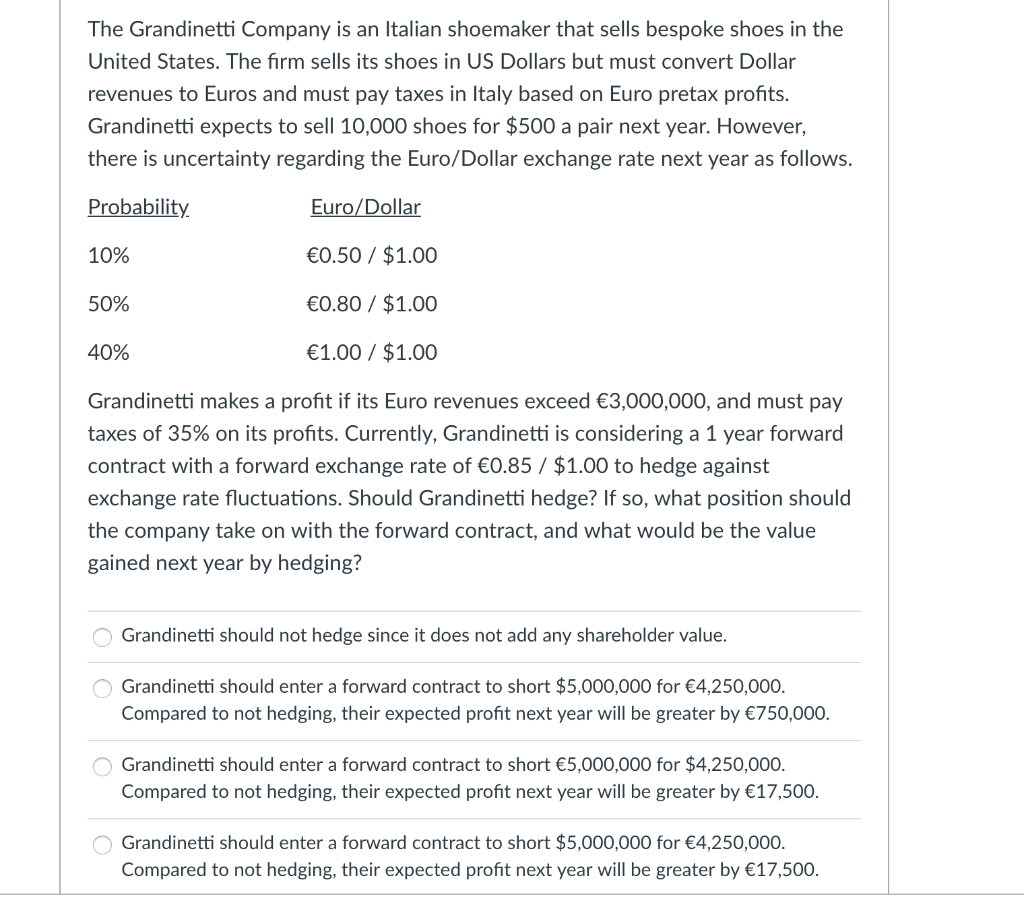

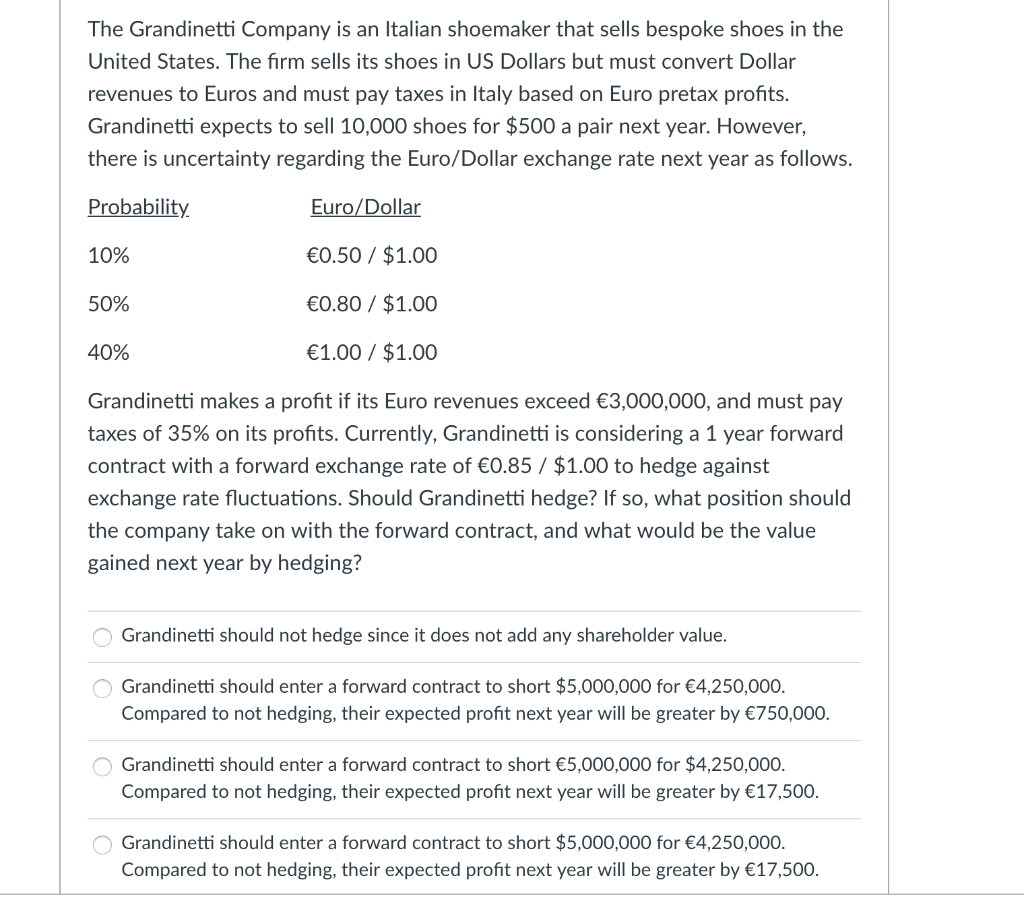

The Grandinetti Company is an Italian shoemaker that sells bespoke shoes in the United States. The firm sells its shoes in US Dollars but must convert Dollar revenues to Euros and must pay taxes in Italy based on Euro pretax profits. Grandinetti expects to sell 10,000 shoes for $500 a pair next year. However, there is uncertainty regarding the Euro/Dollar exchange rate next year as follows. Probability Euro/Dollar 0.50 $1.00 0.80 $1.00 1.00 $1.00 10% 50% 40% Grandinetti makes a profit if its Euro revenues exceed 3,000,000, and must pay taxes of 35% on its profits. Currently, Grandinetti is considering a 1 year forward contract with a forward exchange rate of 0.85 / $1.00 to hedge against exchange rate fluctuations. Should Grandinetti hedge? If so, what position should the company take on with the forward contract, and what would be the value gained next year by hedging? Grandinetti should not hedge since it does not add any shareholder value Grandinetti should enter a forward contract to short $5,000,000 for 4,250,000 Compared to not hedging, their expected profit next year will be greater by 750,000 Grandinetti should enter a forward contract to short 5,000,000 for $4,250,000 Compared to not hedging, their expected profit next year will be greater by 17,500 Grandinetti should enter a forward contract to short $5,000,000 for 4,250,000 Compared to not hedging, their expected