Answer the following questions using the link to the excel sheet. Pictures also attached below:

https://docs.google.com/spreadsheets/d/1L3f_-K8XpR3xPIoabw1u62IC5y8dBFK-/edit?usp=sharing&ouid=109841440177232783905&rtpof=true&sd=true

1. Present-value calculations, rather than future-value calculations, are the key to analysis in the field of corporate finance. Why is this the case? Explain the importance for Largo Global Inc. (LGI) of understanding today's value of projected future revenues and/or costs.

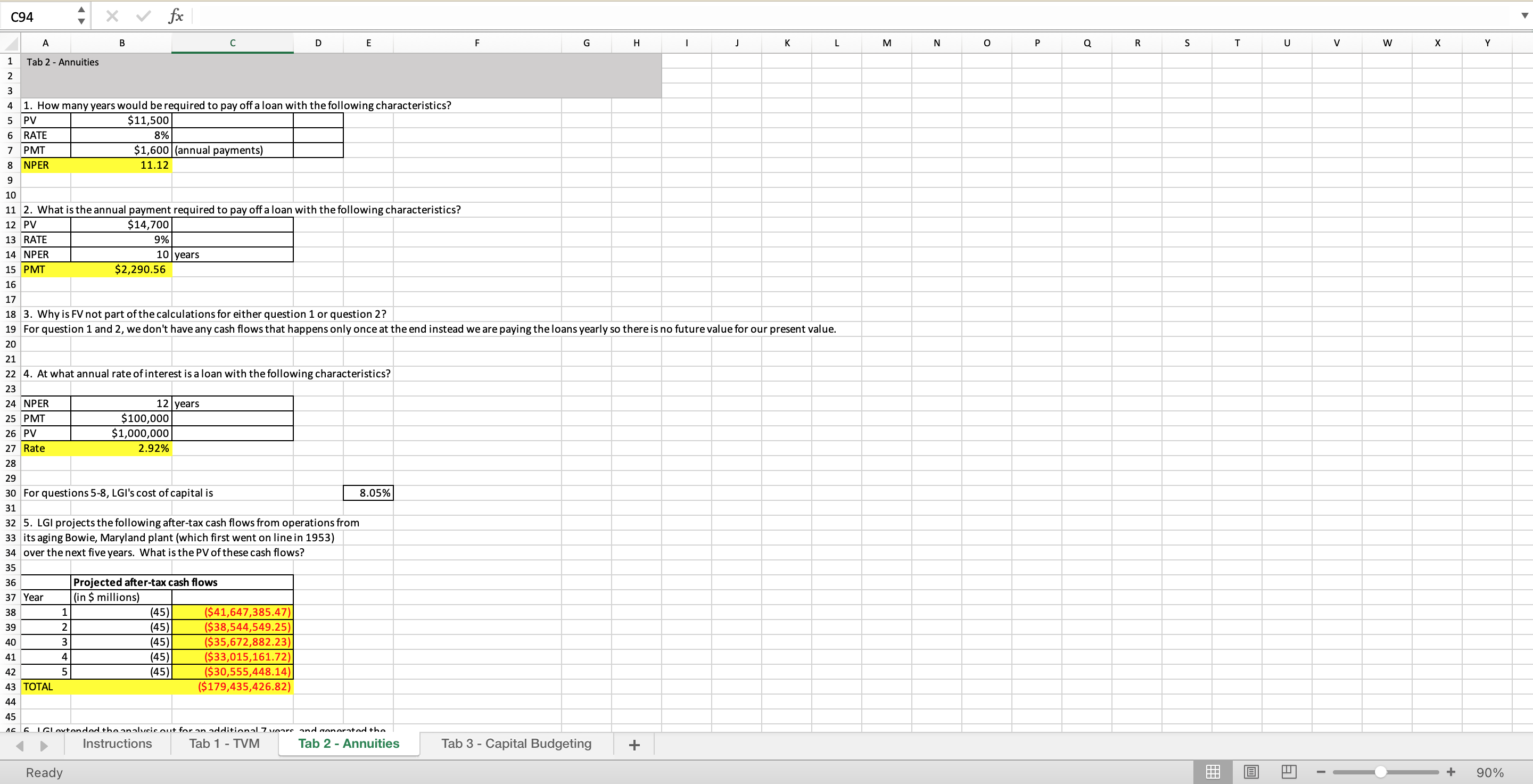

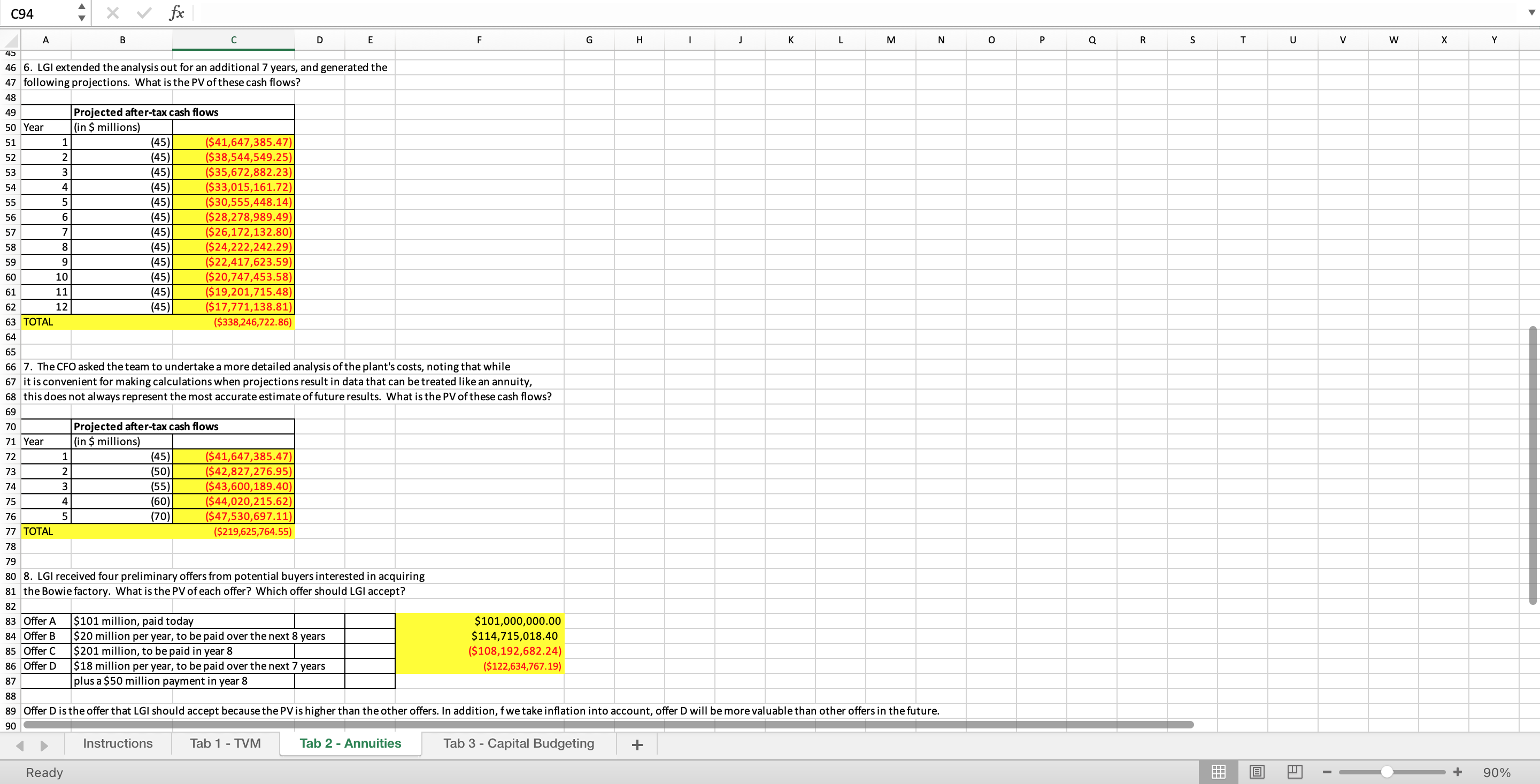

2. Based on your calculations in Tab 2, Question 8, which offer should LGI accept for the Bowie plant? Explain why. Be sure to include the concepts of risk and potential return as part of your discussion.

