Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer please Accounting for Gift Cards Assume lkeo Inc, sold $180,000 of gift cards during the last two weeks of December in Year 1. No

Answer please

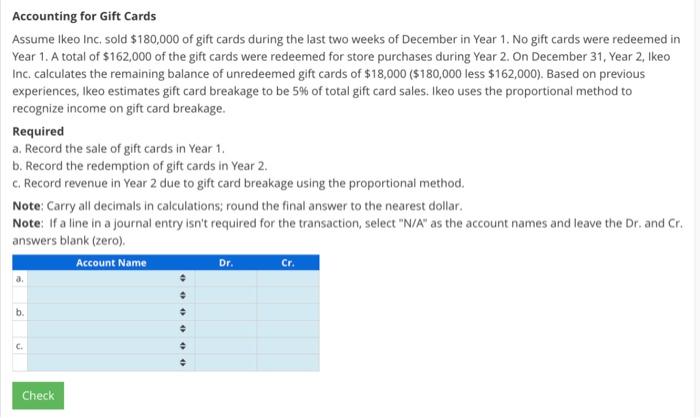

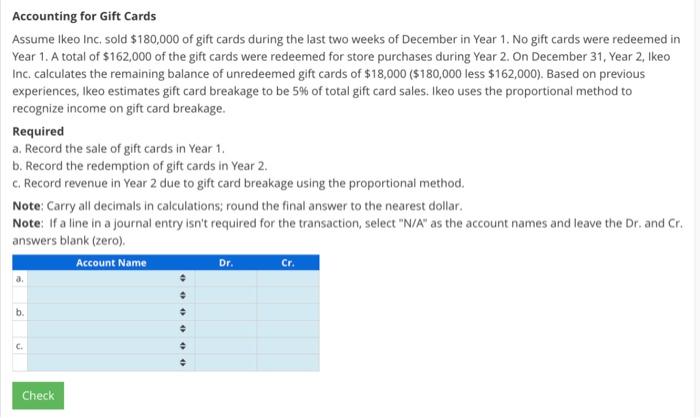

Accounting for Gift Cards Assume lkeo Inc, sold $180,000 of gift cards during the last two weeks of December in Year 1. No gift cards were redeemed in Year 1. A total of $162,000 of the gift cards were redeemed for store purchases during Year 2. On December 31, Year 2, Ikeo Inc. calculates the remaining balance of unredeemed gift cards of $18,000($180,000 less $162,000). Based on previous experiences, Ikeo estimates gift card breakage to be 5% of total gift card sales. Ikeo uses the proportional method to recognize income on gift card breakage. Required a. Record the sale of gift cards in Year 1 . b. Record the redemption of gift cards in Year 2. c. Record revenue in Year 2 due to gift card breakage using the proportional method. Note: Carry all decimals in calculations; round the final answer to the nearest dollar. Note: If a line in a journal entry isn't required for the transaction, select "N/A" as the account names and leave the Dr. and Cr. answers blank (zero)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started