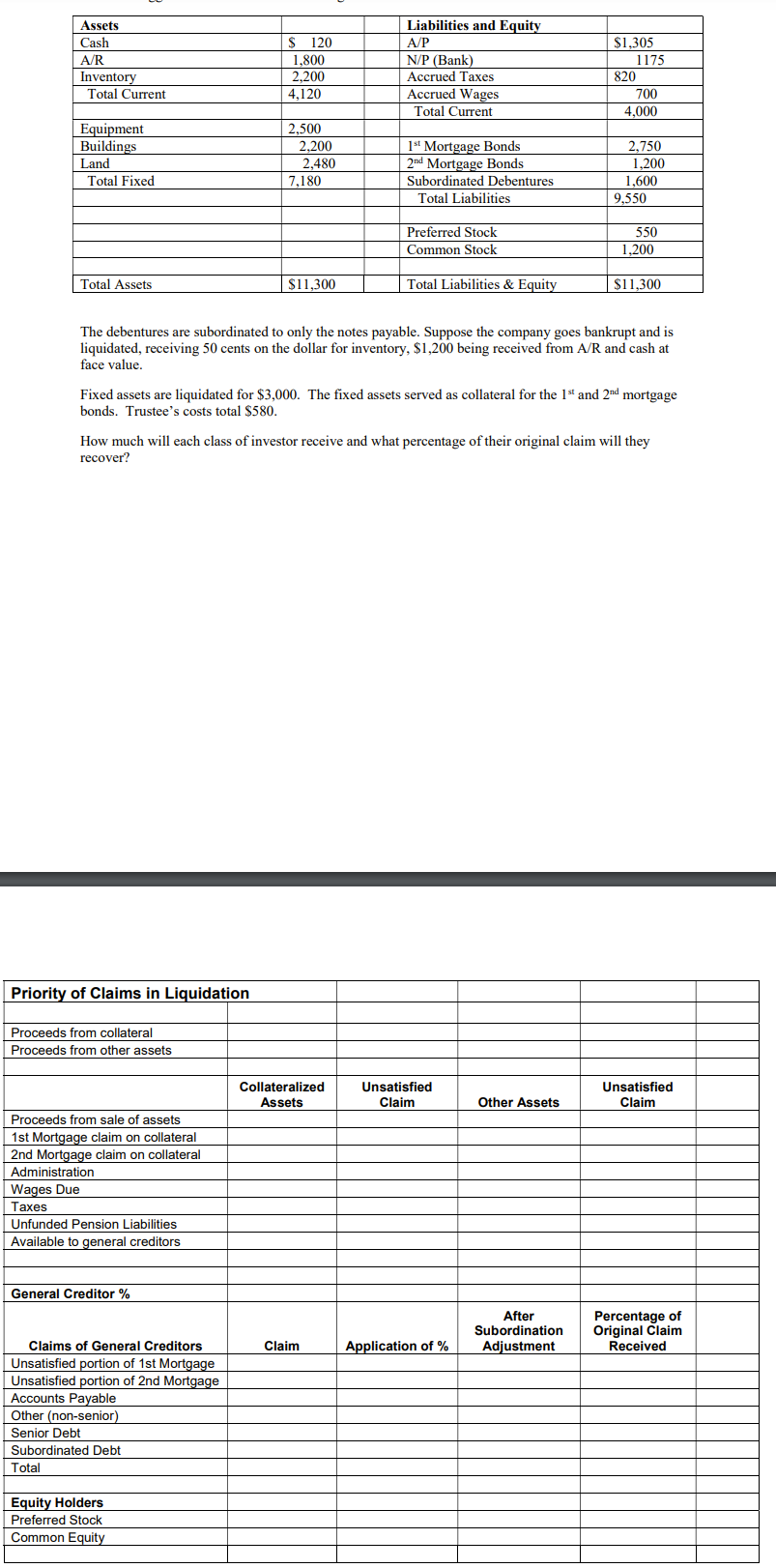

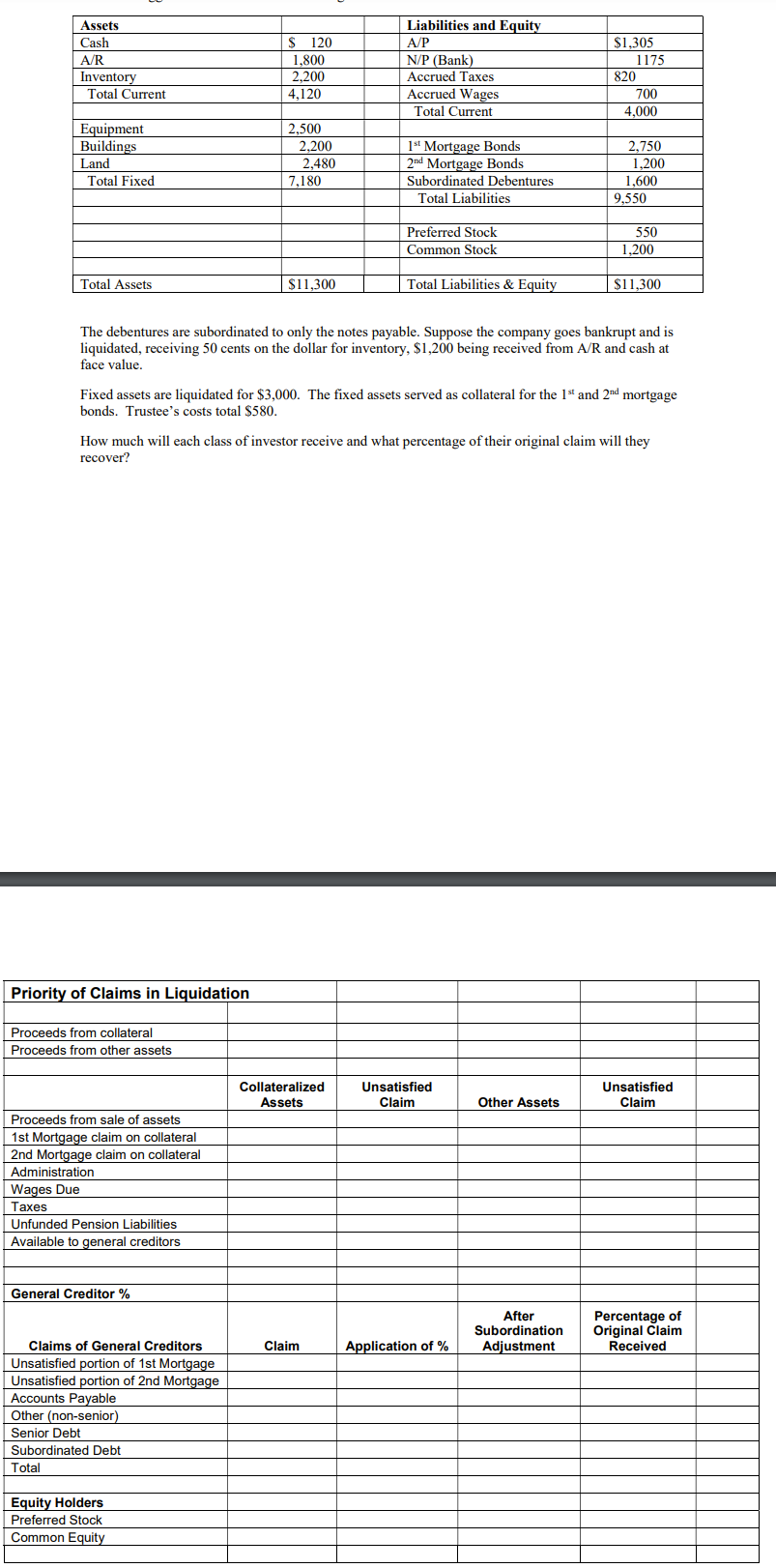

Assets Cash AR Inventory Total Current $ 120 1,800 2,200 4,120 Liabilities and Equity A/P N/P (Bank) Accrued Taxes Accrued Wages Total Current $1,305 1175 820 700 4,000 Equipment Buildings Land Total Fixed 2,500 2,200 2,480 7,180 1" Mortgage Bonds 2nd Mortgage Bonds Subordinated Debentures Total Liabilities 2,750 1,200 1,600 9.550 Preferred Stock Common Stock 550 1,200 Total Assets $11,300 Total Liabilities & Equity $11,300 The debentures are subordinated to only the notes payable. Suppose the company goes bankrupt and is liquidated, receiving 50 cents on the dollar for inventory, $1,200 being received from A/R and cash at face value. Fixed assets are liquidated for $3,000. The fixed assets served as collateral for the 1st and 2nd mortgage bonds. Trustee's costs total $580. How much will each class of investor receive and what percentage of their original claim will they recover? Priority of Claims in Liquidation Proceeds from collateral Proceeds from other assets Collateralized Assets Unsatisfied Claim Unsatisfied Claim Other Assets Proceeds from sale of assets 1st Mortgage claim on collateral 2nd Mortgage claim on collateral Administration Wages Due Taxes Unfunded Pension Liabilities Available to general creditors General Creditor % After Subordination Adjustment Percentage of Original Claim Received Claim Application of % Claims of General Creditors Unsatisfied portion of 1st Mortgage Unsatisfied portion of 2nd Mortgage Accounts Payable Other (non-senior) Senior Debt Subordinated Debt Total