Question

Assignment 4 USE U.S. GAAP CODIFICATION For each of the following financial instruments Company A is a party to, fully explain whether the instrument qualifies

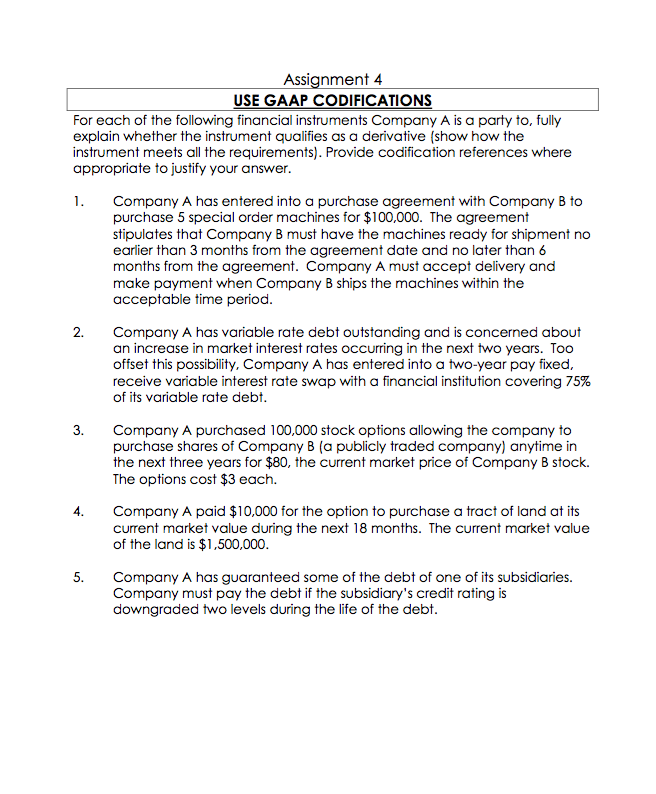

Assignment 4

USE U.S. GAAP CODIFICATION

For each of the following financial instruments Company A is a party to, fully explain whether the instrument qualifies as a derivative (show how the instrument meets all the requirements). Provide codification references where appropriate to justify your answer.

- Company A has entered into a purchase agreement with Company B to purchase 5 special order machines for $100,000. The agreement stipulates that Company B must have the machines ready for shipment no earlier than 3 months from the agreement date and no later than 6 months from the agreement. Company A must accept delivery and make payment when Company B ships the machines within the acceptable time period.

2. Company A has variable rate debt outstanding and is concerned about an increase in market interest rates occurring in the next two years. Too offset this possibility, Company A has entered into a two-year pay fixed, receive variable interest rate swap with a financial institution covering 75% of its variable rate debt.

3. Company A purchased 100,000 stock options allowing the company to purchase shares of Company B (a publicly traded company) anytime in the next three years for $80, the current market price of Company B stock. The options cost $3 each.

4. Company A paid $10,000 for the option to purchase a tract of land at its current market value during the next 18 months. The current market value of the land is $1,500,000.

5. Company A has guaranteed some of the debt of one of its subsidiaries. Company must pay the debt if the subsidiarys credit rating is downgraded two levels during the life of the debt.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started