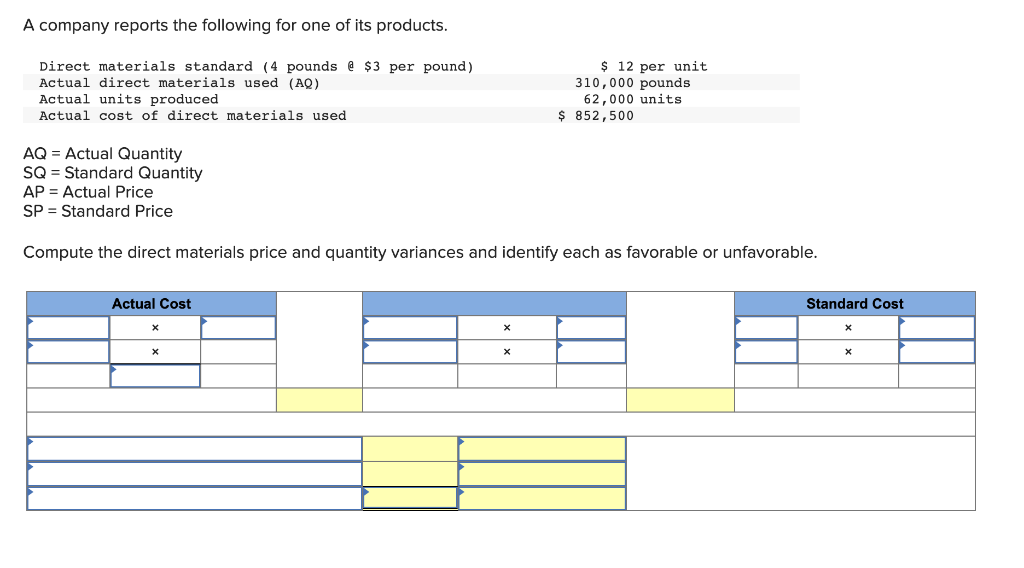

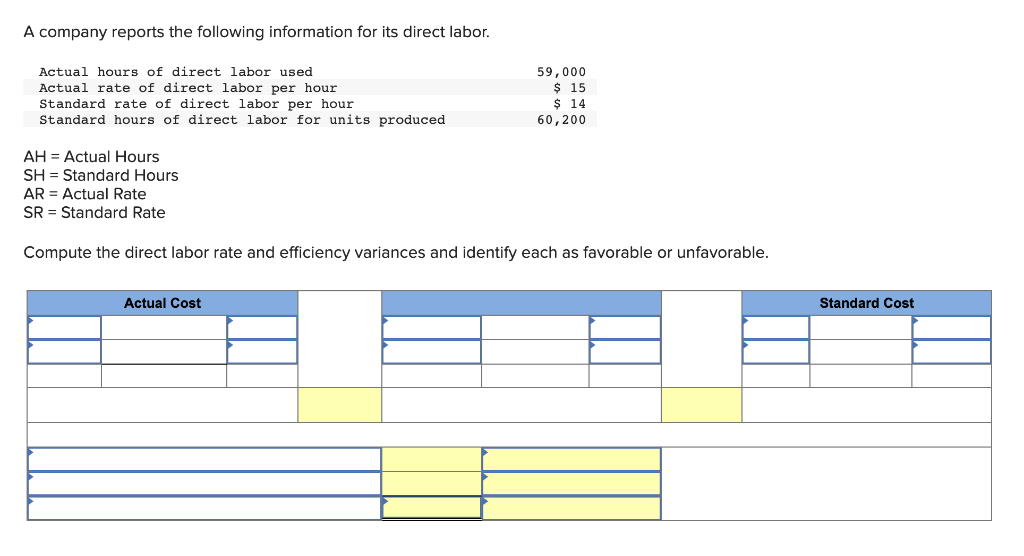

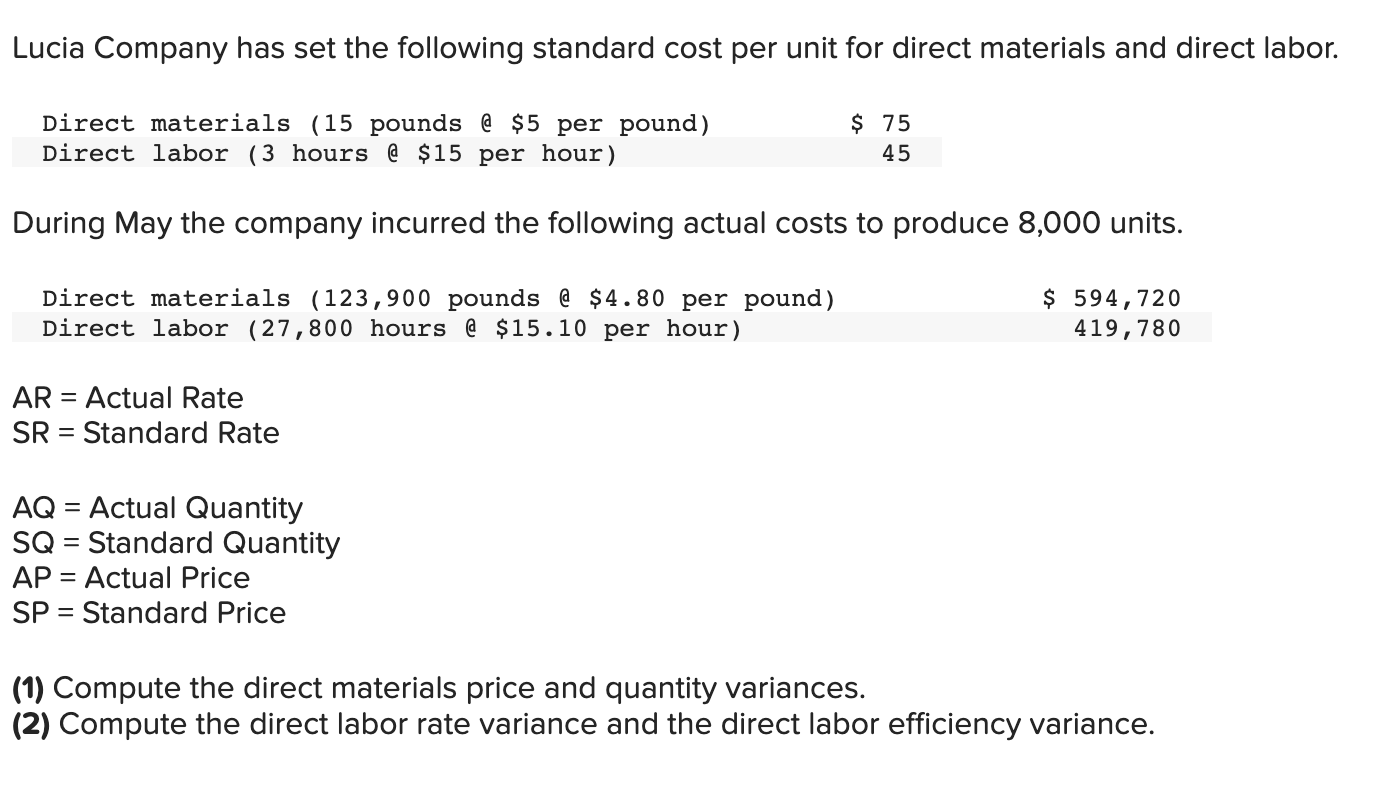

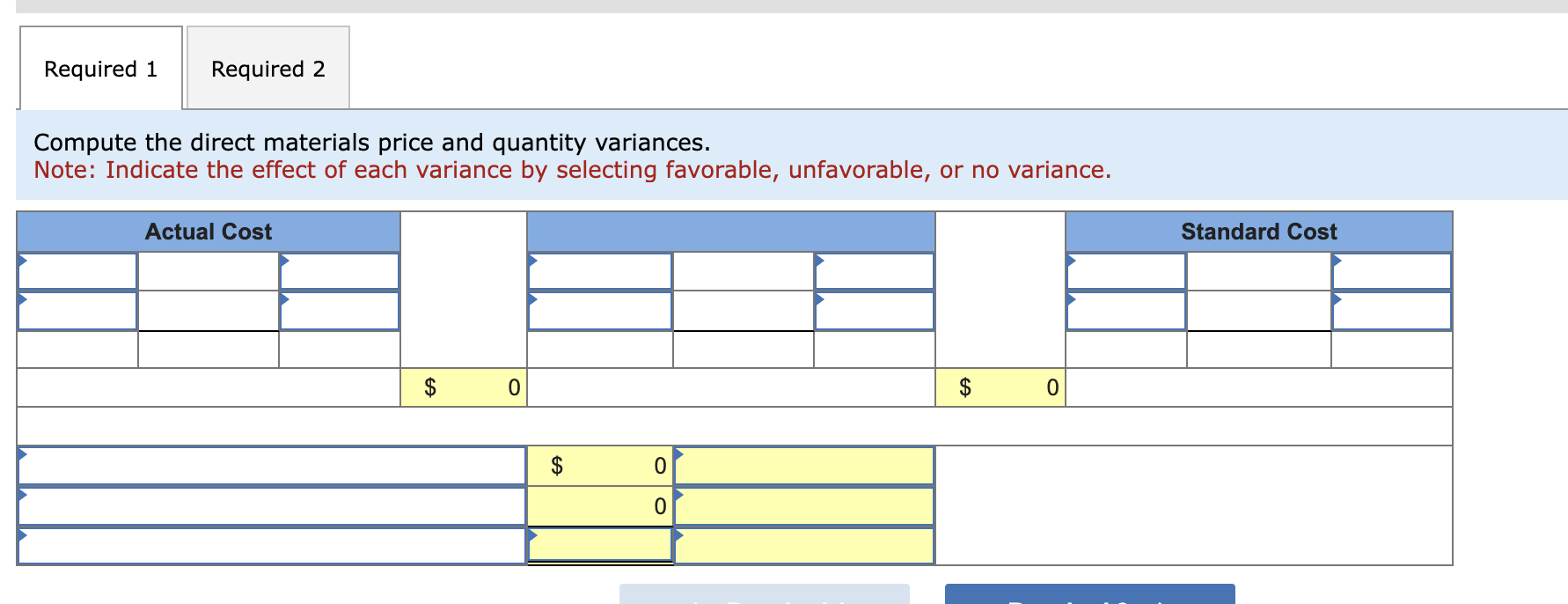

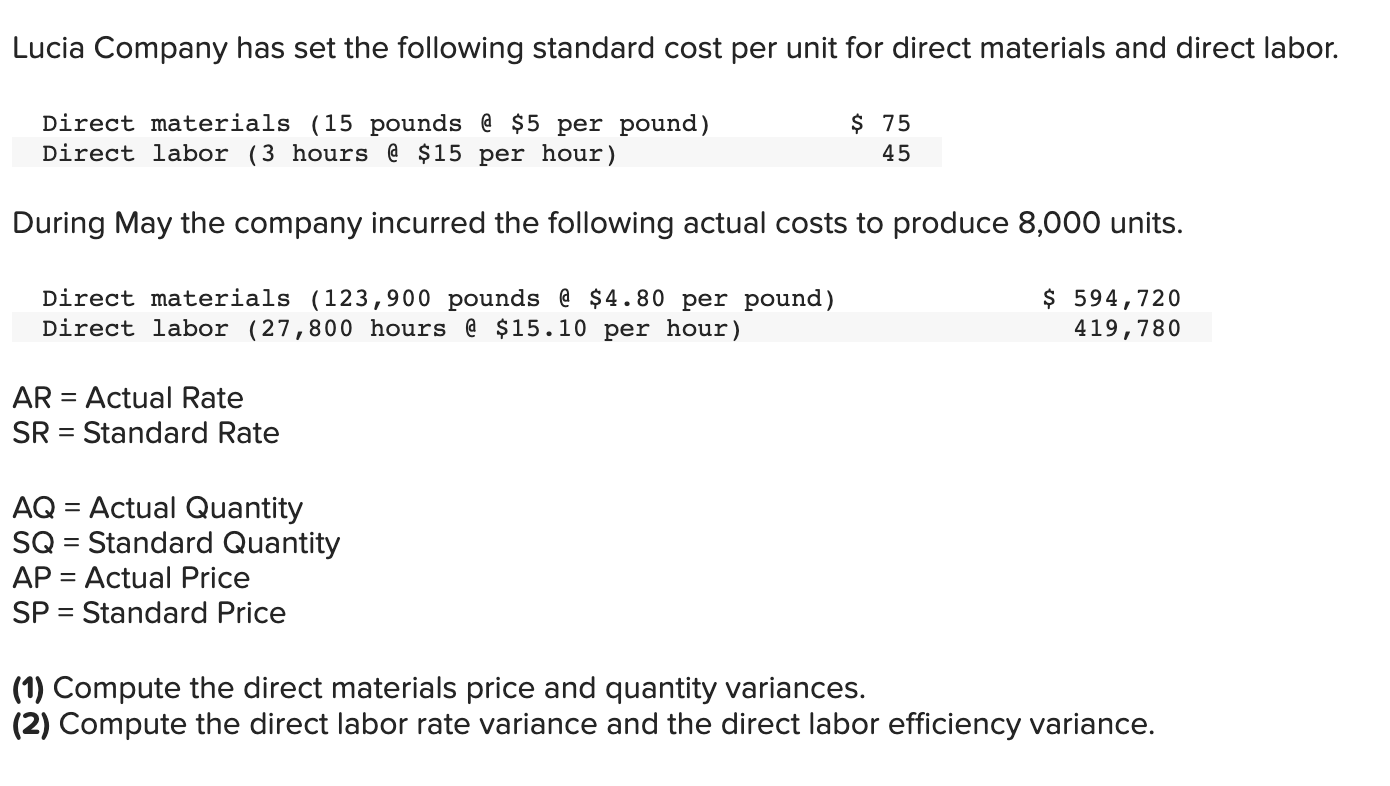

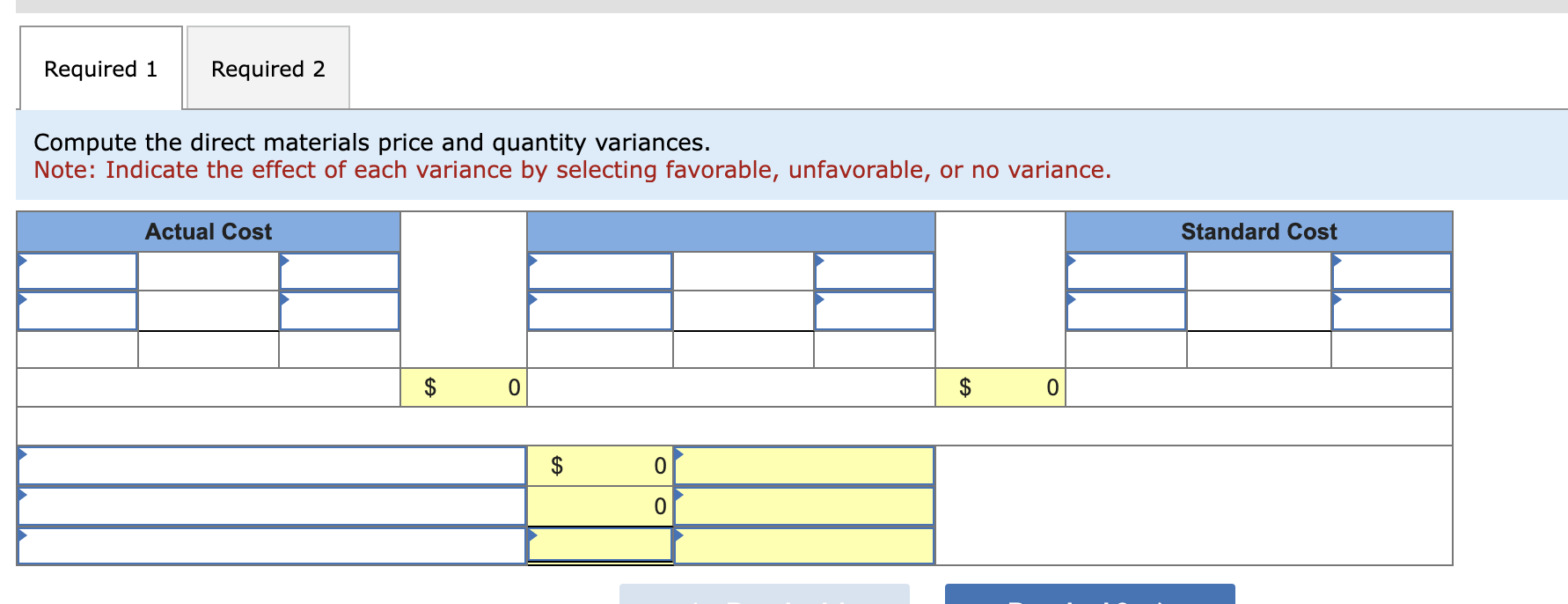

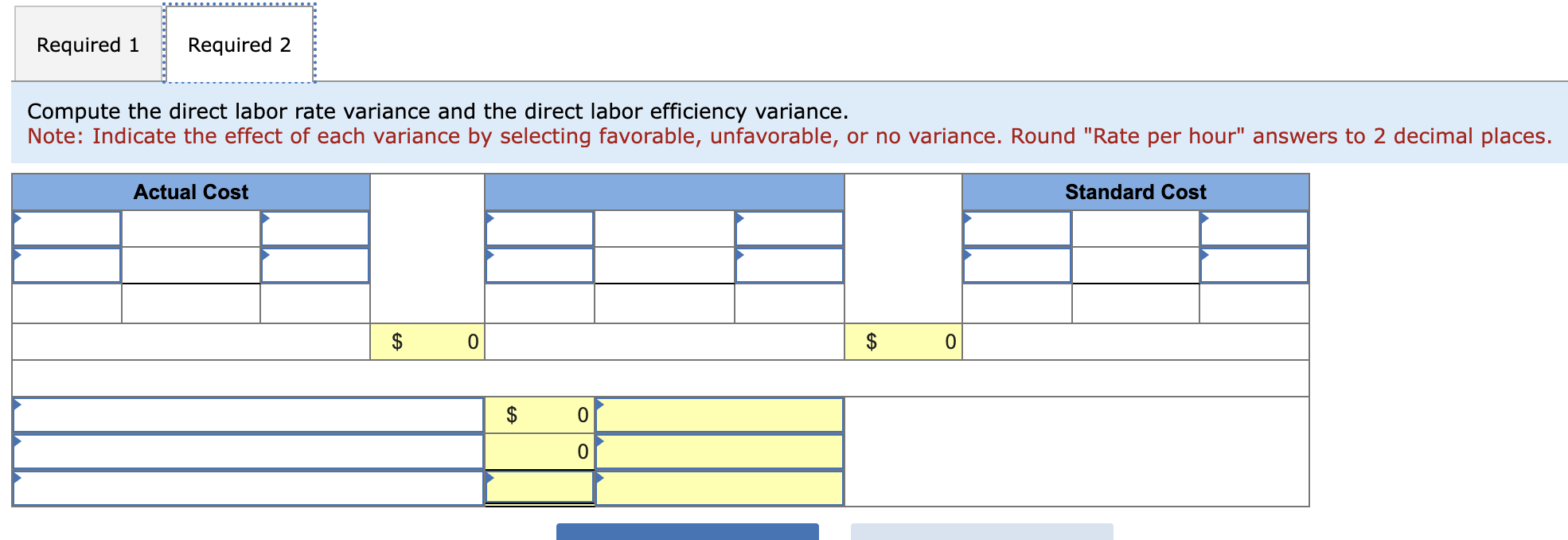

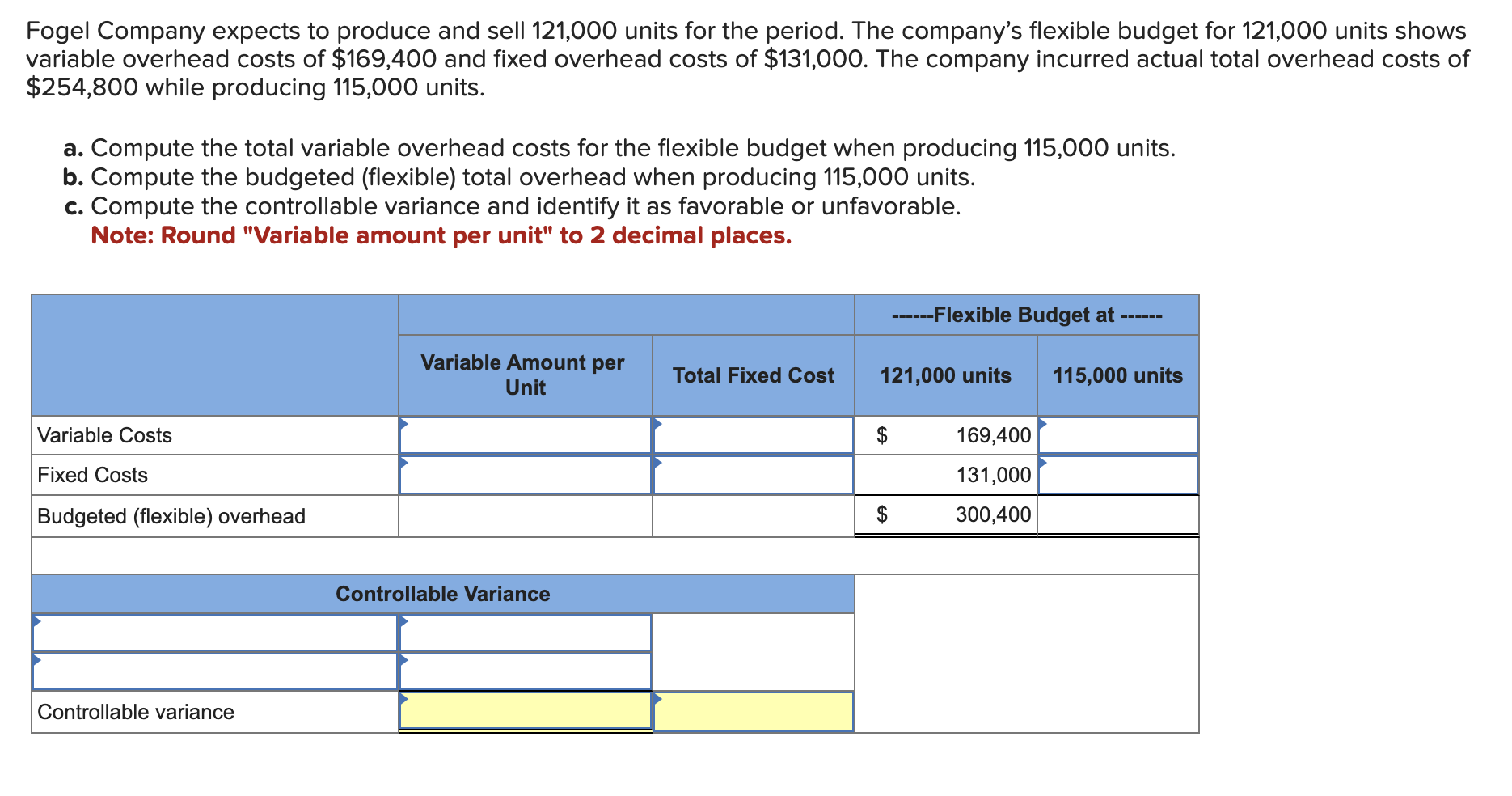

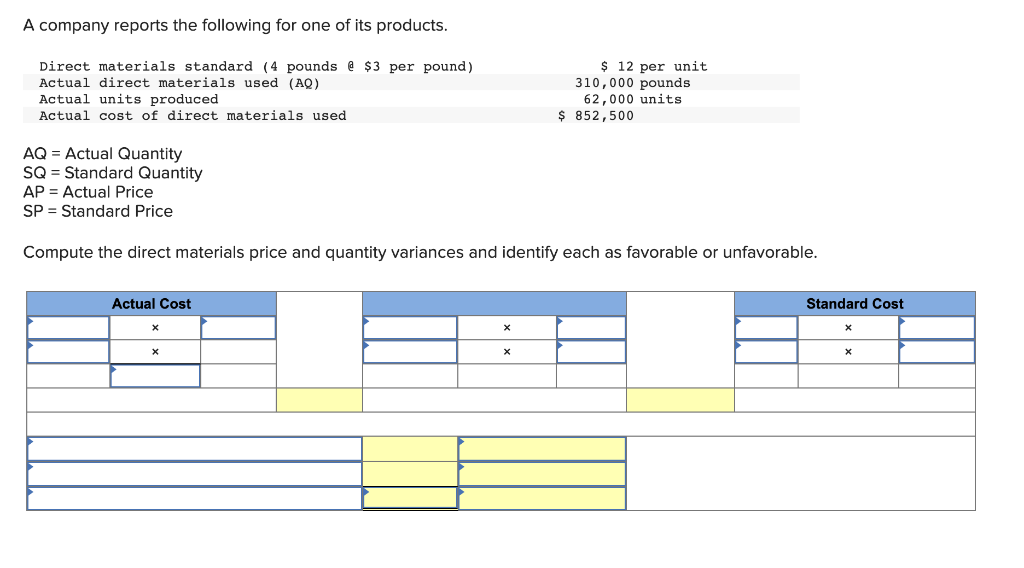

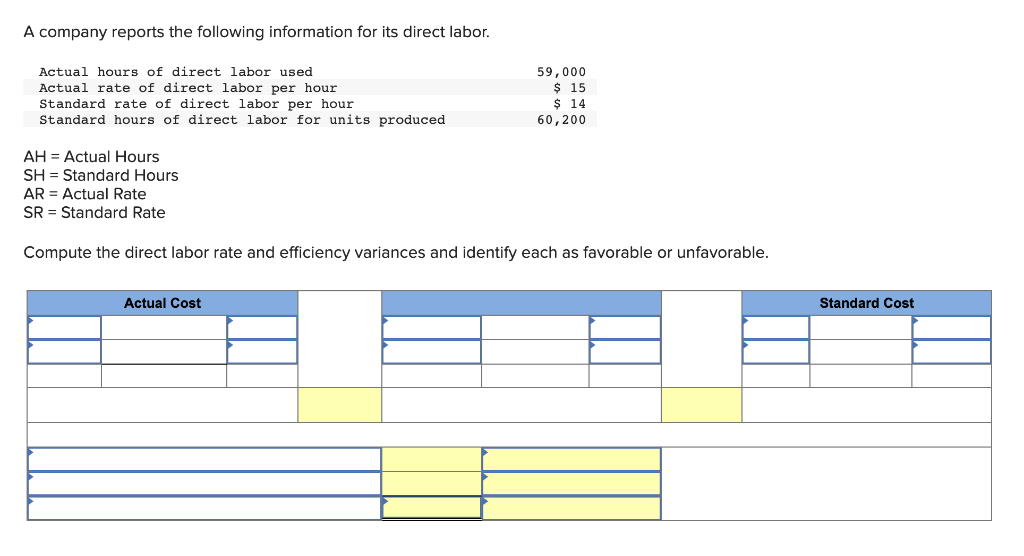

