Answer the following 7 - 13 Intermediate Accounting 1 questions: THANK YOU!

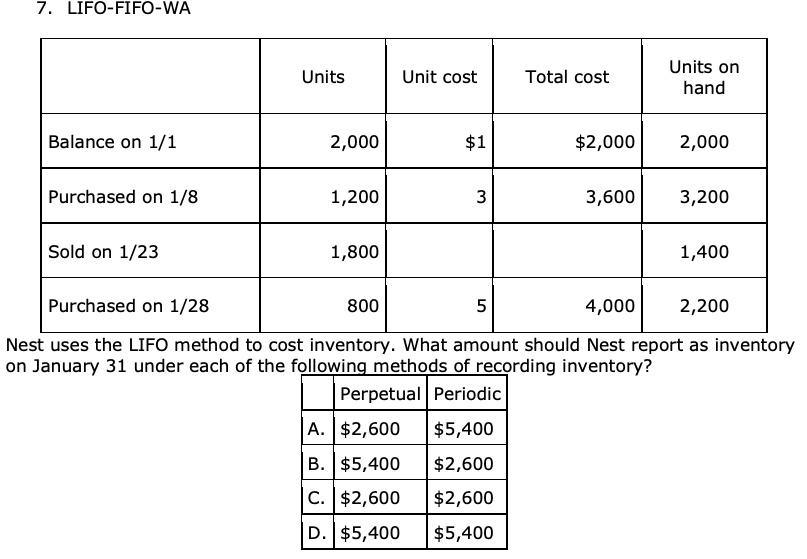

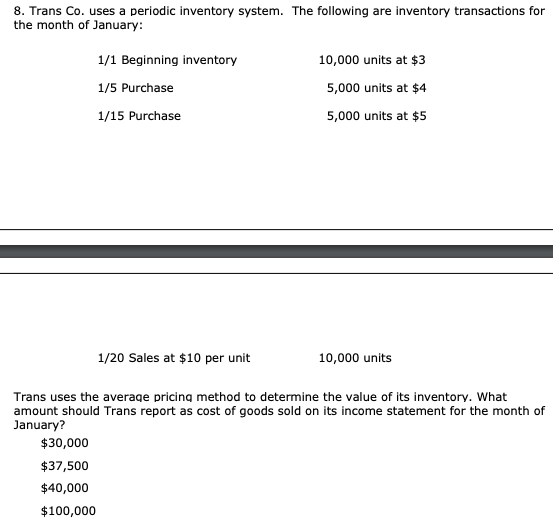

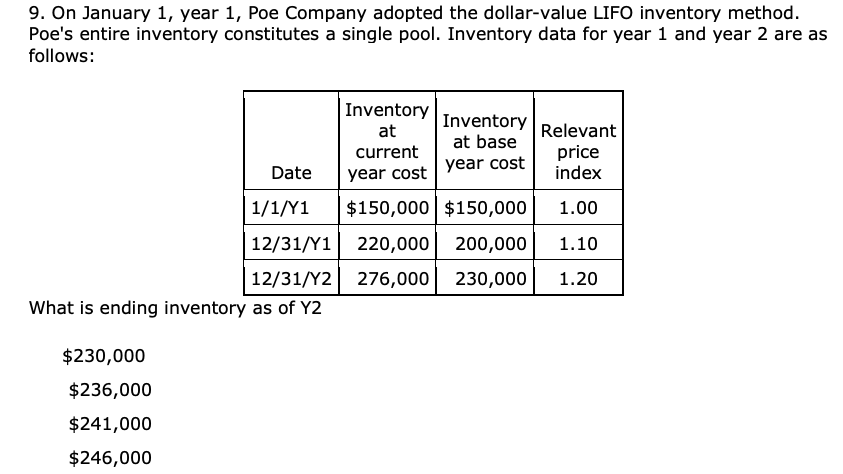

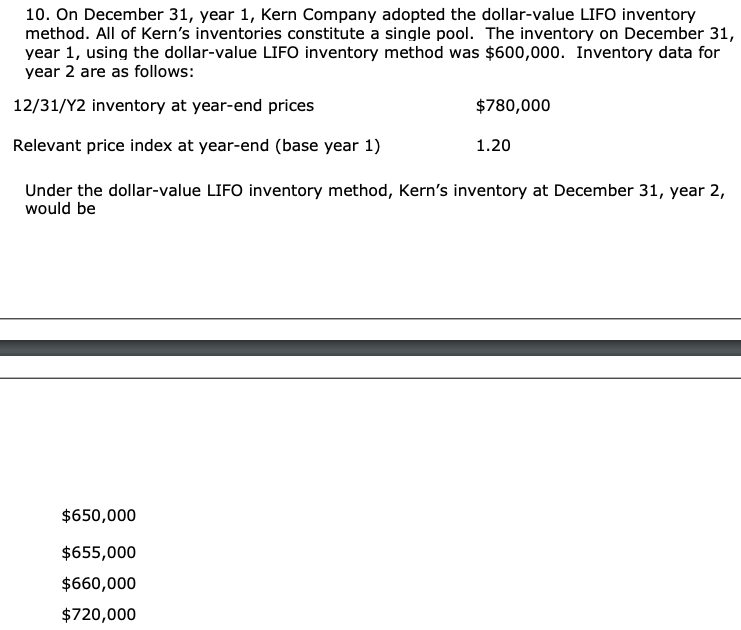

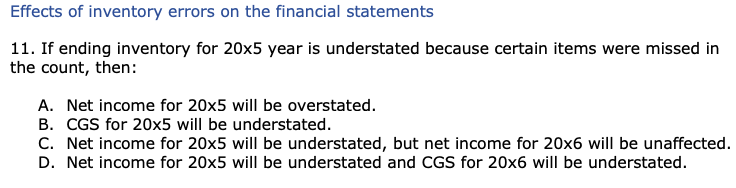

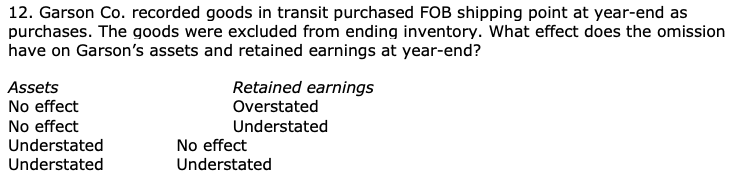

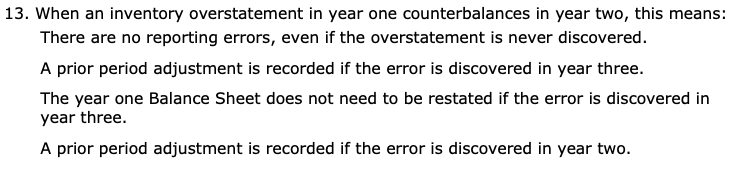

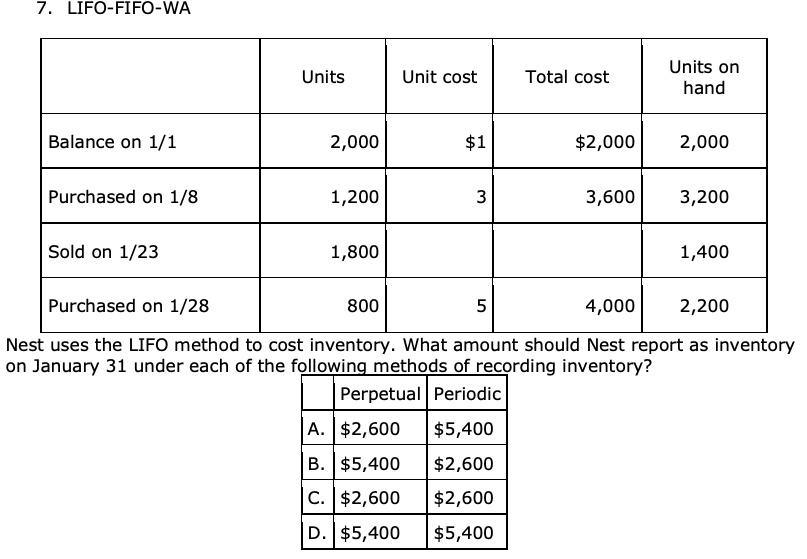

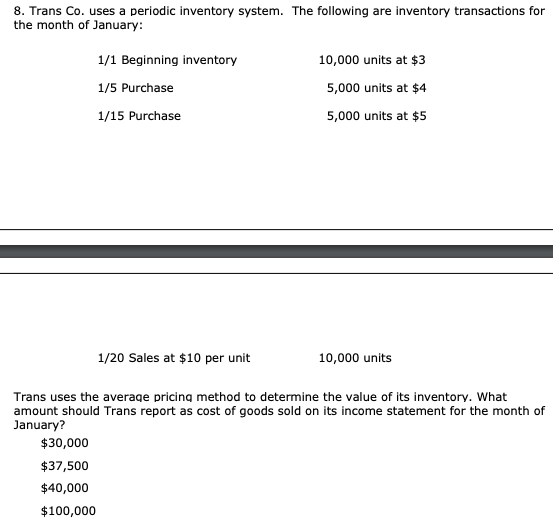

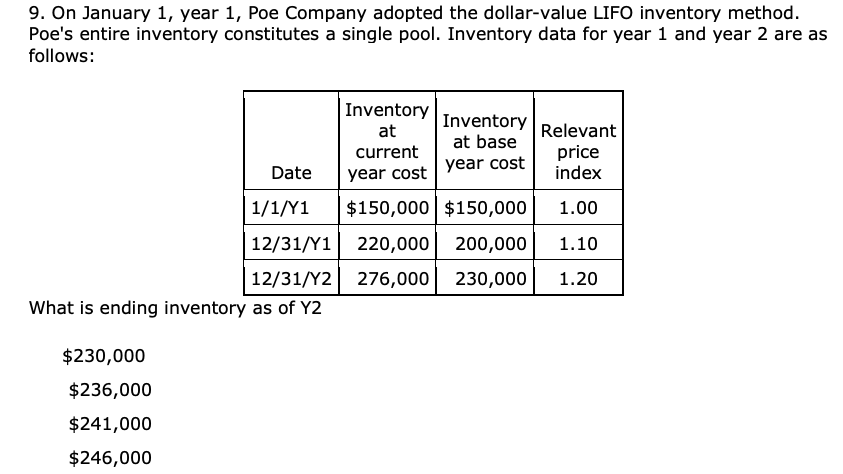

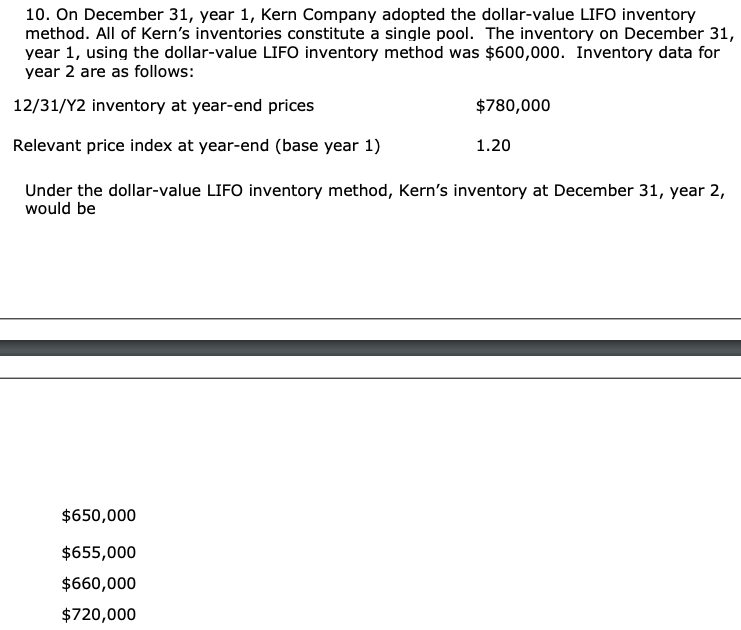

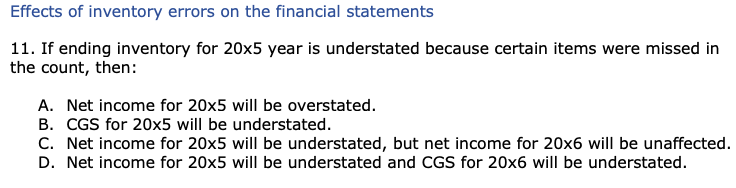

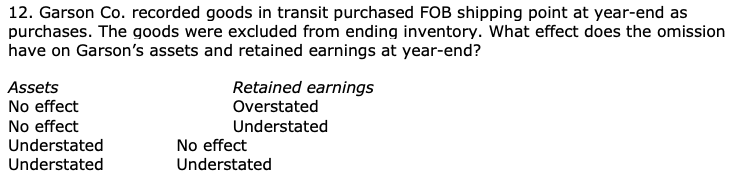

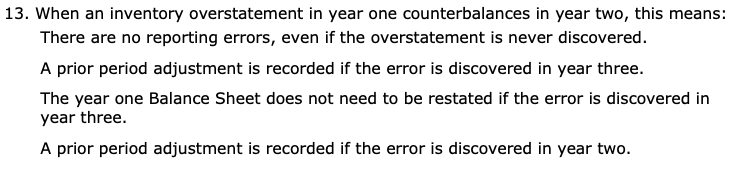

7. LIFO-FIFO-WA Units orn hand Units Unit cost Total cost Balance on 1/1 Purchased on 1/8 Sold on 1/23 Purchased on 1/28 2,000 1,200 1,800 800 $2,0002,000 3,200 1,400 2,200 $1 3,600 5 4,000 Nest uses the LIFO method to cost inventory. What amount should