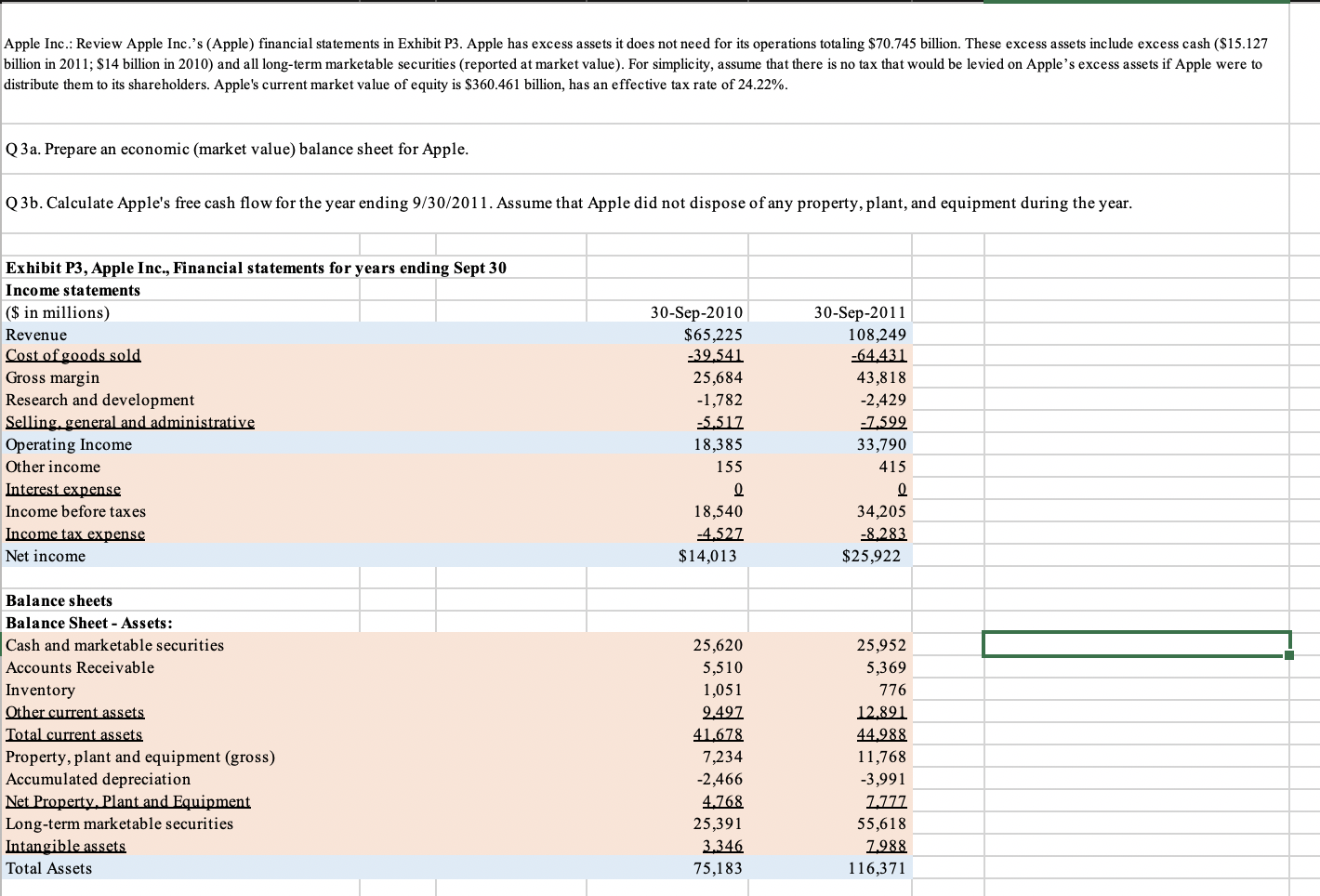

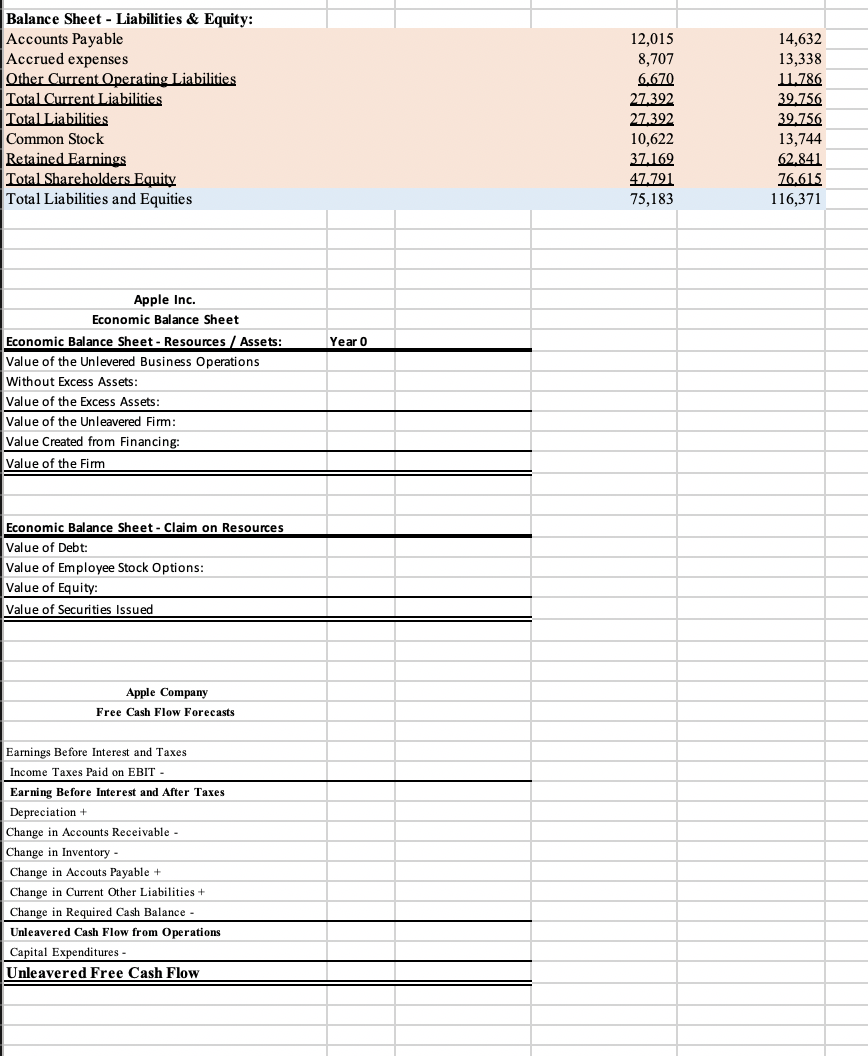

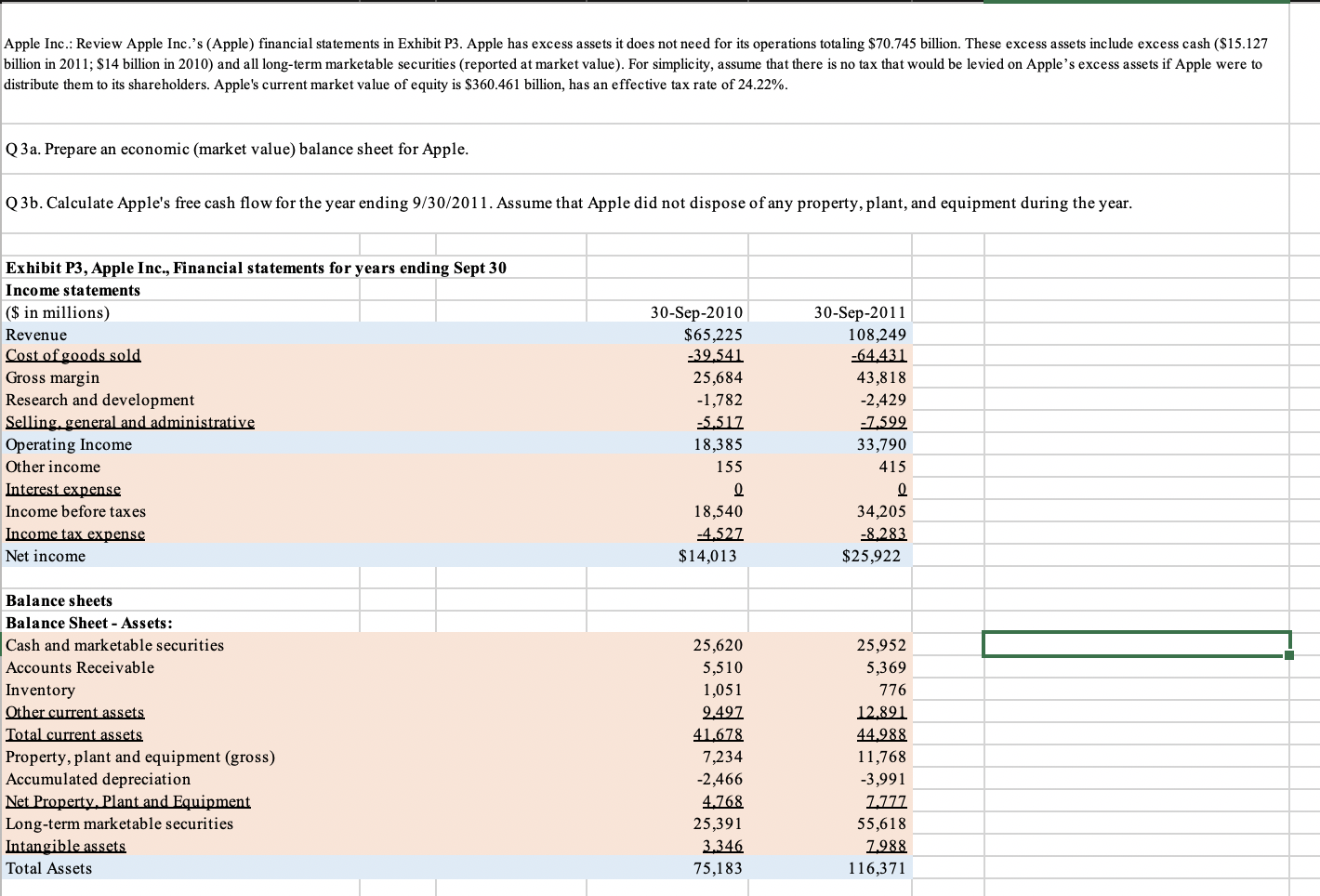

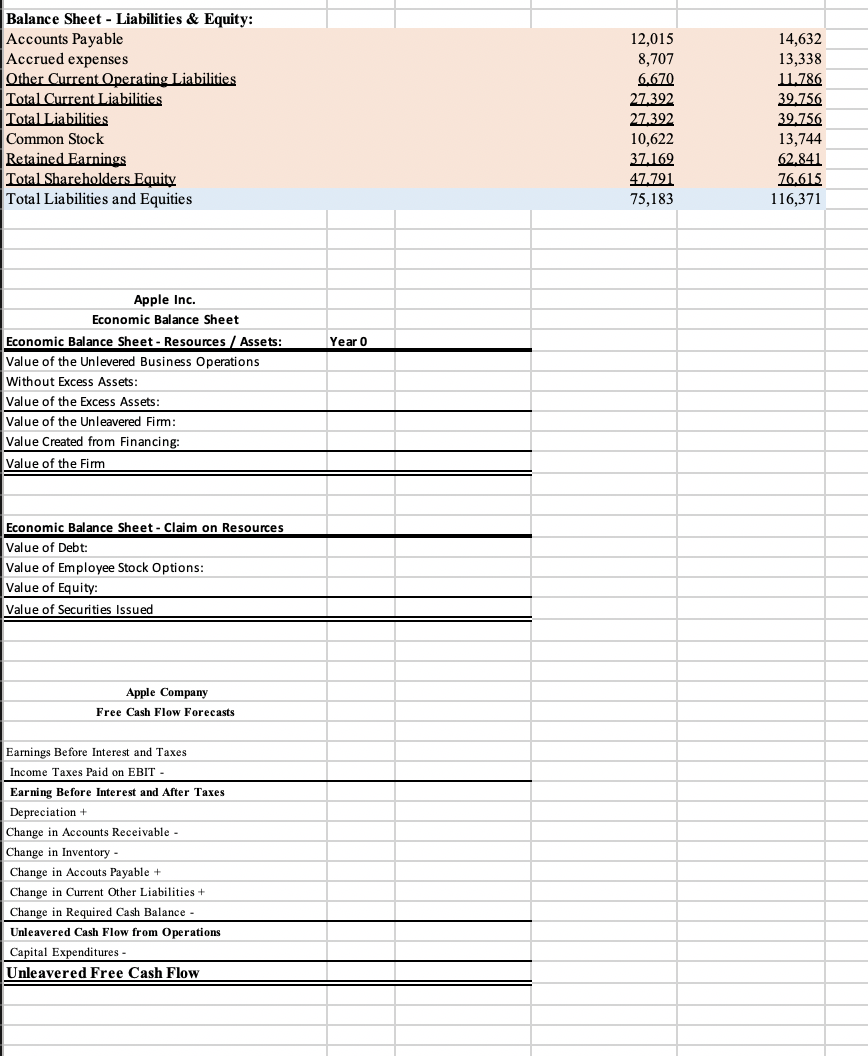

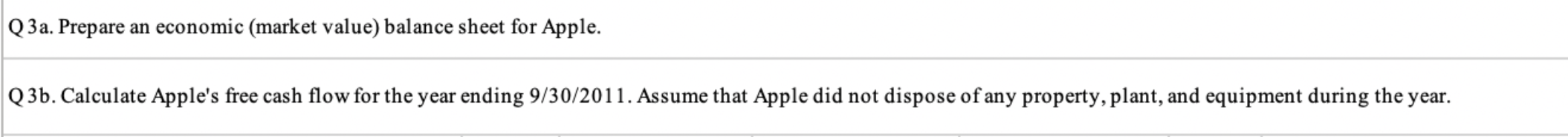

Apple Inc.: Review Apple Inc.'s (Apple) financial statements in Exhibit P3. Apple has excess assets it does not need for its operations totaling $70.745 billion. These excess assets include excess cash ($15.127 billion in 2011; $14 billion in 2010) and all long-term marketable securities (reported at market value). For simplicity, assume that there is no tax that would be levied on Apple's excess assets if Apple were to distribute them to its shareholders. Apple's current market value of equity is $360.461 billion, has an effective tax rate of 24.22%. Q3a. Prepare an economic (market value) balance sheet