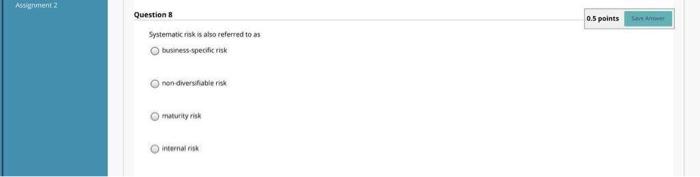

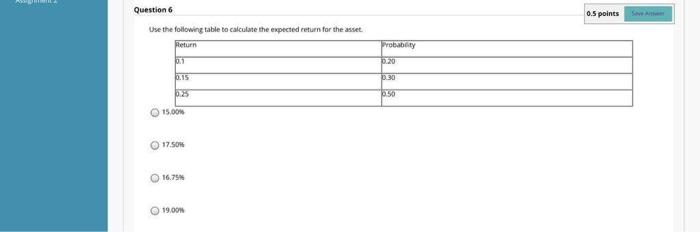

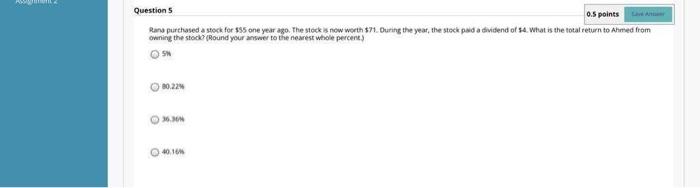

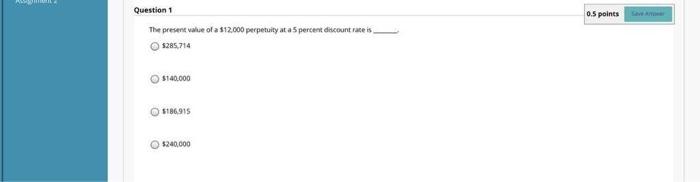

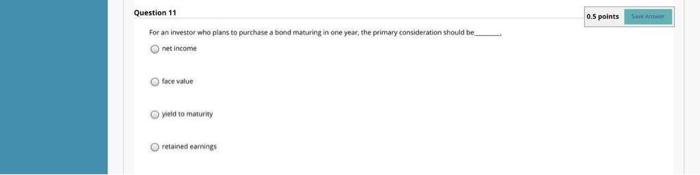

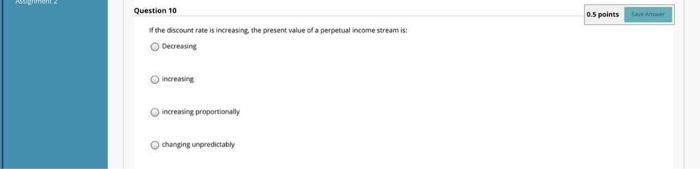

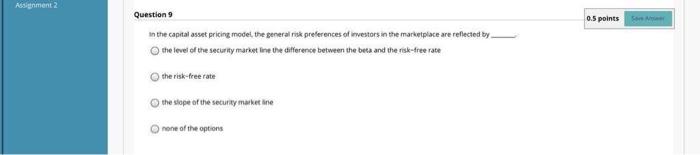

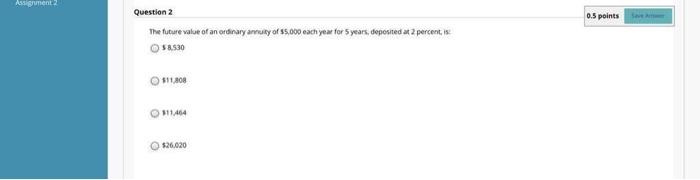

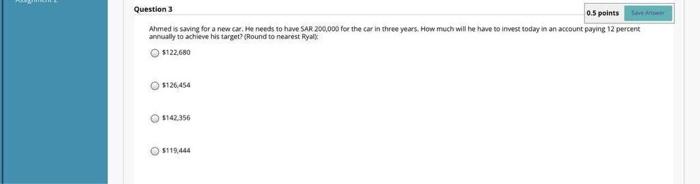

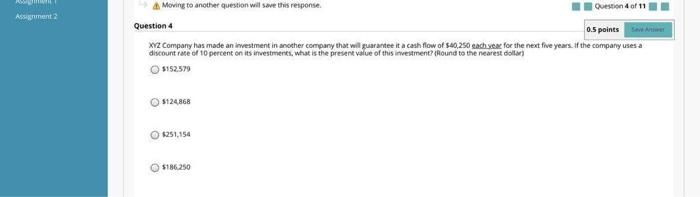

Assignment2 0.5 points Questions Systematic risk is also referred to a business specific risk non diversifiable risk maturity risk internal Question 6 0.5 points Use the following table to calculate the expected return for the asset. Return 1 Probability 0.20 02.15 0.30 bis 050 o 15.00% 17.50W 16.7N 19.000 Questions 0.5 points Rana purchased a stock for $95 one year ago. The stock is now worth $71. During the year, the stock paid a dividend of a What is the total return to Ahmed from owning the stock (Round your answer to the nearest whole percent) OS 1022 40.164 0.5 points Question 1 The present value of a 312.000 perpetuity at a 5 percent discount rate is 5285,714 $140.000 5186915 5240,000 0.5 points Question 11 For an investor who plans to purchase a bond maturing in one year, the primary consideration should be_ net income face value yield to matury retained eaming une 0.5 points Question 10 of the discount rate is increasing the present value of a perpetual income stream is: Decreasing increasing increasing proportionally changing unpredictably Assignment 0.5 points Question 9 in the capital asset pricing model, the general risk preferences of uwestors in the marketplace are reflected by the level of the security market in the difference between the beta and the risk-free rate the risk-free rate the slope of the security marketine none of the options Question 3 0.5 points Ahmed is sawng for a new car. He needs to have SAR 200.000 for the car in three years. How much will be have to investoday in an account paying 12 percent annually to achieve his target? (Round to nearest Ryal 5122,680 $126.454 1142,356 5119.444 Moving to another question will save this response Question 4 of 11 Assignment Question 4 0.5 points XYZ Company has made an investment in another company that will guarantee it a cash flow of $40,250 each year for the next five years. If the company uses a discount rate of 10 percent on its investments, what is the present value of this investment? Round to the nearest dolor 5152579 $124.868 1251,154 5186250 Assignment2 2 points Question 7 What is the difference between systematic and unsystematic risks? For the toolbar.press ALT+F10 (PC) or ALTFNF10 Mac 8 IV. Paragraph Open Sans, 10pt XoOQ SPF 3x X 12 39 T. 9 82 T (+)