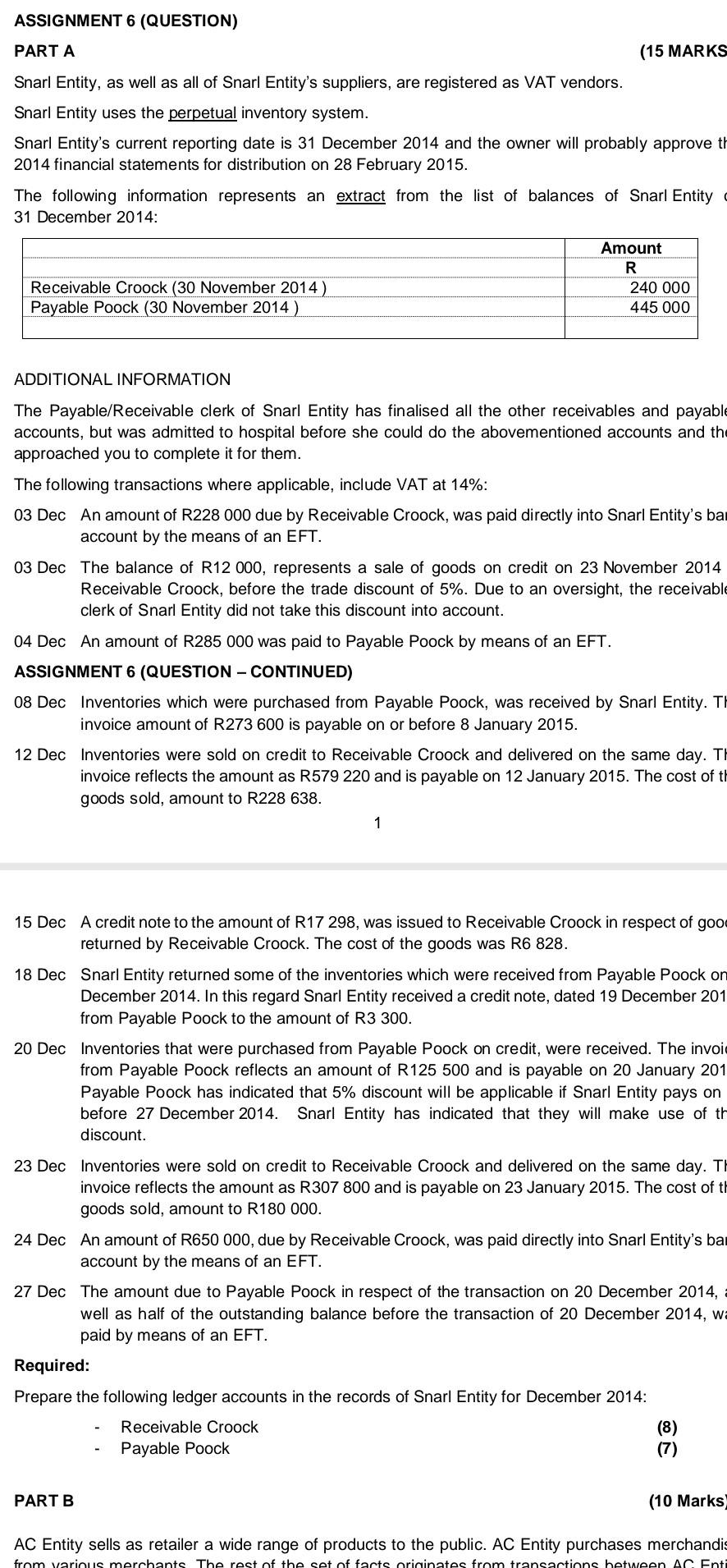

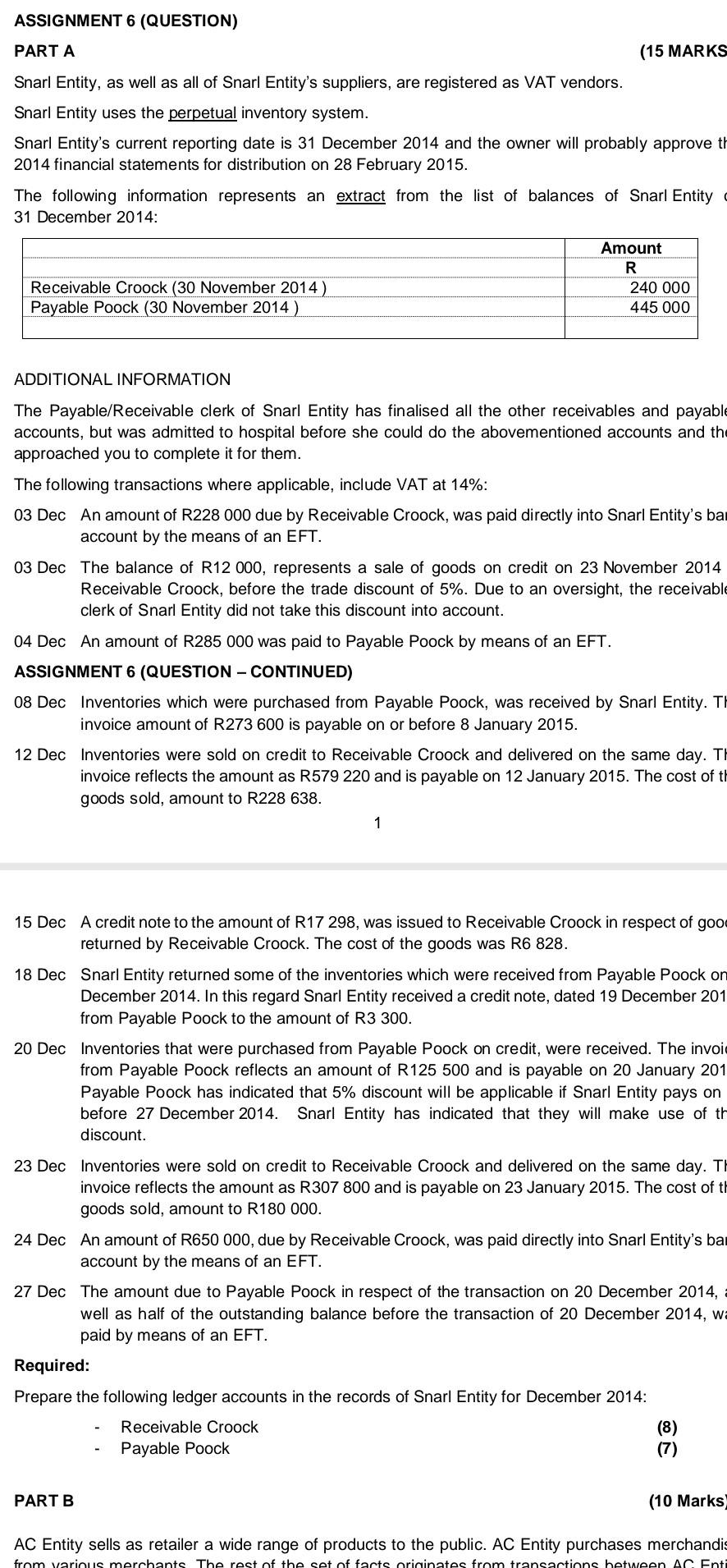

ASSIGNMENT 6 (QUESTION) PART A (15 MARKS Snarl Entity, as well as all of Snarl Entity's suppliers, are registered as VAT vendors. Snarl Entity uses the perpetual inventory system. Snarl Entity's current reporting date is 31 December 2014 and the owner will probably approve t 2014 financial statements for distribution on 28 February 2015. The following information represents an extract from the list of balances of Snarl Entity 31 December 2014: ADDITIONAL INFORMATION The Payable/Receivable clerk of Snarl Entity has finalised all the other receivables and payabl accounts, but was admitted to hospital before she could do the abovementioned accounts and th approached you to complete it for them. The following transactions where applicable, include VAT at 14% : 03 Dec An amount of R228 000 due by Receivable Croock, was paid directly into Snarl Entity's ba account by the means of an EFT. 03Dec The balance of R12 000, represents a sale of goods on credit on 23 November 2014 Receivable Croock, before the trade discount of 5%. Due to an oversight, the receivabl clerk of Snarl Entity did not take this discount into account. 04 Dec An amount of R285 000 was paid to Payable Poock by means of an EFT. ASSIGNMENT 6 (QUESTION - CONTINUED) 08Dec Inventories which were purchased from Payable Poock, was received by Snarl Entity. T invoice amount of R273 600 is payable on or before 8 January 2015. 12Dec Inventories were sold on credit to Receivable Croock and delivered on the same day. T invoice reflects the amount as R579 220 and is payable on 12 January 2015 . The cost of t goods sold, amount to R228 638. 