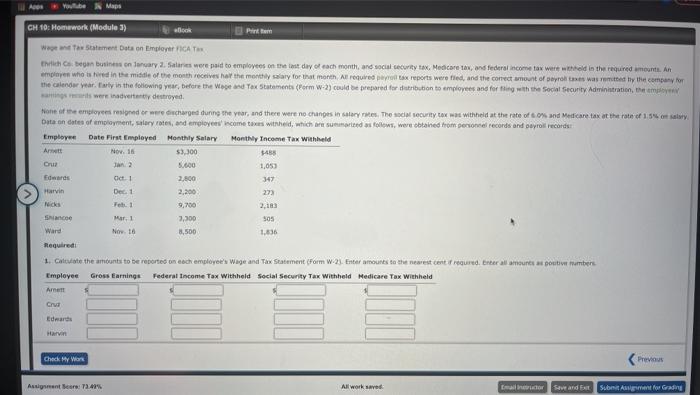

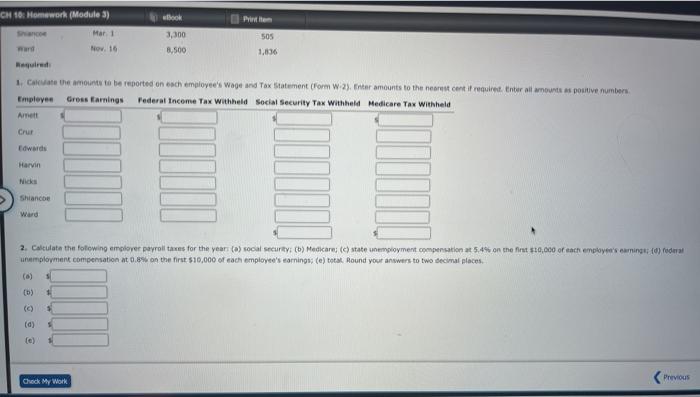

As Youtube Maps CH 10: Homework (Module 3) Book Pri tem Want Tax Statement Data on EmployerTICA the business on lancary 2. Salines were paid to employees on the day of each month and social security tax, Medicare tax, and federal income tax were held in the required amount. An employee who stored in the middle of the month receive her the monthly salary for that month Al required pol tax reports were fied, and the correct amount of peyote wasted by the company for the calendar year tarly in the following year before the age and Tax Statements (Form w-2) could be prepared for tribution to employees and for thing with the Social Security Administration, the as were inadvertently destroyed one of the employees resigned or were discharged during the year, and there were no changes in stocytes. The security Cox was withheld at the rate of and Medicare tax at the rate of 1.5 salary Dita en date of employment, salaryotes, and eye come to wished, which are sured as follows were obtained from personeel records and payroll records Employee Date First Employed Monthly Salary Monthly Income Tax Withheld Art Nov. 16 53,300 3455 Cruz 5.600 1,053 Edwards Oct 1 347 Harvin Dec 1 2,200 273 Neidis Fete 9,700 Se 3,500 505 Ward Now to 8.500 1.836 Required 1. Catulate the amounts to be reported on each employee's Wage and Tax Statement (Form W.2. Enter amounts to the nearest cant required. Enter all amounts poutiner Employee Gross Earnings Federal Income Tax withheld Social Security Tax Withheld Medicare Tax Withheld Amen Crv Edwards Harvin Check My W Previous Assist: 12:41 All works Subotaget for Gradine CH 16Homework (Module 3) book Privite Sco Mar 1 3,300 505 und Nov. 16 8,500 1,836 Required 1. Caleate the amounts to be reported on each employee's wage and Tax Statement (Form W-2). Enter amounts to the nearest cant it required. Enter all wounts as positive numbers Employee Gross Earnings Federal Income Tax withheld Social Security Tax Withheld Medicare Tax Withheld Ameti Crur Edwards Harvin Nicks Shiance Ward 2. Calculate the following employer payroll taxes for the years (a) social security: (b) Medicare (c) state unemployment compensation at 5.4% on the first $10,000 of each employee's coming to federal unemployment compensation at 0.89 on the first $10,000 of each employee's earnings: (e) total Round your answers to two decimal places (6) (6) 1 (d) Previous Check My Work As Youtube Maps CH 10: Homework (Module 3) Book Pri tem Want Tax Statement Data on EmployerTICA the business on lancary 2. Salines were paid to employees on the day of each month and social security tax, Medicare tax, and federal income tax were held in the required amount. An employee who stored in the middle of the month receive her the monthly salary for that month Al required pol tax reports were fied, and the correct amount of peyote wasted by the company for the calendar year tarly in the following year before the age and Tax Statements (Form w-2) could be prepared for tribution to employees and for thing with the Social Security Administration, the as were inadvertently destroyed one of the employees resigned or were discharged during the year, and there were no changes in stocytes. The security Cox was withheld at the rate of and Medicare tax at the rate of 1.5 salary Dita en date of employment, salaryotes, and eye come to wished, which are sured as follows were obtained from personeel records and payroll records Employee Date First Employed Monthly Salary Monthly Income Tax Withheld Art Nov. 16 53,300 3455 Cruz 5.600 1,053 Edwards Oct 1 347 Harvin Dec 1 2,200 273 Neidis Fete 9,700 Se 3,500 505 Ward Now to 8.500 1.836 Required 1. Catulate the amounts to be reported on each employee's Wage and Tax Statement (Form W.2. Enter amounts to the nearest cant required. Enter all amounts poutiner Employee Gross Earnings Federal Income Tax withheld Social Security Tax Withheld Medicare Tax Withheld Amen Crv Edwards Harvin Check My W Previous Assist: 12:41 All works Subotaget for Gradine CH 16Homework (Module 3) book Privite Sco Mar 1 3,300 505 und Nov. 16 8,500 1,836 Required 1. Caleate the amounts to be reported on each employee's wage and Tax Statement (Form W-2). Enter amounts to the nearest cant it required. Enter all wounts as positive numbers Employee Gross Earnings Federal Income Tax withheld Social Security Tax Withheld Medicare Tax Withheld Ameti Crur Edwards Harvin Nicks Shiance Ward 2. Calculate the following employer payroll taxes for the years (a) social security: (b) Medicare (c) state unemployment compensation at 5.4% on the first $10,000 of each employee's coming to federal unemployment compensation at 0.89 on the first $10,000 of each employee's earnings: (e) total Round your answers to two decimal places (6) (6) 1 (d) Previous Check My Work