Factory Labor $370,000 $400.000 Factory- Direct Labor 300,000 286,000 Factory- Indirect Labor 30.000 33,000 Other: Budgeted Actual Depreciation- Building $50,000 $50,000 Depreciation-Factory Equipment 50,000 70,000 Depreciation. Non Factory Equipment 40.000 40,000 Operating cost-Building ) 180,000 200,000 this is the building operating cost for the entire facility except this value does not include building depreciation since the total value of the building depreciation is listed above in a separate line item. How much cash was paid during 20x1 for purchases of raw materials? a. $675.000 b. $695,000 c. $620,000 d. $715,000 e. $682,000 f. None of the answer choices provided are correctStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started