Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Asset management ratios are used to measure how effectively a firm manages its assets, by relating the amount a firm has invested in a

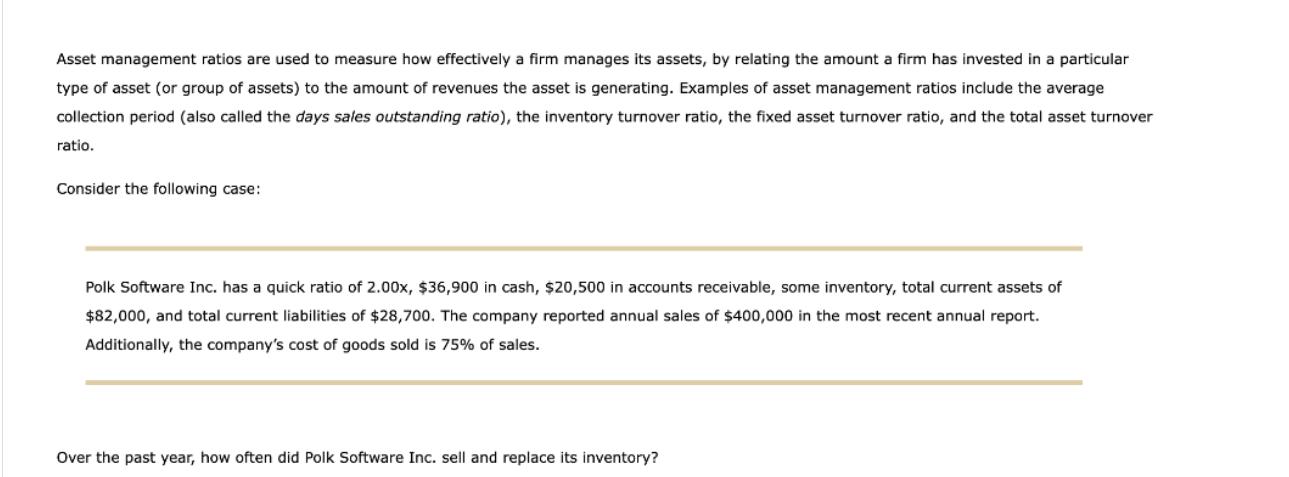

Asset management ratios are used to measure how effectively a firm manages its assets, by relating the amount a firm has invested in a particular type of asset (or group of assets) to the amount of revenues the asset is generating. Examples of asset management ratios include the average collection period (also called the days sales outstanding ratio), the inventory turnover ratio, the fixed asset turnover ratio, and the total asset turnover ratio. Consider the following case: Polk Software Inc. has a quick ratio of 2.00x, $36,900 in cash, $20,500 in accounts receivable, some inventory, total current assets of $82,000, and total current liabilities of $28,700. The company reported annual sales of $400,000 in the most recent annual report. Additionally, the company's cost of goods sold is 75% of sales. Over the past year, how often did Polk Software Inc. sell and replace its inventory?

Step by Step Solution

★★★★★

3.49 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

First lets calculate the average inventory We know the current assets including inventory and t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started