ANSWER PART TWO & THREE PLEASE !!

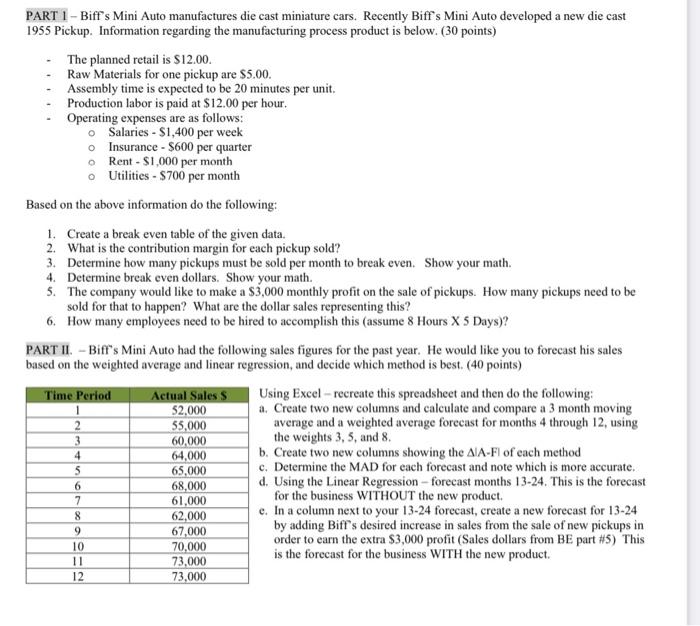

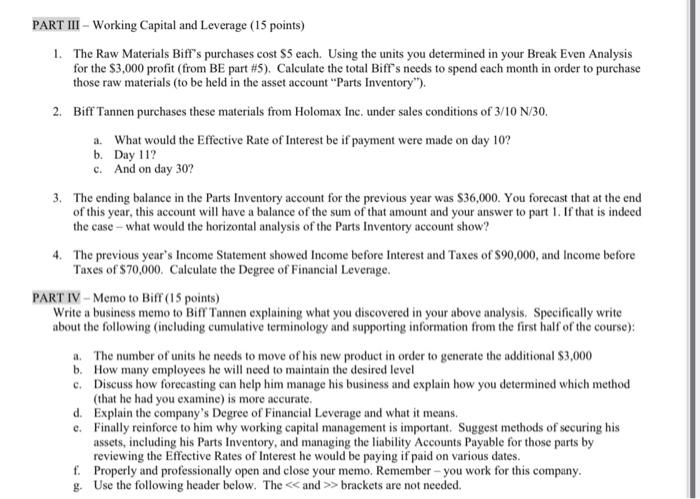

PART 1 - Biff's Mini Auto manufactures die cast miniature cars. Recently Biff's Mini Auto developed a new die cast 1955 Pickup. Information regarding the manufacturing process product is below. ( 30 points) - The planned retail is $12.00. - Raw Materials for one pickup are $5.00. - Assembly time is expected to be 20 minutes per unit. - Production labor is paid at $12.00 per hour. - Operating expenses are as follows: Salaries - $1,400 per week - Insurance - $600 per quarter Rent - $1,000 per month Utilities - $700 per month Based on the above information do the following: 1. Create a break even table of the given data. 2. What is the contribution margin for each pickup sold? 3. Determine how many pickups must be sold per month to break even. Show your math. 4. Determine break even dollars. Show your math. 5. The company would like to make a $3,000 monthly profit on the sale of pickups. How many pickups need to be sold for that to happen? What are the dollar sales representing this? 6. How many employees need to be hired to accomplish this (assume 8 Hours X 5 Days)? PART II. - Biff's Mini Auto had the following sales figures for the past year. He would like you to forecast his sales based on the weighted average and linear regression, and decide which method is best. ( 40 points) Using Excel - recreate this spreadsheet and then do the following: a. Create two new columns and calculate and compare a 3 month moving average and a weighted average forecast for months 4 through 12 , using the weights 3,5 , and 8 . b. Create two new columns showing the AF of each method c. Determine the MAD for each forecast and note which is more accurate. d. Using the Linear Regression - forecast months 13-24. This is the forecast for the business WITHOUT the new product. e. In a column next to your 13-24 forecast, create a new forecast for 13-24 by adding Biff's desired increase in sales from the sale of new pickups in order to earn the extra $3,000 profit (Sales dollars from BE part $5 ) This is the forecast for the business WITH the new product. 1. The Raw Materials Biff's purchases cost $5 each. Using the units you determined in your Break Even Analysis for the $3,000 profit (from BE part #5 ). Calculate the total Biff's needs to spend each month in order to purchase those raw materials (to be held in the asset account "Parts Inventory"). 2. Biff Tannen purchases these materials from Holomax Inc. under sales conditions of 3/10N/30. a. What would the Effective Rate of Interest be if payment were made on day 10 ? b. Day 11 ? c. And on day 30 ? 3. The ending balance in the Parts Inventory account for the previous year was $36,000. You forecast that at the end of this year, this account will have a balance of the sum of that amount and your answer to part 1. If that is indeed the case - what would the horizontal analysis of the Parts Inventory account show? 4. The previous year's Income Statement showed Income before Interest and Taxes of $90,000, and Income before Taxes of \$70,000. Calculate the Degree of Financial Leverage. PART IV - Memo to Biff (15 points) Write a business memo to Biff Tannen explaining what you discovered in your above analysis. Specifically write about the following (including cumulative terminology and supporting information from the first half of the course): a. The number of units he needs to move of his new product in order to generate the additional $3,000 b. How many employees he will need to maintain the desired level c. Discuss how forecasting can help him manage his business and explain how you determined which method (that he had you examine) is more accurate. d. Explain the company's Degree of Financial Leverage and what it means. e. Finally reinforce to him why working capital management is important. Suggest methods of securing his assets, including his Parts Inventory, and managing the liability Accounts Payable for those parts by reviewing the Effective Rates of Interest he would be paying if paid on various dates. f. Properly and professionally open and close your memo. Remember-you work for this company. g. Use