Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answers please 8. If portfolio weights are positive: 1) Can the return on a portiolio aver be less than the small return on an individual

answers please

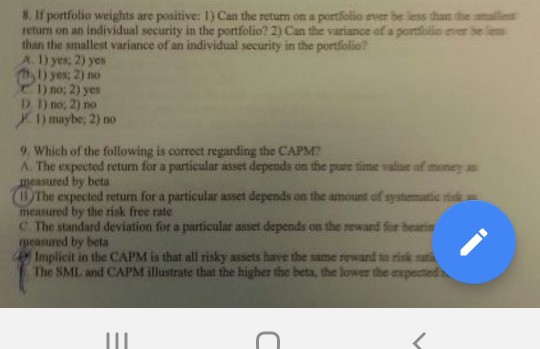

8. If portfolio weights are positive: 1) Can the return on a portiolio aver be less than the small return on an individual security in the portfolio? 2) Can the variance of a portfolio er be less than the smallest variance of an individual security in the portfolio? A 1) yes; 2) yes I) yes; 2) no 1) no; 2) yers D, 1) no; 2) no 1) maybe; 2) no 9 Which of the following is correct reganding the CAPM? A The expected return for a particular asset depends on the pure time value of money as asured by beta The expected return for a particular asset depends on the amount afsystematemi measured by the risk free rate C The standard deviation for a particular asset depends on the rewand for bearin easured by beta Implicit in the CAPM is that all risky assets have the same rewand to risk The SML and CAPM illustrate that the higher the beta, the lower theStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started