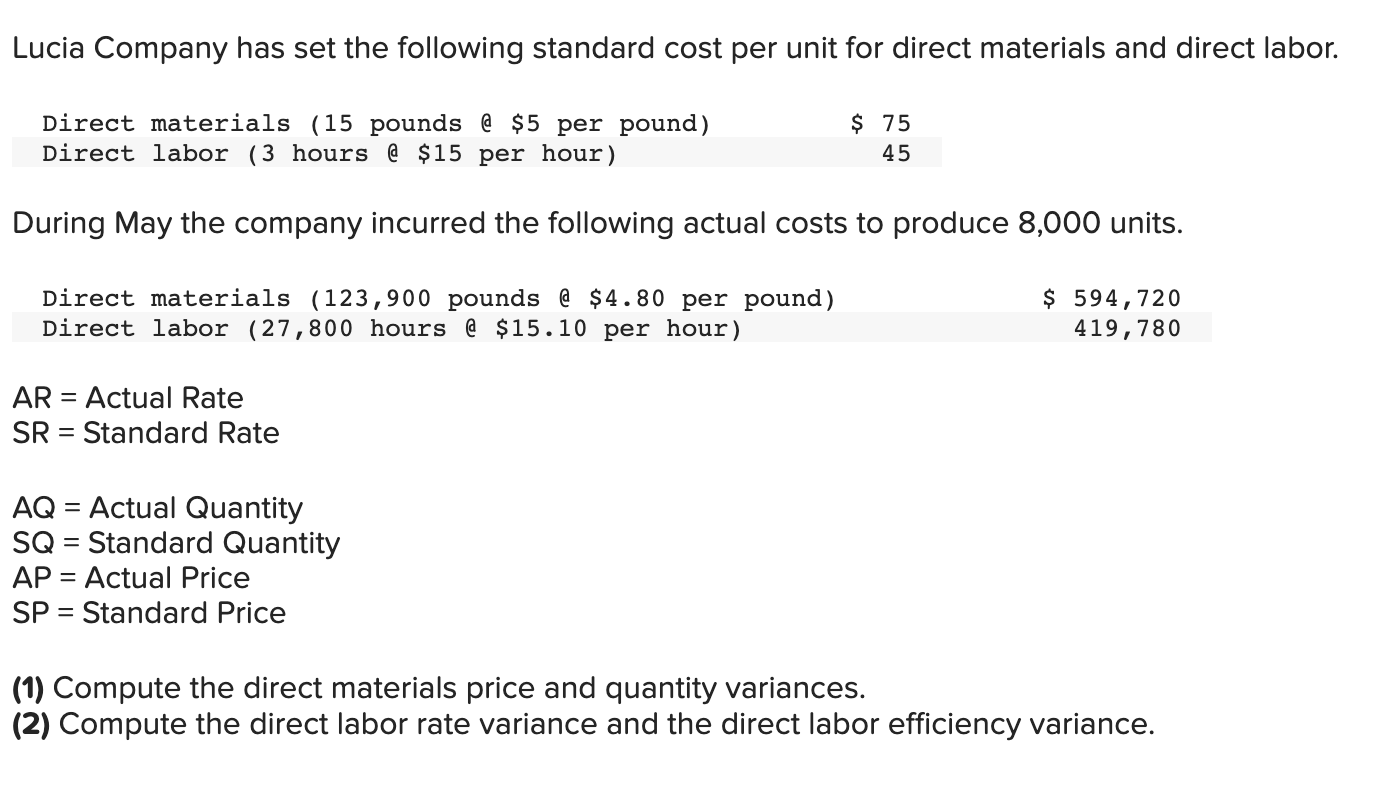

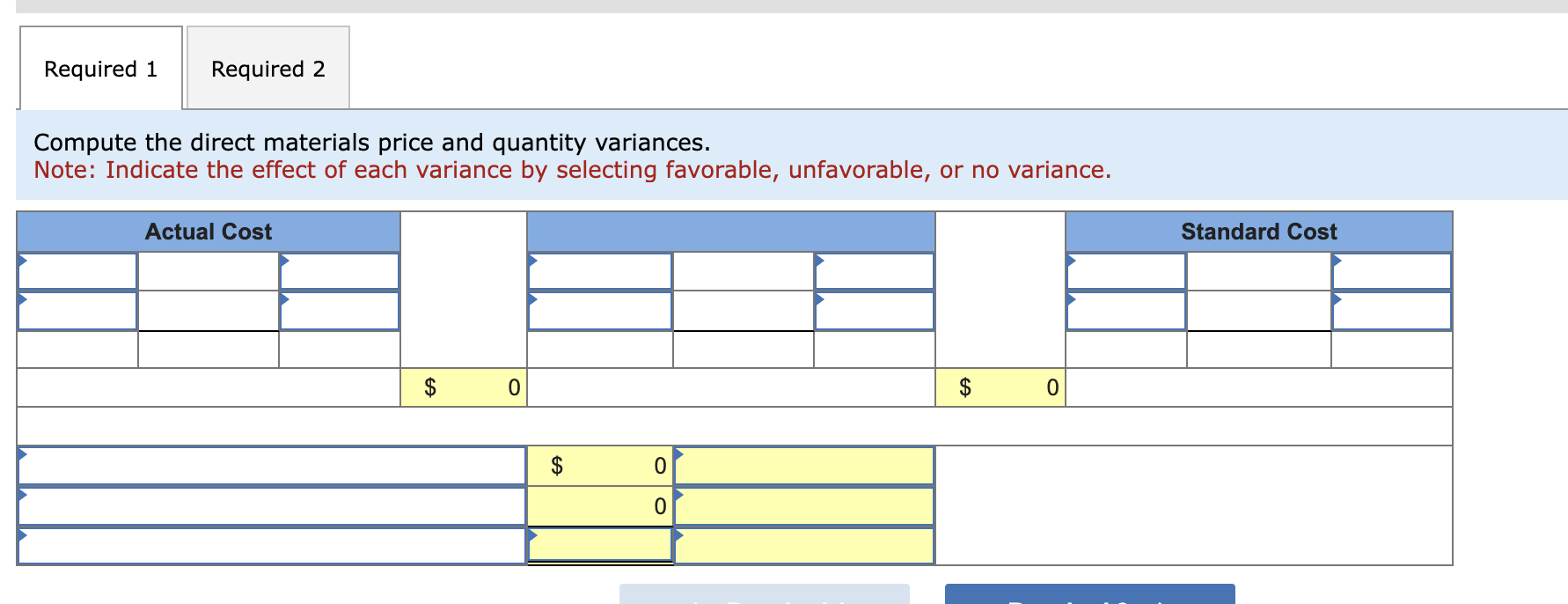

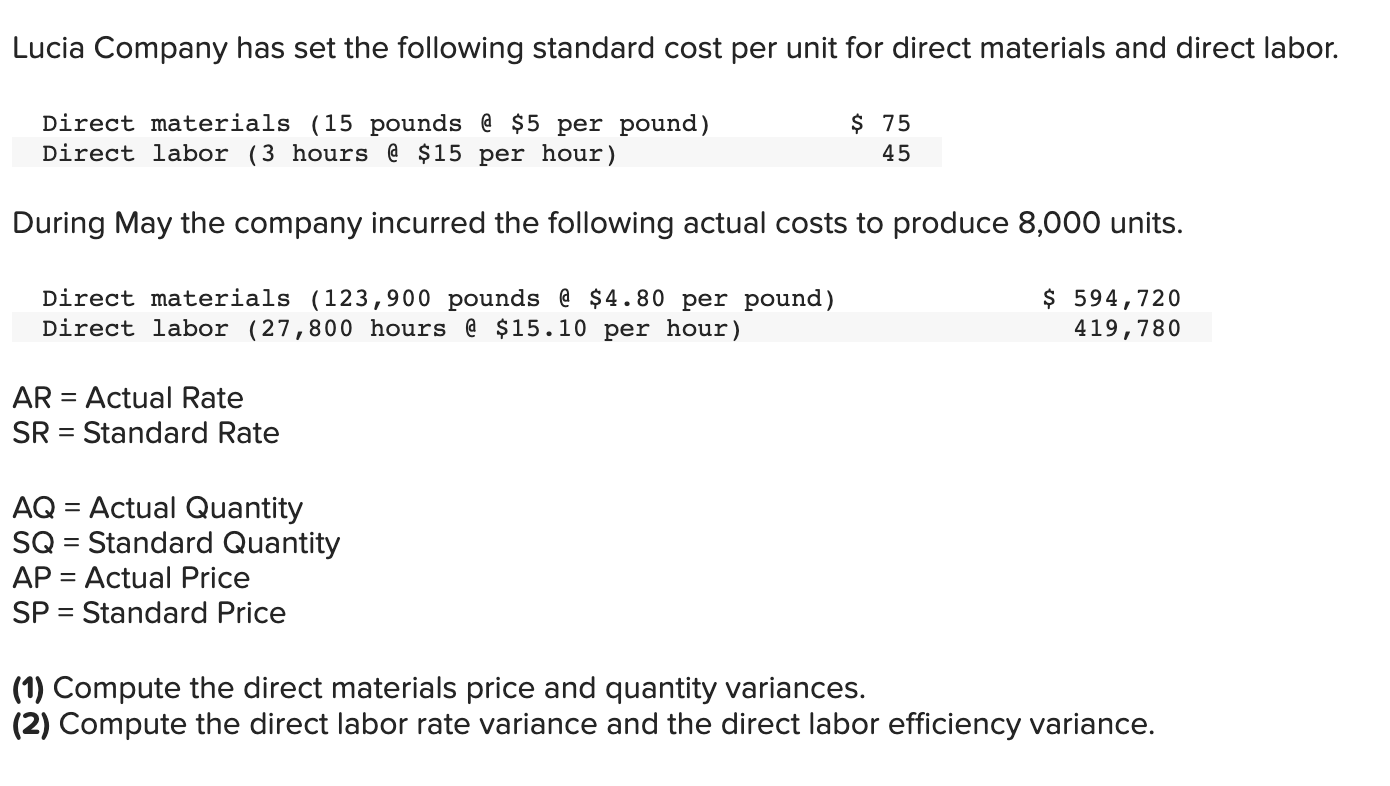

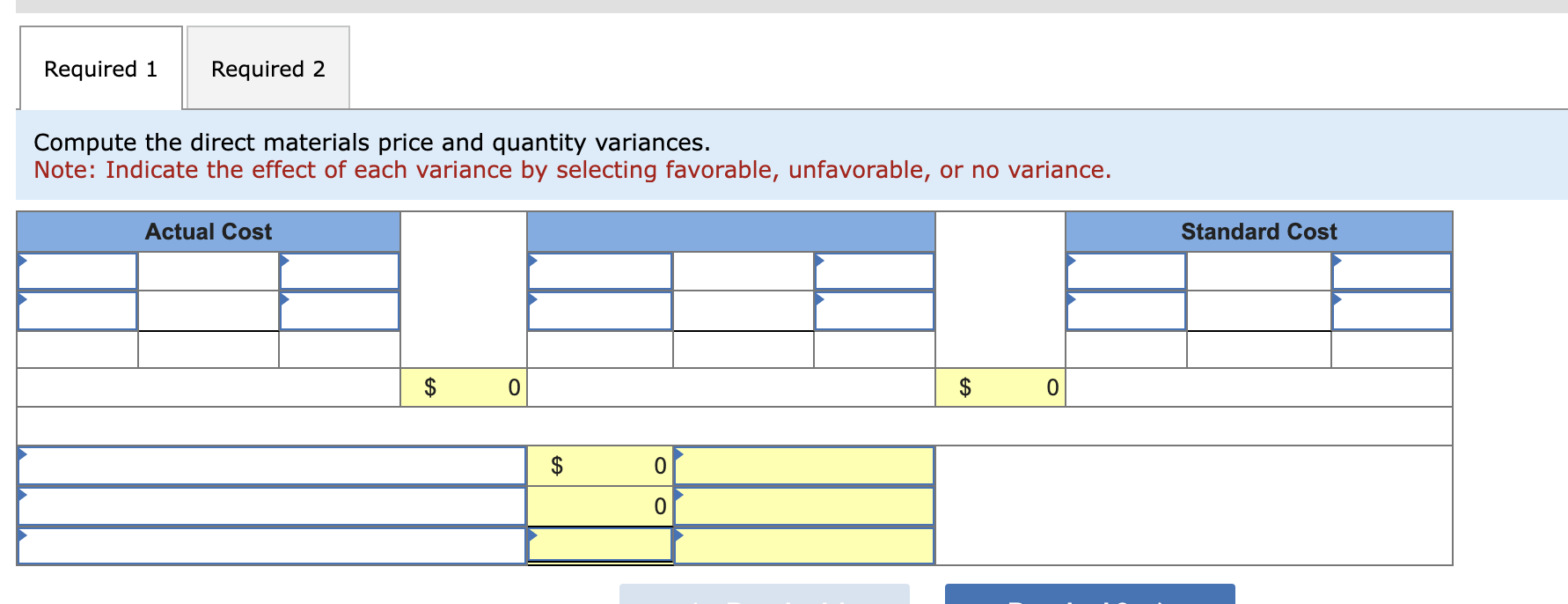

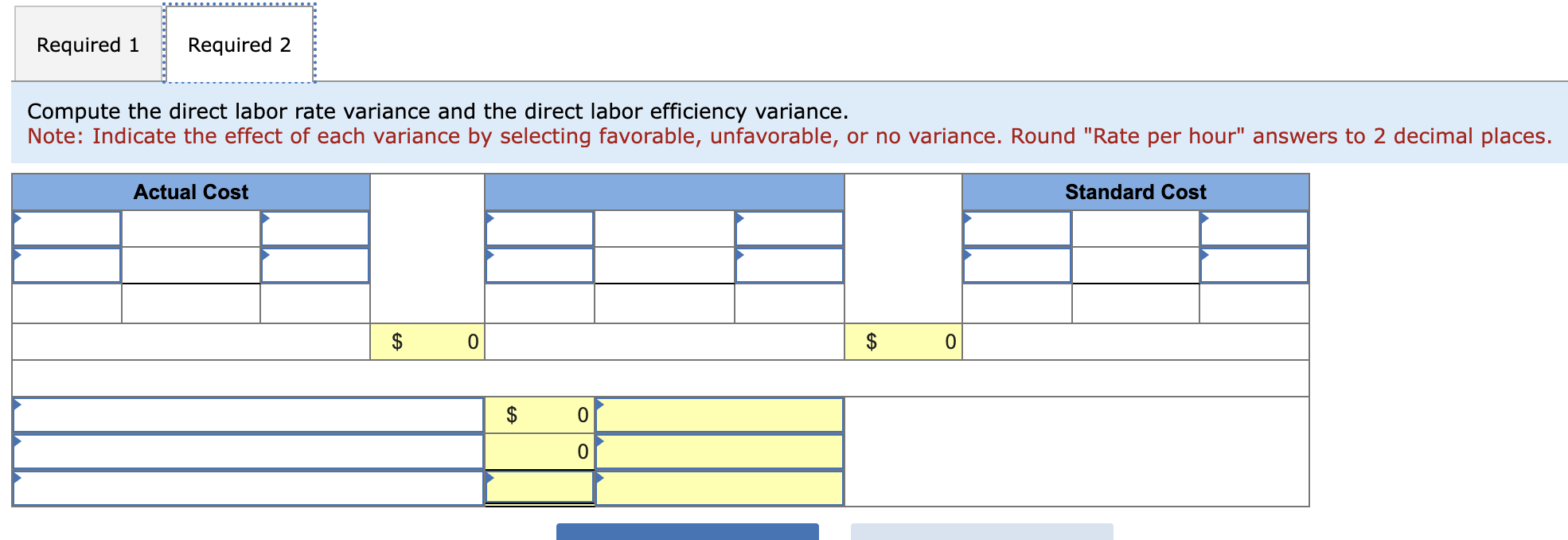

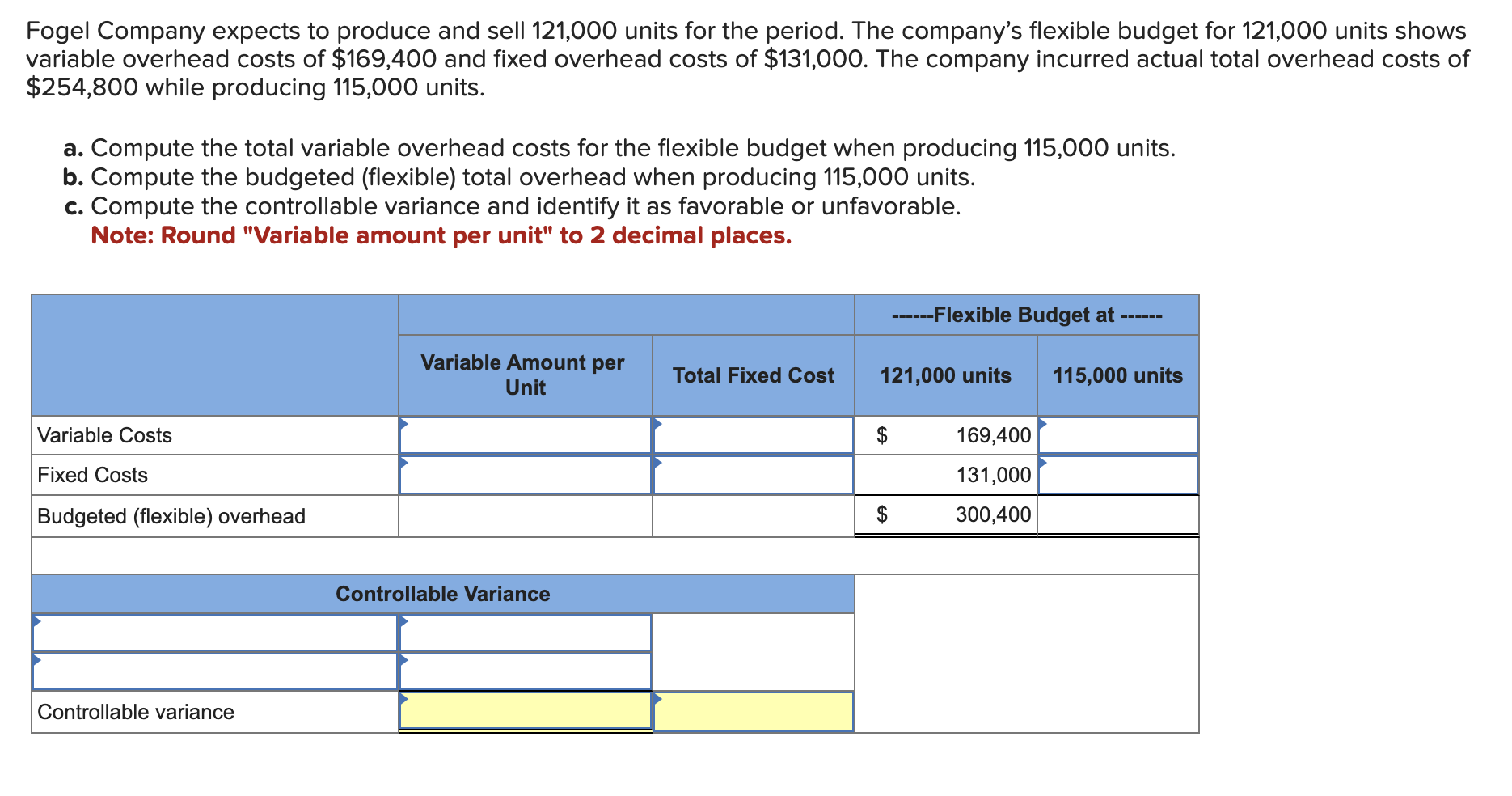

AQ= Actual Quantity A company reports the following information for its direct labor. AH=ActualHoursSH=StandardHoursAR=ActualRateSR=StandardRate