for Apple. Q3b. Calculate Apple's free cash flow for the year ending 9/30/2011. Assume that Apple did not dispose of any property, plant, and equipment during the year. Exhibit P3, Apple Inc., Financial statements for years ending Sept 30 Income statements ($ in millions) Revenue Cost of goods sold Gross margin Research and development Selling, general and administrative Operating Income Other income Interest expense Income before taxes Income tax expense Net income 30-Sep-2010 $65,225 -39.541 25,684 -1,782 5.517 18,385 155 Q 18,540 -4.527 $14,013 30-Sep-2011 108,249 -64.431 43,818 -2,429 -7.599 33,790 415 Q 34,205 -8.283 $25,922 Balance sheets Balance Sheet - Assets: Cash and marketable securities Accounts Receivable Inventory Other current assets Total current assets Property, plant and equipment (gross) Accumulated depreciation Net Property. Plant and Equipment Long-term marketable securities Intangible assets Total Assets 25,620 5,510 1,051 9.497 41.678 7,234 -2,466 4.768 25,391 3.346 75,183 25,952 5,369 776 12.891 44.988 11,768 -3,991 7.777 55,618 7.988 116,371 12,015 8,707 6.670 27.392 Balance Sheet - Liabilities & Equity: Accounts Payable Accrued expenses Other Current Operating Liabilities Total Current Liabilities Total Liabilities Common Stock Retained Earnings Total Shareholders Equity Total Liabilities and Equities 27.392 10,622 37.162 47.791 75,183 14,632 13,338 11.786 39.756 39.756 13,744 62.841 76.615 116,371 Year 0 Apple Inc. Economic Balance Sheet Economic Balance Sheet - Resources / Assets: Value of the Unlevered Business Operations Without Excess Assets: Value of the Excess Assets: Value of the Unleavered Firm: Value Created from Financing: Value of the Firm Economic Balance Sheet - Claim on Resources Value of Debt: Value of Employee Stock Options: Value of Equity: Value of Securities Issued Apple Company Free Cash Flow Forecasts Earnings Before Interest and Taxes Income Taxes Paid on EBIT Earning Before Interest and After Taxes Depreciation + Change in Accounts Receivable - Change in Inventory - Change in Accouts Payable + Change in Current Other Liabilities + Change in Required Cash Balance Unleavered Cash Flow from Operations Capital Expenditures - Unleavered Free Cash Flow Q3a. Prepare an economic (market value) balance sheet for Apple. Q3b. Calculate Apple's free cash flow for the year ending 9/30/2011. Assume that Apple did not dispose of any property, plant, and equipment during the year