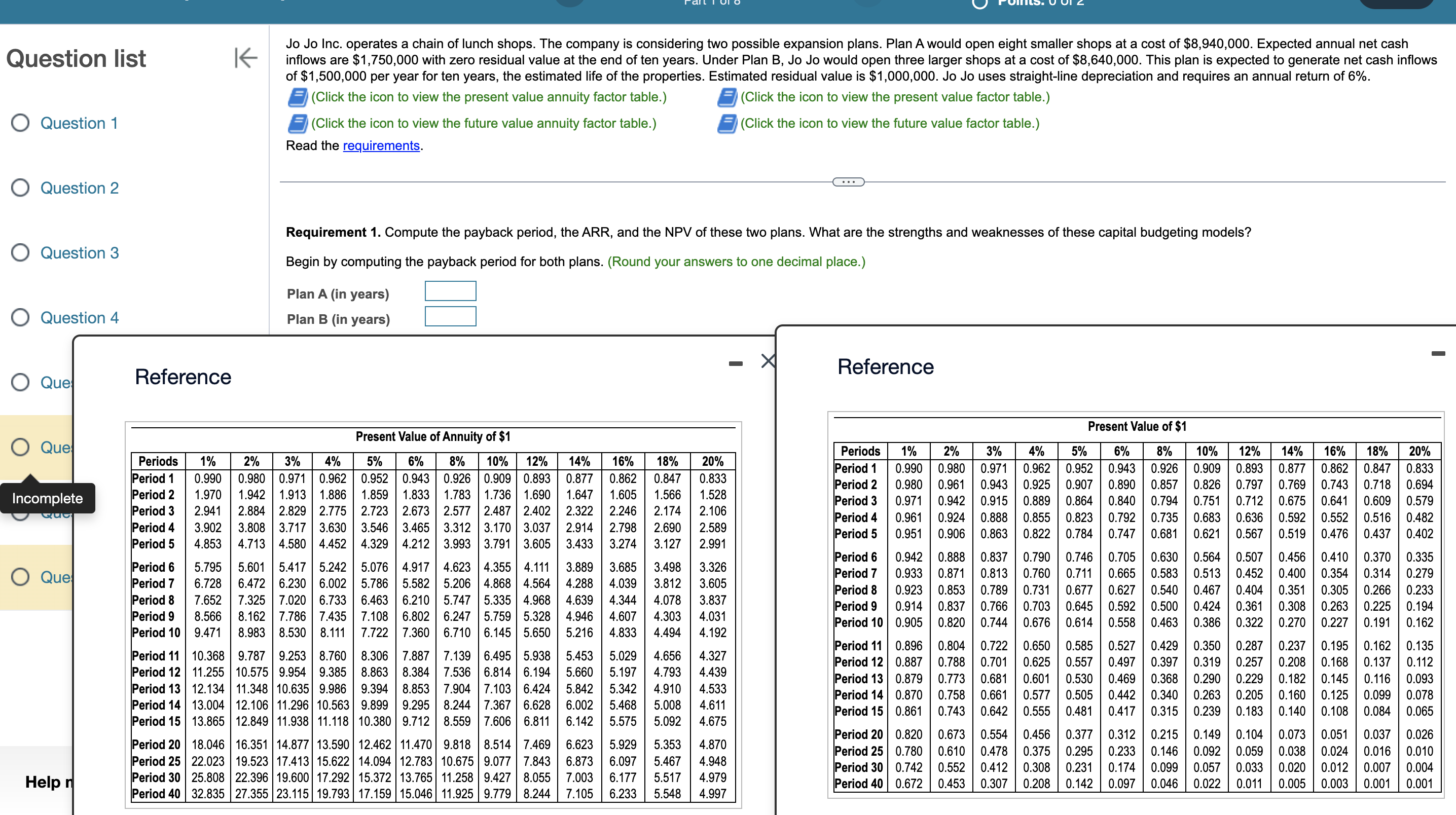

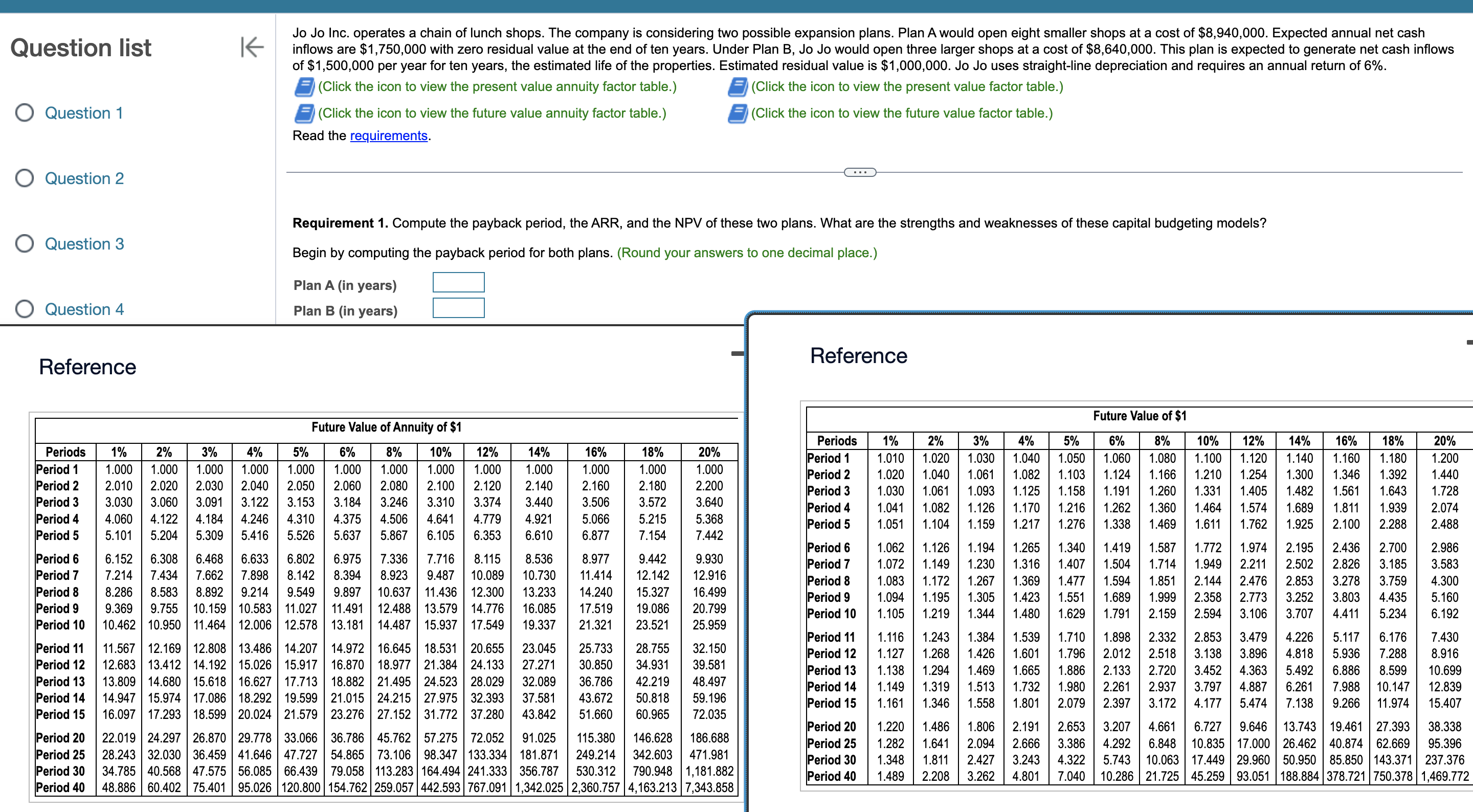

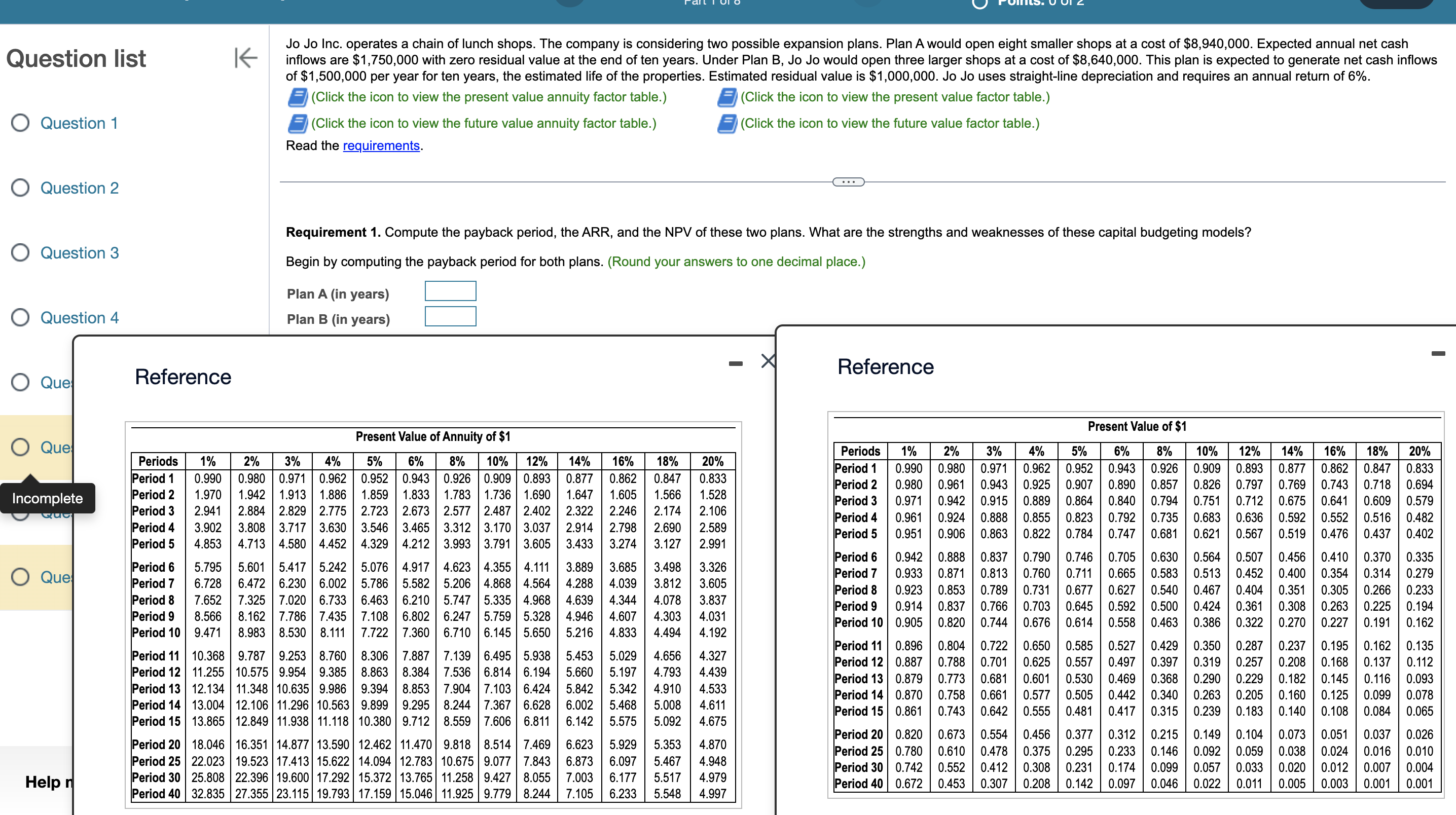

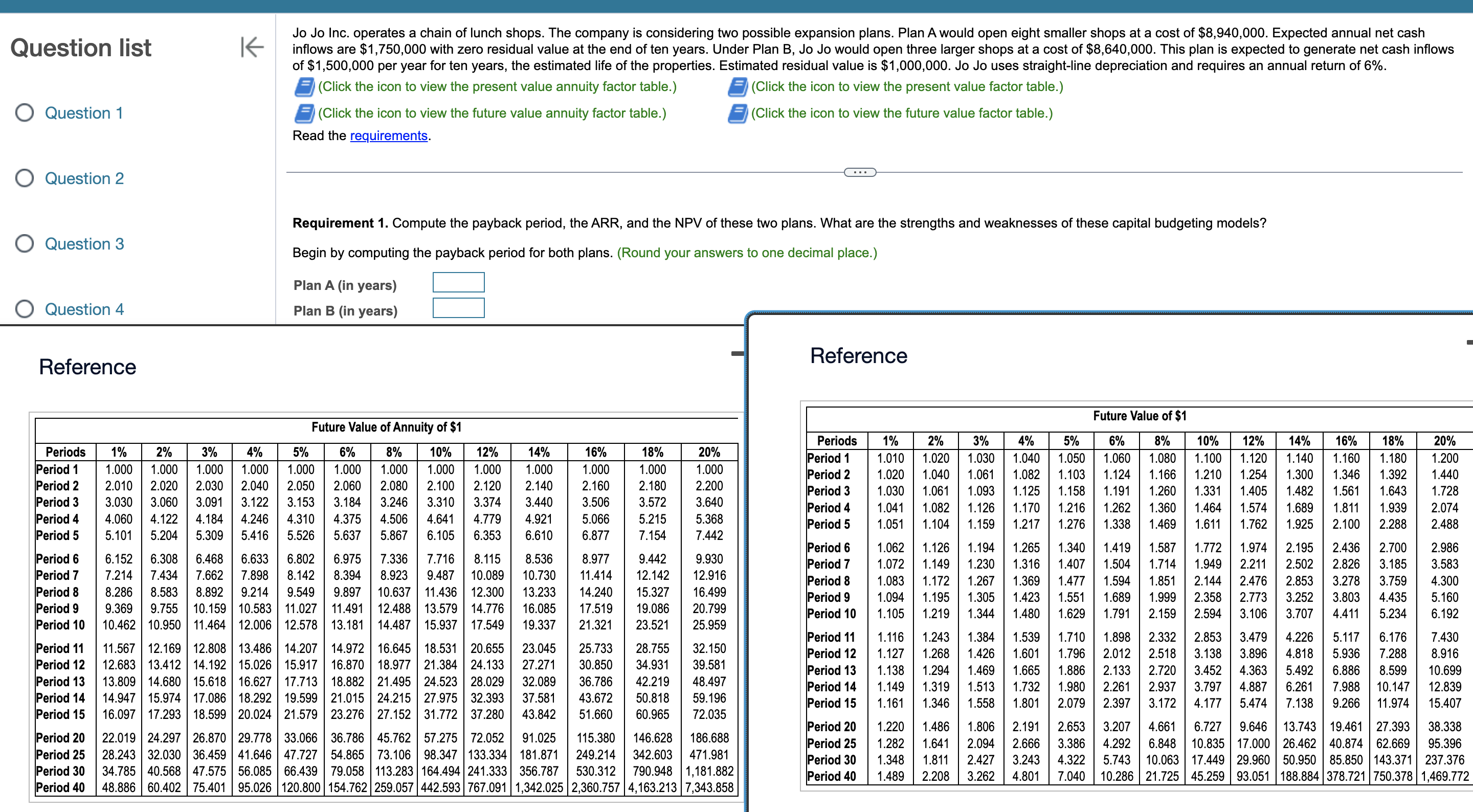

Jo Jo Inc. operates a chain of lunch shops. The company is considering two possible expansion plans. Plan A would open eight smaller shops at a cost of $8,940,000. Expected annual net cash Question list K inflows are $1,750,000 with zero residual value at the end of ten years. Under Plan B, Jo Jo would open three larger shops at a cost of $8,640,000. This plan is expected to generate net cash inflows of $1,500,000 per