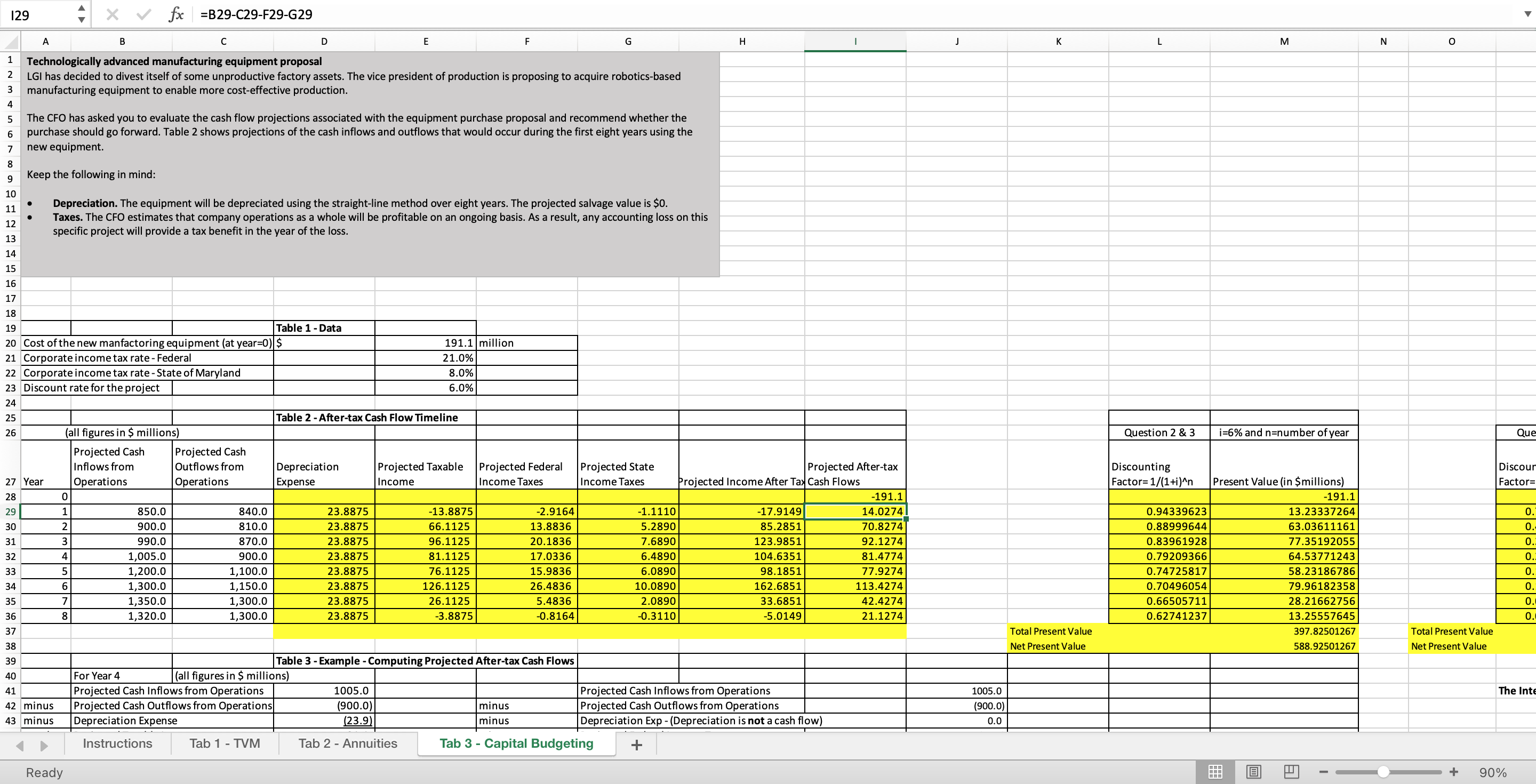

3. The proposed sale of the Bowie plant is part of the effort to divest the company of underperforming assets. A total of $1.2 billion in assets, with a book value of $650 million, have been identified for potential sale. Assuming that all these sales could be accomplished in 2021, identify the major impacts on the following:

a. Balance Sheet, especially these accounts:

- ? Property, plant, and equipment

- ? Accumulated depreciation

- ? Net property, plant, and equipment

b. Statement of Cash Flows, especially the Long-Term Investing Activities

c. Income Statement

Explain the potential impacts, both positive and negative, of these changes for LGI.

