Answered step by step

Verified Expert Solution

Question

1 Approved Answer

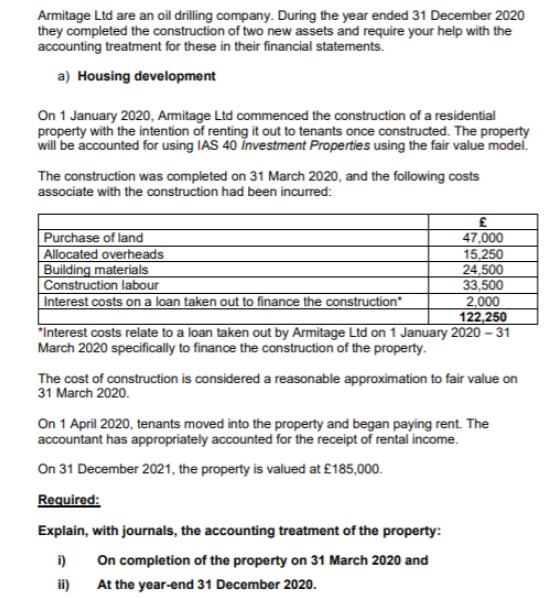

Armitage Ltd are an oil drilling company. During the year ended 31 December 2020 they completed the construction of two new assets and require

Armitage Ltd are an oil drilling company. During the year ended 31 December 2020 they completed the construction of two new assets and require your help with the accounting treatment for these in their financial statements. a) Housing development On 1 January 2020, Armitage Ltd commenced the construction of a residential property with the intention of renting it out to tenants once constructed. The property will be accounted for using IAS 40 Investment Properties using the fair value model. The construction was completed on 31 March 2020, and the following costs associate with the construction had been incurred: Purchase of land Allocated overheads Building materials 47,000 15,250 24,500 33,500 2,000 122,250 *Interest costs relate to a loan taken out by Armitage Ltd on 1 January 2020-31 March 2020 specifically to finance the construction of the property. Construction labour Interest costs on a loan taken out to finance the construction The cost of construction is considered a reasonable approximation to fair value on 31 March 2020. On 1 April 2020, tenants moved into the property and began paying rent. The accountant has appropriately accounted for the receipt of rental income. On 31 December 2021, the property is valued at 185,000. Required: Explain, with journals, the accounting treatment of the property: i) On completion of the property on 31 March 2020 and ii) At the year-end 31 December 2020.

Step by Step Solution

★★★★★

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Journal Entries on 31 March 2020 Dr Investment Property 122250 Cr Land 47000 Cr Construction Labour ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started