1 15 Dec A credit note to the amount of R17 298, was issued to Receivable Croock in respect of goo returned by Receivable Croock. The cost of the goods was R6 828 . 18Dec Snarl Entity returned some of the inventories which were received from Payable Poock on December 2014. In this regard Snarl Entity received a credit note, dated 19 December 201 from Payable Poock to the amount of R3 300. 20Dec Inventories that were purchased from Payable Poock on credit, were received. The invoi from Payable Poock reflects an amount of R125 500 and is payable on 20 January 201 Payable Poock has indicated that 5% discount will be applicable if Snarl Entity pays on before 27 December 2014. Snarl Entity has indicated that they will make use of th discount. 23Dec Inventories were sold on credit to Receivable Croock and delivered on the same day. T invoice reflects the amount as R307 800 and is payable on 23 January 2015. The cost of t goods sold, amount to R180 000. 24 Dec An amount of R650 000, due by Receivable Croock, was paid directly into Snarl Entity's ba account by the means of an EFT. 27 Dec The amount due to Payable Poock in respect of the transaction on 20 December 2014, well as half of the outstanding balance before the transaction of 20 December 2014, w paid by means of an EFT. Required: Prepare the following ledger accounts in the records of Snarl Entity for December 2014: - Receivable Croock (8) - Payable Poock (7) PART B (10 Marks AC Entity sells as retailer a wide range of products to the public. AC Entity purchases merchandi