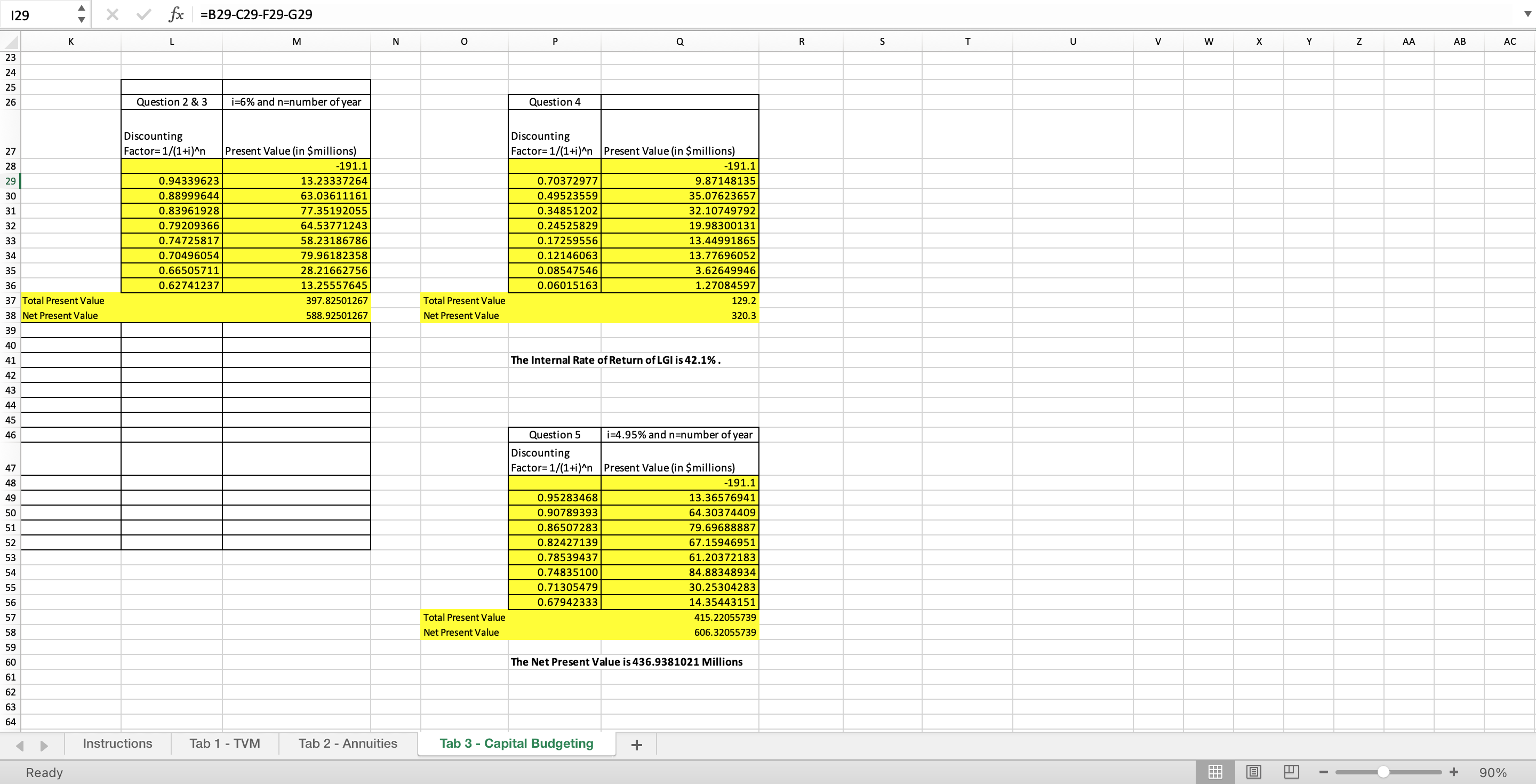

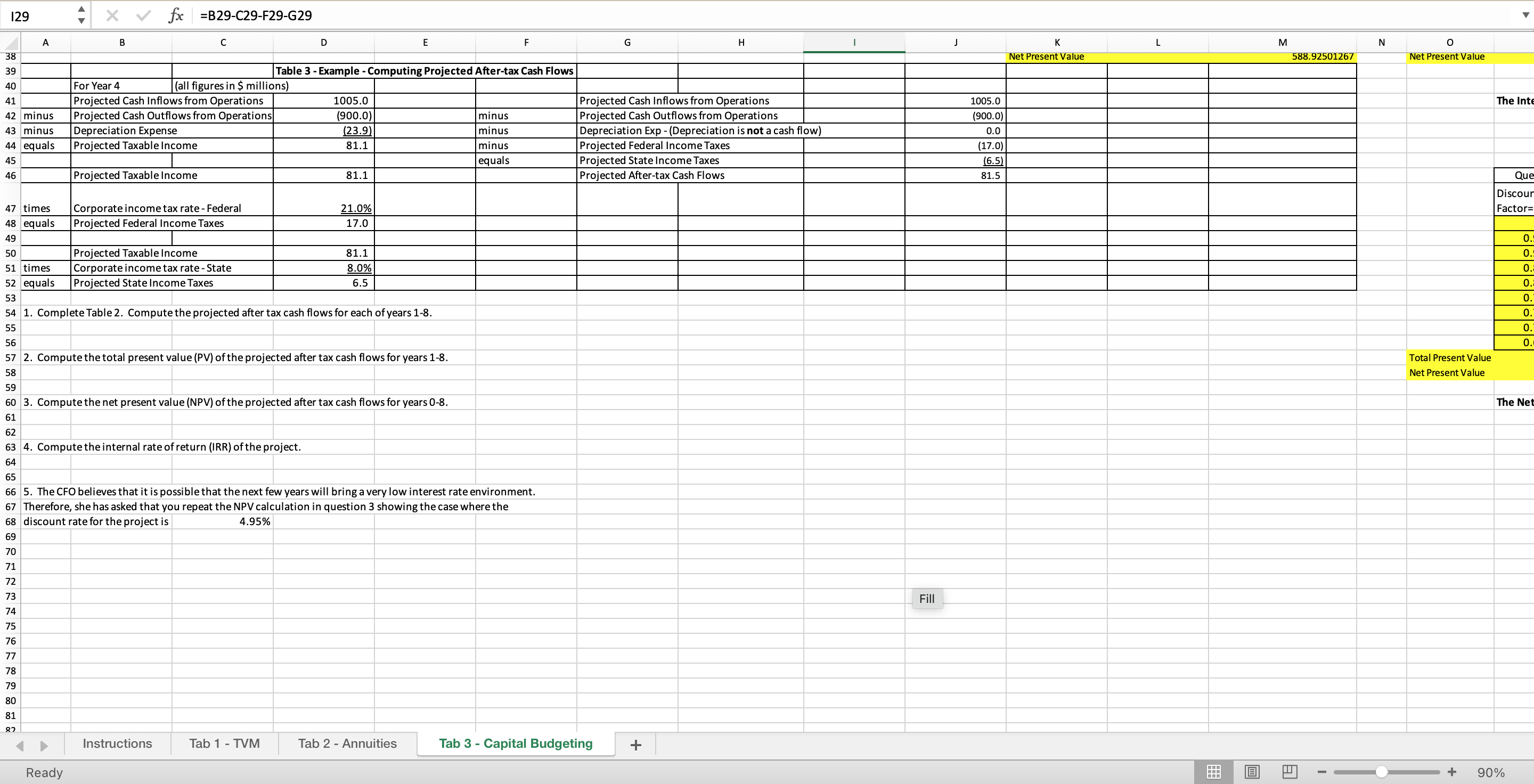

4. Based on your calculations in Tab 3, Questions 1-4, should LGI proceed with the acquisition of the robotics-based manufacturing equipment? Explain your reasoning. How would the acquisition fit into the efforts to turn the company around?

5. In Tab 3, Question 5, did the change in the discount rate make proceeding with the purchase more or less desirable? What do you conclude from this result? Discuss the role of discount rates in LGI's decision-making processes.

