Answered step by step

Verified Expert Solution

Question

1 Approved Answer

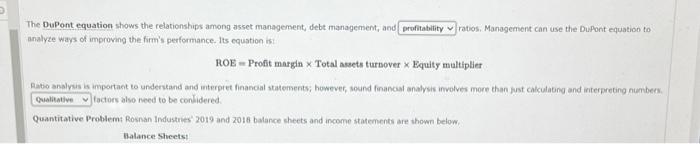

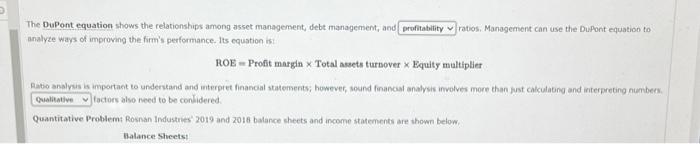

answer The DuPont equation shows the relationships among asset management, debt management, and ratios. Management can use the Du.Pont equation to analyze ways of improving

answer

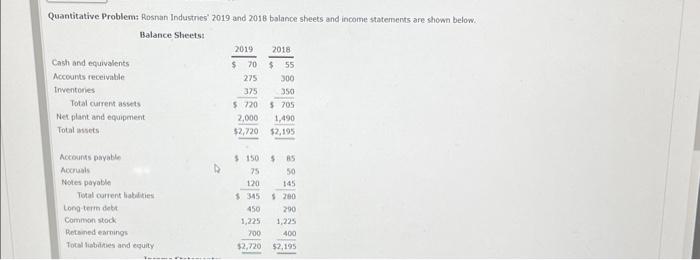

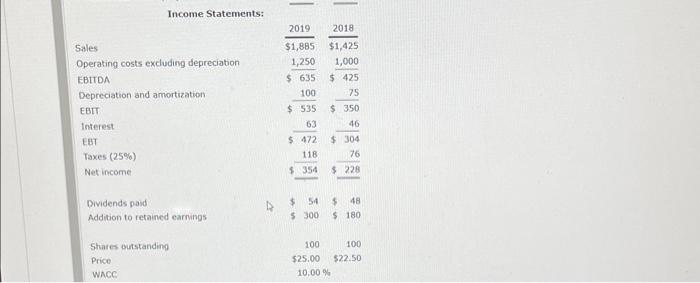

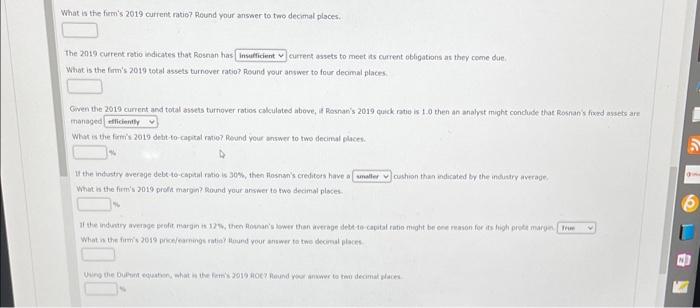

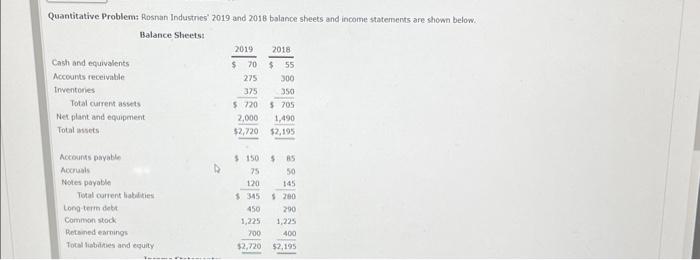

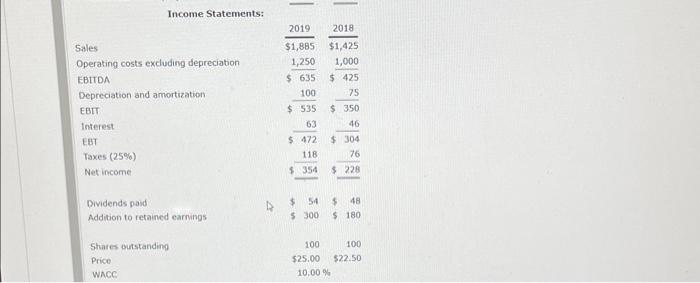

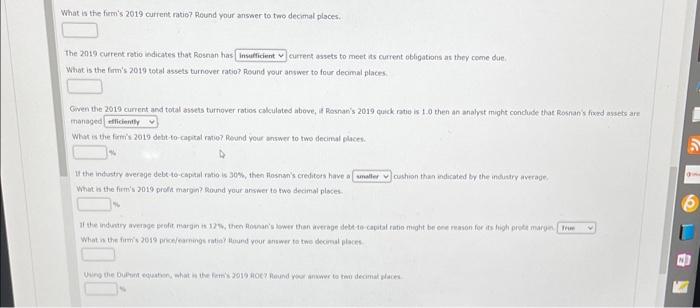

The DuPont equation shows the relationships among asset management, debt management, and ratios. Management can use the Du.Pont equation to analyze ways of improving the firm's performance. Its equation ist ROE = Profit margin Total assets turbover Equity maltiplier Ratio analyeis is important to undervand and interpiet financial statements; however, sound fonancial analvsis involves more than just calculating and interpreting number. lactors also need to be conlidered. Quantitative Problem: Rosnan Industries' 2019 and 2018 balance sheets and income statements are thown below. Balance Sheetst Quantitative Problem: Rosnan Industnes" 2019 and 2018 balance sheets and income statements are shown below. What is the furm's 2019 current ratic? Round your ansaer to two decimal ploces. The 2019 current retio indicates that Rosnan has currers assets to meet its current obligations as they come due, What is the firm's 2019 total assets turnover ratio? Pocund your answer to four decomal places. Gwen the 2019 current and total assets turfipyer ratios calculated above, it Pasnan's 2019 cuick natie is 1.0 then an anahye might conduce that Rosnans fixnd assets are managed What is the formis 2019 detit-to-ragital rate? Round your answer to two decimal places. If the industry werage debt to-capstal ratio is 30%, then flosnan's creditots have a woshion than endicated ty the invuatiry astrage, What is the firm's 2019 profa margin? Round your answer to two decimal places

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started