Compute the direct labor rate and efficiency variances and identify each as favorable or unfavorable. Lucia Company has set the following standard cost per unit for direct materials and direct labor. Directmaterials(15pounds@$5perpound)Directlabor(3hours@$15perhour)$75 During May the company incurred the following actual costs to produce 8,000 units. Directmaterials(123,900pounds@$4.80perpound)Directlabor(27,800hours@$15.10perhour)$94,720419,780 AR= Actual Rate SR= Standard Rate AQ= Actual Quantity SQ= Standard Quantity AP= Actual Price SP= Standard Price (1) Compute the direct materials price and quantity variances. (2) Compute the direct labor rate variance and the direct labor efficiency variance. Compute the direct materials price and quantity variances. Note: Indicate the effect of each variance by selecting favorable, unfavorable, or no variance. Lucia Company has set the following standard cost per unit for direct materials and direct labor. Directmaterials(15pounds@$5perpound)Directlabor(3hours@$15perhour)$75 During May the company incurred the following actual costs to produce 8,000 units. Directmaterials(123,900pounds@$4.80perpound)Directlabor(27,800hours@$15.10perhour)$94,720419,780 AR= Actual Rate SR= Standard Rate AQ= Actual Quantity SQ= Standard Quantity AP= Actual Price SP= Standard Price (1) Compute the direct materials price and quantity variances. (2) Compute the direct labor rate variance and the direct labor efficiency variance. Compute the direct materials price and quantity variances. Note: Indicate the effect of each variance by selecting favorable, unfavorable, or no variance. Compute the direct labor rate variance and the direct labor efficiency variance. Note: Indicate the effect of each variance by selecting favorable, unfavorable, or no variance. Round "Rate per hour" answers to 2 decimal places. Fogel Company expects to produce and sell 121,000 units for the period. The company's flexible budget for 121,000 units shows variable overhead costs of $169,400 and fixed overhead costs of $131,000. The company incurred actual total overhead costs of $254,800 while producing 115,000 units. a. Compute the total variable overhead costs for the flexible budget when producing 115,000 units. b. Compute the budgeted (flexible) total overhead when producing 115,000 units. c. Compute the controllable variance and identify it as favorable or unfavorable. Note: Round "Variable amount per unit" to 2 decimal places