94 4 X V fx A B C D E F G H J K L M N P Q R S T U V w X Y Tab 2 - Annuities 4 1. How many years would be required to pay off a loan with the following characteristics? 5 PV $11,500 6 RATE 8% 7 PM $1,600 (annual payments 8 NPER 11.12 10 11 2. What is the annual payment required to pay off a loan with the following characteristics? 12 PV $14,700 13 RATE 9% 14 NPER 10 years 15 PMT $2,290.56 16 17 18 3. Why is FV not part of the calculations for either question 1 or question 2? 19 For question 1 and 2, we don't have any cash flows that happens only once at the end instead we are paying the loans yearly so there is no future value for our present value. 20 21 22 4. At what annual rate of interest is a loan with the following characteristics? 23 24 NPER 12 years 25 PM $100,000 26 PV $1,000,000 27 Rate 2.92% 28 29 30 For questions 5-8, LGI's cost of capital is 8.05% 31 32 5. LGI projects the following after-tax cash flows from operations from 33 its aging Bowie, Maryland plant (which first went on line in 1953) 34 over the next five years. What is the PV of these cash flows? 35 36 Projected after-tax cash flows 37 Yea (in $ millions) 38 (45) ($41,647,385.47) 39 (45) $38,544,549.25) 40 (45) $35,672,882.23) 41 UT D W I (45) $33,015,161.72) 42 (45) ($30,555,448.14) 43 TOTAL ($179,435,426.82) 44 45 AC 6 1 Glautended the analveis out for an additional 7 weare and manarated the Instructions Tab 1 - TVM Tab 2 - Annuities Tab 3 - Capital Budgeting + Ready " - + 90%C94 X V fx C D E F G H J K L M N O P Q R S T U V W X 45 46 6. LGI extended the analysis out for an additional 7 years, and generated the 47 following projections. What is the PV of these cash flows? 48 49 Projected after-tax cash flows 50 Year (in $ millions 51 (45) ($41,647,385.47) 52 ( 45 ) ($38,544,549.25) ( 45 ) ($35,672,882.23) (45) ($33,015,161.72) (45) ($30,555,448.14) (45) ($28,278,989.49) (45) ($26,172,132.80) (45) ($24,222,242.29) (45) ($22,417,623.59) ( 45 ) ($20,747,453.58) (45) ($19,201,715.48) (45) ($17,771,138.81) 63 ($338,246,722.86) 64 65 66 7. The CFO asked the team to undertake a more detailed analysis of the plant's costs, noting that while 67 it is convenient for making calculations when projections result in data that can be treated like an annuity, 68 this does not always represent the most accurate estimate of future results. What is the PV of these cash flows? 69 70 |Projected after-tax cash flows 71 Year (in $ millions) 72 (45) ($41,647,385.47) 73 (50) ($42,827,276.95) 74 W I (55) ($43,600,189.40) 75 (60 ) ($44,020,215.62) 76 (70) ($47,530,697.11) 77 TOTAL ($219,625,764.55) 78 79 80 8. LGI received four preliminary offers from potential buyers interested in acquiring 81 the Bowie factory. What is the PV of each offer? Which offer should LGI accept? 82 83 Offer A $101 million, paid today $101,000,000.00 84 Offer B $20 million per year, to be paid over the next 8 years $114,715,018.40 85 Offer C $201 million, to be paid in year 8 ($108,192,682.24) 86 Offer D $18 million per year, to be paid over the next 7 years ($122,634,767.19) 87 plus a $50 million payment in year 8 88 89 Offer D is the offer that LGI should accept because the PV is higher than the other offers. In addition, fwe take inflation into account, offer D will be more valuable than other offers in the future. 