profit next year will be greater by 17,500 The Grandinetti Company is an Italian shoemaker that sells bespoke shoes in the United States. The firm sells its shoes in US Dollars but must convert Dollar revenues to Euros and must pay taxes in Italy based on Euro pretax profits. Grandinetti expects to sell 10,000 shoes for $500 a pair next year. However, there is uncertainty regarding the Euro/Dollar exchange rate next year as follows. Probability Euro/Dollar 0.50 $1.00 0.80 $1.00 1.00 $1.00 10% 50% 40% Grandinetti makes a profit if its Euro revenues exceed 3,000,000, and must pay taxes of 35% on its profits. Currently, Grandinetti is considering a 1 year forward contract with a forward exchange rate of 0.85 / $1.00 to hedge against exchange rate fluctuations. Should Grandinetti hedge? If so, what position should the company take on with the forward contract, and what would be the value gained next year by hedging? Grandinetti should not hedge since it does not add any shareholder value Grandinetti should enter a forward contract to short $5,000,000 for 4,250,000 Compared to not hedging, their expected profit next year will be greater by 750,000 Grandinetti should enter a forward contract to short 5,000,000 for $4,250,000 Compared to not hedging, their expected profit next year will be greater by 17,500 Grandinetti should enter a forward contract to short $5,000,000 for 4,250,000 Compared to not hedging, their expected profit next year will be greater by 17,500