Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ASSESSMENT 01 (25 marks) Proton Ltd and Electron Ltd are both software developers. On 1 August 2022 Proton Ltd acquired control in Electron Ltd by

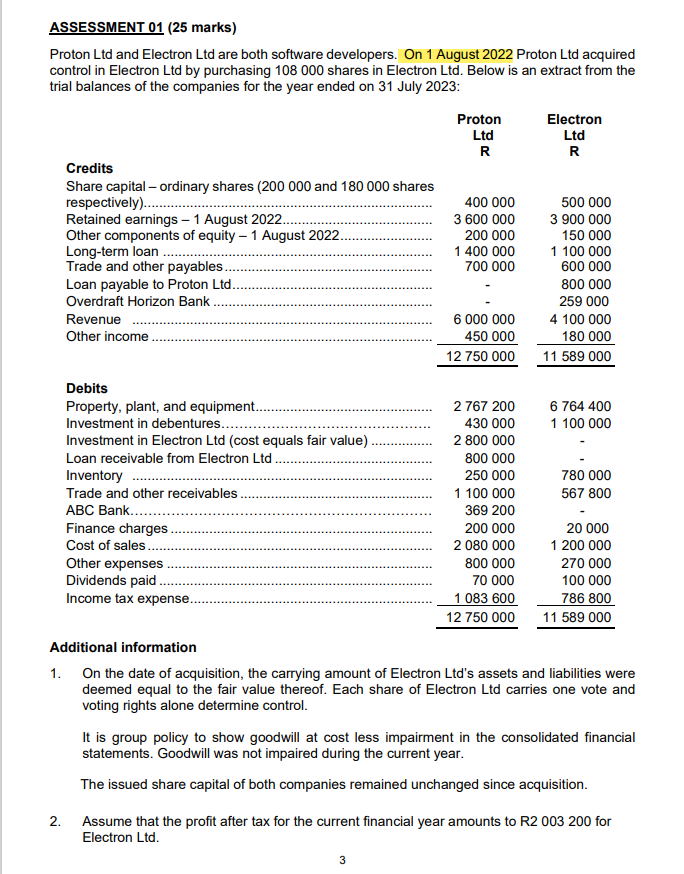

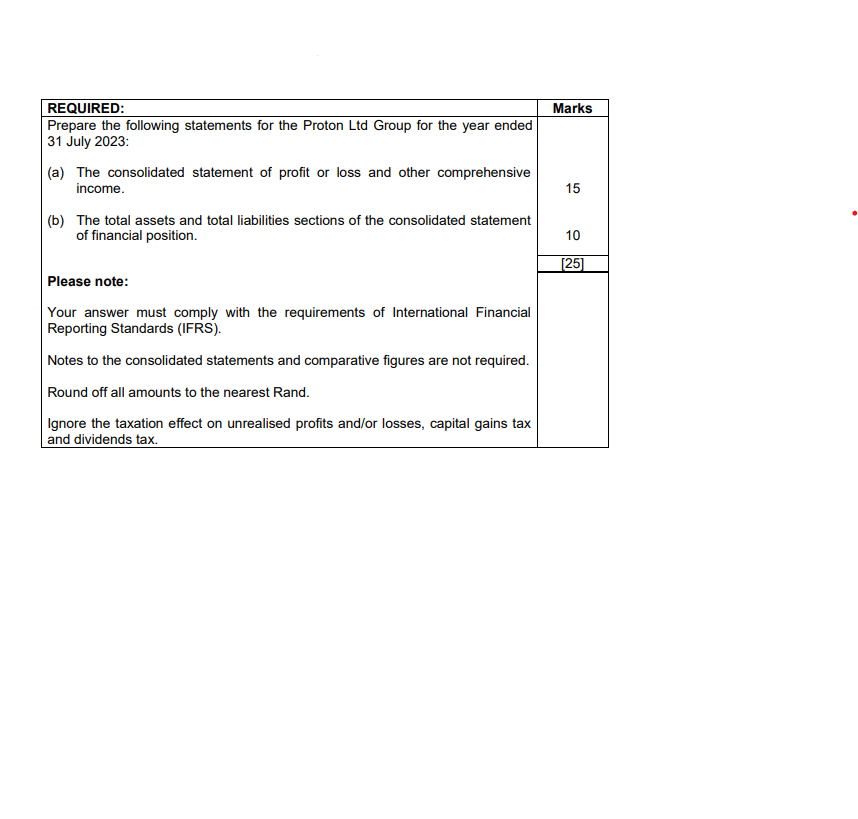

ASSESSMENT 01 (25 marks) Proton Ltd and Electron Ltd are both software developers. On 1 August 2022 Proton Ltd acquired control in Electron Ltd by purchasing 108000 shares in Electron Ltd. Below is an extract from the trial balances of the companies for the vear ended on 31 Julv 2023: Additional information 1. On the date of acquisition, the carrying amount of Electron Ltd's assets and liabilities were deemed equal to the fair value thereof. Each share of Electron Ltd carries one vote and voting rights alone determine control. It is group policy to show goodwill at cost less impairment in the consolidated financial statements. Goodwill was not impaired during the current year. The issued share capital of both companies remained unchanged since acquisition. 2. Assume that the profit after tax for the current financial year amounts to R2 \\( \\mathbf{0 0 3} \\mathbf{2 0 0} \\) for Electron Ltd. REQUIRED: Prepare the following statements for the Proton Ltd Group for the year ended 31 July 2023: (a) The consolidated statement of profit or loss and other comprehensive income. (b) The total assets and total liabilities sections of the consolidated statement of financial position. Please note: Your answer must comply with the requirements of International Financial Reporting Standards (IFRS). Notes to the consolidated statements and comparative figures are not required. Round off all amounts to the nearest Rand. Ignore the taxation effect on unrealised profits and/or losses, capital gains tax and dividends tax

ASSESSMENT 01 (25 marks) Proton Ltd and Electron Ltd are both software developers. On 1 August 2022 Proton Ltd acquired control in Electron Ltd by purchasing 108000 shares in Electron Ltd. Below is an extract from the trial balances of the companies for the vear ended on 31 Julv 2023: Additional information 1. On the date of acquisition, the carrying amount of Electron Ltd's assets and liabilities were deemed equal to the fair value thereof. Each share of Electron Ltd carries one vote and voting rights alone determine control. It is group policy to show goodwill at cost less impairment in the consolidated financial statements. Goodwill was not impaired during the current year. The issued share capital of both companies remained unchanged since acquisition. 2. Assume that the profit after tax for the current financial year amounts to R2 \\( \\mathbf{0 0 3} \\mathbf{2 0 0} \\) for Electron Ltd. REQUIRED: Prepare the following statements for the Proton Ltd Group for the year ended 31 July 2023: (a) The consolidated statement of profit or loss and other comprehensive income. (b) The total assets and total liabilities sections of the consolidated statement of financial position. Please note: Your answer must comply with the requirements of International Financial Reporting Standards (IFRS). Notes to the consolidated statements and comparative figures are not required. Round off all amounts to the nearest Rand. Ignore the taxation effect on unrealised profits and/or losses, capital gains tax and dividends tax Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started