90 Instructions Tab 1 - TVM Tab 2 - Annuities Tab 3 - Capital Budgeting + Ready - + 90%129 X V fx =B29-C29-F29-G29 A B C D E F G H I J K L M N 0 Technologically advanced manufacturing equipment proposal LGI has decided to divest itself of some unproductive factory assets. The vice president of production is proposing to acquire robotics-based manufacturing equipment to enable more cost-effective production. The CFO has asked you to evaluate the cash flow projections associated with the equipment purchase proposal and recommend whether the purchase should go forward. Table 2 shows projections of the cash inflows and outflows that would occur during the first eight years using the new equipment. Keep the following in mind: 10 11 Depreciation. The equipment will be depreciated using the straight-line method over eight years. The projected salvage value is $0. 12 axes. The CFO estimates that company operations as a whole will be profitable on an ongoing basis. As a result, any accounting loss on this 13 specific project will provide a tax benefit in the year of the loss. 14 15 16 17 18 19 Table 1 - Data 20 Cost of the new manfactoring equipment (at year=0) $ 191.1 million 21 Corporate income tax rate - Federal 21.0% 22 Corporate income tax rate - State of Maryland 3.0% 23 Discount rate for the project 5.0% 24 25 Table 2 - After-tax Cash Flow Timeline 26 all figures in $ millions) Question 2 & 3 i=6% and n=number of year Qu Projected Cash Projected Cash nflows from Outflows from Depreciation Projected Taxable Projected Federal Projected State Projected After-tax Discounting Discour 27 Year Operations Operations Expense Income Income Taxes Income Taxes Projected Income After Tax Cash Flows Factor= 1/(1+i)^n Present Value (in $millions) Factor= 28 191.1 -191.1 29 850.0 840.0 23.8875 13.8875 -2.9164 1.1110 17.9149 14.0274 0.94339623 13.23337264 0. 900.0 810.0 23.8875 66.1125 13.8836 5.2890 85.2851 70.8274 0.88999644 63.03611161 990.0 870.0 23.8875 96.1125 20.1836 .6890 123.9851 92.1274 0.83961928 77.35192055 YOUI A W N + 32 1,005.0 900.0 23.8875 81.1125 17.0336 6.4890 104.6351 31.4774 0.79209366 $4.53771243 33 1,200.0 1,100.0 23.8875 76.1125 15.9836 6.0890 98.1851 77.9274 0.74725817 58.23186786 34 1,300.0 1,150.0 23.8875 126.1125 26.4836 10.0890 62.6851 113.4274 0.70496054 79.96182358 35 1,350.0 1,300.0 23.8875 26.1125 5.4836 2.0890 33.6851 42.4274 0.66505711 28.21662756 36 8 1,320.0 1,300.0 23.8875 -3.8875 0.8164 0.3110 -5.0149 21.1274 0.62741237 13.25557645 37 Total Present Value 97.82501267 Total Present Value 38 Net Present Value 588.92501267 Net Present Value 39 Table 3 - Example - Computing Projected After-tax Cash Flows 40 For Year 4 (all figures in $ millions 41 Projected Cash Inflows from Operations 1005.0 Projected Cash Inflows from Operations 1005.0 The Int 42 minus Projected Cash Outflows from Operations 900.0) minu Projected Cash Outflows from Operations 900.0 43 minus Depreciation Expense (23.9 minus Depreciation Exp - (Depreciation is not a cash flow) 0.0 Instructions Tab 