Equity Holders Preferred Stock Common Equity Assets Cash AR Inventory Total Current $ 120 1,800 2,200 4,120 Liabilities and Equity A/P N/P (Bank) Accrued Taxes Accrued Wages Total Current $1,305 1175 820 700 4,000 Equipment Buildings Land Total Fixed 2,500 2,200 2,480 7,180 1" Mortgage Bonds 2nd Mortgage Bonds Subordinated Debentures Total Liabilities 2,750 1,200 1,600 9.550 Preferred Stock Common Stock 550 1,200 Total Assets $11,300 Total Liabilities & Equity $11,300 The debentures are subordinated to only the notes payable. Suppose the company goes bankrupt and is liquidated, receiving 50 cents on the dollar for inventory, $1,200 being received from A/R and cash at face value. Fixed assets are liquidated for $3,000. The fixed assets served as collateral for the 1st and 2nd mortgage bonds. Trustee's costs total $580. How much will each class of investor receive and what percentage of their original claim will they recover? Priority of Claims in Liquidation Proceeds from collateral Proceeds from other assets Collateralized Assets Unsatisfied Claim Unsatisfied Claim Other Assets Proceeds from sale of assets 1st Mortgage claim on collateral 2nd Mortgage claim on collateral Administration Wages Due Taxes Unfunded Pension Liabilities Available to general creditors General Creditor % After Subordination Adjustment Percentage of Original Claim Received Claim Application of % Claims of General Creditors Unsatisfied portion of 1st Mortgage Unsatisfied portion of 2nd Mortgage Accounts Payable Other (non-senior) Senior Debt Subordinated Debt Total Equity Holders Preferred Stock Common Equity