Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer the problem no Q1(I) Answer the Assignment Protected View Saved to this PC- O Scarch ASM SAKIBUR RAHMAN SHUVO AS File Home Insert Design

Answer the problem no Q1(I)

Answer the

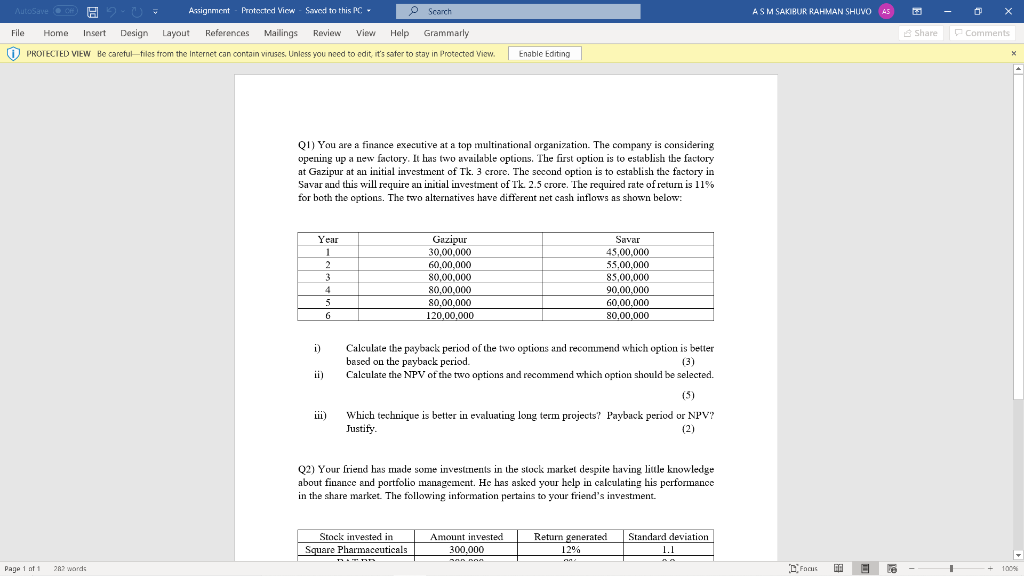

Assignment Protected View Saved to this PC- O Scarch ASM SAKIBUR RAHMAN SHUVO AS File Home Insert Design Layout References Mailings Review View Help Grammarly Share Comments PROTECTED VIEW Be careful-files from the Internet can contain viruses. Unless you need to edit, it's sater to stay in Protected View Enable Editing QI) You are a finance executive at a top multinational organization. The company is considering opening up a new factory. It has two available options. The first option is to establish the factory at Gazipur at an initial investment of Tk. 3 crore. The second option is to establish the factory in Savar and this will require an initial investment of Tk 2.5 crore. The required rate of return is 11% for both the options. The two alternatives have different net cash inflows as shown below: Year 1 2 3 4 5 Gazipur 30,00.000 60,00.000 80,00.000 80,00.000 80,00.000 120,00.000 Savar 45,00,000 55,00,000 85,00.000 90.00.000 60.00,000 80,00.000 i) Calculate the payback period of the two options and reconumend which option is better based on the payback period. (3) Calculate the NPV of the two options and recommend which option should be selected. (5) Which technique is better in evaluating long term projects? Payback period or NPV? Justity. (2) LLL Q2) Your friend has made some investimients in the stock market despite having little knowledge about finance and portfolio management. He has asked your help in calculating his performance in the share market. The following information pertains to your friend's investment. Stock invested in Square Pharmaceuticals Amount invested 300,000 RANG Return generated 12% Standard deviation 1.1 Page 1 of 1 282 words DF G El TE 1 1004Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started