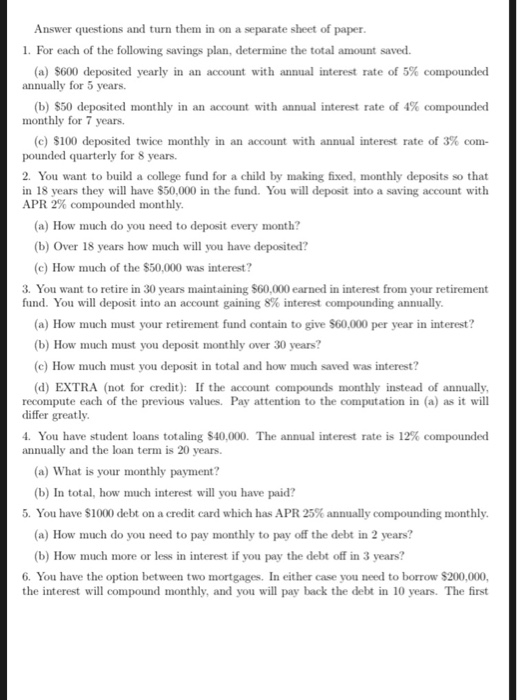

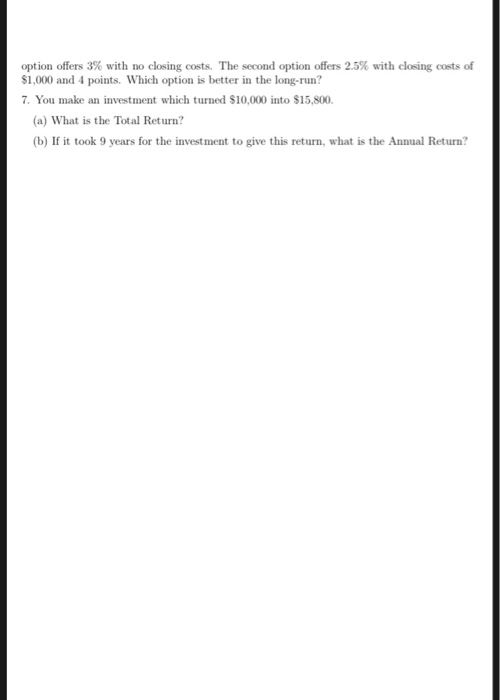

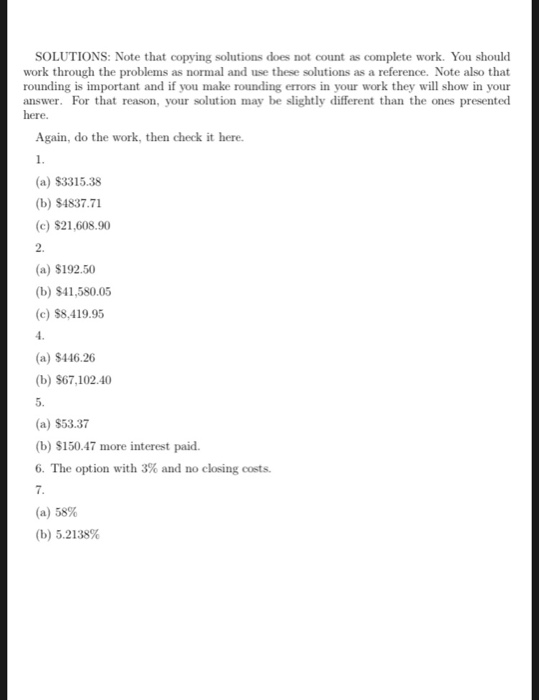

Answer questions and turn them in on a separate sheet of paper 1. For each of the following savings plan, determine the total amount saved (a) $600 deposited yearly in an account with annual interest rate of 5% compounded annually for 5 years. (b) $50 deposited monthly in an account with annual interest rate of 4% compounded monthly for 7 years. (c) $100 deposited twice monthly in an account with annual interest rate of 3% com- pounded quarterly for 8 years. 2. You want to build a college fund for a child by making fixed, monthly deposits so that in 18 years they wil have $50,000 in the fund. You will deposit into a saving account with APR 2% compounded monthly. (a) How much do you need to deposit every month? (b) Over 18 years how much will you have deposited? (c) How much of the $50,000 was interest? 3. You want to retire in 30 years maintaining $60,000 earned in interest from your retirement fund. You will deposit into an account gaining 8% interest compounding annually (a) How much must your retirement fund contain to give $60,000 per year in interest? (b) How much must you deposit monthly over 30 years? (c)How much must you deposit in total and how much saved was interest? (d) EXTRA (not for credit): If the account compounds monthly instead of annually recompute each of the previous values. Pay attention to the computation in (a) as it will differ greatly 4. You have student loans totaling $40.000. The annual interest rate is 12% compounded annually and the loan term is 20 years. (a) What is your monthly payment? (b) In total, how much interest will you have paid? 5. You have $1000 debt on a credit card which has APR 25% annually monthly (a) How much do you need to pay monthly to pay off the debt in 2 years? (b) How much more or less in interest if you pay the debt off in 3 years? 6. You have the option between two mortgages. In either case you need to borrow $200,000, the interest will compound monthly, and you will pay back the debt in 10 years. The first option offers 3% with no closing costs. The second option offers 2.5% with closing costs of $1,000 and 4 points. Which option is better in the long-run? 7. You make an investment which turned $10,000 into $15,800 (a) What is the Total Return? (b) If it took 9 years for the investment to give this return, what is the Annual Return? SOLUTIONS: Note that copying solutions does not count as complete work. You should work through the problems as normal and use these solutions as a reference. Note also that rounding is important and if you make rounding errors in your work they will show in your answer. For that reason, your solution may be slightly different than the ones presented here. Again, do the work, then check it here. (a) $3315.38 (b) $4837.71 (c) $21,608.90 2. (a) $192.50 (b) $41,580.05 (c) $8,419.95 4. (a) $446.26 (b) $67,102.40 5. (a) $53.37 (b) $150.47 more interest paid. 6. The option with 3% and no closing costs. (a) 58% (b) 5.2138%