Question

As a financial manager of Dublin Enterprises, you are required to analyze two proposed capital investments, Projects ABC and Project XYZ. Each has a cost

As a financial manager of Dublin Enterprises, you are required to analyze two proposed capital investments, Projects ABC and Project XYZ. Each has a cost of R400 000, and the cost of capital for each project is 15%. Depreciation is calculated on the straight-line method. The projects’ expected profit are as follows:

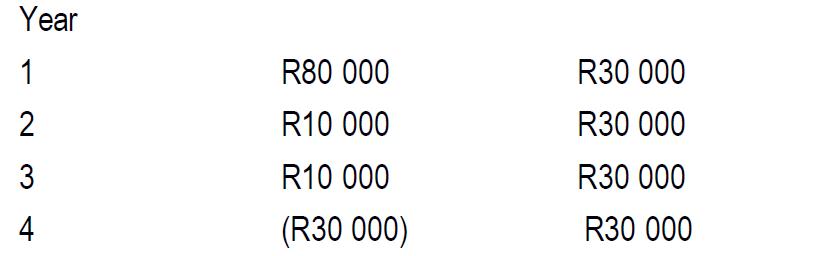

Project ABC Project XYZ

Required

1.1 Calculate the payback period for each project (In years, months and days). (10)

1.2 Calculate the NPV for each project (10)

1.3 Which project or projects should be accepted if they are independent? (1)

1.4 Calculate the ARR for project XYZ (4)

Valpre Limited plans to manufacture bar fridges and the following information is applicable: Estimated sales for the year10 000 units at R6 800 each

Estimated costs for the year:

- Variable costs

- Direct MaterialR1 040 per unit

- Direct LabourR700 per unit

- Variable Manufacturing CostR220 per unit

- Selling expenses10% of selling price per unit sold

- Factory overheads (all fixed)R875 000

- Administrative expenses (all fixed)R786 000.

REQUIRED:

2.1 Calculate the total net profit for the estimated figures. (4)

2.2 Calculate the break-even quantity (4)

2.3 Calculate the break-even value (3)

2.4 Calculate the break-even value using the marginal income ratio. (4)

2.5 Calculate the target sales volume to achieve a profit of R1 841 000. (4)

2.6 Calculate the new break-even quantity and value if the selling price is increased by 15% (4)

2.7 Calculate the margin of safety in units at the original budgeted volume and price

3.1 You want to begin saving for your daughter’s college education and you estimate that she will need R240 000 in 17 years. If you feel confident that you can earn 7.5% per year, how much do you need to invest today?(6)

3.2 Suppose your company expects to increase unit sales of widgets by 14% per year for the next 8 years. If you currently sell 2.5 million widgets in one year, how many widgets do you expect to sell in 6 years?(6)

3.3 You are looking at an investment that will pay R1 800 in 3 years if you invest R400 today. What is the implied rate of interest?(8)

3.4 You want to purchase a new car and you are willing to pay R500 000. If you can invest at 14% per year and you currently have R350 000, how long will it be before you have enough money to pay cash for the car?(5)

Year 1 2 3 4 R80 000 R10 000 R10 000 (R30 000) R30 000 R30 000 R30 000 R30 000

Step by Step Solution

3.37 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Lets work through each of your questions 1 Capital Investment Analysis for Projects ABC and Project XYZ 11 Calculate the Payback Period for Each Project The payback period is the time it takes to reco...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started