1 - TVM Tab 2 - Annuities Tab 3 - Capital Budgeting + Ready + 90%129 X V fx =B29-C29-F29-G29 K L M N O P Q R S T U V W X Y Z AA AB AC 23 24 25 26 Question 2 & 3 i=6% and n=number of year Question 4 Discounting Discounting 27 Factor= 1/(1+i)^n Present Value (in $millions) Factor= 1/(1+i)^n Present Value (in $millions) 28 -191.1 -191.1 29 0.94339623 13.23337264 0.70372977 9.87148135 30 0.88999644 53.03611161 .49523559 35.07623657 31 0.83961928 77.35192055 0.34851202 32.10749792 32 0.79209366 4.53771243 .24525829 9.98300131 33 0.74725817 58.23186786 0.17259556 13.44991865 34 0.70496054 79.96182358 0.12146063 13.77696052 35 0.66505711 28.21662756 0.08547546 3.62649946 36 0.62741237 13.25557645 0.06015163 1.27084597 37 Total Present Value 397.82501267 Total Present Value 129.2 38 Net Present Value 588.92501267 Net Present Value 320.3 39 40 41 The Internal Rate of Return of LGI is 42.1% . 42 43 44 45 46 Question 5 i=4.95% and n=number of year Discounting Factor= 1/(1+i)^n Present Value (in $millions) -191.1 0.95283468 13.36576941 0.90789393 64.30374409 .86507283 79.69688887 .82427139 67.15946951 0.78539437 61.20372183 0.74835100 84.88348934 0.71305479 30.25304283 0.67942333 4.35443151 Total Present Value 415.22055739 Net Present Value 606.32055739 The Net Present Value is 436.9381021 Millions D Instructions Tab 1 - TVM Tab 2 - Annuities Tab 3 - Capital Budgeting + Ready - + 90%129 X V fx =B29-C29-F29-G29 A B D E F G H J K L M N O 38 Net Present Value 588.92501267 Net Present Value 39 Table 3 - Example - Computing Projected After-tax Cash Flows 40 For Year 4 (all figures in $ millions 41 Projected Cash Inflows from Operations 1005.0 Projected Cash Inflows from Operations 1005.0 The Int 42 minus Projected Cash Outflows from Operations 900.0) minus Projected Cash Outflows from Operations (900.0) 43 minus Depreciation Expense (23.9 minus Depreciation Exp - (Depreciation is not a cash flow) 0.0 44 equals Projected Taxable Income 81.1 minus Projected Federal Income Taxes 17.0) 45 equals Projected State Income Taxes (6.5) 46 Projected Taxable Income 81.1 Projected After-tax Cash Flows 81.5 Qu Discou 47 times Corporate income tax rate - Federal 21.0% Factor= 48 equals Projected Federal Income Taxes 17.0 49 0. 50 Projected Taxable Income 81.1 51 times Corporate income tax rate - State 8.0% 52 equals Projected State Income Taxes 5.5 53 54 1. Complete Table 2. Compute the projected after tax cash flows for each of years 1-8. 55 56 57 2. Compute the total present value (PV) of the projected after tax cash flows for years 1-8. Total Present Value 58 Net Present Value 59 60 3. Compute the net present value (NPV) of the projected after tax cash flows for years 0-8. The Net 61 62 63 4. Compute the internal rate of return (IRR) of the project. 64 65 66 5. The CFO believes that it is possible that the next few years will bring a very low interest rate environment. 67 Therefore, she has asked that you repeat the NPV calculation in question 3 showing the case where the 68 discount rate for the project is 4.95% 69 70 71 72 73 Fill 74 75 76 77 78 79 81 D Instructions Tab 1 - TVM Tab 2 - Annuities Tab 3 - Capital Budgeting + Ready - + 90%