the following header below. The brackets are not needed. PART 1 - Biff's Mini Auto manufactures die cast miniature cars. Recently Biff's Mini Auto developed a new die cast 1955 Pickup. Information regarding the manufacturing process product is below. ( 30 points) - The planned retail is $12.00. - Raw Materials for one pickup are $5.00. - Assembly time is expected to be 20 minutes per unit. - Production labor is paid at $12.00 per hour. - Operating expenses are as follows: Salaries - $1,400 per week - Insurance - $600 per quarter Rent - $1,000 per month Utilities - $700 per month Based on the above information do the following: 1. Create a break even table of the given data. 2. What is the contribution margin for each pickup sold? 3. Determine how many pickups must be sold per month to break even. Show your math. 4. Determine break even dollars. Show your math. 5. The company would like to make a $3,000 monthly profit on the sale of pickups. How many pickups need to be sold for that to happen? What are the dollar sales representing this? 6. How many employees need to be hired to accomplish this (assume 8 Hours X 5 Days)? PART II. - Biff's Mini Auto had the following sales figures for the past year. He would like you to forecast his sales based on the weighted average and linear regression, and decide which method is best. ( 40 points) Using Excel - recreate this spreadsheet and then do the following: a. Create two new columns and calculate and compare a 3 month moving average and a weighted average forecast for months 4 through 12 , using the weights 3,5 , and 8 . b. Create two new columns showing the AF of each method c. Determine the MAD for each forecast and note which is more accurate. d. Using the Linear Regression - forecast months 13-24. This is the forecast for the business WITHOUT the new product. e. In a column next to your 13-24 forecast, create a new forecast for 13-24 by adding Biff's desired increase in sales from the sale of new pickups in order to earn the extra $3,000 profit (Sales dollars from BE part $5 ) This is the forecast for the business WITH the new product. 1. The Raw Materials Biff's purchases cost $5 each. Using the units you determined in your Break Even Analysis for the $3,000 profit (from BE part #5 ). Calculate the total Biff's needs to spend each month in order to purchase those raw materials (to be held in the asset account "Parts Inventory"). 2. Biff Tannen purchases these materials from Holomax Inc. under sales conditions of 3/10N/30. a. What would the Effective Rate of Interest be if payment were made on day 10 ? b. Day 11 ? c. And on day 30 ? 3. The ending balance in the Parts Inventory account for the previous year was $36,000. You forecast that at the end of this year, this account will have a balance of the sum of that amount and your answer to part 1. If that is indeed the case - what would the horizontal analysis of the Parts Inventory account show? 4. The previous year's Income Statement showed Income before Interest and Taxes of $90,000, and Income before Taxes of \$70,000. Calculate the Degree of Financial Leverage. PART IV - Memo to Biff (15 points) Write a business memo to Biff Tannen explaining what you discovered in your above analysis. Specifically write about the following (including cumulative terminology and supporting information from the first half of the course): a. The number of units he needs to move of his new product in order to generate the additional $3,000 b. How many employees he will need to maintain the desired level c. Discuss how forecasting can help him manage his business and explain how you determined which method (that he had you examine) is more accurate. d. Explain the company's Degree of Financial Leverage and what it means. e. Finally reinforce to him why working capital management is important. Suggest methods of securing his assets, including his Parts Inventory, and managing the liability Accounts Payable for those parts by reviewing the Effective Rates of Interest he would be paying if paid on various dates. f. Properly and professionally open and close your memo. Remember-you work for this company. g. Use the following header below. The brackets are not needed