Answered step by step

Verified Expert Solution

Question

1 Approved Answer

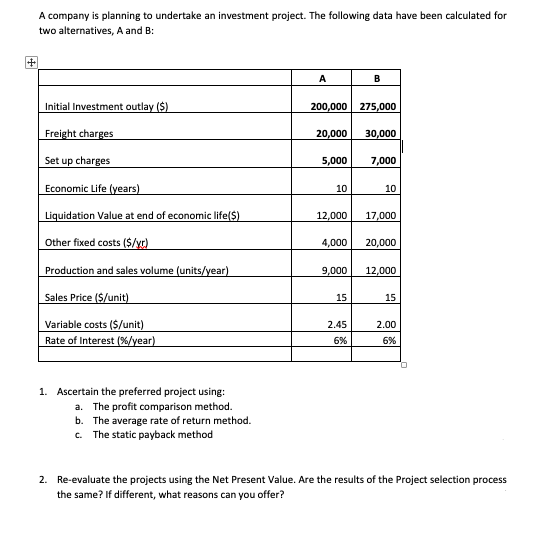

Answer required for QUESTION 2 ONLY. A company is planning to undertake an investment project. The following data have been calculated for two alternatives, A

Answer required for QUESTION 2 ONLY.

A company is planning to undertake an investment project. The following data have been calculated for two alternatives, A and B: + A B Initial Investment outlay ($) 200,000 275,000 20,000 30,000 Freight charges Set up charges 5,000 7,000 10 10 12,000 17,000 4,000 20,000 Economic Life (years) Liquidation Value at end of economic life($) Other fixed costs ($/40) Production and sales volume (units/year) Sales Price ($/unit) Variable costs ($/unit) Rate of Interest (%/year) 9,000 12,000 15 15 2.45 6% 2.00 6% 1. Ascertain the preferred project using: a. The profit comparison method. b. The average rate of return method. c. The static payback method 2. Re-evaluate the projects using the Net Present Value. Are the results of the Project selection process the same? If different, what reasons can you offer? A company is planning to undertake an investment project. The following data have been calculated for two alternatives, A and B: + A B Initial Investment outlay ($) 200,000 275,000 20,000 30,000 Freight charges Set up charges 5,000 7,000 10 10 12,000 17,000 4,000 20,000 Economic Life (years) Liquidation Value at end of economic life($) Other fixed costs ($/40) Production and sales volume (units/year) Sales Price ($/unit) Variable costs ($/unit) Rate of Interest (%/year) 9,000 12,000 15 15 2.45 6% 2.00 6% 1. Ascertain the preferred project using: a. The profit comparison method. b. The average rate of return method. c. The static payback method 2. Re-evaluate the projects using the Net Present Value. Are the results of the Project selection process the same? If different, what reasons can you offerStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started