Question

As a new credit trainee for E National Bank, you have been asked to evaluate the financial position of HS Castings, which has asked for

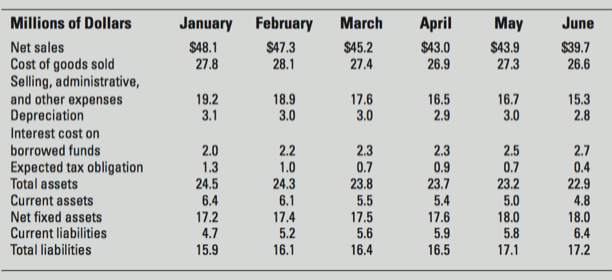

As a new credit trainee for E National Bank, you have been asked to evaluate the financial position of HS Castings, which has asked for renewal of and an increase in its six-month credit line. HS now requests a $7 million credit line, and you must draft your first credit opinion for a senior credit analyst. Unfortunately, HS just changed management, and its financial report for the last six months was not only late but also garbled. As best as you can tell, its sales, assets, operating expenses, and liabilities for the six-month period just concluded display the following patterns:

HS has a 16-year relationship with the bank and has routinely received and paid off a credit line of $4 million to $5 million. The departments senior analyst tells you to prepare because you will be asked for your opinion of this loan request (though you have been led to believe the loan will be approved anyway, because HSs president serves on E banks board of directors). What are your concerns about the borrower if asked? What is the additional information you think maybe helpful to make the lending decision? What is your recommendation? How to deal with the customer relationship?

\begin{tabular}{lcccrrr} \hline Millions of Dollars & January & February & March & April & May & June \\ Net sales & $48.1 & $47.3 & $45.2 & $43.0 & $43.9 & $39.7 \\ Cost of goods sold & 27.8 & 28.1 & 27.4 & 26.9 & 27.3 & 26.6 \\ Selling, administrative, & & & & & & \\ and other expenses & 19.2 & 18.9 & 17.6 & 16.5 & 16.7 & 15.3 \\ Depreciation & 3.1 & 3.0 & 3.0 & 2.9 & 3.0 & 2.8 \\ Interest cost on & & & & & & \\ borrowed funds & 2.0 & 2.2 & 2.3 & 2.3 & 2.5 & 2.7 \\ Expected tax obligation & 1.3 & 1.0 & 0.7 & 0.9 & 0.7 & 0.4 \\ Total assets & 24.5 & 24.3 & 23.8 & 23.7 & 23.2 & 22.9 \\ Current assets & 6.4 & 6.1 & 5.5 & 5.4 & 5.0 & 4.8 \\ Net fixed assets & 17.2 & 17.4 & 17.5 & 17.6 & 18.0 & 18.0 \\ Current liabilities & 4.7 & 5.2 & 5.6 & 5.9 & 5.8 & 6.4 \\ Total liabilities & 15.9 & 16.1 & 16.4 & 16.5 & 17.1 & 17.2 \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started