year for ten years, the estimated life of the properties. Estimated residual value is $1,000,000. Jo Jo uses straight-line depreciation and requires an annual return of 6%. (Click the icon to view the present value annuity factor table (Click the icon to view the present value factor table.) Question 1 (Click the icon to view the future value annuity factor table.) (Click the icon to view the future value factor table.) Read the Question 2 Requirement 1. Compute the payback period, the ARR, and the NPV of these two plans. What are the strengths and weaknesses of these capital budgeting models? Question 3 Begin by computing the payback period for both plans. (Round your answers to one decimal place.) Plan A (in years) Question 4 Plan B (in years) Reference Que Reference Question list Jo Jo Inc. operates a chain of lunch shops. The company is considering two possible expansion plans. Plan A would open eight smaller shops at a cost of $8,940,000. Expected annual net cash inflows are $1,750,000 with zero residual value at the end of ten years. Under Plan B, Jo Jo would open three larger shops at a cost of $8,640,000. This plan is expected to generate net cash inflows of $1,500,000 per year for ten years, the estimated life of the properties. Estimated residual value is $1,000,000. Jo Jo uses straight-line depreciation and requires an annual return of 6%. (Click the icon to view the present value annuity factor table.) (Click the icon to view the present value factor table.) Question 1 (Click the icon to view the future value annuity factor table.) (Click the icon to view the future value factor table.) Read the Question 2 Question 3 Begin by computing the payback period for both plans. (Round your answers to one decimal place.) Plan A (in years)