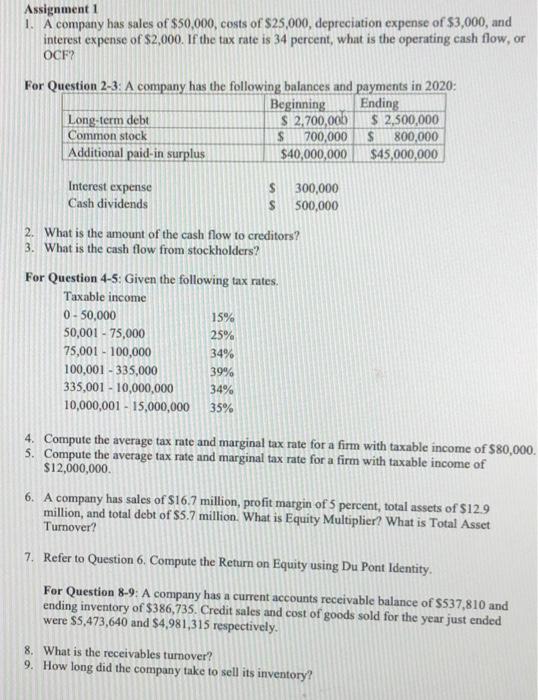

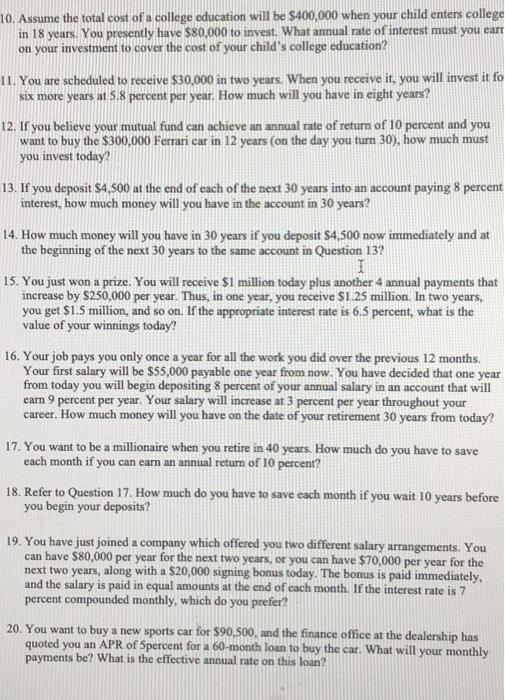

Assignment 1 1. A company has sales of $50,000, costs of $25,000, depreciation expense of $3,000, and interest expense of $2,000. If the tax rate is 34 percent, what is the operating cash flow, or OCF? For Question 2-3: A company has the following balances and payments in 2020: Beginning Ending Long-term debt S 2.700,000 $ 2,500,000 Common stock S 700,000 $800,000 Additional paid-in surplus $40,000,000 $45,000,000 Interest expense $ 300,000 Cash dividends $ 500,000 2. What is the amount of the cash flow to creditors? 3. What is the cash flow from stockholders? For Question 4-5: Given the following tax rates. Taxable income 0 - 50,000 15% 50,001 - 75,000 25% 75,001 - 100,000 34% 100,001 - 335,000 39% 335,001 - 10,000,000 34% 10,000,001 - 15,000,000 35% 4. Compute the average tax rate and marginal tax rate for a firm with taxable income of $80,000 5. Compute the average tax rate and marginal tax rate for a firm with taxable income of $12,000,000 6. A company hus sales of $16.7 million, profit margin of 5 percent, total assets of $12.9 million, and total debt of $5.7 million. What is Equity Multiplier? What is Total Asset Turnover? 7. Refer to Question 6. Compute the Return on Equity using Du Pont Identity. For Question 8-9: A company has a current accounts receivable balance of $537,810 and ending inventory of $386,735. Credit sales and cost of goods sold for the year just ended were $5,473,640 and $4,981,315 respectively. 8. What is the receivables turnover? 9. How long did the company take to sell its inventory? 10. Assume the total cost of a college education will be $400,000 when your child enters college in 18 years. You presently have $80,000 to invest. What annual rate of interest must you earr on your investment to cover the cost of your child's college education? 11. You are scheduled to receive $30,000 in two years. When you receive it, you will invest it fo six more years at 5.8 percent per year. How much will you have in eight years? 12. If you believe your mutual fund can achieve an annual rate of return of 10 percent and you want to buy the $300,000 Ferrari car in 12 years (on the day you turn 30), how much must you invest today? 13. If you deposit $4.500 at the end of each of the next 30 years into an account paying 8 percent interest, how much money will you have in the account in 30 years? 14. How much money will you have in 30 years if you deposit $4,500 now immediately and at the beginning of the next 30 years to the same account in Question 132 15. You just won a prize. You will receive $1 million today plus another 4 annual payments that increase by $250,000 per year. Thus, in one year, you receive $1.25 million. In two years, you get $1.5 million, and so on. If the appropriate interest rate is 6.5 percent, what is the value of your winnings today? 16. Your job pays you only once a year for all the work you did over the previous 12 months. Your first salary will be $55,000 payable one year from now. You have decided that one year from today you will begin depositing 8 percent of your annual salary in an account that will earn 9 percent per year. Your salary will increase at 3 percent per year throughout your career. How much money will you have on the date of your retirement 30 years from today? 17. You want to be a millionaire when you retire in 40 years. How much do you have to save each month if you can earn an annual return of 10 percent? 18. Refer to Question 17. How much do you have to save each month if you wait 10 years before you begin your deposits? 19. You have just joined a company which offered you two different salary arrangements. You can have $80,000 per year for the next two years, or you can have $70,000 per year for the next two years, along with a $20,000 signing bonus today. The bonus is paid immediately, and the salary is paid in equal amounts at the end of each month. If the interest rate is 7 percent compounded monthly, which do you prefer? 20. You want to buy a new sports car for $90,500, and the finance office at the dealership has quoted you an APR of Spercent for a 60-month loan to buy the car. What will your monthly payments be? What is the effective annual rate on this loan