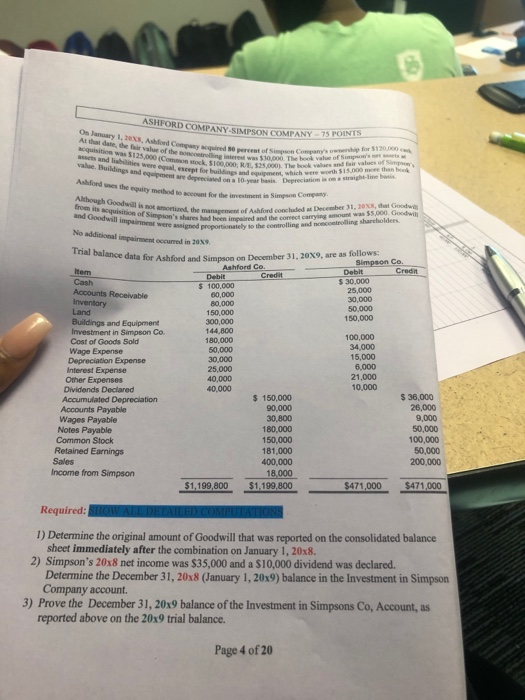

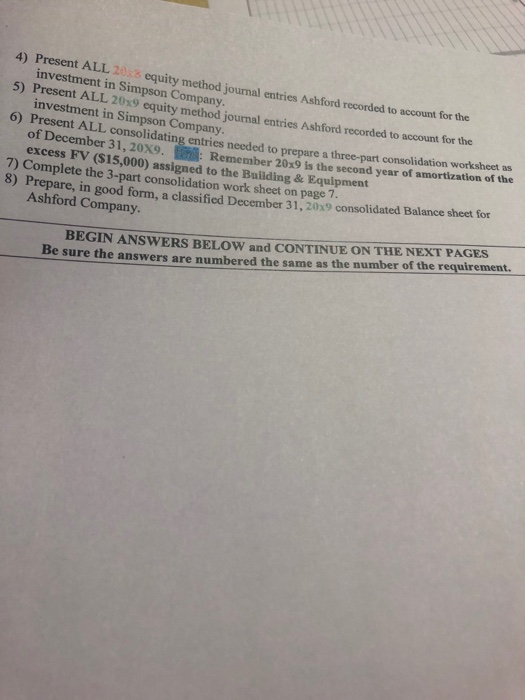

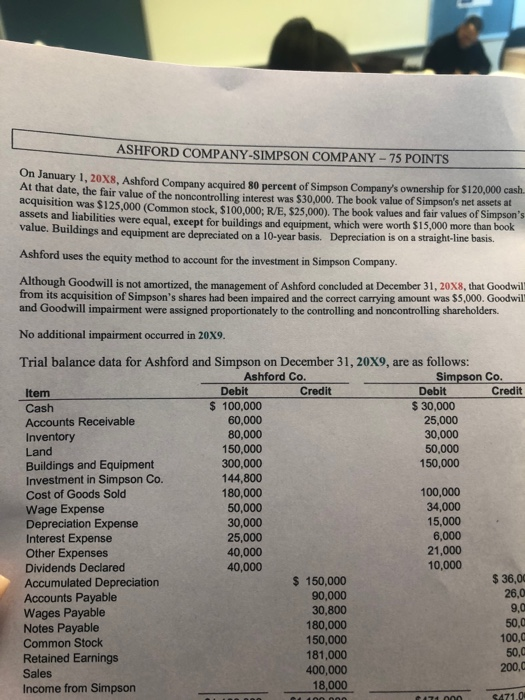

ASHFORD COMPANY.SIMPSON COMPANY-75 POINTS On Jamuary 1, 2X, Ashlord Company acquired pereeat of Simpn Company's owenhip for S1 AL that date, the fair valur of the noncontrolling interest was $30,000. The book value of Simpson's net ets acquisition was $125.000 (Common stock S100.000 RE525.000 The book valu and fair values of Smpo asets and liabilities were equal, escept for buildings and equipment, which were worth $15.000 mee than book value. Buildings and equipment are depreciated on a 10-year basis Depreciation is onastraighe-line basis Ashford uses the equity mrhod to account for the investment in Simpson Company. Although Goodwill is not amortized, the management of Ashford concluded a December 31, 20XS, that Goodw from its acquisition of Simpson's shares had been impaied and the comect carrying mount was $5,000. Goodwi and Goodwill impairment were assigned proportionately to the controlling and oncontrolling shareholders No additional impairment ocured in 20. Trial balance data for Ashford and Simpson on December 31, 20X9, are as follows: Simpson Co. Debit $ 30,000 25,000 30,000 Ashford Co. Debit $ 100,000 60,000 80.000 150.000 300,000 144,800 180,000 Item Cash Accounts Receivable Inventory Land Credit Credit 50,000 150,000 Buildings and Equipment Investment in Simpson Co. Cost of Goods Sold 100,000 34,000 15,000 6,000 21,000 10,000 50.000 30,000 25.000 Wage Expense Depreciation Expense Interest Expense Other Expenses Dividends Declared 40,000 40,000 $ 36,000 26,000 $ 150,000 90,000 30,800 180,000 Accumulated Depreciation Accounts Payable Wages Payable Notes Payable Common Stock Retained Earnings 9,000 50,000 100,000 50,000 200,000 150,000 181,000 400,000 18,000 $1,199,800 Sales Income from Simpson $1,199,800 $471,000 $471,000 Required: SIIOW ALL DETAILED COMPUTATIONS 1) Determine the original amount of Goodwill that was reported on the consolidated balance sheet immediately after the combination on January 1, 20x8. 2) Simpson's 20x8 net income was $35,000 and a $10,000 dividend was declared. Determine the December 31, 20x8 (January 1, 20x9) balance in the Investment in Simpson Company account. 3) Prove the December 31, 20x9 balance of the Investment in Simpsons Co, Account, as reported above on the 20x9 trial balance. Page 4 of 20 4) Present ALL 20 equity method joumal entries Ashford recorded to account for the investment in Simpson Company. 5) Present ALL 20x9 equity method journal entries Ashford recorded to account for the investment in Simpson Company. 6) Present ALL consolidating entries needed to prepare a three-part consolidation worksheet as of December 31, 20X9, : Remember 20x9 is the second year of amortization of the excess FV (S15,000) assigned to the Building & Equipment 7) Complete the 3-part consolidation work sheet on page 7. 