Nest report as inventory on January 31 under each of the following methods of recording inventory? Perpetual Periodic A. $2,600$5,400 B. $5,400 $2,600 C. $2,600 $2,600 D.$5,400 $5,400 8. Trans Co. uses a periodic inventory system. The following are inventory transactions for the month of January: 1/1 Beginning inventory 1/5 Purchase 1/15 Purchase 10,000 units at $3 5,000 units at $4 5,000 units at $5 1/20 Sales at $10 per unit 10,000 units Trans uses the average pricing method to determine the value of its inventory. What amount should Trans report as cost of goods sold on its income statement for the month of January? $30,000 $37,500 $40,000 $100,000 9. On January 1, year 1, Poe Company adopted the dollar-value LIFO inventory method. Poe's entire inventory constitutes a single pool. Inventory data for year 1 and year 2 are as follows: Inventory Inventory Relevant at base year cost at current price Date year cost index 1/1/Y1$150,000 $150,0001.00 12/31/Y1220,000 200,0001.10 12/31/Y2 276,000 230,0001.20 What is ending inventory as of Y2 $230,000 $236,000 $241,000 $246,000 10. On December 31, year 1, Kern Company adopted the dollar-value LIFO inventory method. All of Kern's inventories constitute a single pool. The inventory on December 31, year 1, using the dollar-value LIFO inventory method was $600,000. Inventory data for year 2 are as follows: 12/31/Y2 inventory at year-end price:s $780,000 Relevant price index at year-end (base year 1) 1.20 Under the dollar-value LIFO inventory method, Kern's inventory at December 31, year 2, would be $650,000 $655,000 $660,000 $720,000 Effects of inventory errors on the financial statements 11. If ending inventory for 20x5 year is understated because certain items were missed in the count, then A. Net income for 20x5 will be overstated B. CGS for 20x5 will be understated C. Net income for 20x5 will be understated, but net income for 20x6 will be unaffected. D. Net income for 20x5 will be understated and CGS for 20x6 will be understated 12. Garson Co. recorded goods in transit purchased FOB shipping point at year-end as purchases. The goods were excluded from ending inventory. What effect does the omission have on Garson's assets and retained earnings at year-end? Assets No effect No effect Understated Understated Retained earnings Overstated Understated No effect Understated 13. When an inventory overstatement in year one counterbalances in year two, this means: There are no reporting errors, even if the overstatement is never di A prior period adjustment is recorded if the error is discovered in year three. The year one Balance Sheet does not need to be restated if the error is discovered in year three. A prior period adjustment is recorded if the error is discovered in year two