Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer me this question this is the only information it has if u can send Problem 2: (Show all supporting computations On January 1st of

answer me this question

this is the only information it has if u can send

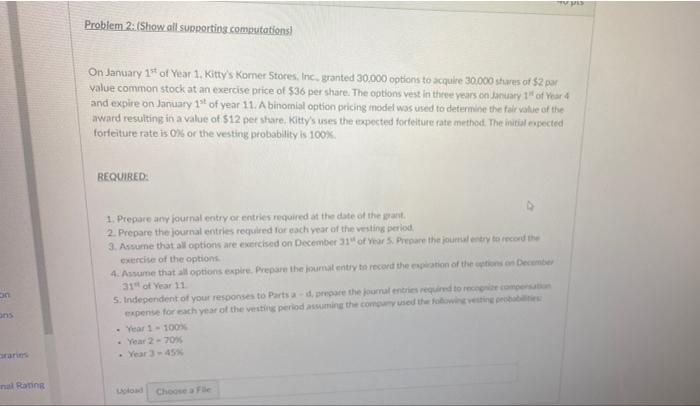

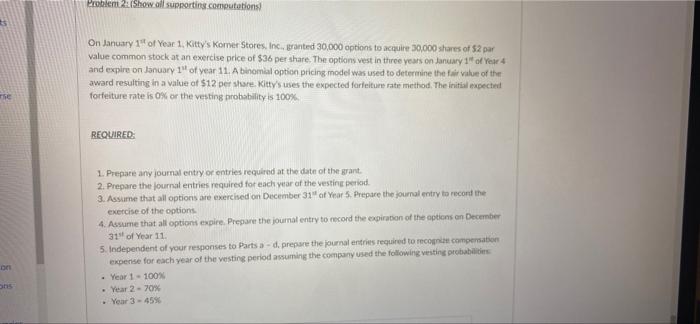

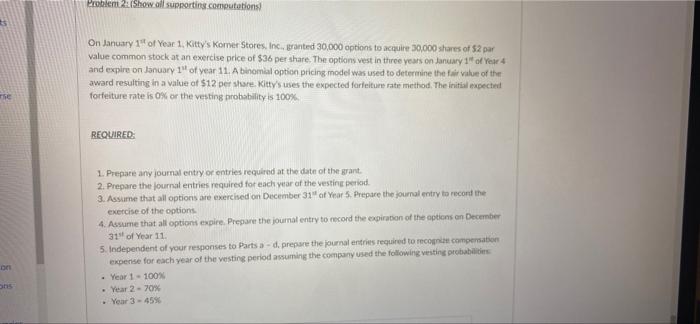

Problem 2: (Show all supporting computations On January 1st of Year 1. Kitty's Komer Stores, Inc., granted 30.000 options to acquire 30.000 stures of $2 p. value common stock at an exercise price of 536 per share. The options vest in the years on January 1" of Year and expire on January 19 of year 11. A binomial option pricing model was used to determine the fair value of the 1st award resulting in a value of $12 per sture, Kitty's uses the expected forteture rate method. The initial expected forfeiture rate is 0% of the vesting probability is 100% REQUIRED 1. Prepare any journal entry or entries required at the date of the grant 2. Prepare the journal entries required for each year of the vesting period 3. Assume that all options are exercised on December 31" of Years. Prepare the jourulentry to record the exercise of the options 4. Assume that all options expre. Prepare the journal entry to record the expiration of the win December 31 ot Year 11 5. Independent of your responses to Parts and prepare the journal entries required to recor expense for each year of the veste period aming the companied the foloweetin e Year 100% Year 2 - 70% Year 3 - 458 ons nal Rating Choose afle Problem Show all supporting.computations On January 1st of Year 1. Kitty's Komer Stores, Inc., Branted 30,000 options to acquire 30,000 shares of 52 par value common stock at an exercise price of $36 per share. The optionsvest in three years on January 1" of Year 4 and expire on January 1" of year 11. A binomial option pricing model was used to determine the fair value of the award resulting in a value of $12 per share. Kitty's uses the expected forfeitur rate method. The initial expected forfeiture rate is 0% or the vesting probability is 100% Te REQUIRED 1. Prepare any journal entry or entries required at the date of the grant 2. Prepare the journal entries required for each year of the vestint period. 3. Assume that all options are exercised on December 31" of Year 5. Prepare the journal entry to record the exercise of the options 4. Assume that all options expire. Prepare the journal entry to record the expiration of the options on December 31 of Year 11 5. Independent of your responses to Parts - de prepare the journal entries required to recog.compensation expense for each year of the vesting period assuming the company used the following vesting probabilis Year 1 - 100% Year 2 - 70% Year 3 - 4550 Dn Problem 2: (Show all supporting computations On January 1st of Year 1. Kitty's Komer Stores, Inc., granted 30.000 options to acquire 30.000 stures of $2 p. value common stock at an exercise price of 536 per share. The options vest in the years on January 1" of Year and expire on January 19 of year 11. A binomial option pricing model was used to determine the fair value of the 1st award resulting in a value of $12 per sture, Kitty's uses the expected forteture rate method. The initial expected forfeiture rate is 0% of the vesting probability is 100% REQUIRED 1. Prepare any journal entry or entries required at the date of the grant 2. Prepare the journal entries required for each year of the vesting period 3. Assume that all options are exercised on December 31" of Years. Prepare the jourulentry to record the exercise of the options 4. Assume that all options expre. Prepare the journal entry to record the expiration of the win December 31 ot Year 11 5. Independent of your responses to Parts and prepare the journal entries required to recor expense for each year of the veste period aming the companied the foloweetin e Year 100% Year 2 - 70% Year 3 - 458 ons nal Rating Choose afle Problem Show all supporting.computations On January 1st of Year 1. Kitty's Komer Stores, Inc., Branted 30,000 options to acquire 30,000 shares of 52 par value common stock at an exercise price of $36 per share. The optionsvest in three years on January 1" of Year 4 and expire on January 1" of year 11. A binomial option pricing model was used to determine the fair value of the award resulting in a value of $12 per share. Kitty's uses the expected forfeitur rate method. The initial expected forfeiture rate is 0% or the vesting probability is 100% Te REQUIRED 1. Prepare any journal entry or entries required at the date of the grant 2. Prepare the journal entries required for each year of the vestint period. 3. Assume that all options are exercised on December 31" of Year 5. Prepare the journal entry to record the exercise of the options 4. Assume that all options expire. Prepare the journal entry to record the expiration of the options on December 31 of Year 11 5. Independent of your responses to Parts - de prepare the journal entries required to recog.compensation expense for each year of the vesting period assuming the company used the following vesting probabilis Year 1 - 100% Year 2 - 70% Year 3 - 4550 Dn

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started