8) Prepare, in good form, a classified December 31, 20x9 consolidated Balance sheet for Ashford Company. BEGIN ANSWERS BELOW and CONTINUE ON THE NEXT PAGES Be sure the answers are numbered the same as the number of the requirement. ASHFORD COMPANY-SIMPSON COMPANY - 75 POINTS On January 1, 20X8, Ashford Company acquired 80 percent of Simpson Company's ownership for $120,000 cash. At that date, the fair value of the noncontrolling interest was $30,000. The book value of Simpson's net assets at acquisition was $125,000 (Common stock, $100,000; R/E, $25,000). The book values and fair values of Simpson's assets and liabilities were equal, except for buildings and equipment, which were worth $15,000 more than book value. Buildings and equipment are depreciated on a 10-year basis. Depreciation is on a straight-line basis. Ashford uses the equity method to account for the investment in Simpson Company. Although Goodwill is not amortized, the management of Ashford concluded at December 31, 20X8, that Goodwill from its acquisition of Simpson's shares had been impaired and the correct carrying amount was $5,000. Goodwil and Goodwill impairment were assigned proportionately to the controlling and noncontrolling shareholders. No additional impairment occurred in 20X9. Trial balance data for Ashford and Simpson on December 31, 20X9, are as follows: Simpson Co. Credit Ashford Co. Debit Credit Debit Item $ 100,000 $ 30,000 25,000 30,000 50,000 150,000 Cash Accounts Receivable Inventory 60,000 80,000 150,000 300,000 144,800 180,000 50,000 30,000 25,000 40,000 40,000 Land Buildings and Equipment Investment in Simpson Co. Cost of Goods Sold Wage Expense Depreciation Expense Interest Expense Other Expenses Dividends Declared Accumulated Depreciation Accounts Payable Wages Payable Notes Payable mmon Stock Retained Earnings Sales Income from Simpson 100,000 34,000 15,000 6,000 21,000 10,000 $ 36,00 26,0 9,0 50,0 100,0 50,0 $ 150,000 90,000 30,800 180,000 150,000 181,000 400,000 18,000 200,0 S471.0 400 000 CA71 000 ASHFORD COMPANY.SIMPSON COMPANY-75 POINTS On Jamuary 1, 2X, Ashlord Company acquired pereeat of Simpn Company's owenhip for S1 AL that date, the fair valur of the noncontrolling interest was $30,000. The book value of Simpson's net ets acquisition was $125.000 (Common stock S100.000 RE525.000 The book valu and fair values of Smpo asets and liabilities were equal, escept for buildings and equipment, which were worth $15.000 mee than book value. Buildings and equipment are depreciated on a 10-year basis Depreciation is onastraighe-line basis Ashford uses the equity mrhod to account for the investment in Simpson Company. Although Goodwill is not amortized, the management of Ashford concluded a December 31, 20XS, that Goodw from its acquisition of Simpson's shares had been impaied and the comect carrying mount was $5,000. Goodwi and Goodwill impairment were assigned proportionately to the controlling and oncontrolling shareholders No additional impairment ocured in 20. Trial balance data for Ashford and Simpson on December 31, 20X9, are as follows: Simpson Co. Debit $ 30,000 25,000 30,000 Ashford Co. Debit $ 100,000 60,000 80.000 150.000 300,000 144,800 180,000 Item Cash Accounts Receivable Inventory Land Credit Credit 50,000 150,000 Buildings and Equipment Investment in Simpson Co. Cost of Goods Sold 100,000 34,000 15,000 6,000 21,000 10,000 50.000 30,000 25.000 Wage Expense Depreciation Expense Interest Expense Other Expenses Dividends Declared 40,000 40,000 $ 36,000 26,000 $ 150,000 90,000 30,800 180,000 Accumulated Depreciation Accounts Payable Wages Payable Notes Payable Common Stock Retained Earnings 9,000 50,000 100,000 50,000 200,000 150,000 181,000 400,000 18,000 $1,199,800 Sales Income from Simpson $1,199,800 $471,000 $471,000 Required: SIIOW ALL DETAILED COMPUTATIONS 1) Determine the original amount of Goodwill that was reported on the consolidated balance sheet immediately after the combination on January 1, 20x8. 2) Simpson's 20x8 net income was $35,000 and a $10,000 dividend was declared. Determine the December 31, 20x8 (January 1, 20x9) balance in the Investment in Simpson Company account. 3) Prove the December 31, 20x9 balance of the Investment in Simpsons Co, Account, as reported above on the 20x9 trial balance. Page 4 of 20 4) Present ALL 20 equity method joumal entries Ashford recorded to account for the investment in Simpson Company. 5) Present ALL 20x9 equity method journal entries Ashford recorded to account for the investment in Simpson Company. 6) Present ALL consolidating entries needed to prepare a three-part consolidation worksheet as of December 31, 20X9, : Remember 20x9 is the second year of amortization of the excess FV (S15,000) assigned to the Building & Equipment 7) Complete the 3-part consolidation work sheet on page 7. 8) Prepare, in good form, a classified December 31, 20x9 consolidated Balance sheet for Ashford Company. BEGIN ANSWERS BELOW and CONTINUE ON THE NEXT PAGES Be sure the answers are numbered the same as the number of the requirement. ASHFORD COMPANY-SIMPSON COMPANY - 75 POINTS On January 1, 20X8, Ashford Company acquired 80 percent of Simpson Company's ownership for $120,000 cash. At that date, the fair value of the noncontrolling interest was $30,000. The book value of Simpson's net assets at acquisition was $125,000 (Common stock, $100,000; R/E, $25,000). The book values and fair values of Simpson's assets and liabilities were equal, except for buildings and equipment, which were worth $15,000 more than book value. Buildings and equipment are depreciated on a 10-year basis. Depreciation is on a straight-line basis. Ashford uses the equity method to account for the investment in Simpson Company. Although Goodwill is not amortized, the management of Ashford concluded at December 31, 20X8, that Goodwill from its acquisition of Simpson's shares had been impaired and the correct carrying amount was $5,000. Goodwil and Goodwill impairment were assigned proportionately to the controlling and noncontrolling shareholders. No additional impairment occurred in 20X9. Trial balance data for Ashford and Simpson on December 31, 20X9, are as follows: Simpson Co. Credit Ashford Co. Debit Credit Debit Item $ 100,000 $ 30,000 25,000 30,000 50,000 150,000 Cash Accounts Receivable Inventory 60,000 80,000 150,000 300,000 144,800 180,000 50,000 30,000 25,000 40,000 40,000 Land Buildings and Equipment Investment in Simpson Co. Cost of Goods Sold Wage Expense Depreciation Expense Interest Expense Other Expenses Dividends Declared Accumulated Depreciation Accounts Payable Wages Payable Notes Payable mmon Stock Retained Earnings Sales Income from Simpson 100,000 34,000 15,000 6,000 21,000 10,000 $ 36,00 26,0 9,0 50,0 100,0 50,0 $ 150,000 90,000 30,800 180,000 150,000 181,000 400,000 18,000 200,0 S471.0 400 000 CA71 000